FX Daily Strategy: Europe, February 3rd

RBA Hike Rates by 25bps with hawkish forecast

Otherwise, supporting the Aussie

Slate of Kiwi Data Unlikely to Sway RBNZ

As both headline and trimmed mean CPI stays above 3%, market participants have increased their anticipation of the RBA hiking rates with around 70% of a hike being priced in and almost fully priced in for the two coming meeting. And indeed, the RBA has increased the cash rate to 3.85% in the February meeting as Inflation continues to run hot. The inflationary picture has turned hot after the Q3, partially from previous year's energy rebate base effect but also suggest stronger underlying inflation. The rate hike is mostly priced in and thus the forward guidance in cash rate assumption is the real hawkish surprise.

In the latest cash rate assumption, the RBA is seeing two more hike to 4.2% by year end 2026. It came as a hawkish surprise with most market participants expecting only one more hike this year. Their CPI forecast has also been revised higher, with headline shooting to 4.2% in mid 2026 before retreating back with target range in mid 2027. Trimmed mean CPI is also revised 0.5% higher throughout 2026. Moreover, the RBA is visualizing a stronger labor market and more economic growth for Australia in 2026.

The hawkish take from the RBA is supporting the Aussie as most market participants are originally looking for only one more hike in 2026. The revision in forecast will also lead to second thoughts on Australian growth in private demand. On the chart, the pair is lower at the opening to reach .6920 low before turning higher as prices consolidate losses from the .7094 high. Daily studies are unwinding overbought readings and suggest room for deeper corrective pullback to retrace recent strong gains from the .6660, early-January lows. Break of support at the .6942/.6900, 2024 year high and gap area, will open up room for deeper pullback to .6850/.6800 support. Meanwhile, resistance is lowered to the .7000 level which is now expected to cap and sustain pullback from the .7094 high.

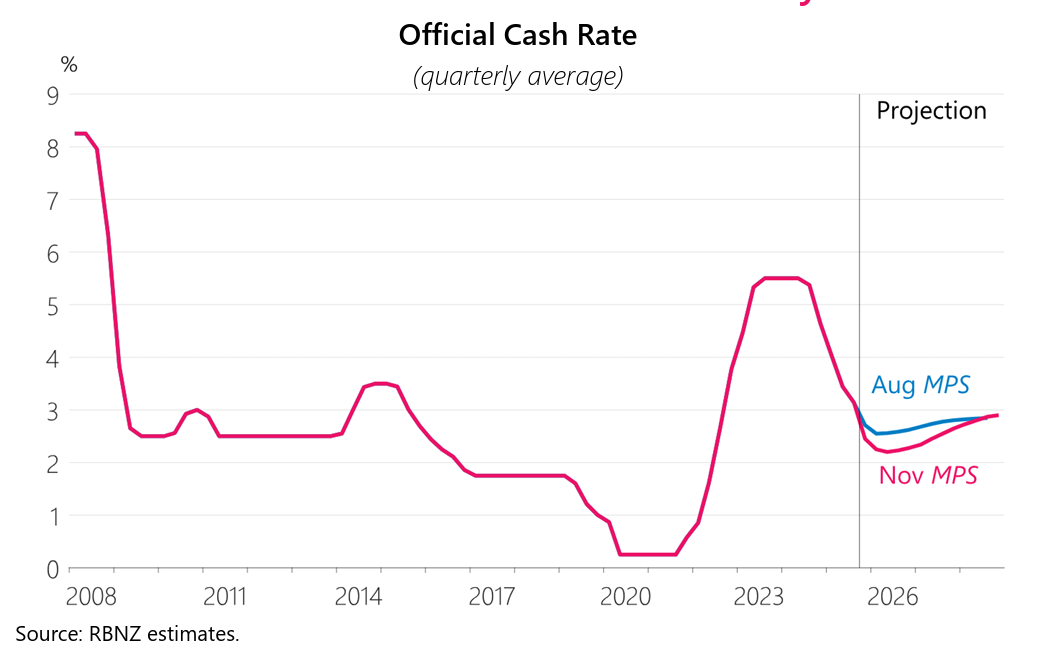

The Q4 Labor data will be released for NZ in late New York session. With little expectation to see a significant hawkish/dovish surprise, the data should not have a sustainable impact towards the Kiwi. Afterall, the RBNZ OCR forecast is seeing no more rate cut from the current 2.25% and first rate hike in late 2026. CPI is also downplayed by attributing the spike in inflation to "higher tradables inflation along with high inflation in household energy costs and local council rates", factors that are deemed to ease in 2026. Their forecast see inflation to moderate towards the mid point of target range in 2026.