FOMC Minutes from September 17 to show differing views on the future rates path

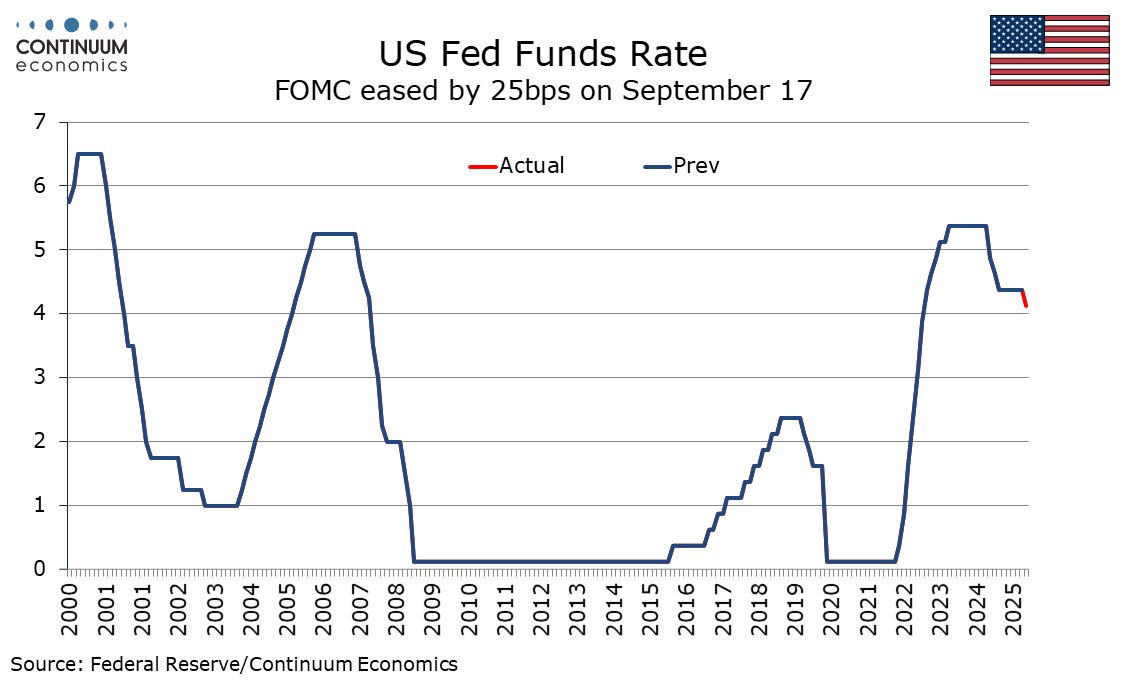

The Fed will continue to function during the government shutdown, and minutes from the September 17 meeting are due on October 8. They are likely to show a broad consensus in favor of the 25bps easing delivered at the meeting, but a variety of views on the appropriate path going forward. The individual opinions will not be identified in the minutes, but it appears clear that the regional Fed presidents are more hawkish than the permanent voters.

There was only one dissent from the meeting’s decision, incoming Governor Stephen Miran voting for a 50bps ease. Otherwise notable doves such as Governors Christopher Waller and Michelle Bowman as well as hawks such as St Louis Fed’s Alberto Musalem and Kansas City Fed’s Jeffrey Schmid went along with the 25bps ease. This was presented by Chairman Jerome Powell as a risk management move in response to a changing balance of risks. Most important was a recent slowdown in employment growth to a minimal pace, but also several Fed speakers have also stated that the feed through of tariffs to inflation has been less than initially feared.

