Preview: Due July 5 - U.S. June Employment (Non-Farm Payrolls) - Initial claims suggest some loss of momentum

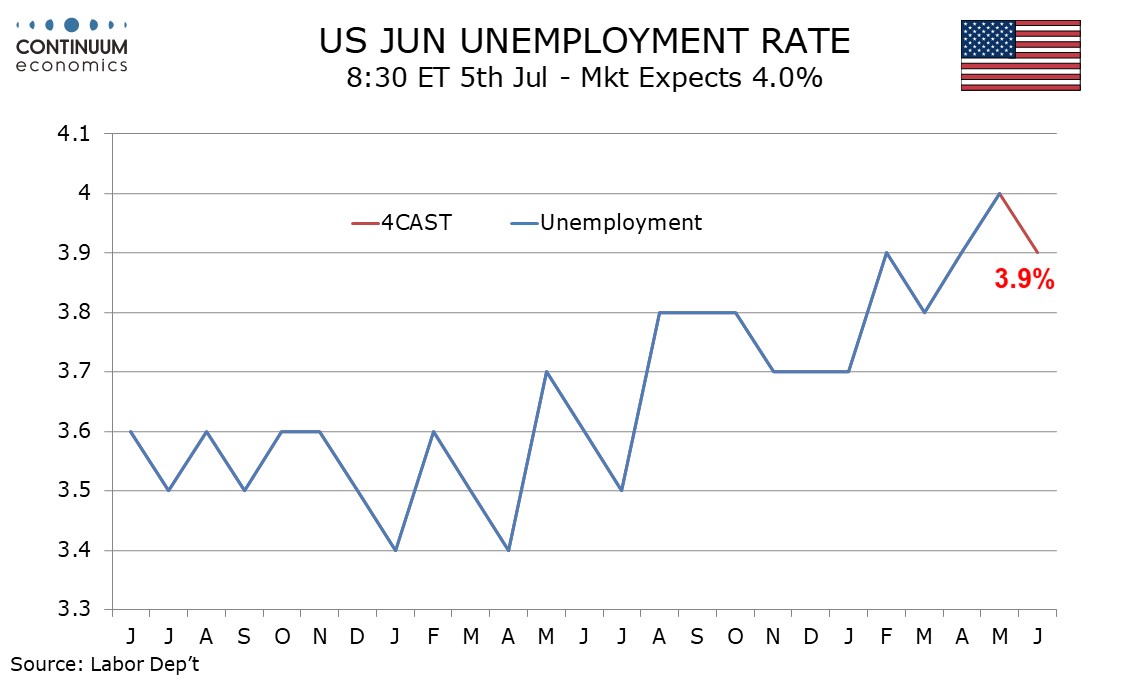

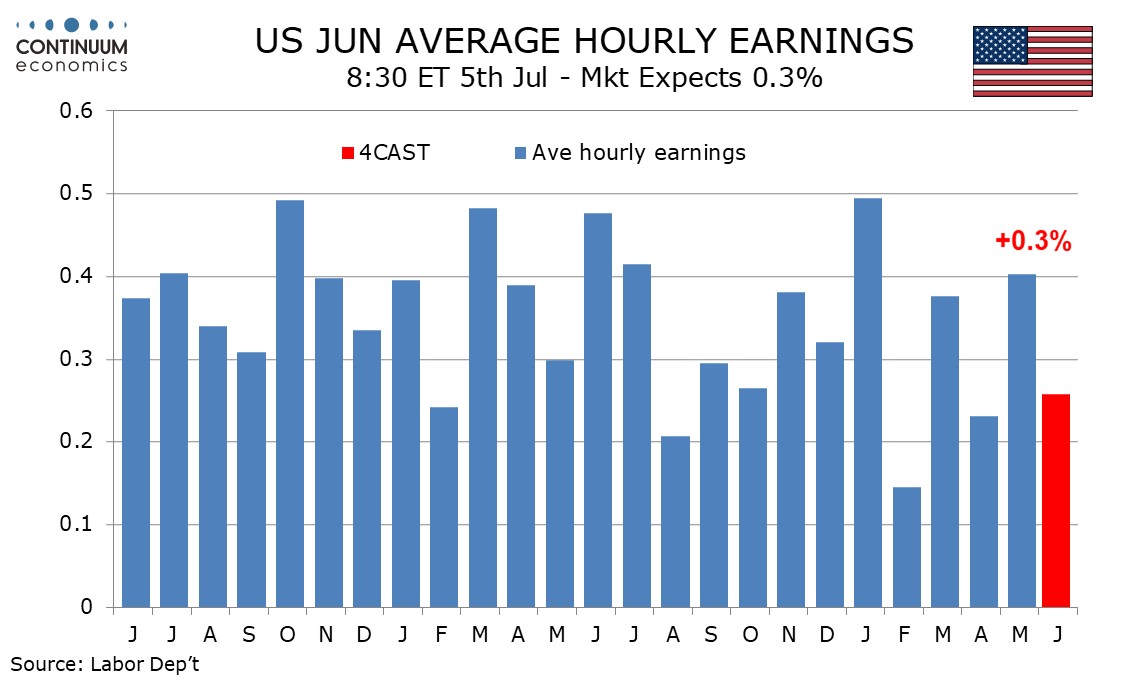

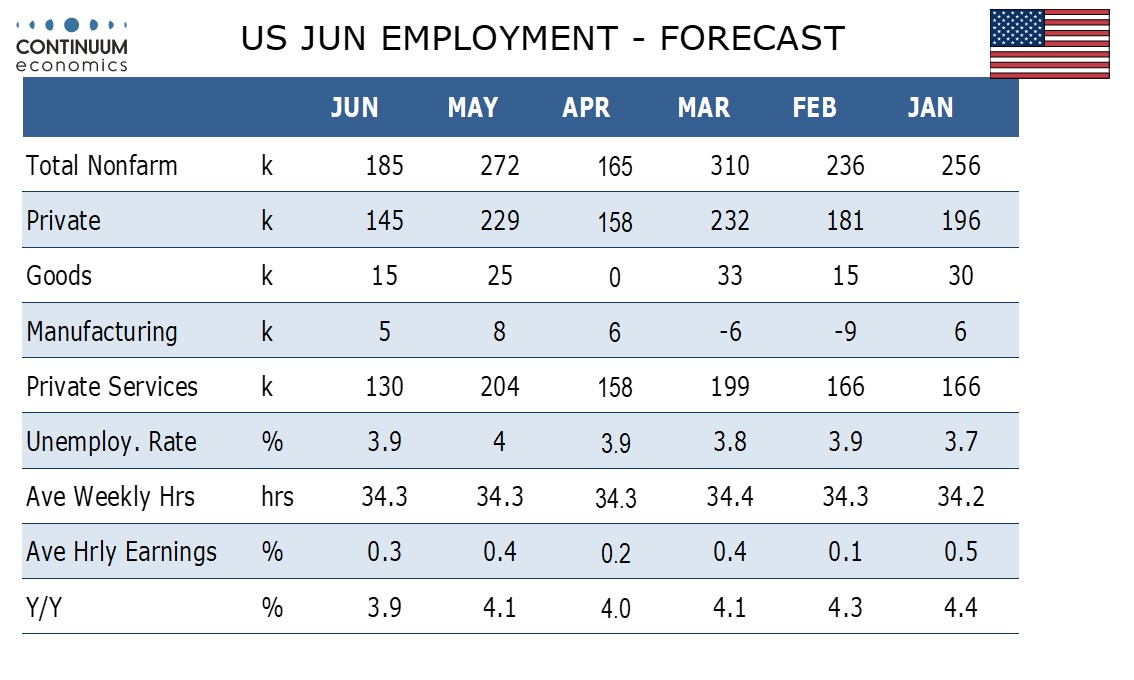

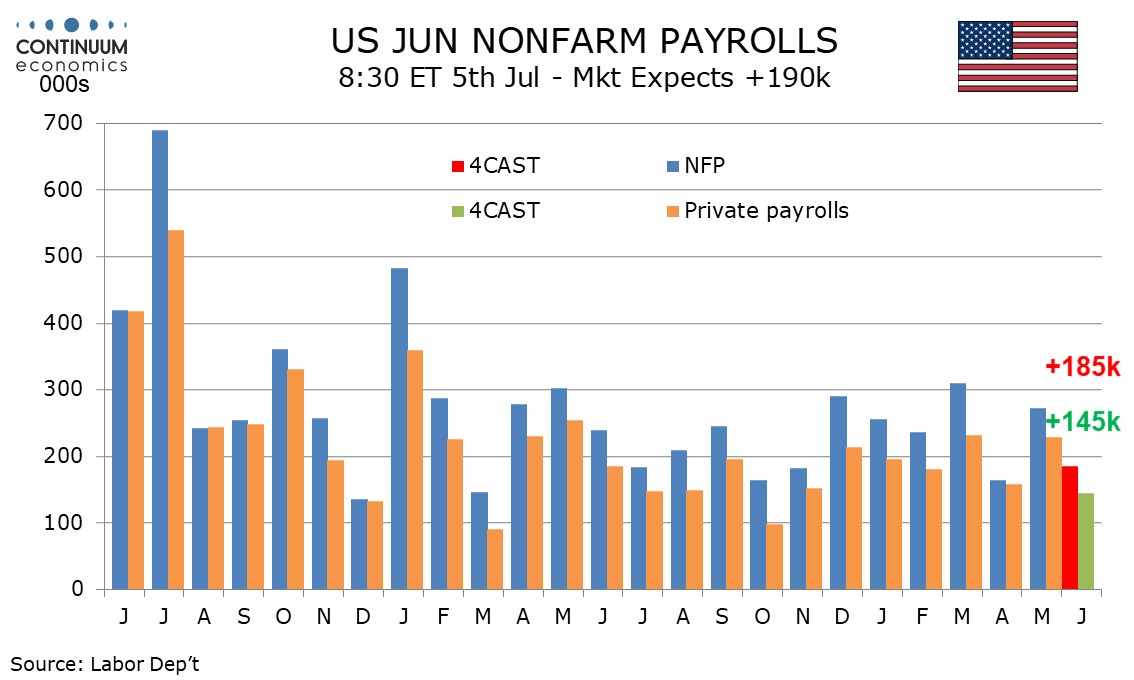

We expect June’s non-farm payroll to hint at some loss of labor market momentum, with a 185k increase overall and 145k in the private sector, the latter the slowest since October 2023. We expect average hourly earnings to follow a strong 0.4% May increase with a rise of 0.3% and less before rounding, though we expect unemployment to reverse a May increase to 4.0% and fall back to 3.9%.

The main reason to expect a loss of labor market momentum is a recent pick up in the initial claims trend, with continued claims edging higher too. Our forecasts