EUR/USD, USD/JPY flows: EUR awaits IFO, JPY vol up

IFO the main data for Monday and EUR downside favoured, but little impact likely. JPY vol higher ahead of BoJ

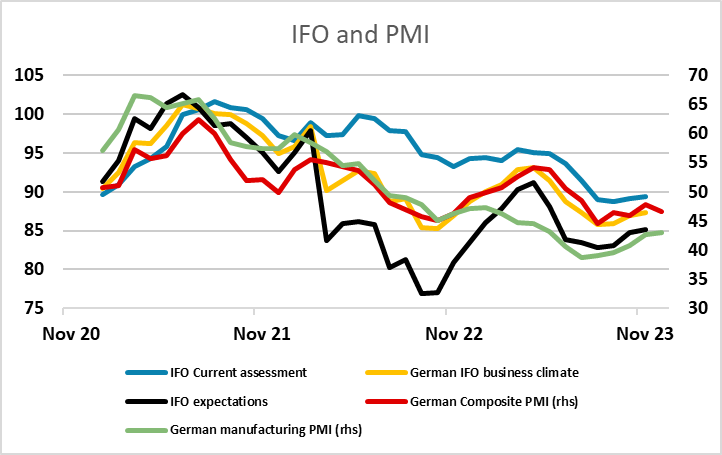

The IFO survey is today’s main data, but is unlikely to deviate much from the German PMI already released last week. The two surveys have been very closely correlated for the last year. The risks is therefore to the downside, with the market looking for a modest pick-up in IFO, while the PMI slipped back in December. EUR/USD continues to look a little rich above 1.09, but in fairly quiet conditions we are unlikely to see much deviation, with the focus more on tomorrow’s BoJ meeting as the last major event before the end of the year.

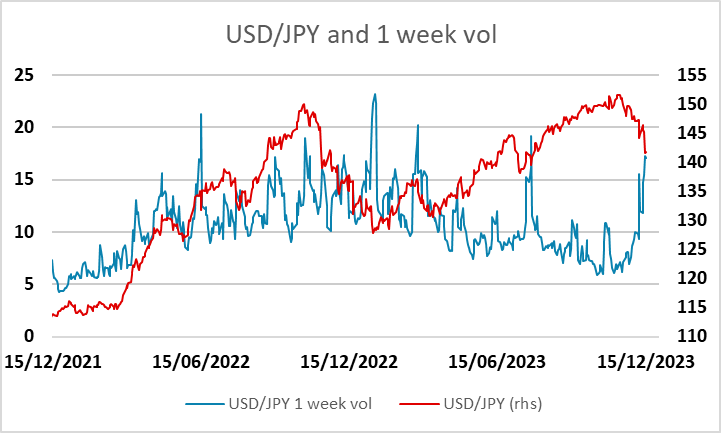

There is no real expectation of policy action tomorrow, but around 20% of analysts surveyed are looking for tighter policy at the January meeting, and that would likely mean some signal to that effect at tomorrow’s meeting. The BoJ has surprised markets before so there are some nerves, with implied volatility up sharply. However, such rises in implied vol in recent times have usually followed sharp JPY gains rather than predicted them, so the risks may be more on USD/JPY upside after the meeting.