FOMC Review: March Easing Seen Unlikely but Q2 Remains Plausible

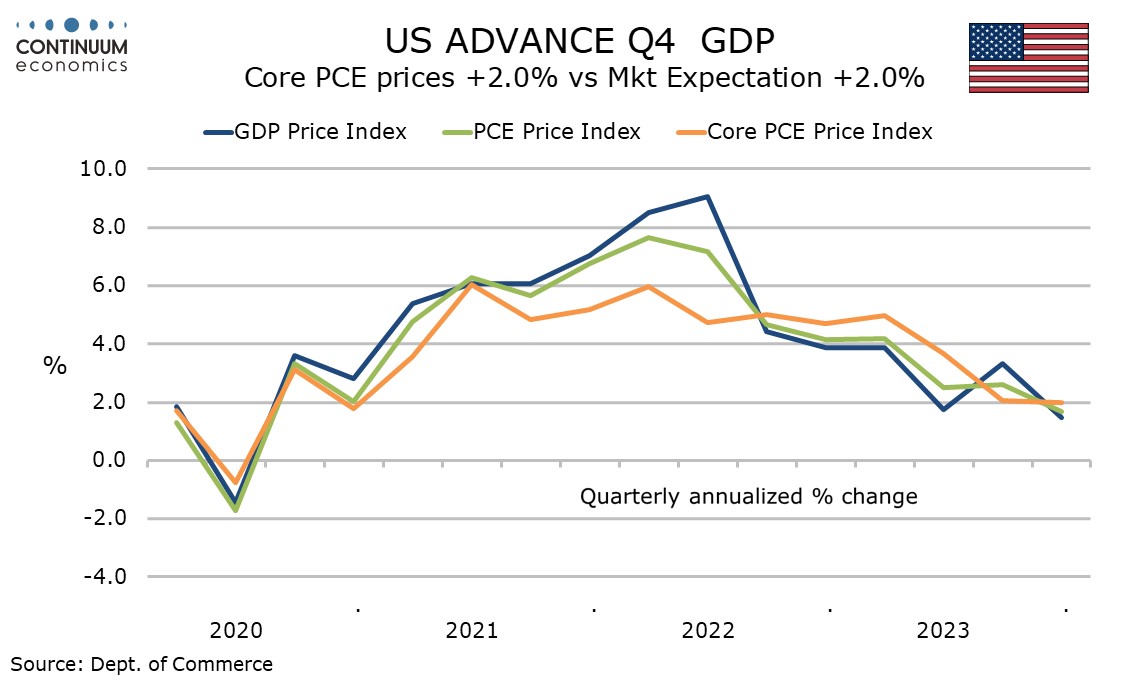

The latest FOMC statement and press conference from Fed’s Powell has had a limited impact on the market which took it as slightly hawkish, though it was a little more dovish than we expected. The Fed appears to have responded less to recent strong activity data than we expected, focusing more on progress on inflation, while making it clear that more progress is needed before easing starts.

Our view remains unchanged

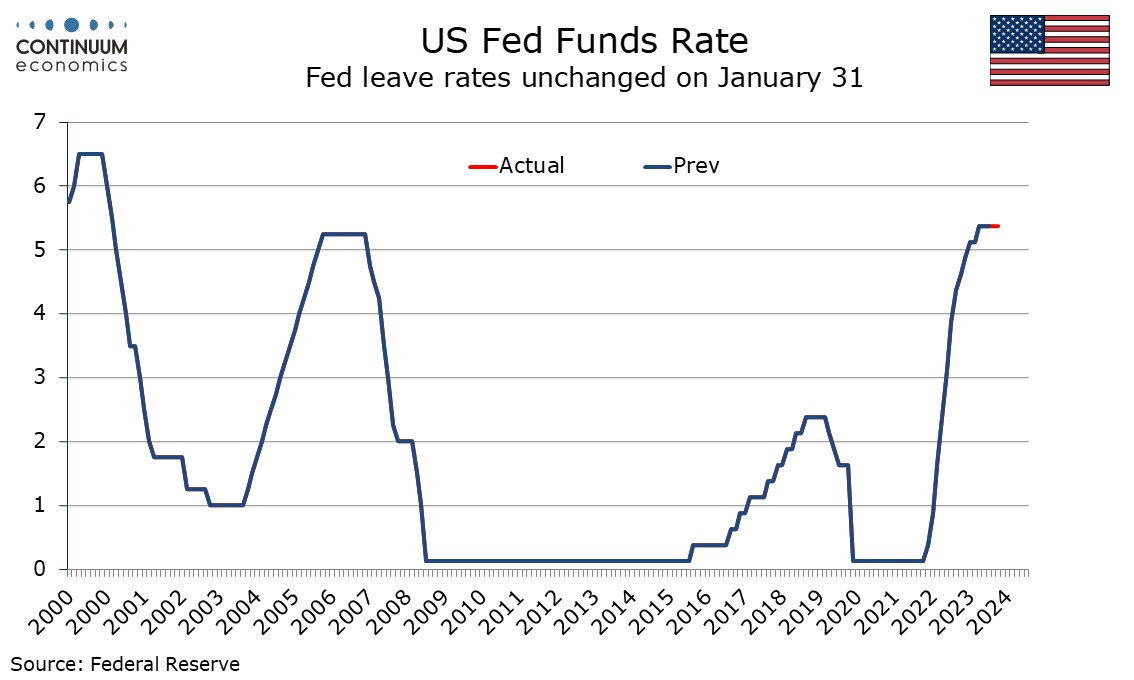

Going into the meeting we saw risk that continued strong growth would push easing out into Q3, though we now are able to stick with our previous view that easing will start in Q2 (more likely June than May) and we will see five 25bps easing in 2024, with one in Q2 and two each in Q3 and Q4. Chairman Jerome Powell explicitly stated that he did not see a March cut as likely, despite the fact we will see two non-farm payroll and two CPI releases between now and the March meeting, to which markets responded with some disappointment.

When will the Fed be ready to ease?

Powell seemed pleased with the progress made on inflation, stating that we have seen six months of good data. He saw strong GDP growth as more likely to leave inflation stuck above the 2% target rather than triggering a re-acceleration. It is unclear how much more subdued inflation data we will need to satisfy the Fed but if Q1 core PCE comes in near the 2% target on an annualized basis that would make three straight quarters, and then the Fed would probably consider easing. Powell stated that the Fed is not waiting for the economy to weaken before starting easing, so unexpected weakening of the economy could bring easing forward.

Our view of five 25bps easings in 2024 is more dovish than the Fed’s December dots, which looked for 75bps of easing in 2024. The Fed may be a little more dovish now than they were in December (they will update their dots in March) while we also see risk that the economy, while still resilient, may lose a little more momentum than the Fed expects, even if a move into recession now looks unlikely.

Statement saw significant changes

While the latest meeting had a limited impact on the markets, there were significant changes to the statement. It saw risks moving into a better balance and replaced a reference to determining the extent of any additional policy firming that may be needed with a reference to considering any adjustments to the target range, thus leaving both tightening and easing options open. The statement went on to say that they do not expect it will be appropriate to reduce the target range until the FOMC has achieved greater confidence that inflation is moving sustainably toward 2%. Powell stated that rates were likely at the peak, suggesting the bar for further tightening is quite high. The next move is likely to be an ease, but the Fed is not ready to move yet.