View:

May 06, 2025

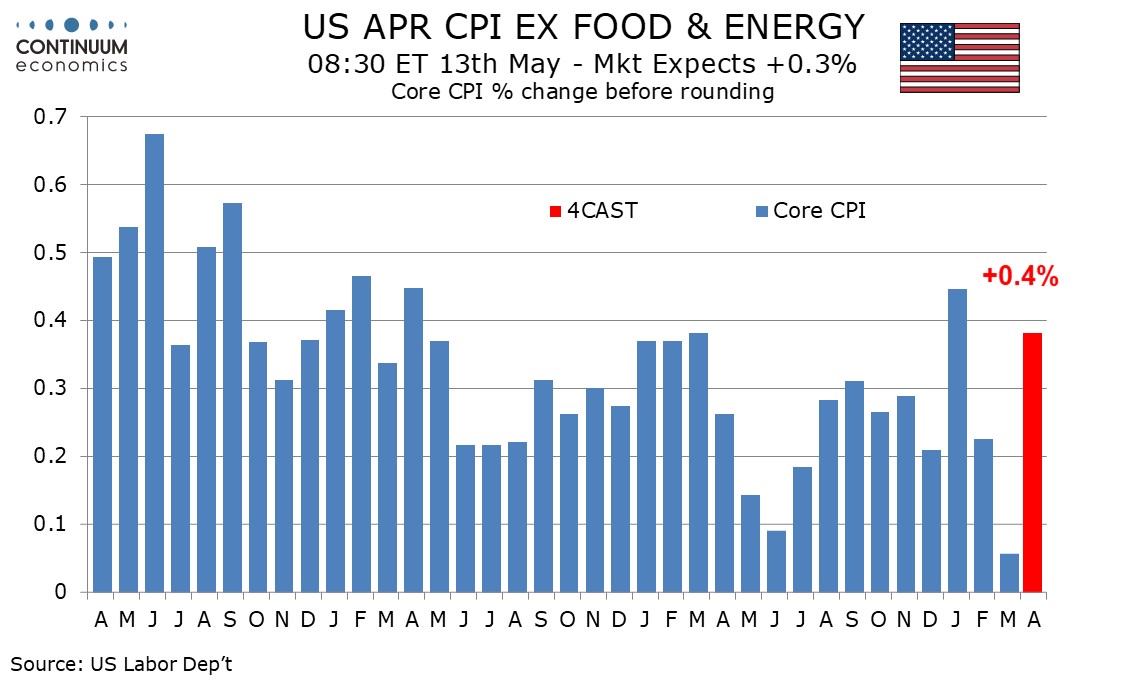

Preview: Due May 13 - U.S. April CPI - Upside risk after a below trend March

May 6, 2025 3:49 PM UTC

We expect April CPI to increase by 0.3% overall and by 0.4% ex food and energy, the core rate reflecting a rebound from a below trend March as well as some impact from tariffs, though the extent of the tariff impact is highly uncertain. We see the core rate at 0.38% before rounding.

South Africa’s Automotive and Agricultural Sectors Will Be Tested Amid Trump’s Additional Tariffs

May 6, 2025 3:14 PM UTC

Bottom Line: Taking into account that the 31% U.S. additional tariffs on South African goods could still come into effect despite a 90-day reprieve from the U.S. president Trump, the threat is still alive as South African economy will be negatively impacted by tariffs partly nullifying the African G

US March trade deficit surges as service export weakness adds to pre-tariff strength in goods imports

May 6, 2025 1:04 PM UTC

March’s record US trade deficit of $140.5bn is even higher than expected though consistent with the assumptions of the Q1 GDP report. Exports surged by 4.4% ahead of the April 2 tariff announcement while exports rose by a marginal 0.2%.

Tariff Man

May 6, 2025 8:45 AM UTC

With the U.S. equity market having rebounded, President Donald Trump instinct on tariffs have seen threats of pharma tariffs and a 100% tariff on non U.S. films. Slow progress is also reported on bilateral deals, despite White House PR spin. However, Trump will see pressure rising from three so

Transit Revoked, Ties Recalibrated: What Bangladesh's Pivot Signals

May 6, 2025 5:32 AM UTC

India’s revocation of transhipment access to Bangladesh marks a broader shift in bilateral ties, driven by Dhaka’s strategic pivot towards China and Pakistan. The move reflects India’s growing unease over regional security and the erosion of mutual trust post-regime change in Dhaka. For India,

Standoff Renewed: India and Pakistan Edge Closer to the Brink

May 6, 2025 3:33 AM UTC

India–Pakistan tensions have sharply escalated following a deadly terror attack in Kashmir, prompting sweeping diplomatic, military, and economic measures on both sides. New Delhi has ordered mock civilian defence drills and restricted the flow of river Chenab. Additionally, ceasefire violations a

May 05, 2025

U.S. April ISM Services - A correction higher within a slowing trend

May 5, 2025 2:15 PM UTC

April’s ISM services index of 51.6 has corrected higher from March’s 50.8 though remains quite subdued and is weaker than each index from September through February. Prices paid accelerated, to 65.1 from 60.9, reaching their highest since January 2023.

Preview: Due May 15 - U.S. April Industrial Production - A rise overall, but slippage in manufacturing

May 5, 2025 12:45 PM UTC

We expect April industrial production to rise by 0.5% overall but with a 0.3% decline in manufacturing. This would represent a reverse mix of March’s data, when overall industrial production fell by 0.3% but manufacturing increased by 0.3%.