FX Daily Strategy: N America, July 31st

BoJ and FOMC the focus

We see BoJ standing pat suggesting knee jerk JPY decline, but downside limited

FOMC will need to be dovish to justify market pricing, so USD risks on the upside

CAD may benefit most if Fed are dovish given positioning

BoJ and FOMC the focus

Knee jerk JPY decline, but downside limited

FOMC will need to be dovish to justify market pricing, so USD risks on the upside

CAD may benefit most if Fed are dovish given positioning

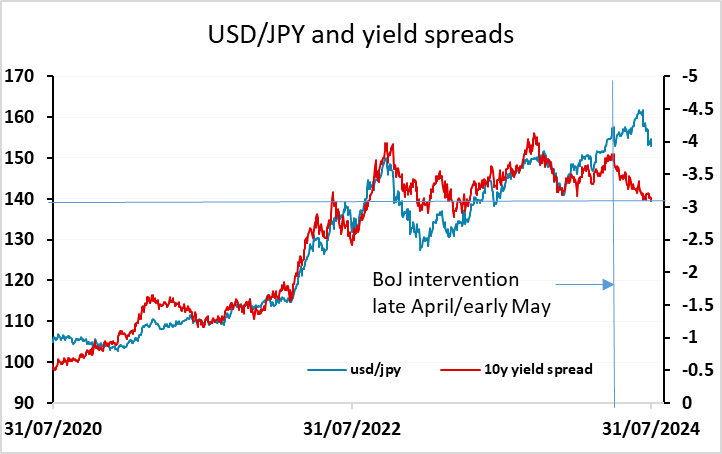

The BoJ meeting and the FOMC meeting are the main events for Wednesday. The market was pricing around a 55% chance of a 10bp rate hike from the BoJ, which was at odds with the Reuters survey of economists in which 75% of respondents expected no change. However, the BoJ hiked the policy rate by 15bps to 0.25% and announced their plans to reduce bond purchase by three trillion JPY over the coming two years. They also indicated further tightening was likely if data came in in line with their projections in the next year or two. There were some indications of the likely decision in the NY afternoon after reports from Jiji and Nikkei, which triggered JPY gains, but there was some profit-taking on the announcement. However, the JPY extended gains sharply in the European morning session, breaking the key technical support area at 151.70/152 and reaching a low near 150. Yield spreads still suggest scope for big JPY gains against a range of currencies, with scope to 140 agaisnt the USD.

The FOMC also meets on July 31 and while a change in rates remains unlikely the FOMC is likely to signal that easing is possible if data before the next meeting on September 18 provides further evidence of falling inflationary pressure. This will see changes to the wording of the statement, but Chairman Jerome Powell will stress that any easing will be data-dependent. This is problematic for the market which is already more than fully pricing in a 25bp rate cut in September, suggesting that a 25bp cut is seen as a near certainty while a 50bp cut is a possibility. The statement will need to be quite dovish to justify this pricing, so the risks may be towards a USD rally on the news.

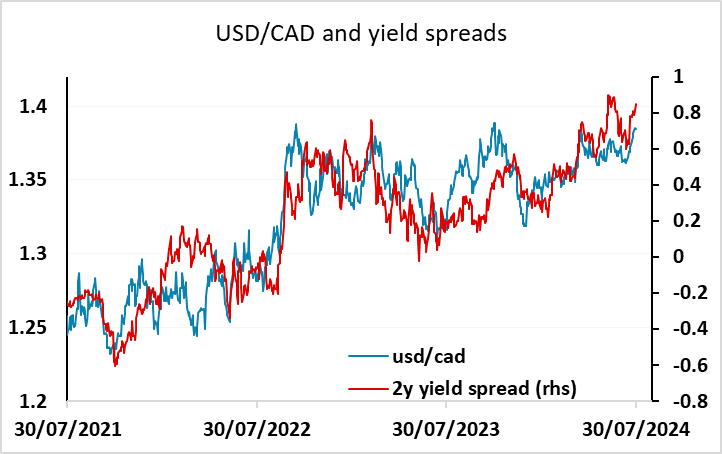

The central bank meetings are the main focus, but there is also plenty of data scheduled. Australian Q2 CPI, Eurozone preliminary CPI for July, the ADP employment report and Canadian May GDP data are all due. However, in practice, it seems unlikely that any of this will have a lot of impact ahead of the FOMC meeting. The CAD may be the currency with the most potential to move, as the CFTC data shows record speculative net short positioning in the futures market. Strong data and a dovish FOMC statement could trigger a sharp CAD recovery.