FX Weekly Strategy: Asia, December 16-20th

A Cautious 25bps Easing for FOMC

BoJ To hike or Not to Hike

Riksbank Flagging a Little Further Easing?

Norges Bank Still Resistant

Benign Inflation Signals But BoE Still Cautious

For the week ahead

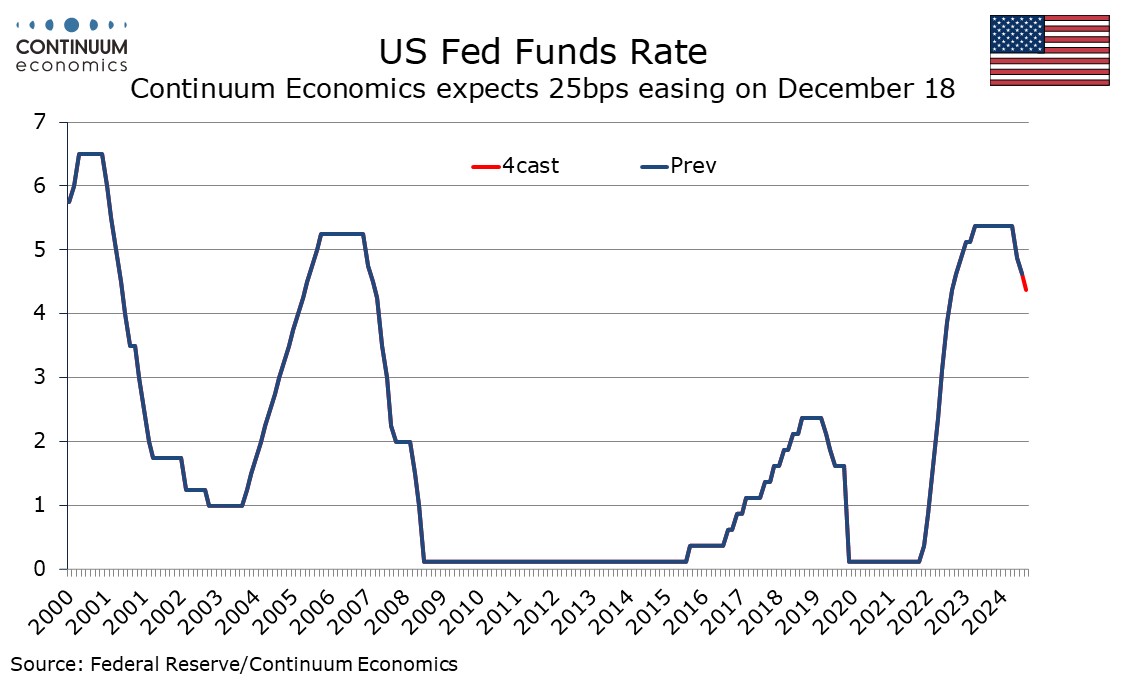

The FOMC meets on December 18 and we expect a 25bps easing to a 4.25-4.5% range. Fed commentary has generally suggested that rates are moving lower while cautioning against assuming easing at any meeting is a done deal. Absence of major surprises in recent employment and CPI data probably clears the way for a 25bps move, but the Fed is likely to suggest that the pace of easing is likely to be more cautious in 2025.

The FOMC is likely to have a genuine debate between a 25bps move and a pause, and a dissenting vote from an easing decision is possible, most likely from Governor Michelle Bowman, who dissented against September’s 50bps move, preferring 25bps. A 25bps move would be consistent with the median in September’s dots, but then nine out of 19 respondents were higher than the median, and only one below. We expect the median dots for end 2025 and end 2026 policy to be revised marginally higher, by 25bps each to 3.625% and 3.125% respectively, thus implying 75bps of easing in 2025 and 50bps in 2026, while leaving 2027 and the long-run neural rate unrevised at 2.875%. Recent data suggests economic forecasts for end 2024 will look stronger than in September, GDP significantly so at 2.5% Q4/Q4 rather than 2.0%, while unemployment will be seen at 4.2% rather than 4.4%. We expect core PCE prices to be seen at 2.8% yr/yr in Q4 2024 rather than 2.6%. Revisions to forecasts for 2025 through 2027 will probably be small, but we expect 2025 unemployment to be revised marginally lower and core PCE prices to be revised marginally higher for 2025 and 2026, reaching the 2.0% target in 2027 rather than 2026.