would see the 6-month averages slowing for the first time since November 2023, overall to 237k from 255k in May with the private sector at 190k from 202k.

We expect a modest slowing across the board though business and professional merits particular attention after rising by a 12-month high of 47k in May, the main reason May data was on the firm side of trend at 272k overall and 249k in the private sector. Government is likely to continue contributing positively in June, led by state and local. Negative seasonal adjustments provide some downside risk overall.

May’s strong non-farm payroll was not matched by the household survey which calculates the unemployment rate, which rose on a 408k decline in employment despite a 250k dip in the labor force. We expect both those series to bounce back in June, sending unemployment back down to April’s rate of 3.9% after a rise to 4.0% in May.

Trend in average hourly earnings appears close to 0.3% per month even if we have not seen a 0.3% increase since December 2023. We saw a 0.5% increase in January followed by a 0.1% rise in February, and gains of 0.4% in March and May with a 0.2% April gain in between. We expect a 0.3% rise in June, though risk is lower rather than higher with our forecast being 0.26% before rounding. This would see yr/yr growth fall to a 4-year low of 3.9%, from 4.1% in May.

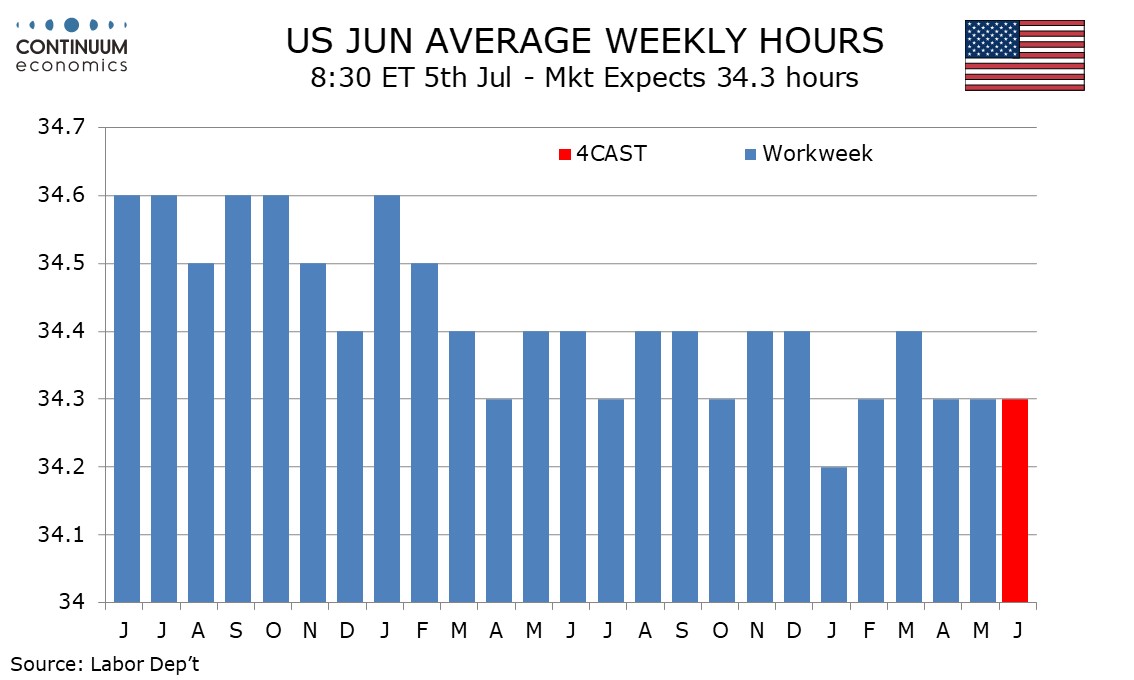

We expect a workweek of 34.3 hours for a third straight month, representing some easing of trend since 2023 when the majority of months came in at 34.4. This would leave aggregate hours worked up by 0.1% on the month, and by 1.6% annualized in Q2.