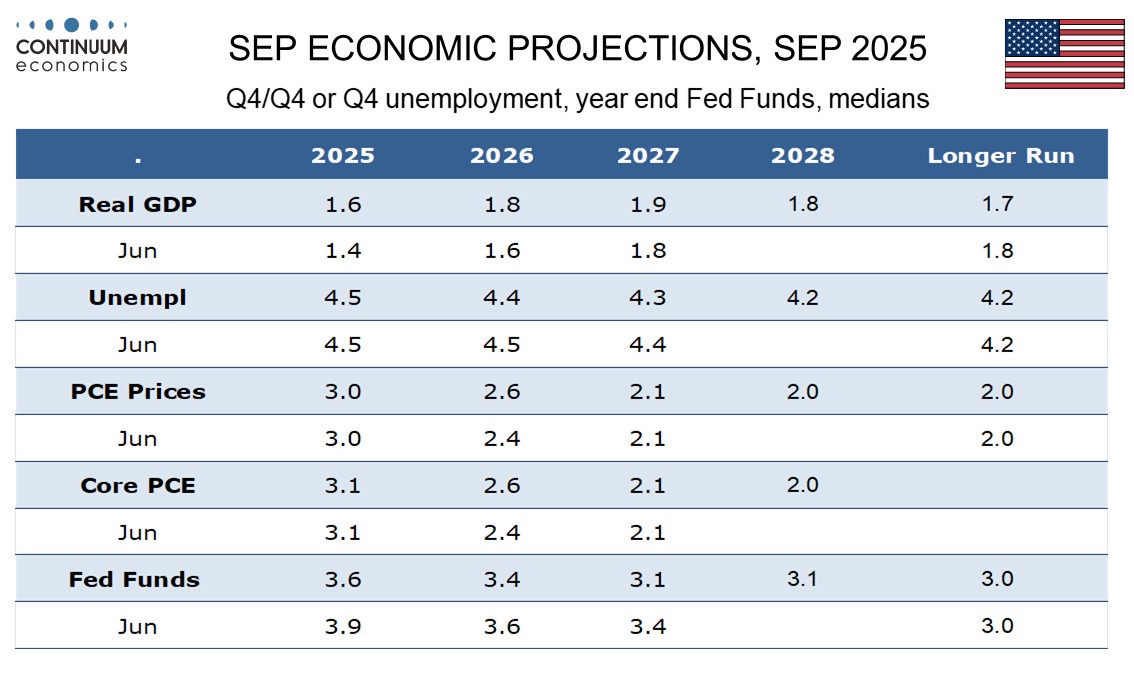

Hawks therefore agreed to a modest fine tuning in rates but are cautious about doing more. Doves, excluding Miran, were willing to back a modest 25bps move too but will want more in coming meetings. These differences are likely to be outlined in the minutes. Some feel the slowing in the labor market is a serious concern which could if it extends further bring risk of recession. Others feel it is to a large extent a matter of slowing labor supply and that the economy is still growing and close to full employment. On inflation some feel the limited feed through from tariffs to inflation so far is significant, while others are concerned the bulk of the impact is yet to come. Some are confident that the inflationary impact will be temporary, and several have suggested their confidence in that has increased. However others are more cautious, and the longer term impact of tariffs is not a debate that can be quickly resolved. Most appear to agree with Powell that excluding tariffs inflation is moving lower, but some disagree, Chicago Fed’s Austin Goolsbee in particular expressing concern over strength in service inflation.

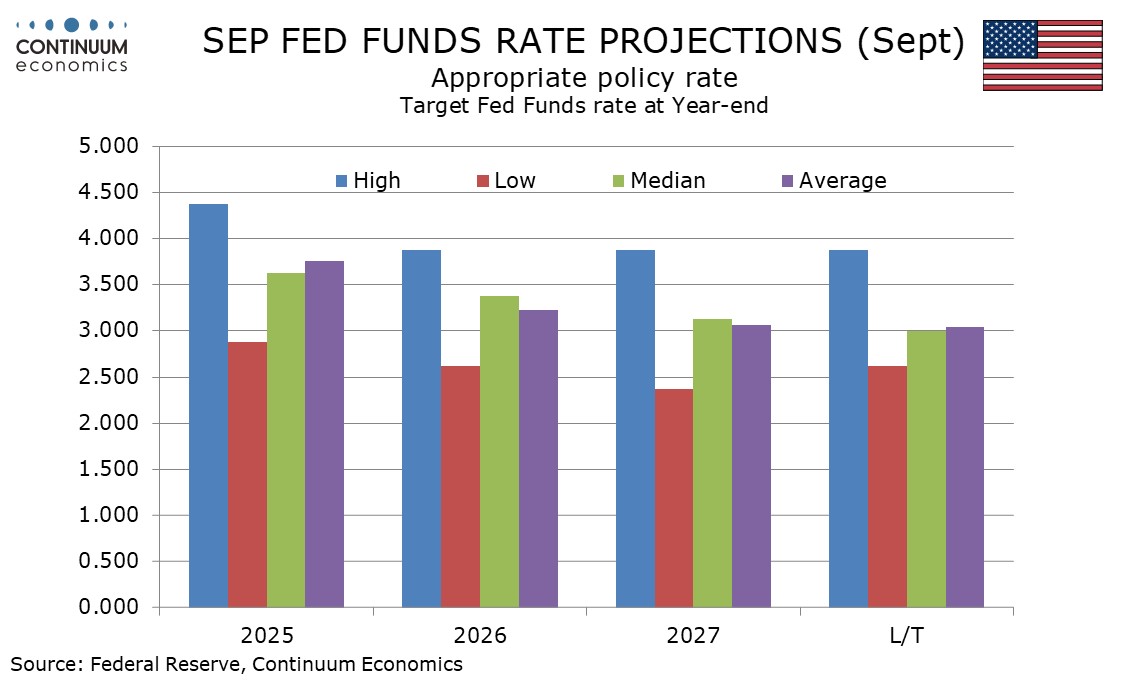

The dots from the meeting showed a clear divide in views, with one (clearly a non-voter) opposing the 25bps cut and six wanting no more easing this year. Two want only one more move, leaving nine out of nineteen more hawkish than the median which is for two more moves. Miran is a sole dovish outlier below the median, wanting 125bps more. Hawkish comments since the meeting have come from Goolsbee, Musalem and Schmid, as well as Dallas Fed’s Logan and Cleveland Fed’s Hammack. We feel Hammack is the most likely to be the one who would not have voted for the latest ease. That leaves two more who favor no more moves this year to be identified. Governor Michael Barr is probably one of them, as he was warning about the risks of persistent tariff-led inflation in the summer, but has said little on the subject recently.

