Bank of Canada to Deliver a Cautious 25bps Easing on June 5

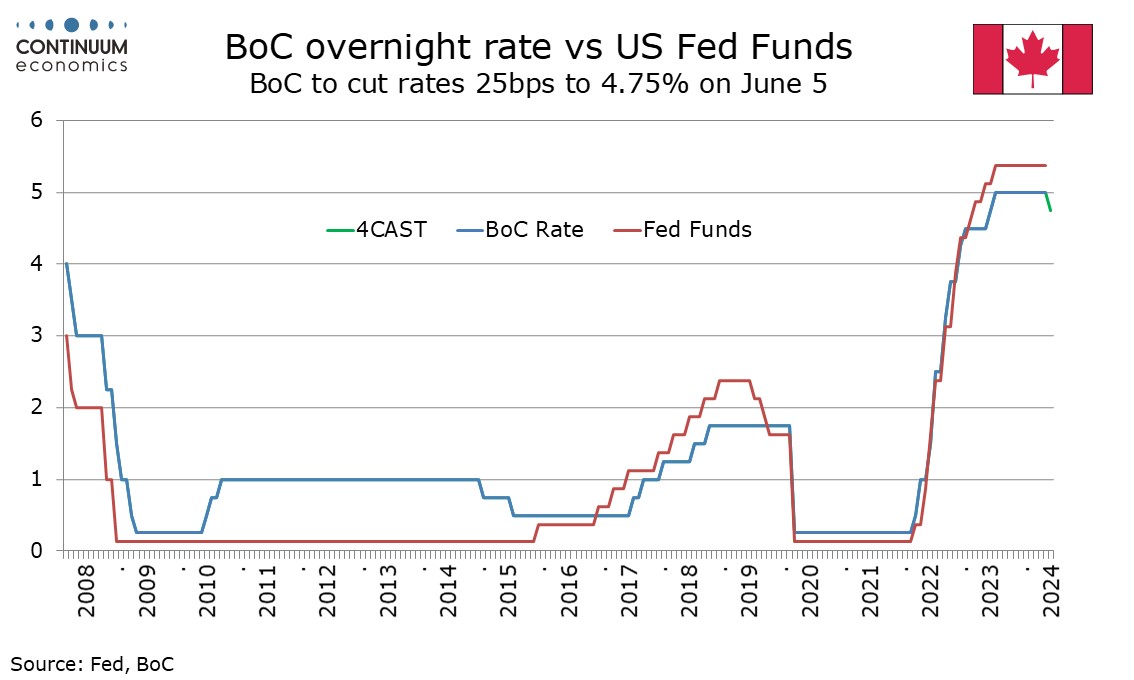

The Bank of Canada meets on June 5 and we believe they will see recent inflationary data as having delivered sufficient progress to justify a 25bps easing, to 4.75%. The statement will however be careful to state that inflation remains too high and give no strong signals for future moves, which will be data-dependent.

