Fed SLOOS on Bank Lending mostly resilient

The Fed’s Q2 Senior Loan Officer Opinion Survey on bank lending practices generally sustains a less negative tone seen in the last survey for Q1, and does not suggest that the Fed need to have any serious concerns about the business investment outlook.

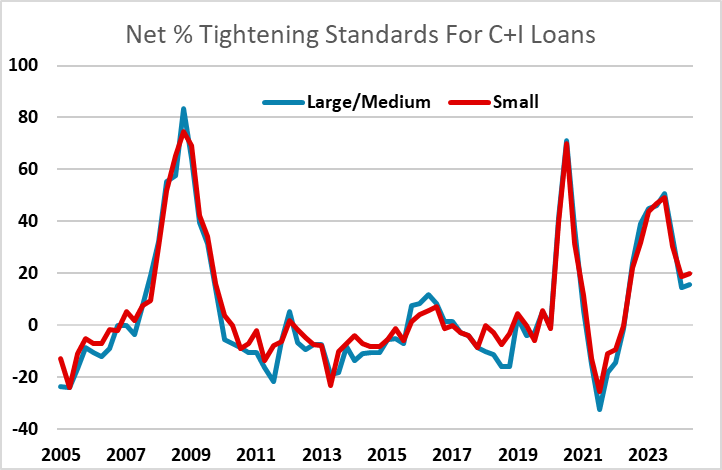

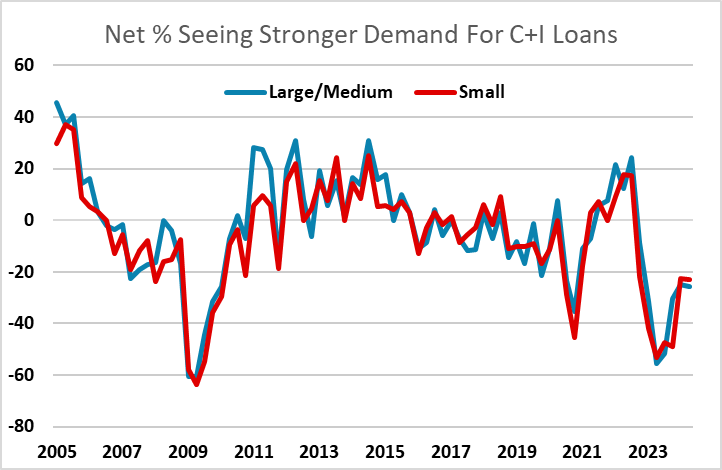

The net percentage tightening standards for C+I loans, 15.6% for large and medium and 19.7% for small firms, was almost unchanged from respective Q1 outcomes of 14.5% and 18.6%, while well below levels seen in 2023. The net percentage reporting stronger demand similarly was marginally more negative after being significantly less negative in Q1. The percentage increasing spreads of loan rates over banks’ cost of funds saw a third straight quarterly decline.

Findings for commercial real estate showed the proportion tightening standards declining and indicators of demand significantly less negative, suggesting easing risks in commercial real estate, seen by many as one of the more vulnerable sectors of the economy. There were similar improvements in measures of supply and demand for mortgage loans. Demand for consumer loans weakened however despite mixed indicators on supply.

The survey suggests resilience in business investment which was seen as a source of downside risk after the banking sector worries in early 2023, though there may be some fading on the consumer side, which has been a recent source of strength in the economy.