Published: 2025-05-05T12:45:45.000Z

Preview: Due May 15 - U.S. April Industrial Production - A rise overall, but slippage in manufacturing

3

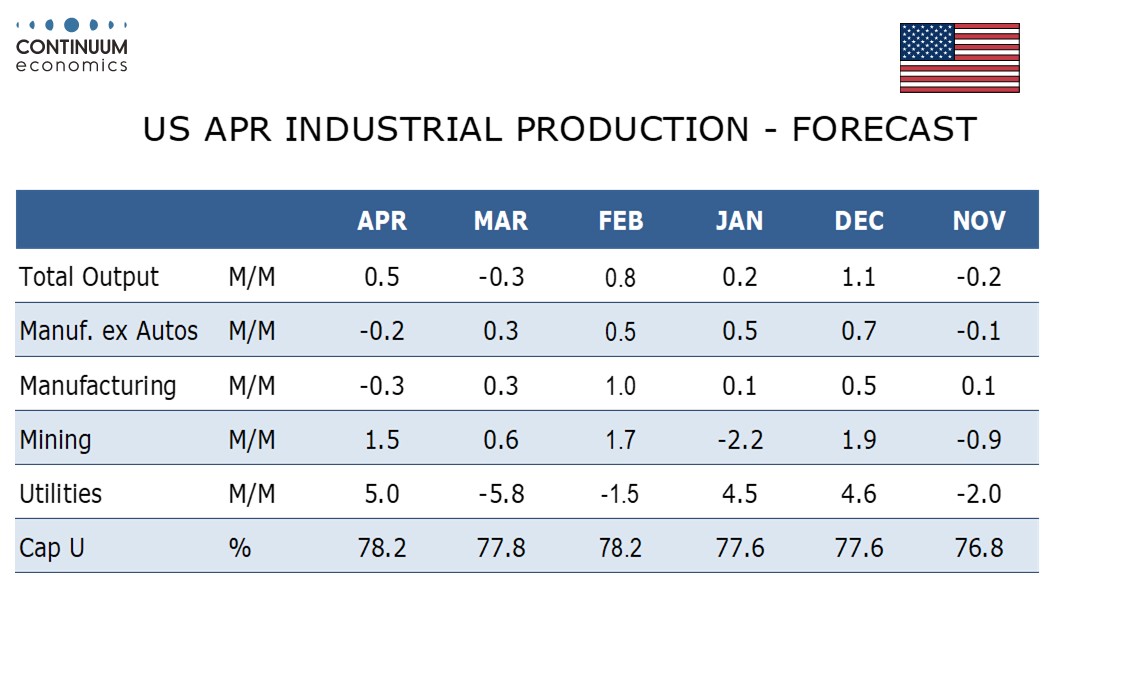

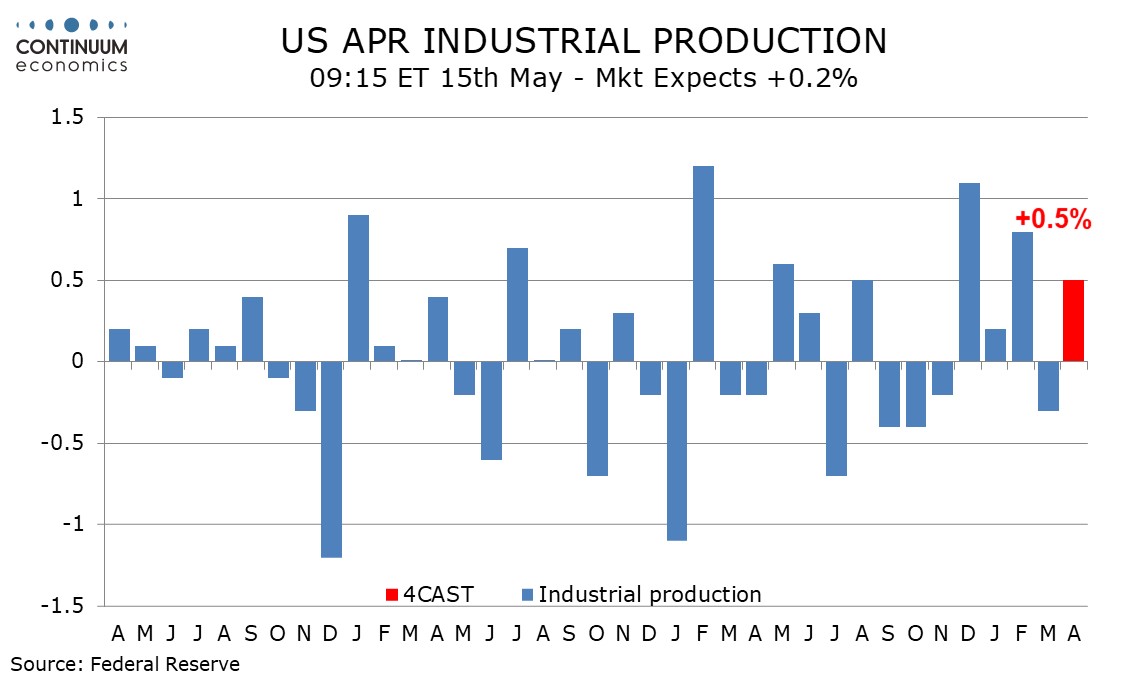

We expect April industrial production to rise by 0.5% overall but with a 0.3% decline in manufacturing. This would represent a reverse mix of March’s data, when overall industrial production fell by 0.3% but manufacturing increased by 0.3%.

Weekly electrical output suggests a rebound in weather sensitive utilities from a 5.8% decline in March, and