FX Daily Strategy: APAC, May 7th

FOMC the focus but limited scope for reaction

USD remains under pressure on a broad front

AUD may have most potential for gains in risk neutral markets

SEK unlikely to be moved by CPI

CHF the less attractive safe haven

FOMC the focus but limited scope for reaction

USD remains under pressure on a broad front

AUD may have most potential for gains in risk neutral markets

SEK unlikely to be moved by CPI

CHF the less attractive safe haven

The FOMC meeting is the main focus for Wednesday, but there is no expectation of any change in policy, and with no update to the dots, there is limited scope for the meeting to have a market impact. In the current exceptionally uncertain environment, the FOMC are unlikely to give much away on future policy. Chairman Powell is likely to signal at the press conference that future meetings will be live and dependent on data, which should sustain market hopes for easing. The possibility of easing should not, however, be seen as anything close to a commitment. As it stands, the market is pricing in nothing for this meeting and round a 33% chance of a cut in June. This looks about right, as there are certainly hawkish voices on the Fed who will baulk at the idea of easing if inflation is rising, even if that rise is a one off due to tariffs. June will probably be too early for easing as there is unlikely to be enough evidence of economic weakness by then, especially given the confusion in the data resulting from the big Q1 rise in imports in an attempt to avoid tariffs.

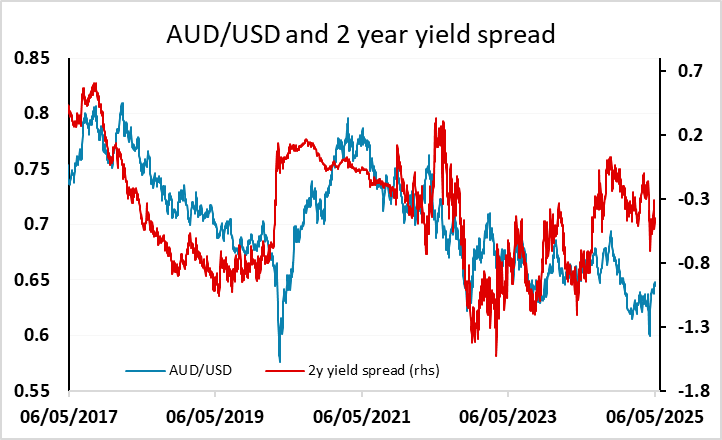

However, the USD is probably less concerned about Fed policy now than it has been for a long time. There is definitely a sense in the market that the USD has lost some attractiveness as a result of the tariff policy and the unpredictability of Trump in general. It is no longer seen as the primary safe haven, and there would need to be a return to a more risk loving environment if it was to benefit from increased capital inflows seeking high returns. This is of course possible at some point, but we see little chance of the equity market continuing its recent recovery in the next couple of months given the uncertainty about economic prospects and the high starting level. From here, we see some USD weakness on a broad front, but it is unlikely to be sharp unless there is some much weaker data emerging in the near term. As long as equities remain within recent ranges, the AUD may have the most potential for gains, having substantially underperformed yield spreads in the last couple of years. The break above the 0.6400-25 resistance area suggests scope for a further advance.

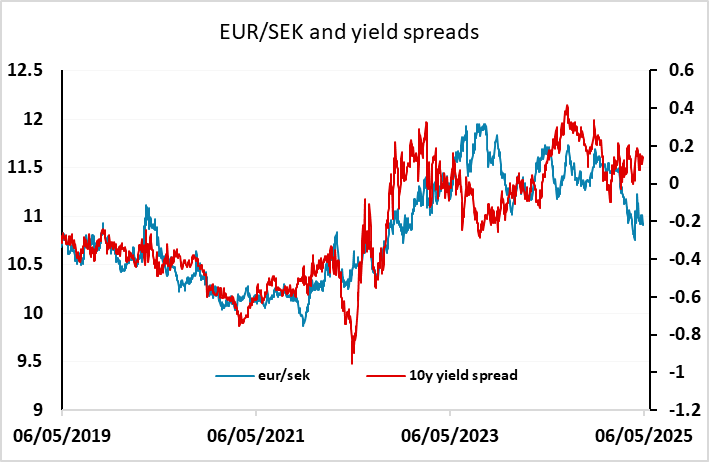

Elsewhere, there is Swedish CPI data in Europe, with the consensus looking for a small rise in the targeted CPIF measure to 2.5% in a y/y basis. This is of more interest given the Riksbank meeting this week, but there is no expectation of Riksbank action and CPI would need to be substantially below consensus for the market to price in any chance of a cut at Thursday’s meeting. However, a cut is halfway priced in for the June meeting, and the CPI data could influence that. We continue to see short term risks as mainly being on the downside for the SEK against both the EUR and NOK, as the gains made in the last few months look a little excessive.

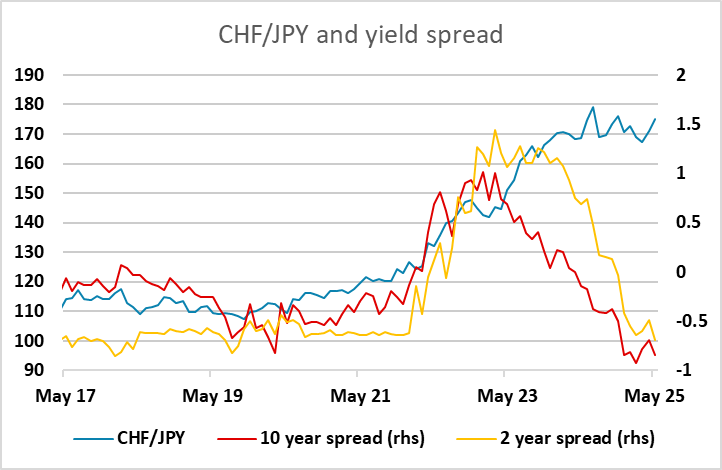

While the JPY was the strongest performer on Tuesday, helped by the more risk averse market tone, the CHF didn’t manage to make similar gains as it normally does when risk appetite weakens. This was due mainly to the comments from SNB president Schlegel, who noted the recent strength of the CHF, and the potential both for SNB intervention and for rates to be cut to zero or even below. EUR/CHF rose modestly on the day, but it seems unlikely that he SNB can do a great deal to further discourage CHF buyers, with rates already very unattractive and intervention historically generally failing to do anything other than slow gains. Even so, we do see the CHF as substantially overvalued, and CHF/JPY looks the most obviously overvalued pair, given the normally similar risk characteristics of the JPY and CHF.