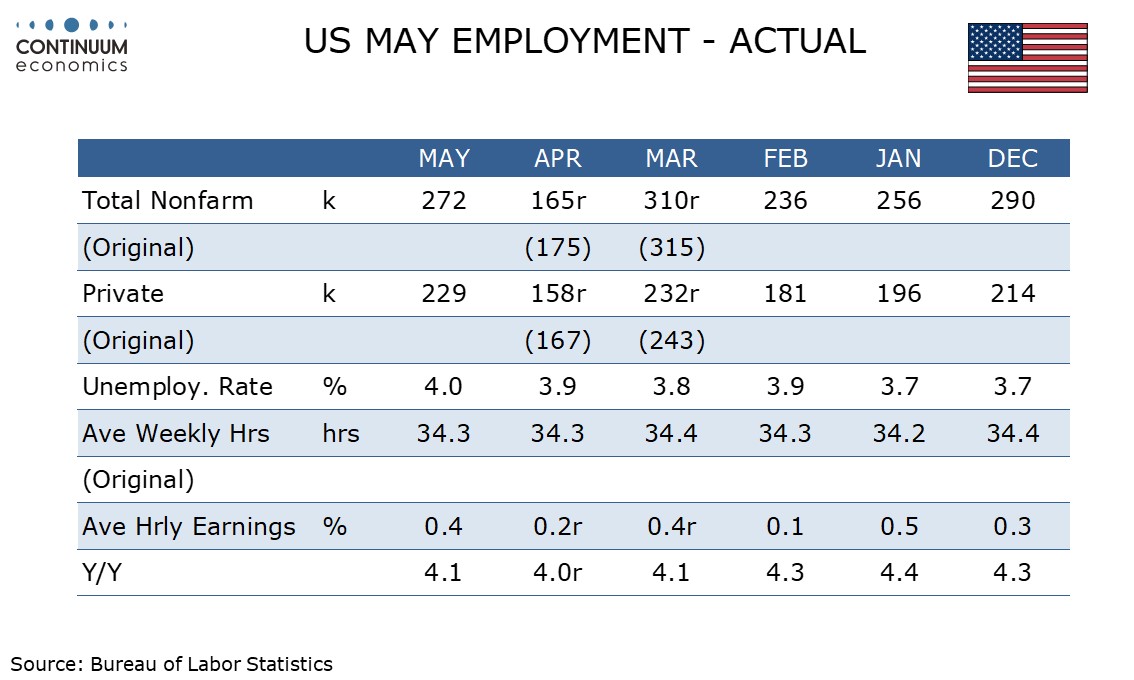

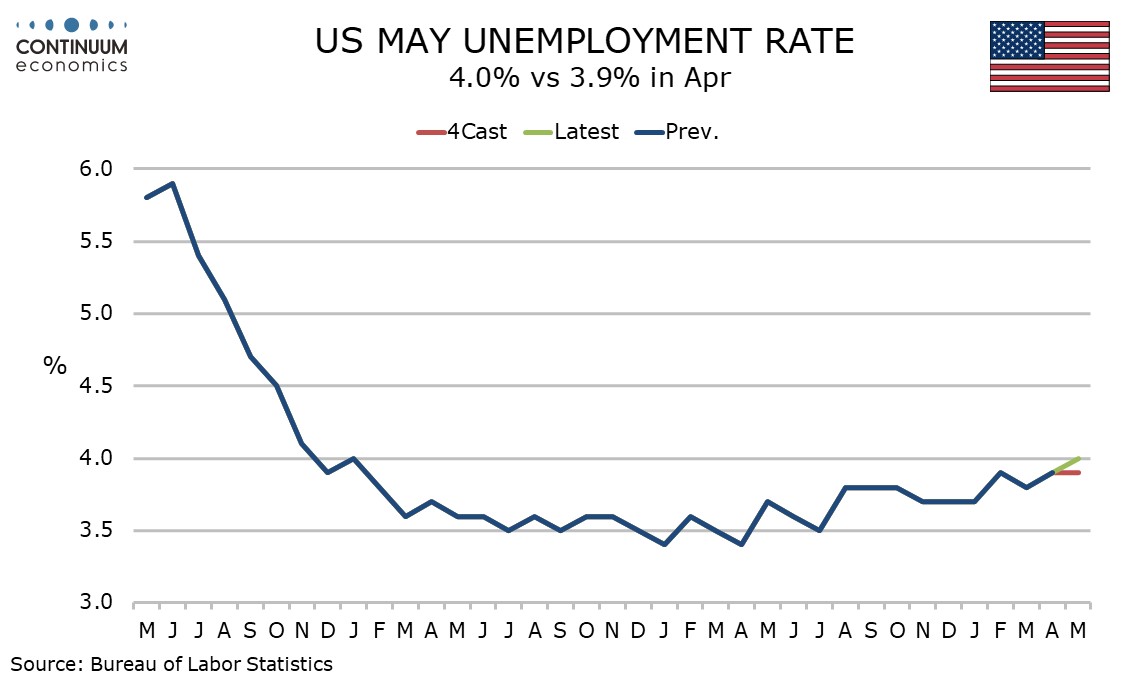

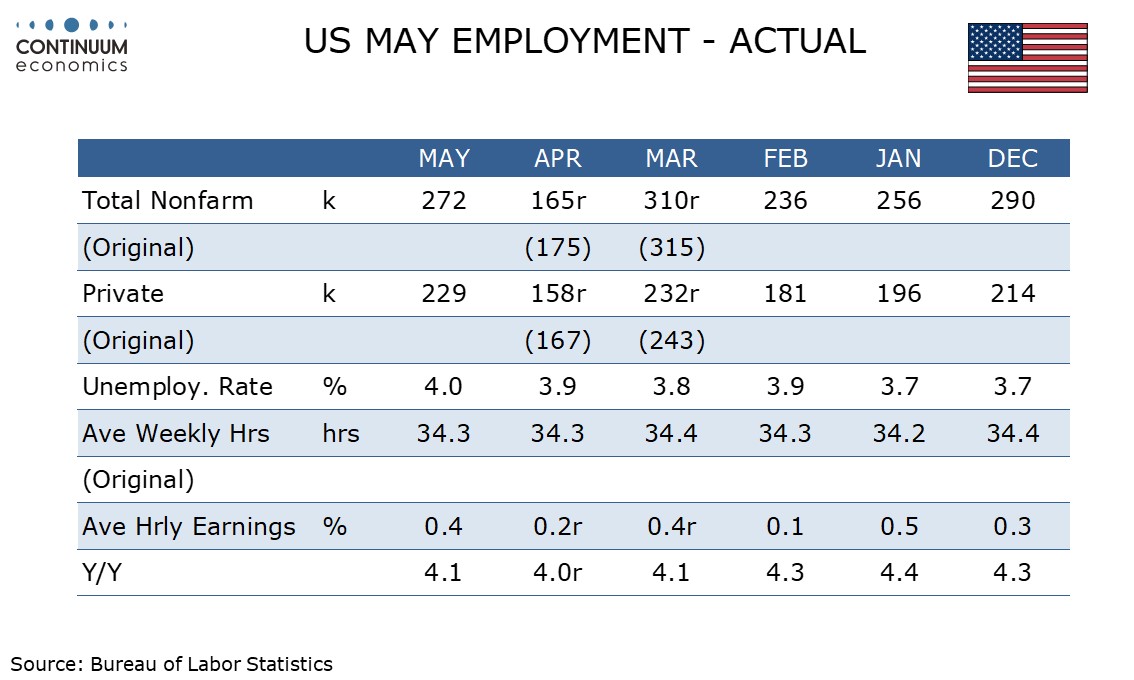

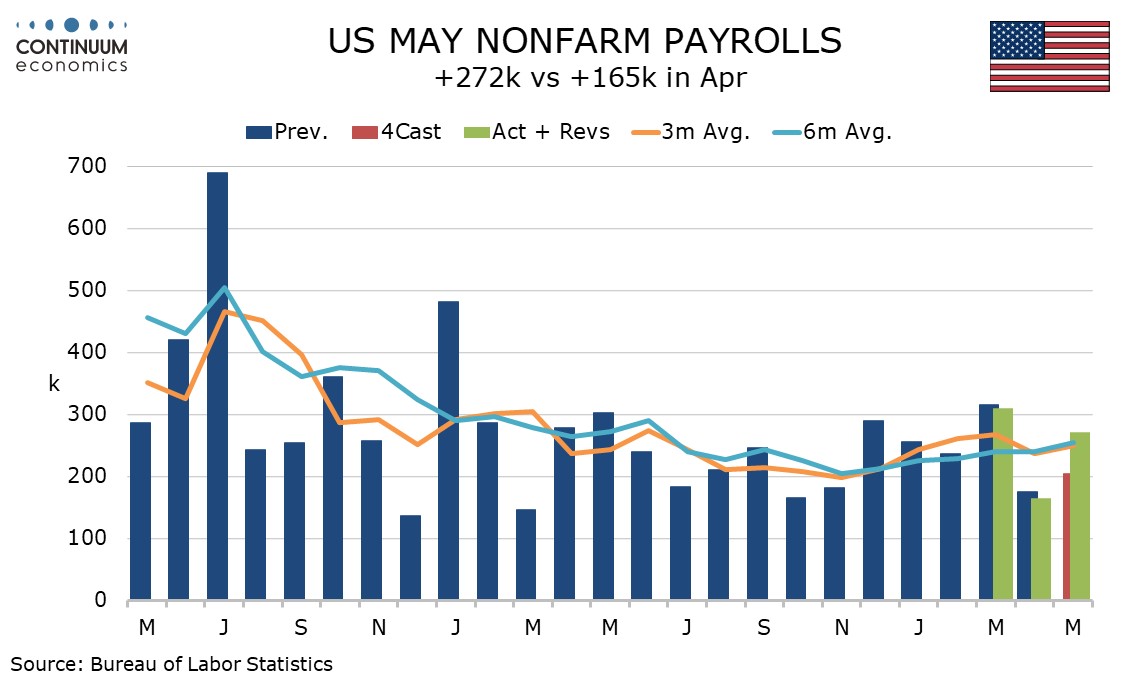

May’s non-farm payroll is clearly stronger than expected with a 272k increase and only 15k in negative back month revisions, with private payrolls up by 229k. Average hourly earnings are also on the firm side of consensus with a rise of 0.4%. Despite unemployment edging up to 4.0% from 3.9% with weak details, this data suggests the labor market, and the US economy, remain strong.

April’s slower payroll gain (revised down by 10k to 165k) now looks like a correction from March’s above trend gain of 310k (revised down by 5k). May’s data is a little above trend (the 6-month averages are 255k overall and 202k in the private sector), but not sharply.

Health care and social assistance at 83.5k remains the leading contributor to job growth. Also strong were leisure and hospitality at 42k and government at 43k (the latter a return to trend after a weak April corrected a very string March). Otherwise the picture is of a lack of weakness rather than any very strong sectors. Construction at 21k was stronger than manufacturing at 8k.

Health care and social assistance at 83.5k remains the leading contributor to job growth. Also strong were leisure and hospitality at 42k and government at 43k (the latter a return to trend after a weak April corrected a very string March). Otherwise the picture is of a lack of weakness rather than any very strong sectors. Construction at 21k was stronger than manufacturing at 8k.

