FX Daily Strategy: APAC, July 30th

BoJ meeting may lead to short lived JPY dip

JPY still likely to rise strongly through the year

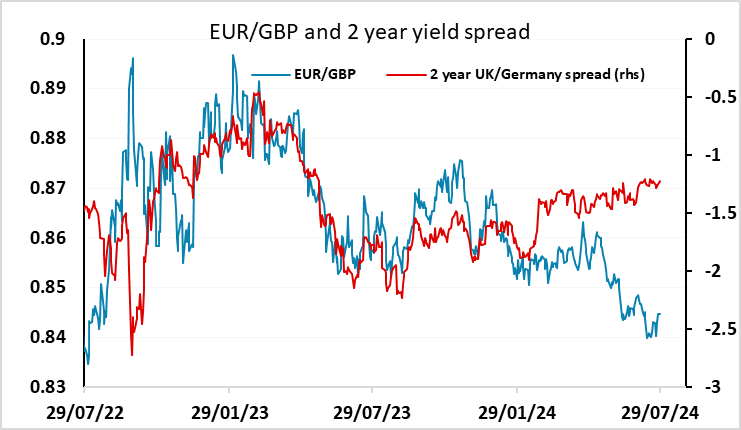

GBP risks on the downside on MPC meeting

USD might blip briefly higher after FOMC

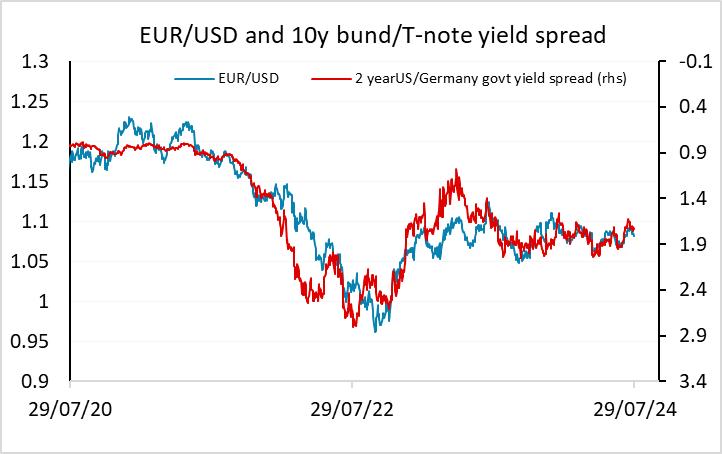

EUR/USD has some downside risks on GDP data…

…but hard to see a substantial move sub-1.08

GBP remains at risk despite recovery on Monday

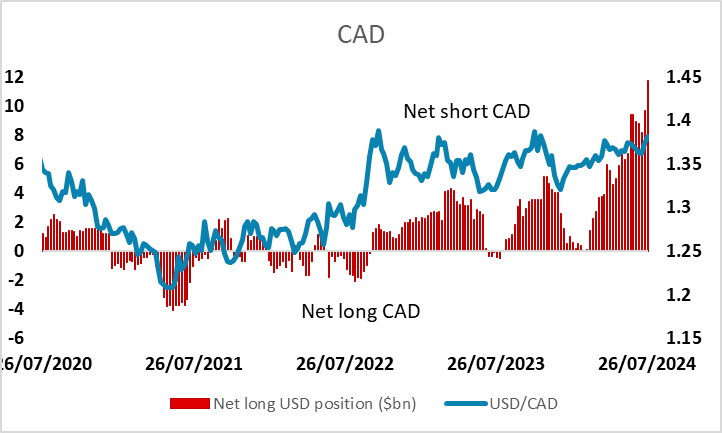

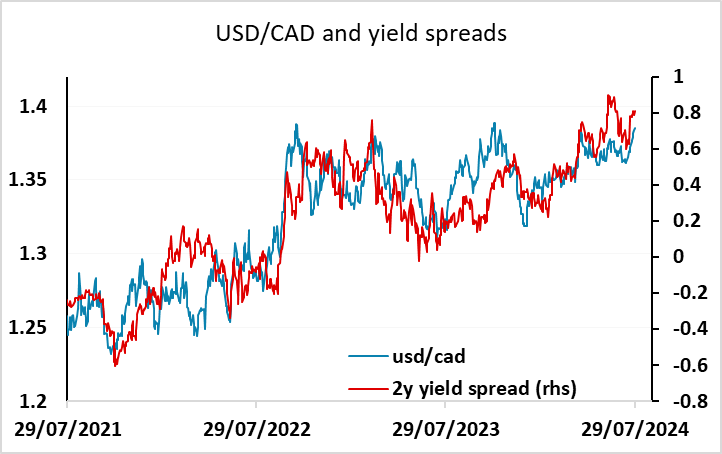

CAD weakness continues, but positioning suggests 1.40 will be tough to break

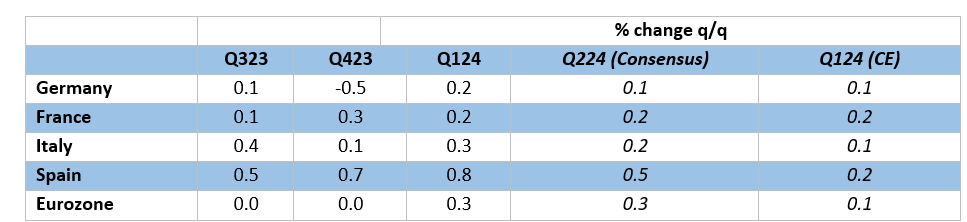

Tuesday sees Eurozone GDP data for Q2 and preliminary German and Spanish CPI data for July. According to revised official national accounts data, the EZ economy actually avoided what was previously suggested to have been a modest recession in H2 last year. Moreover, the economy sparked back into life in Q1, albeit against a backdrop of marked national growth divergences but the EZ outcome exceeded expectations. Indeed, Q1 GDP rose by 0.3% q/q, three times the ECB estimate and even Germany saw a return to positive growth. However, real GDP was bolstered in Q1 by weaker imports, working day effects and unseasonable weather and there was a weak capex backdrop, so the underlying picture remains unclear. But it seems that such GDP growth rates continued into the last quarter, with the ECB suggesting a pick-up to 0.4%. We think that this is too high and doubt whether it will persist, given both weaker survey data into this quarter and official data featuring continued manufacturing and construction softness. Indeed, we see a 0.1% increase, involving more national divergence.