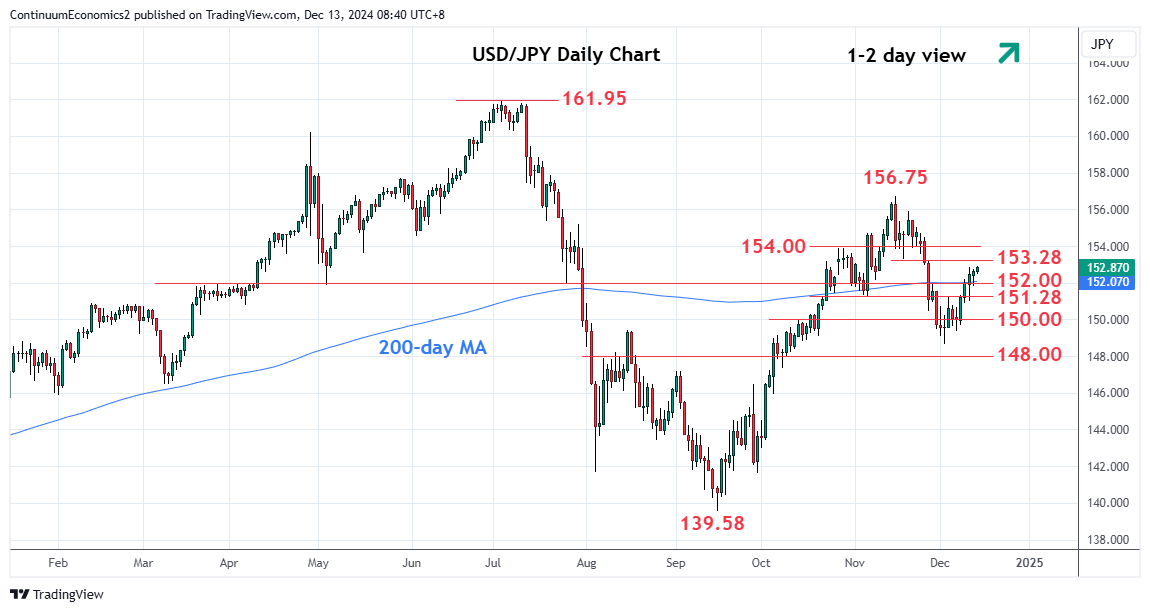

While the current inflationary development points towards a 25bps hike from the BoJ, the latest "leaks" from the BoJ seems to suggest they do not want to be perceived as in a rush. It is signaling the BoJ is likely at most to be hiking by 10bps or even decide to hold for the December meeting. The BoJ may be missing the window to tighten to their ideal neutral rate if they are taking things too slow. We believe the change in price/wage setting and consumer behavior will be changing at a more gradual pace than the BoJ anticipates, leading to a lower short term and steady trend inflation picture. It may then be difficult for the BoJ to justify their decision to further tighten. Wage has been steadily increasing above 2% with core inflation also above 2%. BoJ's Ueda has acknowledged the current inflationary pressure has tilted towards wage, rather than cost and is the sustainable cycle BoJ is looking for. We continue to favor a policy tightening from the BoJ in December where it looks like a 10bps hike will be more likely.

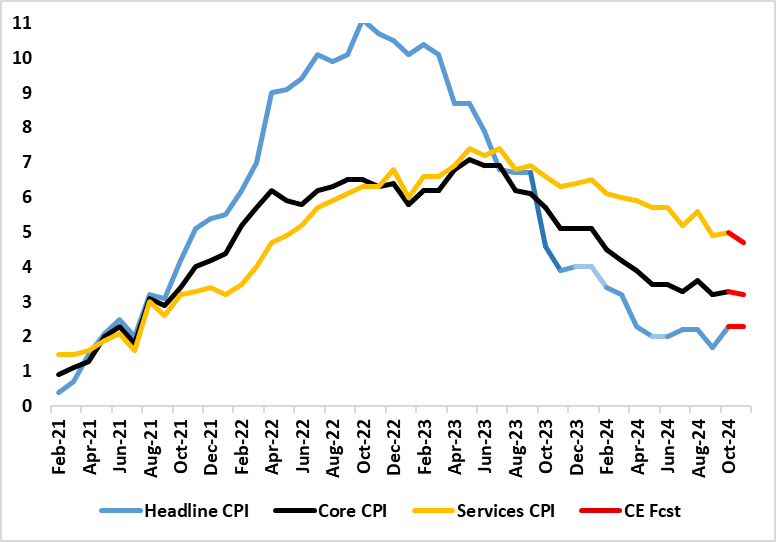

Figure: Disinflation Stalling?