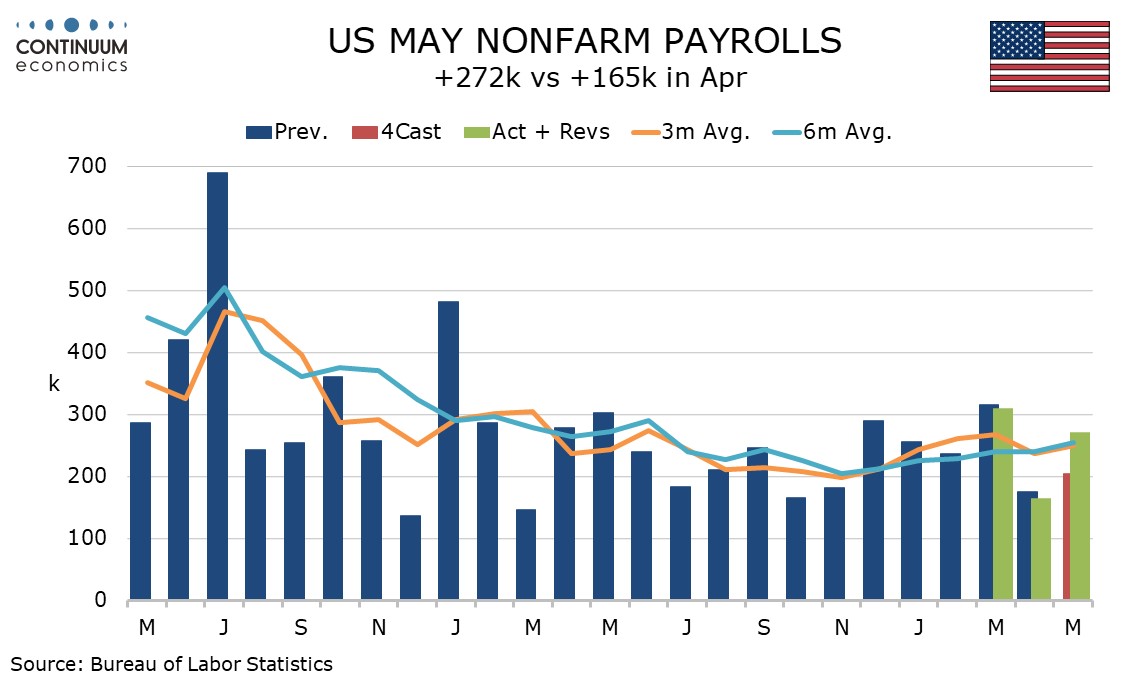

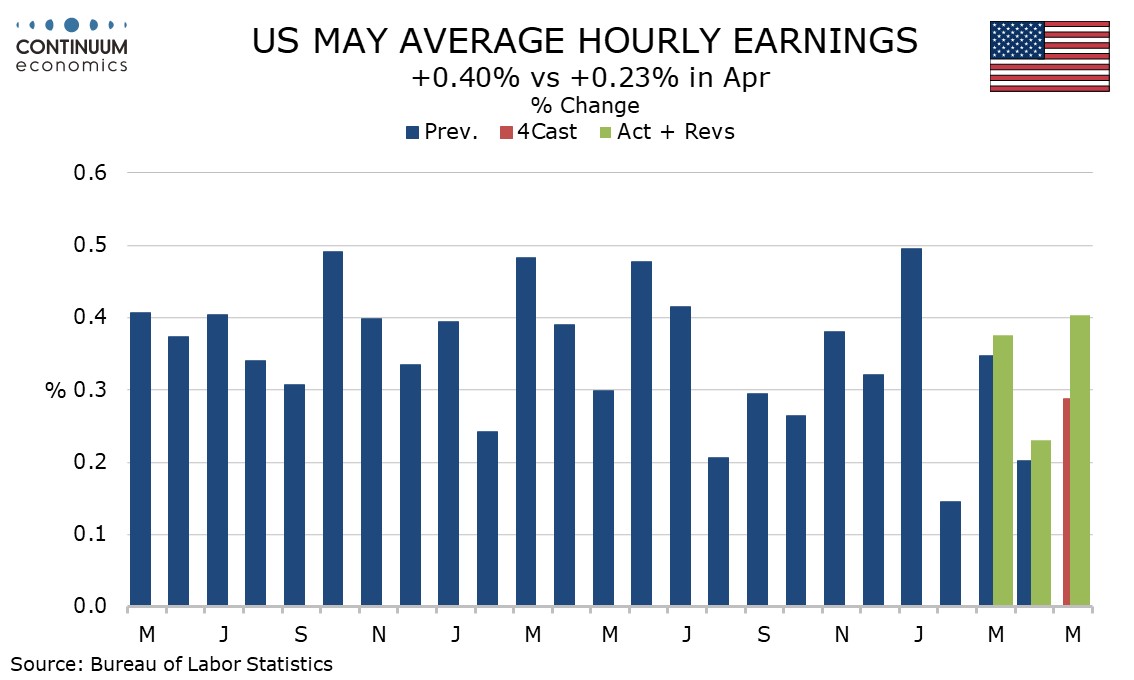

Average hourly earnings rose by 0.403% before rounding with April revised to 0.231% from 0.202% and March to 0.347% from .0347%, leaving yr/yr growth at 4.1% versus 4.0% in April (revised from 3.9%). Trend in average hourly earnings looks a little stronger than what would be consistent with 2.0% inflation.

Average hourly earnings rose by 0.403% before rounding with April revised to 0.231% from 0.202% and March to 0.347% from .0347%, leaving yr/yr growth at 4.1% versus 4.0% in April (revised from 3.9%). Trend in average hourly earnings looks a little stronger than what would be consistent with 2.0% inflation.