We believe Barr is the only permanent voter with a more hawkish dot than the median. Waller and Bowman are clearly dovish while New York Fed’s Williams, and Governors Lisa Cook and Philip Jefferson have tended to deliver a similar tone to Powell. Of the regional Fed presidents, only San Francesco’s Mary Daly has been sounding clearly dovish on rates. Atlanta Fed’s Raphael Bostic has identified himself as one of the two who favor only one more ease. That leaves four regional Fed presidents that are harder to identify. Minneapolis Fed’s Kashkari has expressed some caution on inflation but appears comfortable enough with easing to suggest he is probably on the median. Richmond Fed’s Thomas Barkin and Boston Fed’s Susan Collins have been fairly balanced, and Philadelphia Fed’s Anna Paulson who took office on July 1 is still unknown. Those three will include one who favors no more easing, one who favors one and one who favors the median view of two. Our tentative estimates are respectively Paulson, Barkin and Collins.

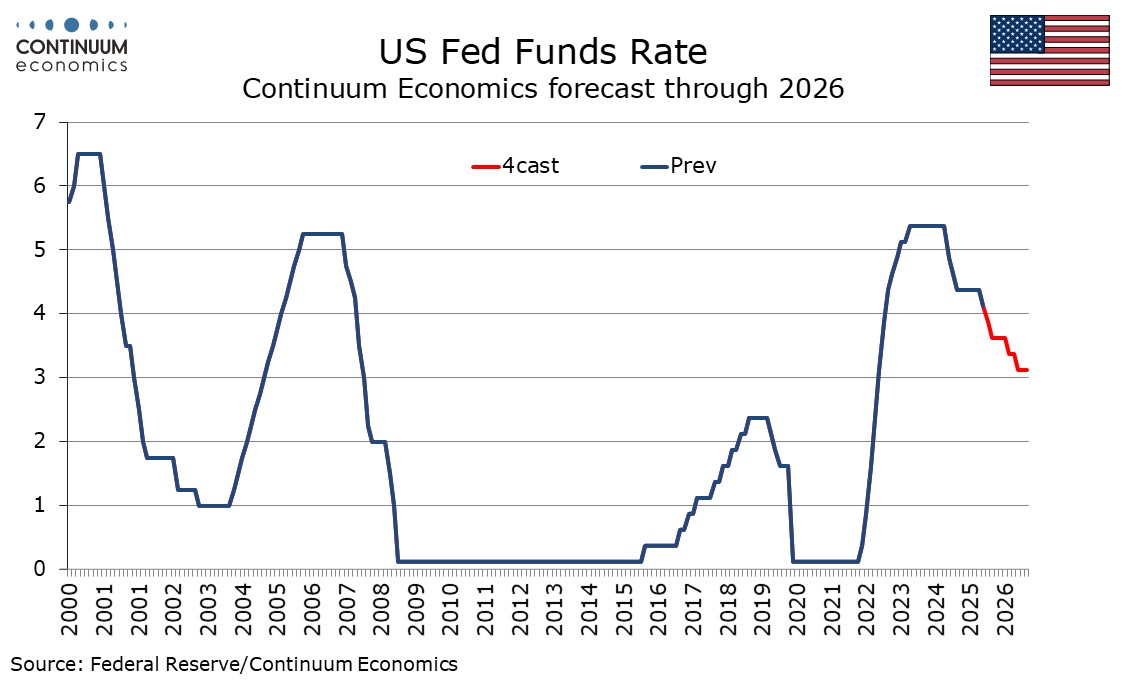

It does appear clear that while the dots are quite evenly split between hawks and those who are either mainstream or dovish, most of the hawks are regional Fed presidents who do not have a permanent vote. This year the rotating votes are Schmid, Musalem, Goolsbee and the relatively moderate Collins. In 2026 they will be hawks Hammack and Logan, the moderate Kashkari and the still unknown Paulson. That does not mean the two 25bps easings in the median dots for the remainder of this year are guaranteed, as the Fed would like to be guided by data, with the absence of key data as long as the government shutdown lasts a clear problem. If it persists through October the Fed may even pause on October 29. We still however expect 50bps to be delivered in the current quarter.