Despite what seems to be an accelerated pace of central bank easing nearby, speculation that the Norges Bank would ease by year –end had grown, but have now largely dissipated. What seems to be the final nail in the coffin of a rate cut has been the November CPI numbers, higher than consensus but actually in line with Norges Bank expectations but with some pick-up in terms of short-run dynamics (Figure). Thus, another (ie eighth successive) widely expected stable policy decision should be forthcoming at the remaining Board decision on Dec 19 so that the policy rate at 4.5% has been in place for a year. Admittedly, last time around in November, the Board but amended its policy guidance a touch, offering it a little more policy flexibility, as this time around, it will be armed with fresh forecast which could make a policy cut at that or some near-term juncture more explainable. The scheduled decision on Jan 23 could still see the first rate cut, although this is not fully consistent with the little-revised official policy outlook, which may still suggest nothing before March. We still see some 150 bp of rate cuts in 2025 – 50 bp-plus more than the Norges Bank is advertising!

The Norges Bank probably still sees policy risks being balanced, this view buttressed by a firmer than expected mainland real economy backdrop, the question being the extent to which the latter may as much reflect improved supply side developments related to productivity. If so, this may feature (via a reassessment of the output gap) in the updated economic projections which still look too optimistic to us, not least given that they are based around a EZ picture for next year which sees 1.3% GDP growth almost twice what we envisage.

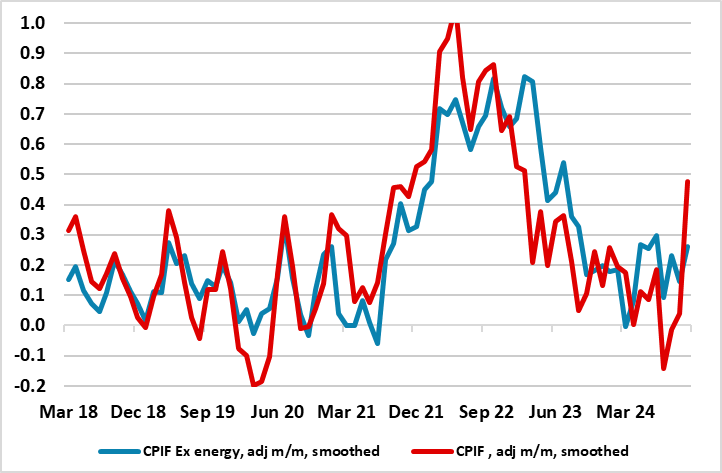

Figure: Short-Term Inflation Dynamics Less Favorable?

A fifth successive rate cut is seen at this looming December Riksbank meeting, but rather back to a 25 bp move rather than the 50 bp cut last time around (to 2.75% vs the 4.0% peak seen up until last May). This would fulfil the policy guidance advertised at the September Board meeting. But it will be the updated projections that will be the main news, not least given data of late that has been on the high side of expectations, including a small recovery in GDP and CPIF data well above Riksbank thinking (Figure). Regardless, this is unlikely to alter policy thinking where inflation worries have subsided to be replaced by clearer worries about the real economy. And in regard to the latter, the Riksbank may revise down its slightly above-consensus GDP outlook out to 2027, the question being whether a lower terminal policy rate will be considered, or merely getting there a little faster. But amid downside growth risks and realties through Europe, we now still see the policy rate troughing at 2.0% by mid-2025, now 25 bp below our previous thinking and Also the same amount below the Riksbank’s terminal rate but one we seeing being arrived at two quarters earlier. But deeper cuts are possible as even the Riksbank acknowledges.

Admittedly, the inflation surprises have been concentrated inn energy and result of the EU’s new electricity directive which has caused a sharp increase in electricity prices in Sweden since its introduction in late October. But even inflation ex energy has started to flatten out although the CPI measures on the basis is still consistent with target having already been met. Even so, the prices outlook inflation certainly for the next year has become a little more uncertain

But in terms of what has happened, it is clear that while lower inflation has provided the scope to ease policy in this speedier manner, the rationale is increasingly that from a weak economy. Last time around the Board statement was clear that ‘there are still few clear signs of a recovery. To further support economic activity, the policy rate needs to be cut somewhat faster than was assessed in September. It is important in itself that economic activity strengthens, but it is also a necessary condition for inflation to stabilize close to the target’.

Figure: Services Inflation to Slow?