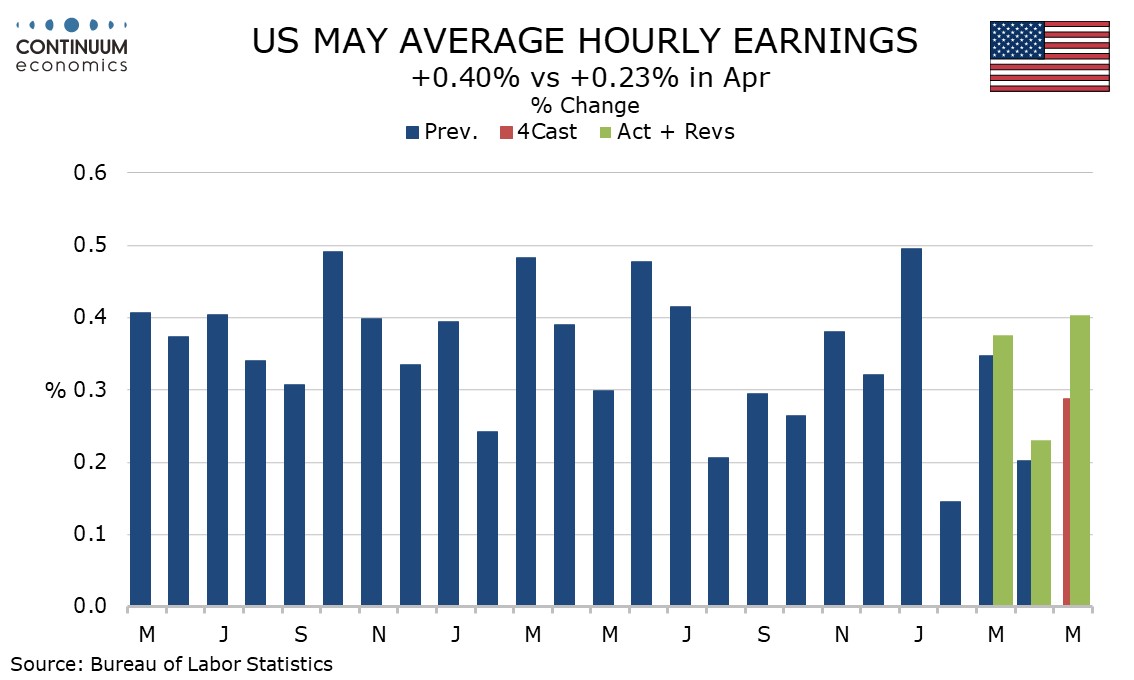

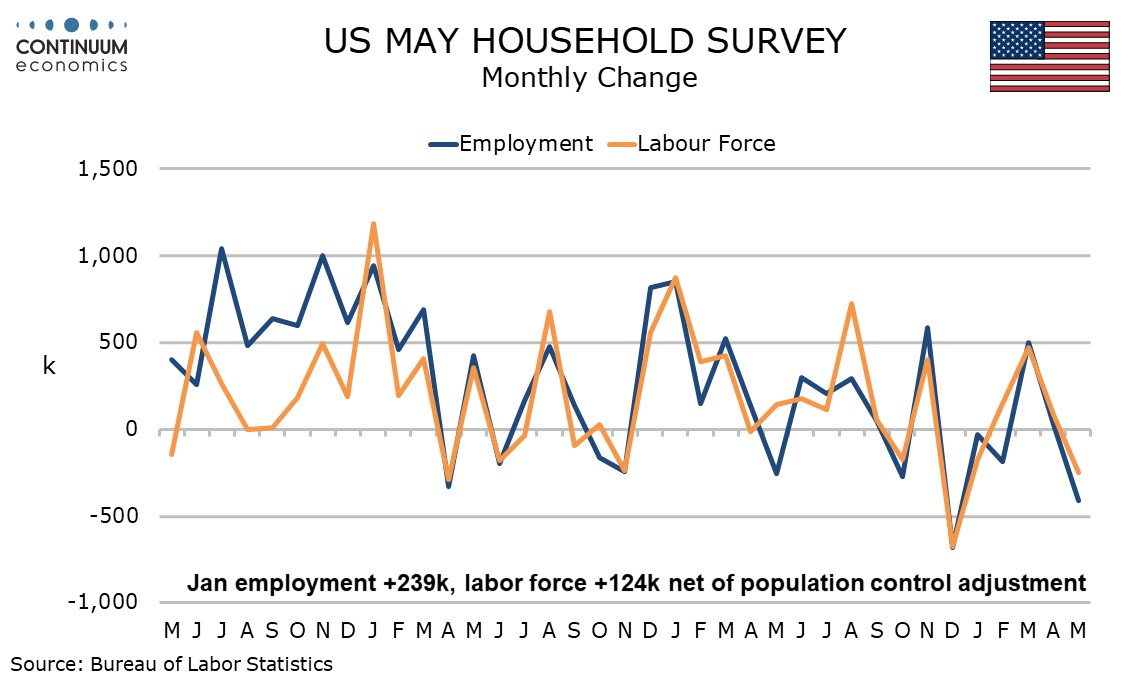

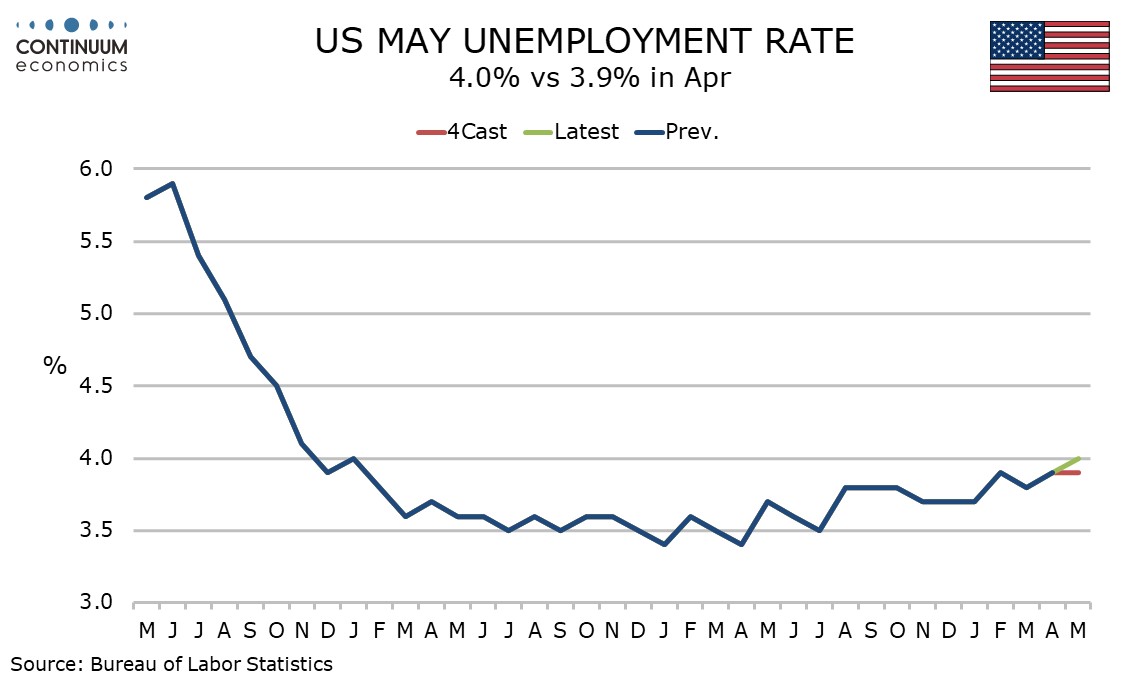

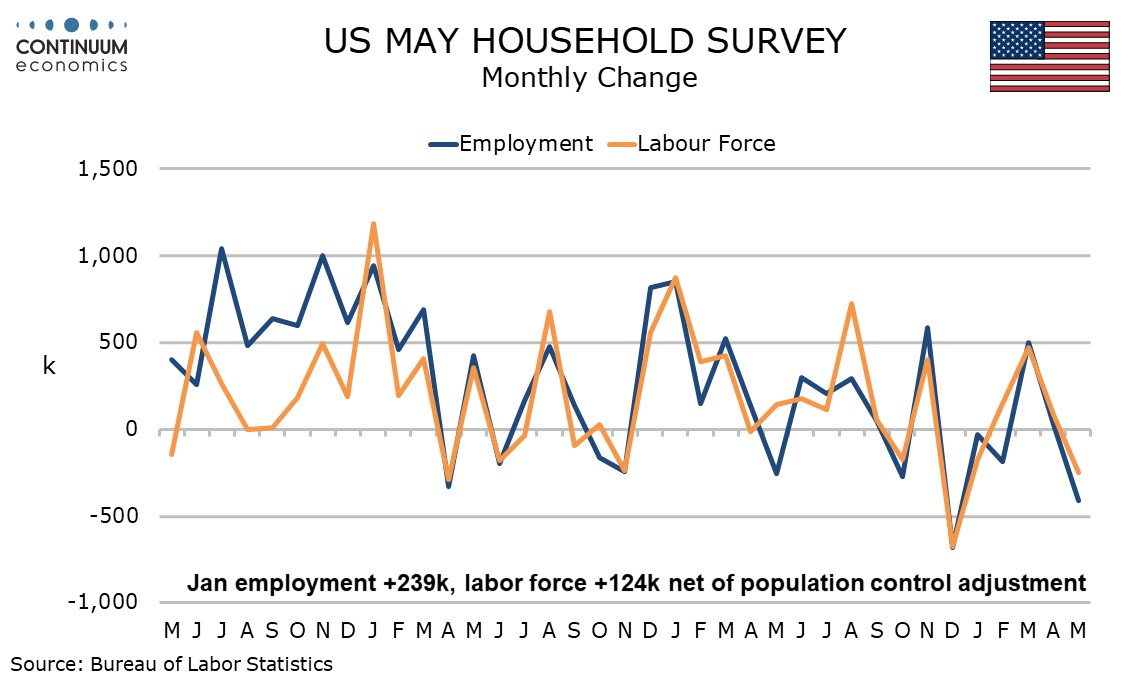

While the payroll looks strong, the household survey (which calculates the unemployment rate) gives a starkly different message, with the rise in unemployment coming despite a 250k decline in the labor force, with employment plunging by 408k. The household survey has been underperforming the nonfarm payrolls for some time but this contrast is particularly stark.

While the payroll looks strong, the household survey (which calculates the unemployment rate) gives a starkly different message, with the rise in unemployment coming despite a 250k decline in the labor force, with employment plunging by 408k. The household survey has been underperforming the nonfarm payrolls for some time but this contrast is particularly stark.