we expect a rise of 5.0%. The non-farm payroll detail also suggests a positive contribution from mining, which we expect to increase by 1.5%.

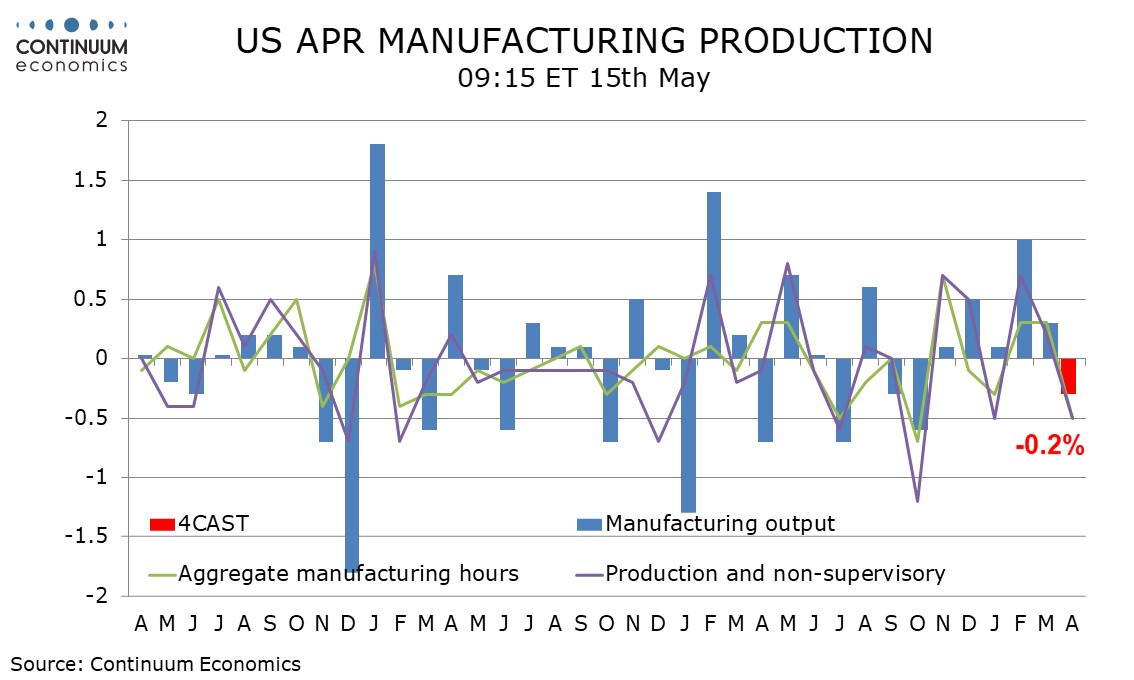

The non-farm payroll detail however shows slippage in manufacturing aggregate hours worked, and with the ISM production index weaker we expect manufacturing output to fall by 0.2%, with a 0.3% decline ex autos.

We expect capacity utilization to rise to 78.2% from 77.8% overall, but manufacturing to fall to 77.1% from 77.3%. This would return both series to where they were in February.