FX Daily Strategy: N America, Oct 7

JPY weakness on Takaichi election looks overdone

EUR may have more downside on French political and fiscal deadlock

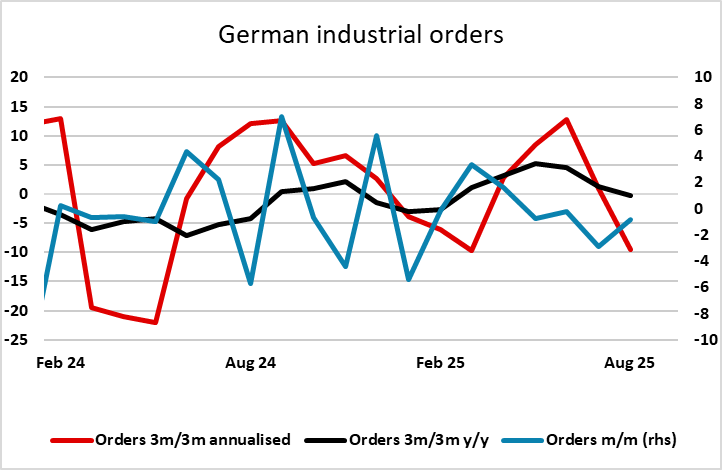

German orders numbers need to show a recovery in August

JPY weakness on Takaichi election looks overdone

EUR may have more downside on French political and fiscal deadlock

German orders numbers need to show a recovery in August

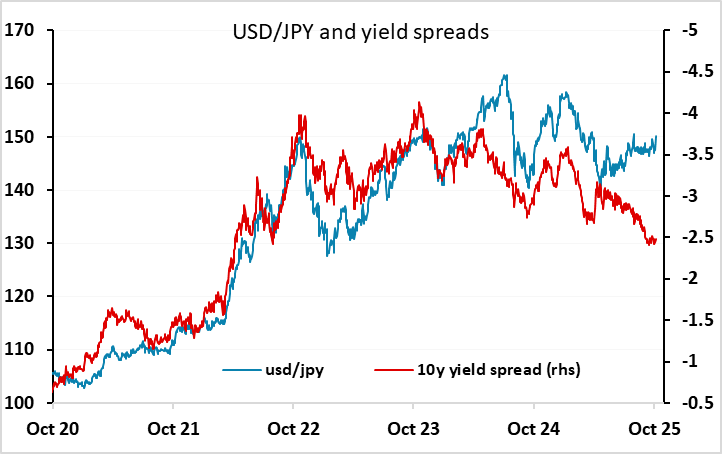

With the US government shutdown still preventing the release of any significant official data, the market will continue to look for other drivers. Q4 does tend to be a quarter that is more volatile and reactive, and we saw this on Monday with the sharp gains in USD/JPY in reaction to the election of Sanae Takaichi as the new LDP leader and Japanese PM. However, we see this move as very overdone. While Takaichi does have history as a supporter of Abenomics, suggesting she would be in favour both of easier fiscal policy and easier monetary policy, she has no legal control over BoJ policy. In practice, there may be more influence from the Japanese government over the BoJ than there is from the US government over the Fed or the UK government over the BoE, but the influence is nevertheless quite limited, especially when the BoJ governor Ueda is clearly his own man. The money and bond markets have only shown a modest reduction in expectations of short term BoJ tightening, with the chances of an October hike down to around 25% from 35%, and this looks insufficient to justify the sharp upmove seen in USD/JPY. USD/JPY is already well above levels consistent with the historic correlation with yield spreads, and spreads barely moved on the LDP election.

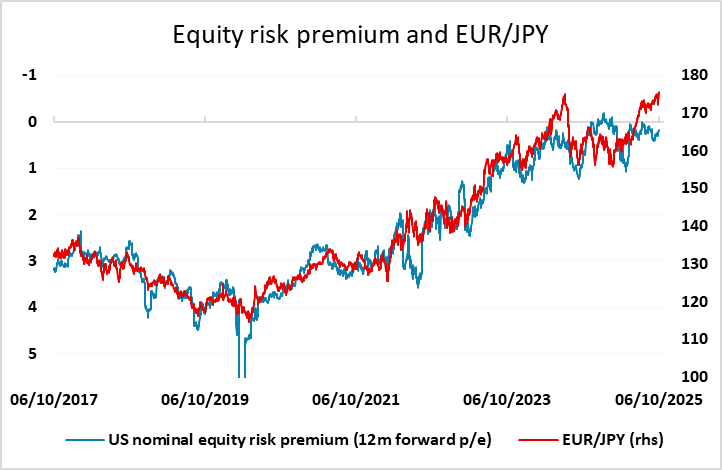

Of course, USD/JPY has failed to benefit from the contraction in yield spreads with the US seen in the second half of the year, and the basis for JPY weakness still looks to be primarily the strength of risk appetite and the low level of risk premia, which has been well correlated with JPY weakness, particularly on the crosses. So events in Japan have in general had little sustained impact on the JPY. Even at current levels, the low level of risk premia doesn’t look sufficient to justify JPY weakness on the crosses, and the new all time high in EUR/JPY achieved on Monday looks a step too far.

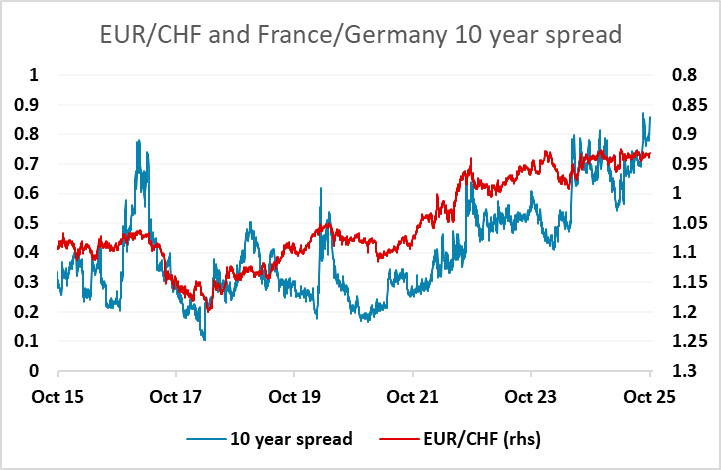

For the EUR, the resignation of French PM Lecornu, who had only been in place for a month, triggered a brief EUR sell off against the USD, and while the USD fell back later in the day, the EUR remained softer on the European crosses. In practice, the resignation may not have much sustained impact, but the French fiscal situation remains problematic, and looks unlikely to be addressed by the current government. Any further evidence of economic weakness in France could increase the pressure on the French government and the EUR. EUR/JPY looks the most clearly overvalued cross and seems likely to be particularly vulnerable at these high levels on any evidence of European weakness, but any rise in Germany France spreads as a result of concerns about the French fiscal position also tends to be negative for EUR/CHF.

Given the lack of official US data, there may be more interest than usual in the IBD/Tipp economic sentiment index for October due on Tuesday, although the recent trend has been quite flat so a big impact is unlikely. Other than that, we had strong leading indicators and household spending from Japan and French trade data showing a slightly larger than expected deficit, while German August factory orders disappointed once agan shoing their fourth straight decline, all of which supports a weaker EUR/JPY.