Indonesia CPI Review: Inflation Peaks on Base Effects, Not Demand

The January inflation spike is more noise than signal, driven by base effects, not a demand surge. With core pressures steady and the rupiah in focus, BI remains on a measured path. Easing remains likely in H1.

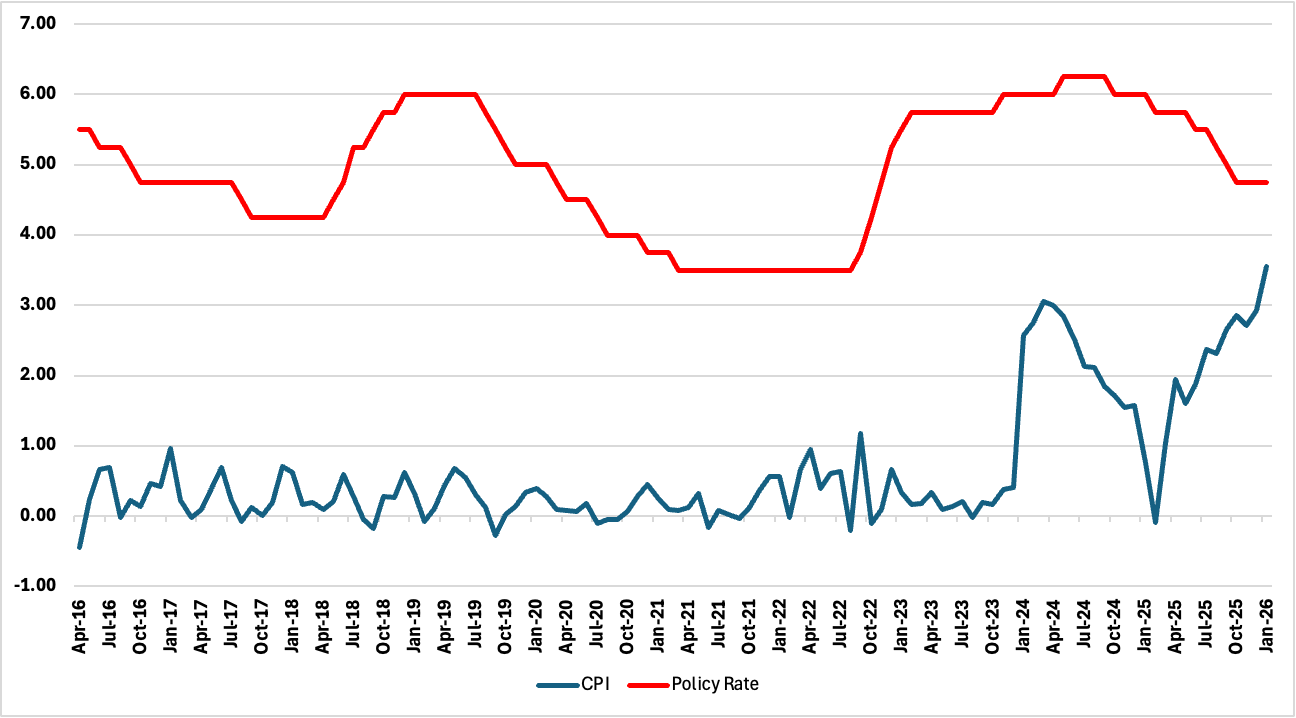

Indonesia’s January CPI data delivered a sharp but explainable spike, with annual inflation rising to 3.55% y/y, the highest print since May 2023, nudging past the upper bound of Bank Indonesia’s (BI) 1.5–3.5% target range. Yet beneath the headline, the picture is less alarming than it looks. The jump was driven almost entirely by base effects. A temporary electricity tariff subsidy introduced in January 2025 had artificially depressed last year’s inflation base, and with its expiry, price growth in the housing, water, electricity, and fuel category surged to 11.93% y/y, contributing a disproportionate 1.73 percentage points to headline inflation. Strip that out, and underlying pressures remain contained.

Figure 1: Indonesia CPI and Policy Rate (%)

Indeed, core inflation, a cleaner measure of domestic demand, rose only modestly to 2.45% y/y, reaffirming that price pressures remain largely supply-side and seasonal. On a sequential basis, the index actually declined by 0.15% m/m, reflecting softer food and transport prices post-holiday.

BI’s Pause Looks Prescient

Bank Indonesia’s January 22 policy hold at 4.75% now looks vindicated. Faced with IDR depreciation pressures and still-contained inflation expectations, the central bank opted to prioritise currency stability over pre-emptive easing. With the headline spike looking transitory, this stance appears well-calibrated, guarding against capital outflows and imported inflation without compromising the medium-term easing cycle. We expect that if the rupiah stabilises and food/energy shocks remain in check, BI could cut rate once in H1 2026, potentially taking the benchmark rate to 4.5% by June. That would give monetary support to the government’s 4.9–5.4% GDP growth ambition without stoking inflation.

Outlook: Normalisation, Not a Rethink

The forward path is steady, not reactive. Inflation is projected to ease to around 2.7% by March–April, with the base effect fading and supply chains normalising. Policymakers remain attuned to residual risks, climate disruptions, volatile food prices, and US dollar strength, but are unlikely to deviate from their wait-and-watch bias unless the rupiah sees sharp, sustained volatility.