FX Daily Strategy: APAC, April 16th

USD may recover modestly on US retail sales

GBP may benefit from lower CPI inflation

CAD has scope for modest gains on unchanged BoC

Risky currency pairs could reverse some recent weakness if volatility declines further

USD may recover modestly on US retail sales

GBP may benefit from lower CPI inflation

CAD has scope for modest gains on unchanged BoC

Risky currency pairs could reverse some recent weakness if volatility declines further

Wednesday sees UK CPI, US retail sales and the BoC monetary policy meeting. Ahead of all that the risk tone for the day could be set by the Chinese Q1 GDP and March retail sales and industrial production data.

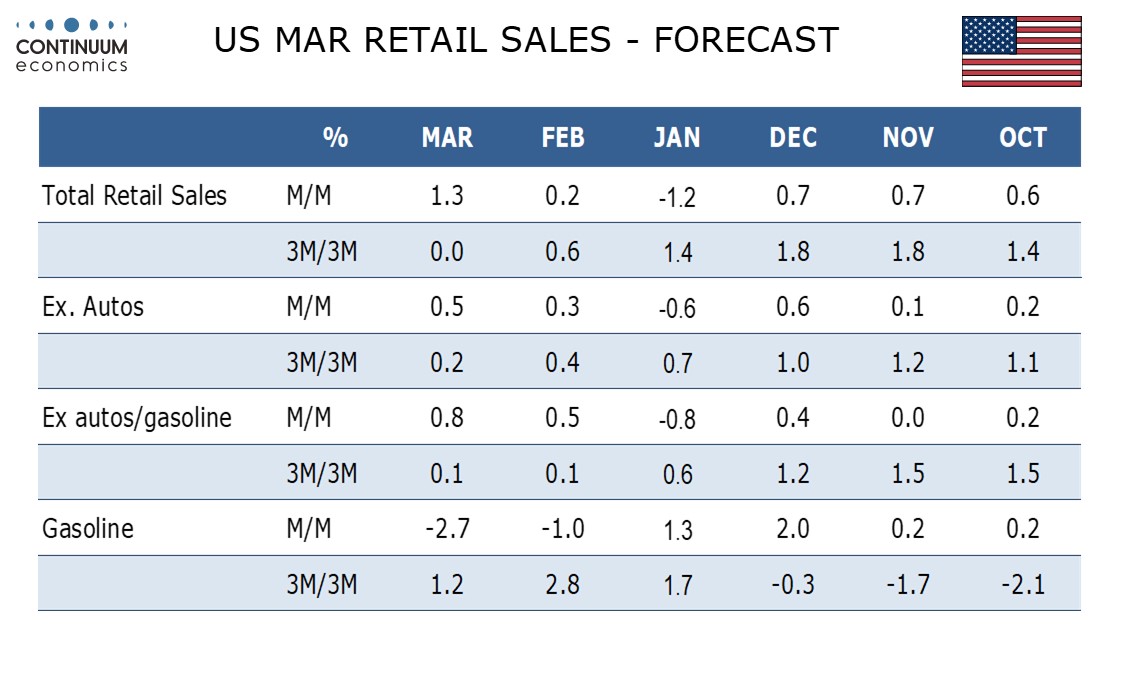

We expect US retail sales to rise by 1.3%, led by autos, in what will be a strong end to a subdued quarter. Ex autos we expect a moderate rise of 0.5% but ex autos and gasoline the rise we expect sales to rise by 0.8%. Industry data suggests a sharp rise in auto sales. This may be due to spending being accelerated due to fears of tariff-led price hikes. Data at this stage will be hard to interpret because of potential timing distortions related to tariff concerns, so there is unlikely to be a great deal of market reaction to these numbers. In any case, our forecasts are broadly in line with consensus. Still, given the weakness of the USD in the last few weeks, a stronger end to Q1 may be seen as encouraging, moderating the risk of a sharp Q1 GDP contraction.

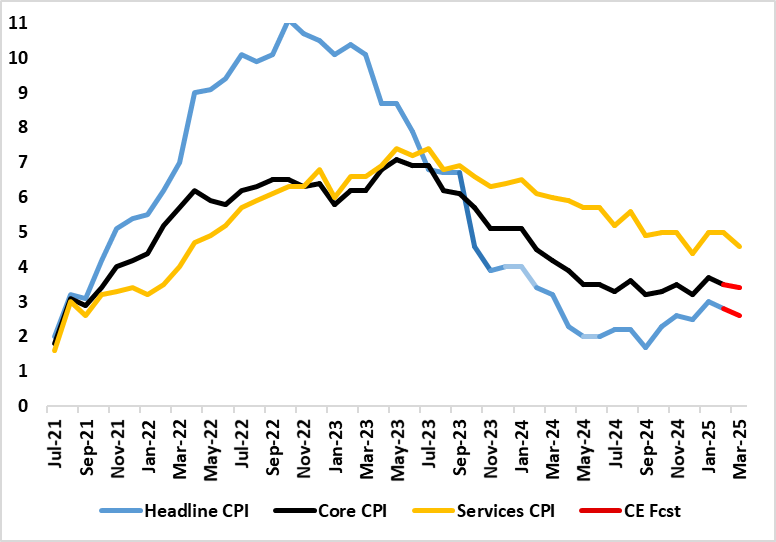

UK March CPI Inflation to Slip Back Broadly – Albeit Temporarily?