The market consensus of 0.2% q/q for Q2 GDP is also below the ECB projection, but still above ours, so there may be some downside risks for the EUR on the data. The EUR was already under pressure against a generally firm USD on Monday, and weak data could be expected to trigger a break back below 1.08. But based on yield spreads, which continue to move closely with EUR/USD, there is still quite limited scope for much movement, and any dip below 1.08 is likely to be modest unless we also see much weaker than expected preliminary July CPI data from Germany and Spain. However, if anything we see mild upside risks to German inflation, with the headline holding at 2.5% rather than falling to 2.4% as the consensus predicts. So we doubt EUR/USD will move far from 1.08. There are, however, end of month flows to consider, and although most models don’t suggest these will have a big impact this month, both the direction and size of the impact are always uncertain.

After early gains EUR/GBP moved lower through the session on Monday, but we still see downside risks for GBP in the run-up to the BoE MPC meeting on Thursday. EUR/GBP is at historically low levels in real terms – the lowest since 2015 – and is trading below the level suggested by the recent correlation with nominal yield spreads. Net long speculative positioning in the futures market in GBP is also at record levels according to the latest CFTC data. Meanwhile, the market continues to move towards pricing in the first BoE rate cut on Thursday, with the probability of a cut now priced at 60%. GBP hasn’t suffered from this yet, but the risks of a significant GBP correction lower look to be mounting.

In contrast to GBP, net speculative short CAD positions in the futures market are at record highs in the latest CFTC data. USD/CAD continues to move quite closely with yield spreads, and is approaching the October 2022 high just below 1.40. There is no obvious trigger to reverse CAD declines after the latest BoC rate cut, but with positioning this extended we would be wary of expecting further significant gains. New information is likely to be required for a break above 1.40.