GBP flows: GBP gains after BoE MPC leaves rates unchanged

GBP up after unchanged rate decision from MPC, with 8-1 vote less dovish than expected. Upside scope for GBP/USD

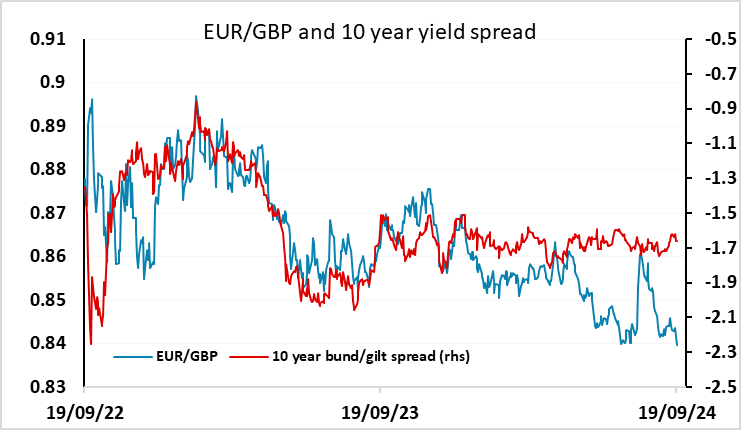

The unchanged rates combined with the 8-1 vote from the BoE MPC has given GBP a boost, with EUR/GBP testing the year’s lows seen in July at 0.8382. The decision was expected, but 2 dissents had been expected, and the fairly anodyne statement has led the market to reduce expectations of a cut in November, which is now priced as a 65% chance. The statement also says 'a gradual approach to removing policy restraint remains appropriate', so it seems unlikely we will get more than one more cut this year unless the data takes a major turn for the worse.

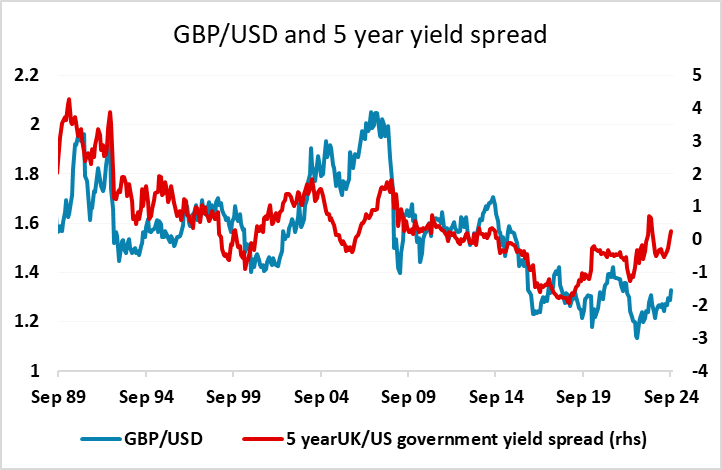

Yield spreads still don’t really support ongoing GBP strength against the EUR, so we would be wary of chasing EUR/GBP lower here. There may be more of a case for GBP/USD gains after the 50bp cut from the Fed, with longer term relationships still suggesting we may have scope for GBP/USD to extend gains if confidence in the UK economy continues to improve.