Source: ONS, Continuum Economics

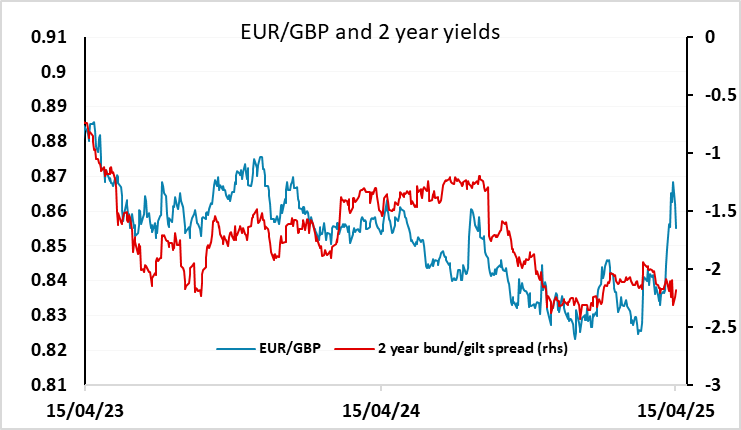

While we get the March UK CPI data, there is likely to be limited interest as the main near-term UK inflation story is what happens in the April data when a series of energy, utility, post office and some other regulated and service price rises are due, albeit now possibly offset somewhat by a fall in petrol prices if the slump in energy prices persists. All of which might make the March data something of a side issue even though they may show headline CPI inflation retreating a little further; we see it dropping a further 0.2 ppt to 2.6%, a notch below BoE thinking. But we will be interested to see if there are more signs of softer clothing and rental inflation, both possible signs that weak consumers are starting to rein in company pricing power. For GBP, it may be that softer data is supportive, just as the weaker than expected labour market data was, as the market will welcome the potential for the BoE to support the economy with rate cuts. The GBP FX market is now less concerned with yield spreads and more concerned with risk, so data that allows the BoE to act to offset any headwinds from US tariffs may be welcomed.

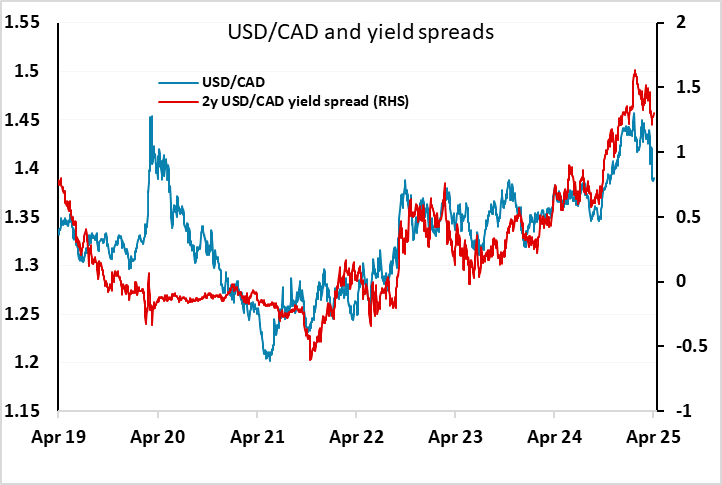

The BoC decision is a little more in the balance after the stronger than expected Canadian CPI reported on Tuesday. Even so, we don’t expect a BoC rate cut, despite the market now pricing a 25bp cut as close to a 50-0 chance. The BoC minutes at the last meeting preached caution, and given the current uncertainties we would expect them to leave things alone for now. This could allow USD/CAD to slip back towards 1.38, but major CAD gains look unlikely, as USD/CAD declines have run a little head of yield spreads and while we may not get a cut this month, a cut is likely before too long.

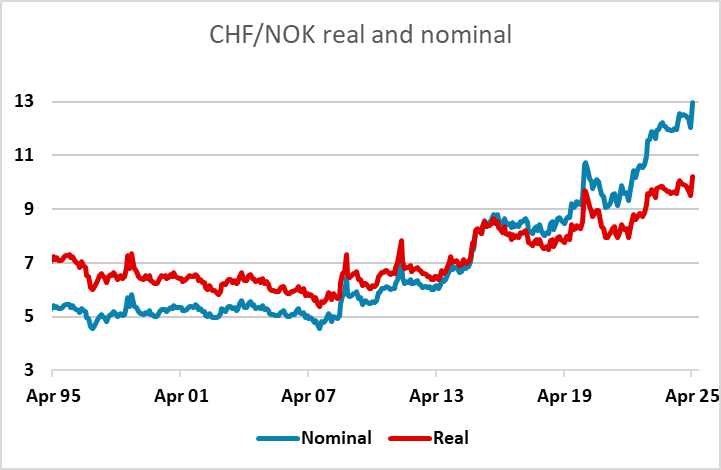

After the mildly positive equity market performance seen on Tuesday we can see some more broadly neutral trading up to Easter, with the market now likely to need hard data to decide how damaging the tariff furore has been. Lower volatility should be enough to allow some more gains in the riskier currencies that sold off with equities earlier in the month, even if we don’t see much recovery. The NOK may have the most scope for further recovery, as it continues to hover near all time lows against the CHF, which could also see some more general weakness if volatility declines.