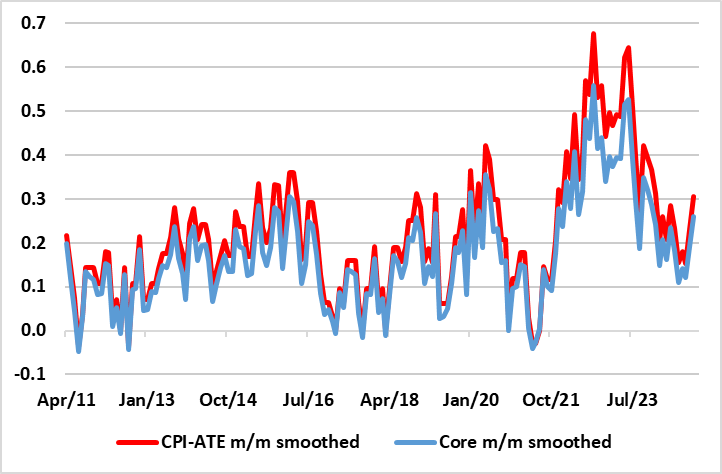

While they may not affect the overall BoE verdict on Dec 19, which looks very likely to be a pause after last month’s 25 bp cut (to 4.75%), forthcoming data may very well influence the MPC vote and the message in the updated Monetary Policy Summary. In particular, CPI data (Dec 18) may have some influence as we think that a stable 2.3% y/y reading (Figure) may mask short-term adjusted details that suggest core inflation may already be hovering around target. Overall, we see the BoE vote having at least one dissent, but with the MPC largely adhering to its new scenario strategy with a central view that has allowed Governor Bailey to flag around four 25 bp cuts next year. We see a little more than that still in the coming year!

In what was something of a more hawkish assessment and outlook, the BoE nevertheless delivered the expected further 25 bp Bank Rate cut to 4.75% last month with only one (expected) dissent against. But after what had been hints of a possibly more policy activism from Governor Bailey prior to the decision, the MPC instead adhered to its the gradualist approach, thereby conforming with the caution long advocated by Chief Economist Pill. It does seem that the recent Budget has had a material impact on MPC thinking, to a degree that despite recent soft data and higher market rates, an inflation target undershoot is projected only from mid-2027 onwards.

But the other key development is the BoE is also trying to implement the Bernanke Review, ie to alter its strategy and communications. In this regard it has already highlighted more formal scenarios for the inflation outlook, an upside and downside and a central case, the latter used as the basis for the MPR projections and encompassing more price pressures than envisaged in August. We still think there are shortcomings not being met and we wonder whether what may be long drawn out review may actually handicap actual policy making as the MPC wrestles with an alternative policy outlooks and whether communication may thus suffer.

All of which made it unlikely that this looming December MPC meeting would see more easing. Regardless, given the below-consensus outlook we still envisage for both growth and inflation, we still see an additional 125 bp of easing by end-2025.

Thus the BoE has plenty of data to assess ahead of its decision next week. As for inflation, coming in higher than expected and a notch above BoE thinking, CPI inflation jumped to 2.3% in October, partly due a swing in airfares, amplified by base effects. The data also showed a fresh rise (of 0.1 ppt) in both the core and services inflation to 3.3% and 5.0% respectively (Figure 1), the latter up from a 28-mth low. Nevertheless, the CPI data backdrop is still consistent with underlying inflation still having fallen, especially when assessed in shorter-term dynamics (Figure 2) something we think will be repeated in these November data. The data will show some rise in fuel prices but we see a slip in services to rate (4.7%) below BoE thinking.

The MPC will probably get early access to the CPI data and possibly to labor market figures (Dec 17) which may show more signs of job losses, alongside little further drop in earnings. The data on payrolls is becoming ever more important, both given the repeated falls they have reported of late but also questioning the validity of the BoE’s interpretation of how tight the labor market actually is, as they suggest far less inactive workers than official ONS numbers. This Friday also sees GDP data that could undermine the BoE projections at least for the current quarter as may PMI data (Dec 16) which are already pointing to slumping business optimism. The BoE very clearly took the recent Budget as being unambiguously stimulative and it was in terms of the shift in the fiscal stance. But the emerging issue is whether the tax rises have accentuated what were already growing concerns that are now being flagged more clearly by the likes of business survey numbers. If so, the BoE may be getting complacent.

