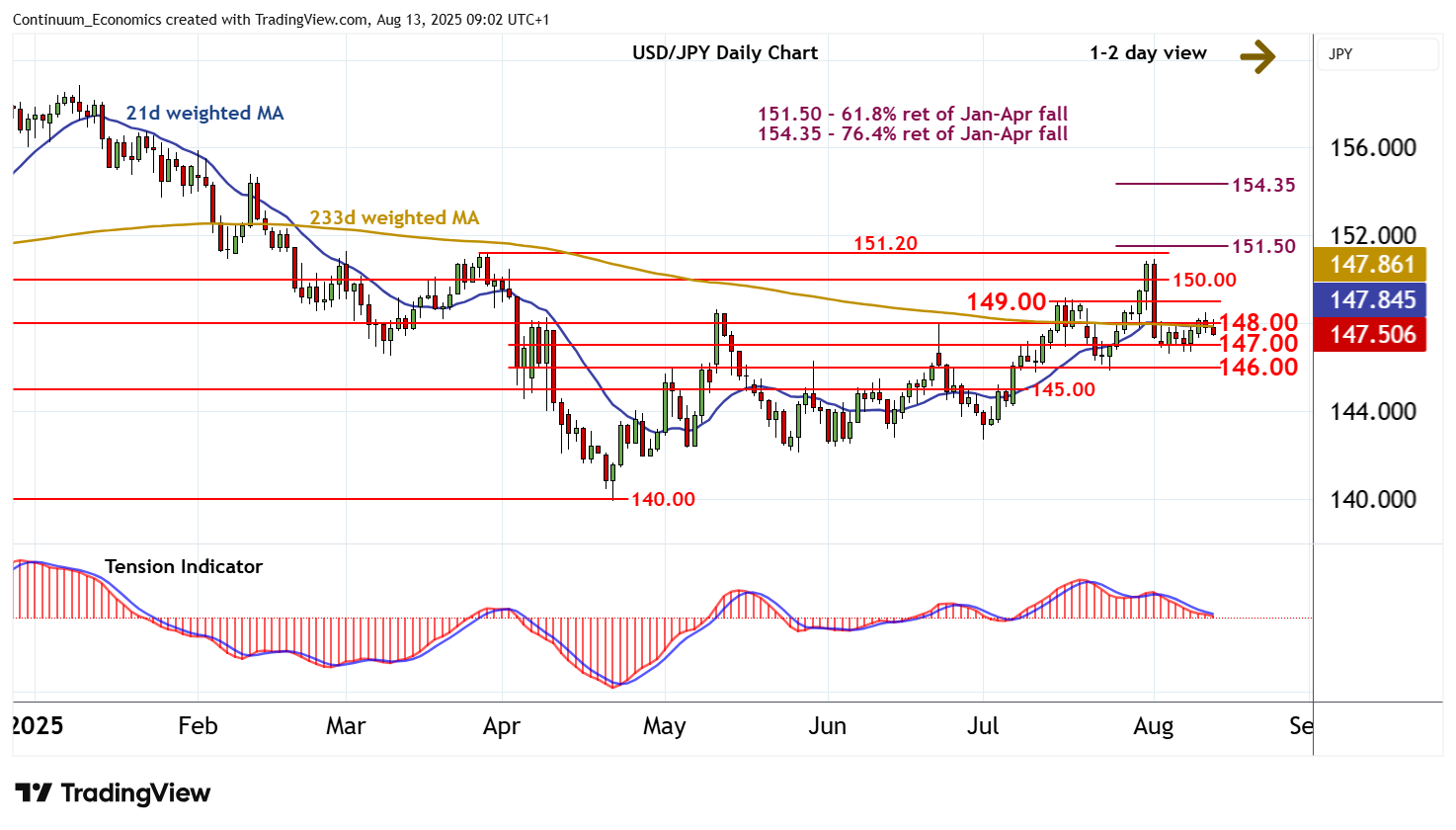

Chart USD/JPY Update: Back in range

Consolidation above 148.00 has given way to a fresh pullback

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 150.00 | ** | congestion | S1 | 147.00 | congestion | ||

| R3 | 149.00 | congestion | S2 | 146.00 | * | break level | ||

| R2 | 148.50~ | 12 Aug high | S3 | 145.00 | * | congestion | ||

| R1 | 148.00 | ** | break level | S4 | 144.00 | * | congestion |

Asterisk denotes strength of level

08:50 BST - Consolidation above 148.00 has given way to a fresh pullback, as intraday studies turn lower, with prices once again trading below 148.00. Oversold daily stochastics are also turning down and the daily Tension Indicator is under pressure, highlighting room for a test of congestion support at 147.00. A break will open up stronger support at 146.00. But mixed/positive weekly charts should limit any initial tests in fresh consolidation. A close below here, however, will turn sentiment negative and confirm a deeper pullback from the 150.90~ weekly high of 1 August. Meanwhile, any retests above 148.00 should be limited in consolidation beneath congestion resistance at 149.00.