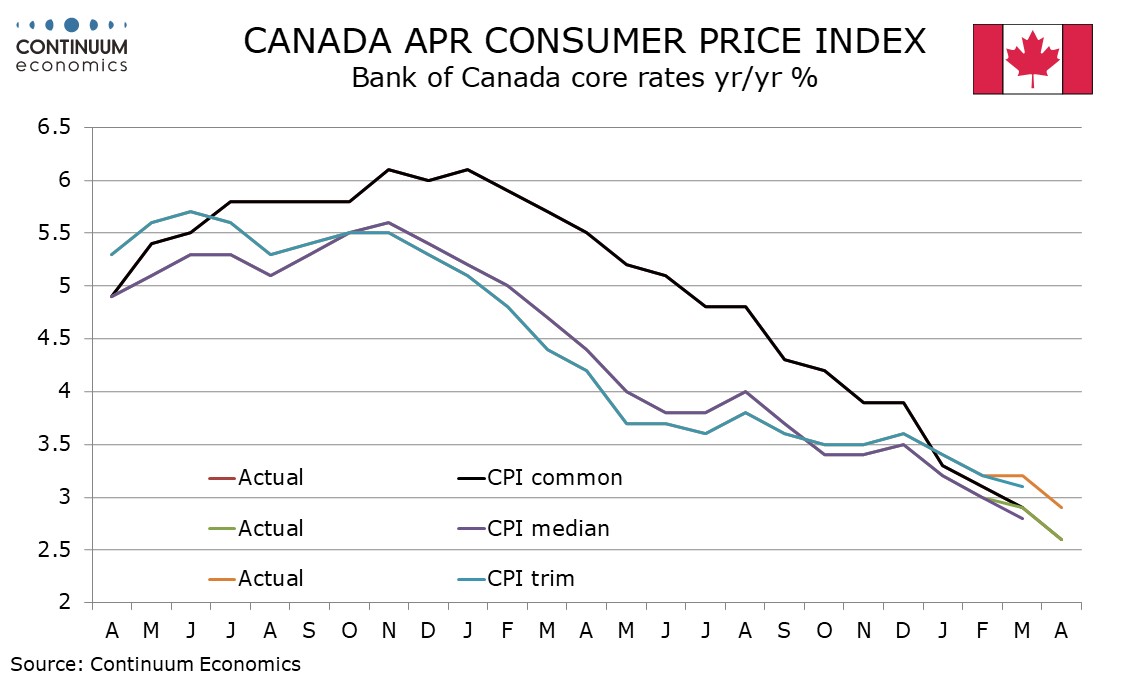

At its last meeting on April 10 the BoC stated that “while inflation is still too high and risks remain, CPI and core inflation have eased further in recent months. The council will be looking for evidence that this downward momentum is sustained.” The BoC has seen CPI data for March and April since that meeting, and the average of the BoC’s three core inflation rates now stands at 2.7%, versus 3.1% in February and 3.7% in December 2023. The ex food and energy rate is not one of the BoC’s core rates, but seasonally adjusted gains of 0.1% January, February and April, with a 0.2% increase in March, show that underlying momentum has slowed significantly in recent months.

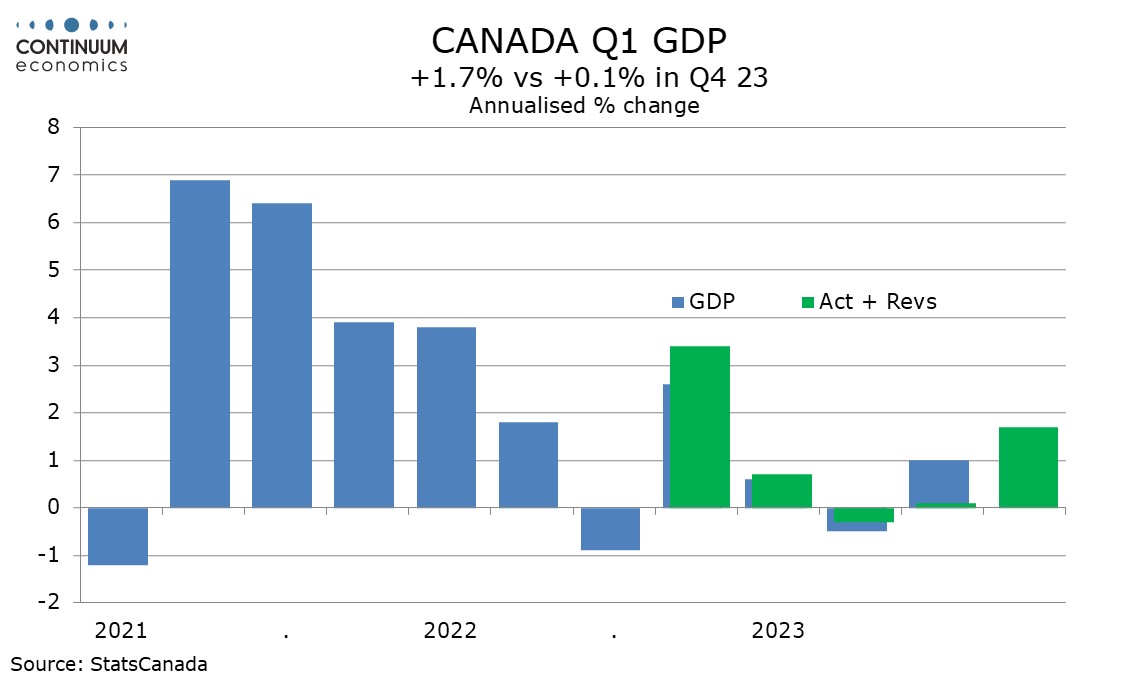

Data on economic activity suggests no urgent need to cut rates, but no strong obstacles to easing either. Q1 GDP at 1.7% annualized was significantly softer than a 2.8% forecast made by the BoC in April and Q4 2023 was revised down to 0.1% from 1.0%. However Q1 domestic demand was healthy at a 2.9% pace with slower inventory growth the an restraint on GDP, and a preliminary April estimate for a 0.3% increase suggests moderate growth continues in early Q2. Canadian employment growth has accelerated in recent months though the unemployment rate at 6.1% is well above the 5.0% seen at the start of 2023.

There being no monetary policy report scheduled this month means that the BoC will not update its economic forecasts. The BoC is unlikely to give any clear signals on future policy moves and we do not expect the BoC to announce any changes to its quantitative tightening program at this meeting. Our current expectation is that the BoC will pause in July, when the next Monetary Policy report is due but ease by 25bps at its September, October and December meetings, leaving rates at 4.0% at the end of the year. However the timing of moves will depend on incoming data.