USA The key US event comes with Wednesday’s FOMC decision. We expect a 25bps easing but the statement and dots are likely to be fine-tuned in a marginally hawkish direction, suggesting that the pace of easing is likely to become more gradual in early 2025. Monday sees December’s Empire State manufacturing survey and then S and P PMIs for December. For the latter we expect marginal slippage in manufacturing to 49.0 from 49.7 and services to 55.5 from 56.1. On Tuesday we expect November retail sales to maintain a healthy picture, rising by 0.6%, with 0.5% gains ex autos and ex autos and gasoline. We expect this to be followed by a 0.4% increase in November industrial production, with manufacturing up by 0.8% in a rebound from recent hurricanes and a strike at Boeing. October business inventories and December’s NAHB homebuilders’ survey are also due.Ahead of the FOMC on Wednesday we expect November housing starts to rise by 3.7% to 1.36m while permits rise by 0.8% to 1.43m, and the Q3 current account deficit to rise to a record $294bn from $266.8bn in Q2. Thursday will see the second revision to Q3 GDP which we will forecast after Tuesday’s data. Also due are weekly initial claims which will cover the survey week for December’s non-farm payroll, and December’s Philly Fed manufacturing survey. Later we expect November existing home sales to rise by 4.8% to 4.15m. November’s leading indicator is also due.We expect Friday’s core PCE price index to see a 0.2% increase in November, underperforming a 0.3% core CPI. We expect a 0.5% rise in personal income and will forecast personal spending after Tuesday’s retail sales report. Final December Michigan CSI data follows.

CANADA The Canadian government will release its fall economic statement on Monday. November CPI is due on Tuesday and we expect a slowing trend to resume after an October bounce, with yr/yr growth slipping to 1.9% from 2.0% with slower gains in the BoC’s core rates too. Friday sees October retail sales. A preliminary estimate for a 0.7% rise was made with September’s report.

UK While they may not affect the overall BoE verdict on Thursday, which looks very likely to be a pause after last month’s 25 bp cut (to 4.75%), forthcoming data may very well influence the MPC vote and the message in the updated Monetary Policy Summary. In particular, CPI data (Wed) may have some influence as we think that a stable 2.3% y/y reading (Figure 1) may mask short-term adjusted details that suggest core inflation may already be hovering around target. Overall, we see the BoE vote having at least one dissent, but with the MPC largely adhering to its new scenario strategy and its central view.

The MPC will probably get early access to the CPI data and possibly to labor market figures (Tue) which may show more signs of job losses, alongside little further drop in earnings. The data on payrolls is becoming ever more important, both given the repeated falls they have reported of late but also questioning the validity of the BoE’s interpretation of how tight the labor market actually is, as they suggest far less inactive workers than official ONS numbers. Monday sees This Friday also PMI data which are already pointing to slumping business optimism – we see the headline edging down slightly. Finally, retail sales (Fri) may show another drop, the outcome complicated by Black Friday, these coming alongside public borrowing numbers, the latter still likely to be overshooting year-before outcomes.

EurozoneAfter consumer confidence data (likely to remain weak), the week starts with PMI data for December, and as with the UK, important not just to assess if the economy is slowing but also the extent to which price and cost pressures may be ebbing further. The November Composite PMI dropped to a 10-mth low and we see no further change this time around. Other business surveys are due, including those from Germany’s ZEW and Ifo (Tue) and the French INSEE (Thu). And there is wide array f ECB speakers next week, led off by Lagarde on Monday!

Rest of Western EuropeThere are key events in Sweden. A fifth successive rate cut is seen at Thursday’s December Riksbank verdict, but rather back to a 25 bp move rather than the 50 bp cut last time around (to 2.75% vs the 4|% peak seen up until last May). This would fulfil the policy guidance advertised at the September Board meeting. But it will be the updated projections that will be the main news. Business survey data (Fri) may also have been made available to the Board.

In Norway, despite what seems to be an accelerated pace of central bank easing nearby, speculation that the Norges Bank would ease by year –end had grown, but have now largely dissipated. What seems to be the final nail in the coffin of a rate cut has been the November CPI numbers, higher than consensus but actually in line with Norges Bank expectations but with some pick-up in terms of short-run dynamics. Thus, another (ie eighth successive) widely expected stable policy decision should be forthcoming in Thursday’s verdict so that the policy rate at 4.5% will then have been in place for a year.

JP

The BoJ meeting will be on Thursday where we think the BoJ will likely either hike by only 10bps or hold rate unchanged after the latest “leaks”. While we think the current inflationary dynamics should allow the BoJ to hike by 25bps, the BoJ seems prefer taking thins slowly. We also have National CPI on Friday which should be supportive for a hike. Else, We also have trade data on Wednesday.

