JPY, CHF, NOK flows: Risk sentiment improved o/n but NOK lags

More Chinese equity gains on reports of Chinese injection of capital into banks. JPY weak, most risky currencies better, but NOK under pressure. CHF a focus on SNB meeting today

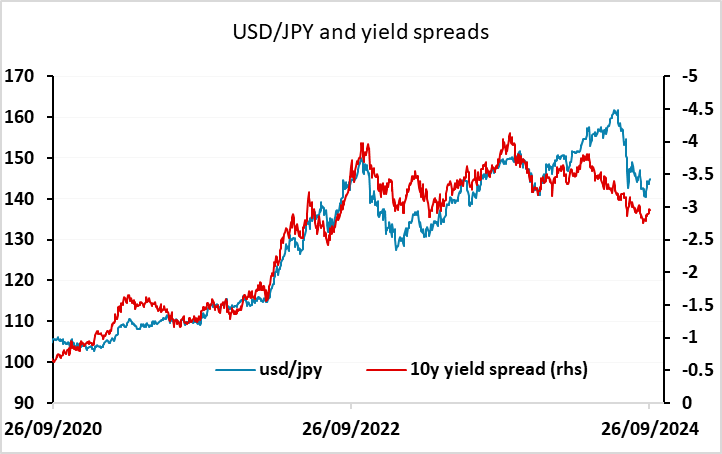

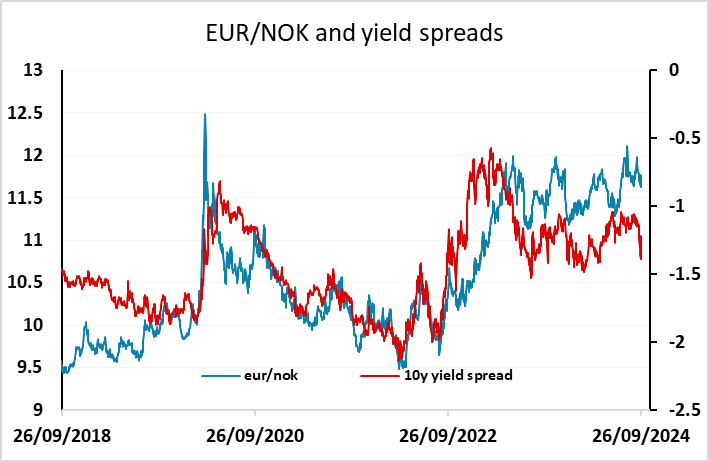

A fairly quiet start to Thursday, with the USD not much changed following a risk positive Asian session helped by reports of a Chinese capital injection into banks. The JPY remains under a little pressure on the back of the strong equity market, with USD/JPY trading above 145 overnight for the first time since September 4. The USD has still retained most of the gains seen after the stronger than expected new home sales data yesterday. While the risk positive currencies have generally performed well overnight after a correction on Wednesday, and are mostly still higher on the week, the NOK is an exception, having suffered sharp losses yesterday. There should, however, be scope for it to recovery this morning given the better risk tone overnight.

Main focus in the European morning will be the SNB rate decision. EUR/CHF edged above 0.95 yesterday for the first time in more than a month, and has potential to extend gains if the strong overnight risk tone is sustained on the back of another rate cut and a continued dovish outlook.