FOMC Dots and economic forecasts marginally more hawkish

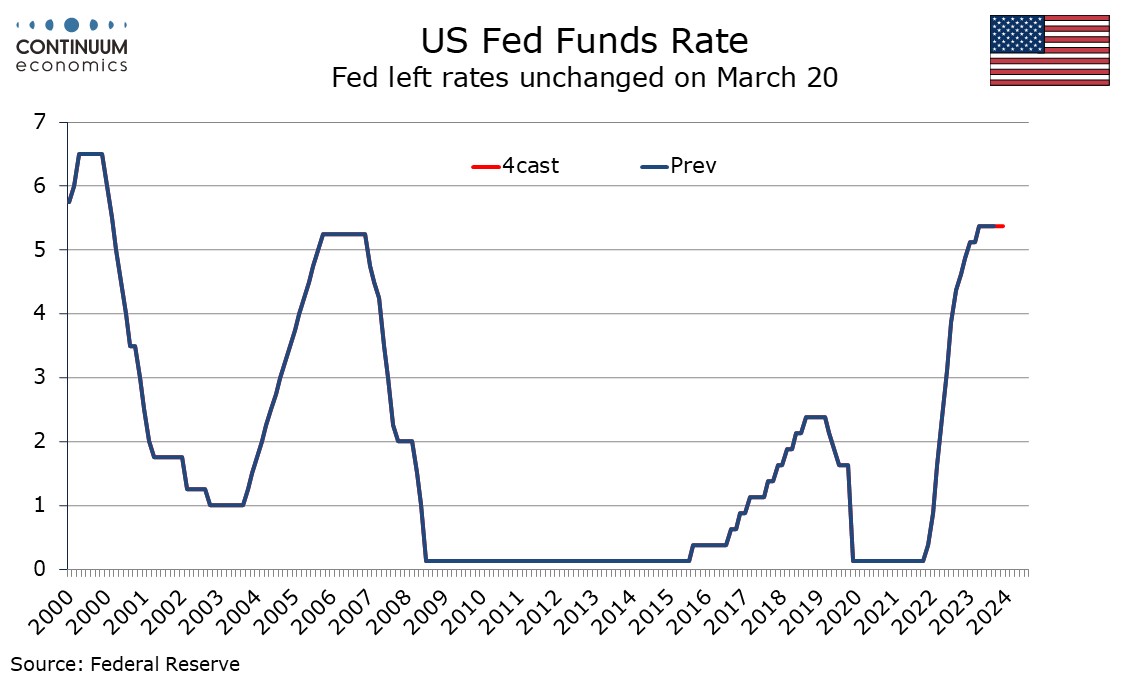

The FOMC has left rates unchanged as expected and continues to state it needs greater confidence that inflation is moving to 2.0% before easing. The dots are slightly more hawkish despite 2024 still seen having 75bps of easing, with 2025 now seen having only 75bps rather than 100bps. Economic forecasts have been fine-tuned higher too.

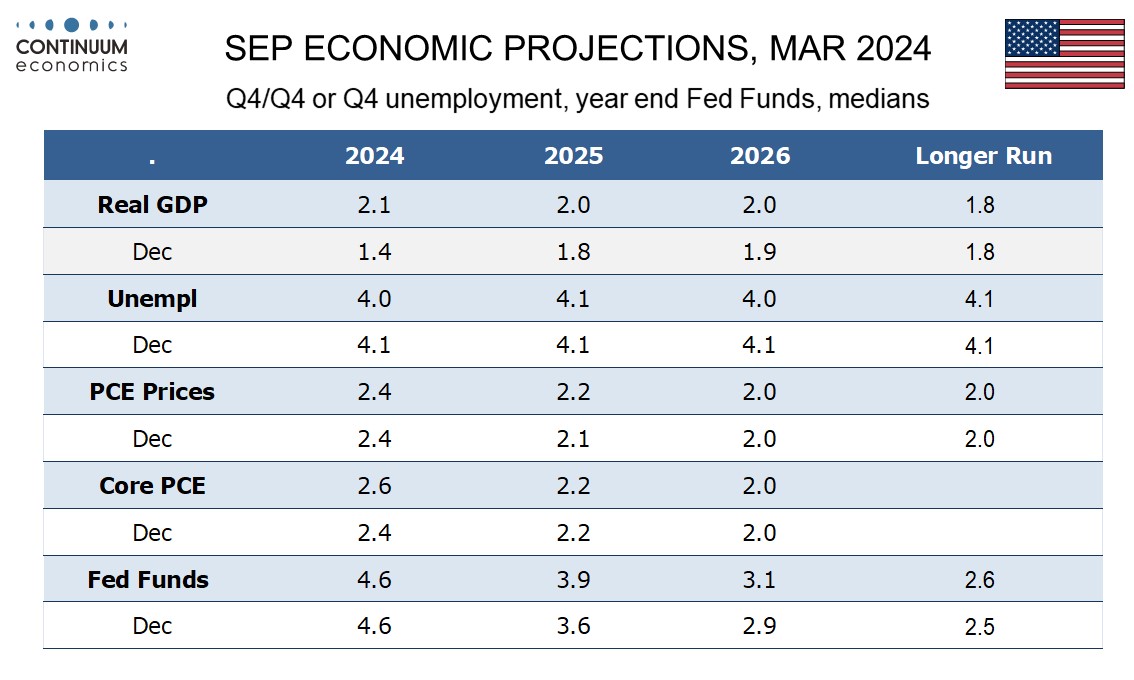

The upward revisions to GDP are quite significant, 2024 to 2.1% Q4/Q4 from 1.4%, with both 2025 and 2026 also seen at 2.0% despite long-run potential still being seen at 1.8%. Unemployment for Q4 of 2024 and 2026 has been revised down 4.0% from 4.1% though 2025 remains at the long-run rate of 4.1%. The Q4 2024 core PCE price index is seen at 2.6% rather than 2.4% presumably in response to strong January and (for CPI) February data, but he path forward seems similar, 2025 still seen at 2.2% and 2026 on target at 2.0%.

Nine out of 19 participants see the end 2024 Fed Funds target at the unchanged 4.625% median with only one below and nine above, so it was a close thing that the median did not nudge higher. The 2025 median did rise, to 3.875% from 3.625%, with six on the median, nine below and only four above, so the shift upwards was marginal. 2026 saw the median rise to 3.125% from 2.875%, again with six on the median, nine below and four above. The long run neutral rate was nudged up to 2.625% from 2.5%. Only one participant is on the median, eight are still on 2.5%, one is below and nine above, some significantly.

The statement is almost unchanged from January’s, though the one change is hawkish, with a reference to the pace of job gains, which is still described as strong, having moderated since early last year removed.