AU

Mostly tier two data with PMIs on Monday, Consumer Confidence and Inflation expectation on Tuesday and Wednesday.

NZ

We have NZ Trade Balance on Friday, along with consumer confidence. Business Outlook and confidence are on Thursday. The key GDP will also be released on the same day where sluggishness is expected but will not affect RBNZ as they are already deep in the easing cycle.

Recap for the week

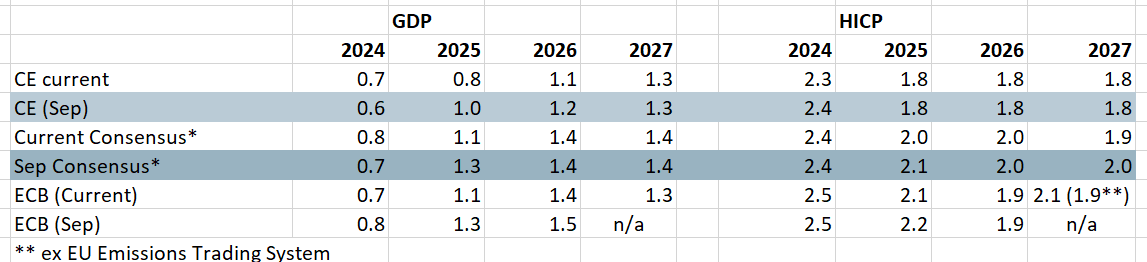

Figure: The ECB’s Revised Outlook in Perspective

A fourth 25 bp discount rate cut at this latest Council meeting, to 3%, was also the third in a row. But this meeting was important for the (as we expected) change in forward guidance in which the ECB accepts that on-target inflation is likely to be durable enough so that it no longer has to pursue policy restriction. In this regard, the first glimpse of 2027 economic projections support this as they point to a second successive year of around-target inflation even on a core basis and also on the basis of markets assuming rates fall to around 2% in 2026. Amid what has been faster easing, the ECB must be considering what neutral policy and we think the implies around four 25 bp cuts in H1 next year, with an ensuing around-neutral 2% policy rate. But it is possible that amid a continued sub-par growth outlook into 2026, then further easing may be on the cards into 2026.

As we envisaged, this meeting did see a major change in forward guidance. Indeed, and as Chief Economist Lane suggested in an interview last week, this would entail a transition in guidance moving from what hitherto has been backward-looking by being data-dependent to being forward-looking in assessing incoming risks. Admittedly, the ECB as a whole seems reluctant at this juncture to move totally away from being data-dependent, but however much Lagarde suggested otherwise, the Council must be considering what constitutes ‘neutral’. Admittedly, what constitutes neutral varies over time and according to alternative assessments. Notably, according to some ECB hawks, this 25 bp move this month would constitute policy being at least at the upper end of a range of neutral estimates. This contrasts with the more dovish ECB thinking as highlighted by BoF Governor Villeroy who has pointed to a neutral estimate between 2% and 2.5%. And somewhere in the middle there is also thinking that there may have been a bit of an upward movement in this underlying real interest rate but, albeit probably most of it being cyclical, possibly a result of a recent rise in government deficits reducing the saving/investment balance.