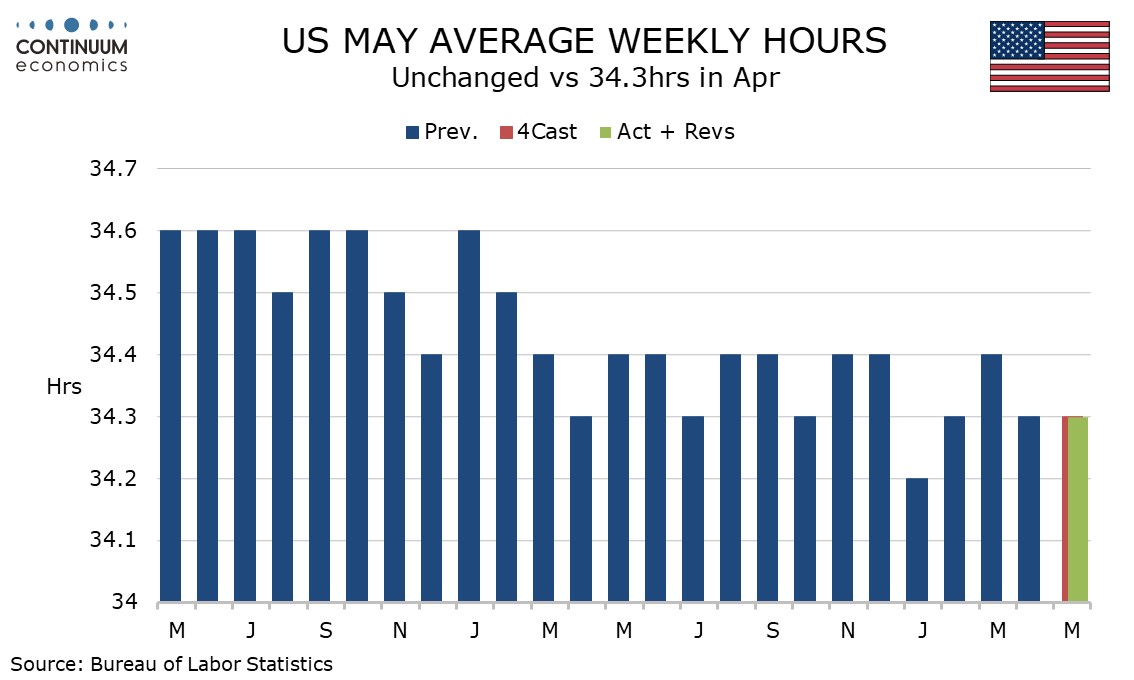

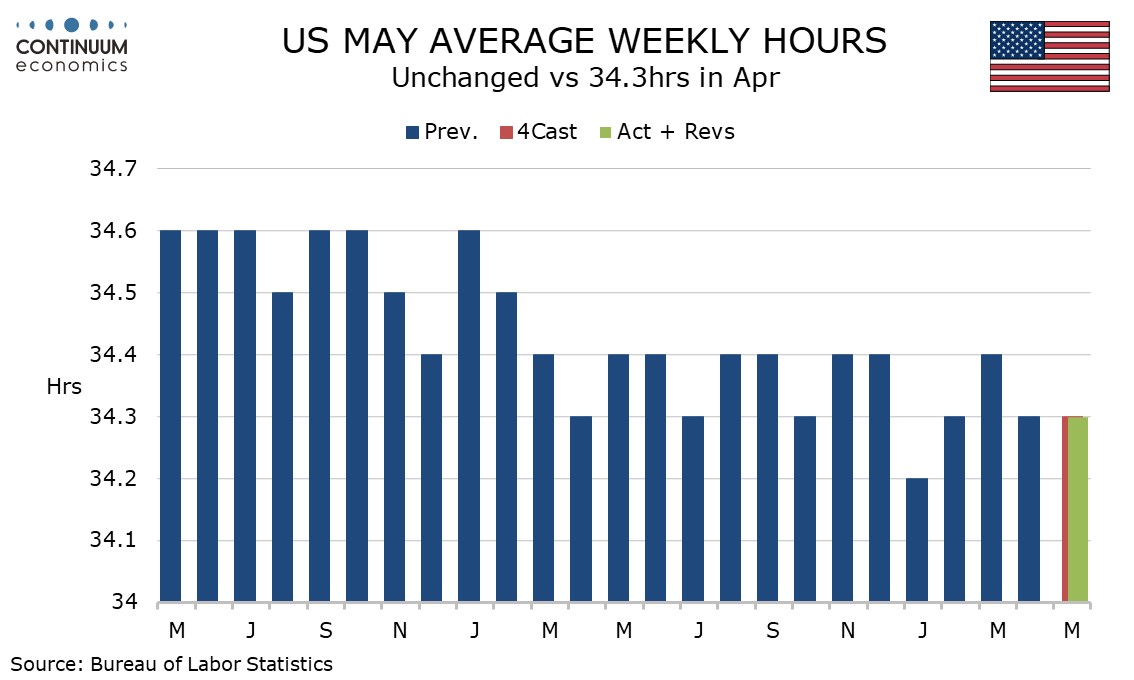

The average workweek, remaining at 34.3 hours, remains on the weak side of recent trend, beating only a weather-depressed January, and this is a sign that the economy is losing a little momentum. Still, strength in employment means that aggregate hours worked increased by 0.2%, with most sectors up but construction particularly firm after a weak April, and manufacturing flat.

The average workweek, remaining at 34.3 hours, remains on the weak side of recent trend, beating only a weather-depressed January, and this is a sign that the economy is losing a little momentum. Still, strength in employment means that aggregate hours worked increased by 0.2%, with most sectors up but construction particularly firm after a weak April, and manufacturing flat.

The strength of the recent data questions whether the economy is losing momentum, as had been implied by a slower Q1 GDP increase and generally soft data for April to open Q2. This keeps rate cuts off the table near term, July as well as June now looking very unlikely. September is still some way off, but softer data will be needed well before that meeting if easing is to start then.

The strength of the recent data questions whether the economy is losing momentum, as had been implied by a slower Q1 GDP increase and generally soft data for April to open Q2. This keeps rate cuts off the table near term, July as well as June now looking very unlikely. September is still some way off, but softer data will be needed well before that meeting if easing is to start then.