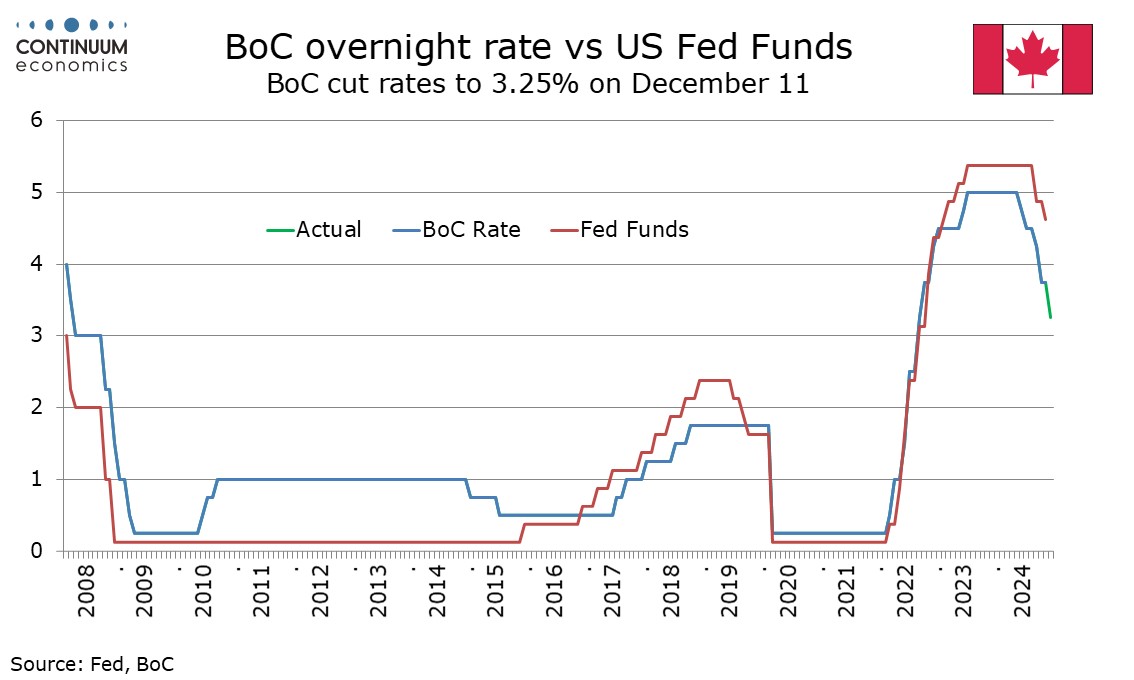

The Bank of Canada has delivered a second straight 50bps easing, taking the rate to 3.25%, as largely expected. This puts the rate at the upper end of the 2.25-3.25% range the BoC sees as neutral, and Governor Tiff Macklem stated he now anticipates a more gradual approach to policy. We expect three 25bps easings in 2025, though the threat of tariffs makes the outlook very uncertain.

The Bank of Canada’s statement for the most part reads fairly dovishly. While seeing the global economy as evolving largely as expected in October the BoC notes the 1.0% rise in Q3 GDP was weaker than projected, and adds recent data suggest Q4 will also underperform the BoC’s 2.0% forecast made in October. The BoC also expected 2025 GDP to be weaker than the 2.3% Q4/Q4 October forecast due to a reduced immigration target. The BoC did not mention that October CPI was slightly higher than expected, stating it has been near the 2% target since the summer and is expected to remain so. A brief dip in CPI to 1.5% is expected during a GST holiday that will run from December 14 through February 15, but the BoC will look through that.

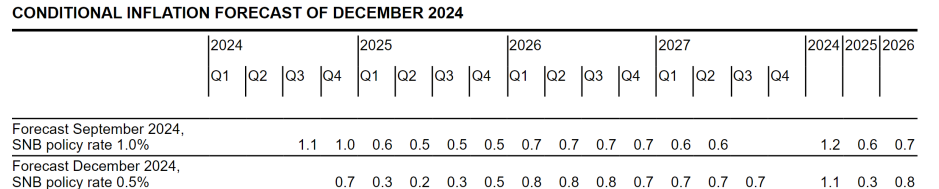

Figure: SNB CPI Inflation Projections Remain Clearly Below Target

In what seems to be ever-clearer policy front-loading, the SNB cut its policy rate by 50 bp (to 0.5%), thereby accentuating an easing cycle that had delivered three 25 bp moves since March. Possibly, this larger, but far from unexpected, reduction was driven by a fresh assessment that the inflation undershoots (both that seen of late and that projected out to 2027) is increasingly a reflection of weaker underlying price pressures rather than currency induced disinflation. But notably, and despite the marked anticipated inflation undershoot (Figure), the SNB was less explicit this time around about further cuts, save to repeat its long-standing mantra that it ‘will adjust its monetary policy if necessary to ensure inflation remains within the range consistent with price stability over the medium term’. Possibly, and maybe reflecting recovery property prices, this signals a policy pause, but we still see another 25 bp cut in Q1 next year.

Back in September, the updated outlook suggested an even larger undershoot in the medium-term which flagged further easing not least as the SNB was explicit in suggesting that ‘Further cuts in the SNB policy rate may become necessary in the coming quarters’, rhetoric then repeated (end Oct) by SNB President Schlegel. This rhetoric was not repeated this time around, even though the inflation backdrop has proved to be weaker than expected and that even with a halving of the policy rate. Indeed, the medium-term inflation outlook still sees a marked undershoot of target (Figure ), albeit where (again) the ‘new forecast is within the range of price stability over the entire forecast horizon’.

The RBA kept the cash rate on hold at 4.35% as per previewed in the November meeting when the RBA downplayed latest moderation in headline CPI, instead referred to the middle of target range and progress in underlying inflation before the chance of easing. The forward guidance statement did not change from the November statement, citing "The Board will continue to rely upon the data and the evolving assessment of risks to guide its decisions.", suggesting the RBA has not changed their view since. The RBA viewed the headline moderation of Q3 CPI to be partially attributed from the government subsidy of energy prices and stated that underlying inflation did not show the same pace of moderation. However, they also acknowledge that wage growth is slowing despite tight labor market. Combined with the weaker growth in Australian economy, the RBA should be getting ready to ease once underlying inflation shows more cooling.

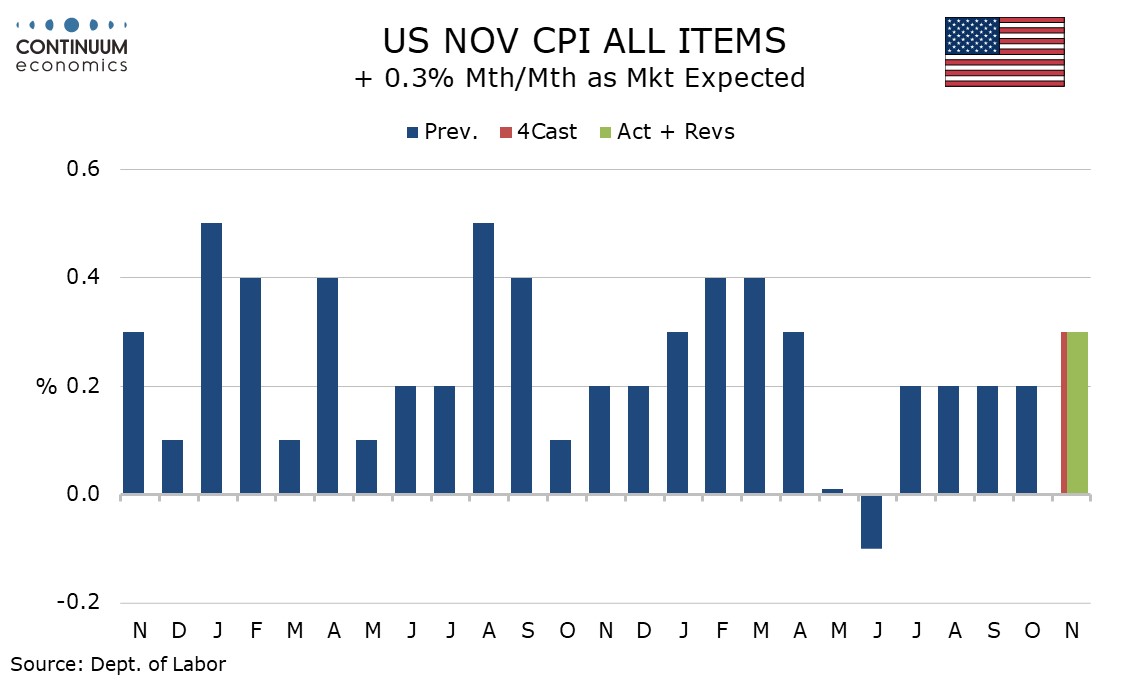

November CPI is in line with expectations at +0.3% both overall and ex food and energy, with both up by 0.31% before rounding. Core CPI with four straight 0.3% gains is still a little high for comfort but the data is probably subdued enough to allow the FOMC to deliver a 25bps easing next week, though they may hint at a slower pace of easing in early 2025.

Gasoline prices rose by 0.6% but energy overall rose by only 0.2%. Food was above trend at 0.4%. The detail is unusual in that commodities ex food and energy matched the usually stronger services ex energy, both rising by 0.3%. Commodities were supported by strength in autos, with used autos seeing a second straight strong month with a rise of 2.0% and new vehicles also accelerating with a rise of 0.6%. Apparel followed a 1.5% October decline with a modest rise of 0.2%.

This is a second straight 0.3% gain in services less energy and signals some recent loss of momentum. Transportation services, a recent source of strength both in air fares and auto services, were unchanged, restrained by a fall in auto rentals. Air fares were up a modest 0.4%. Shelter rose by 0.3% with owners’ equivalent rent up by only 0.2%, its slowest since early 2021. Loss of momentum here will be welcome to the Fed. Shelter did however see support from a 3.7% rise in the volatile lodging away from home sector.