FX Daily Strategy: Europe, May 16th

USD to stay soft after mildly softer CPI

USD/JPY still has most scope for decline

EUR/JPY also looks overstretched

AUD unlikely to move far on employment data

USD to stay soft after mildly softer CPI

USD/JPY still has most scope for decline

EUR/JPY also looks overstretched

AUD unlikely to move far on employment data

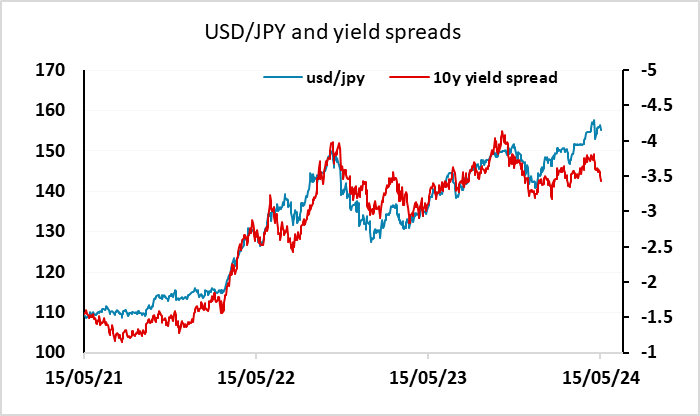

The main data of the week is behind us, and while the US CPI was only marginally on the soft side of expectations, it sustained the impression that there is scope for a Fed rate cut by September or perhaps even by July. Retail sales were also slightly on the soft side of consensus, but only due to weakness in autos. Nevertheless, the run of US data in the last couple of weeks has shown some evidence of weakness and allowed a general decline in US yields, which extended on Wednesday. The implication of this is usually that he USD also suffers, particularly against the JPY, especially given the rise seen in Japanese yields this week, and the USD did initially fall quite sharply on the data. While it did subsequently recover, yield spreads do clearly suggests there is big downside risk in USD/JPY, and with the Japanese authorities likely to respond to any renewed strength to 157 or above with intervention, it’s hard to make the case for the USD/JPY bulls.

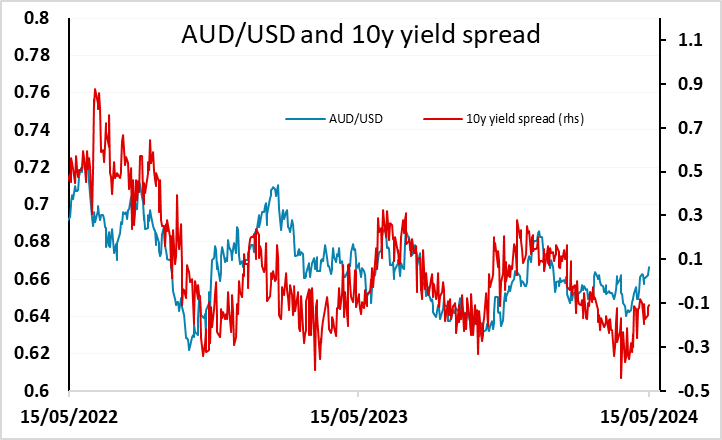

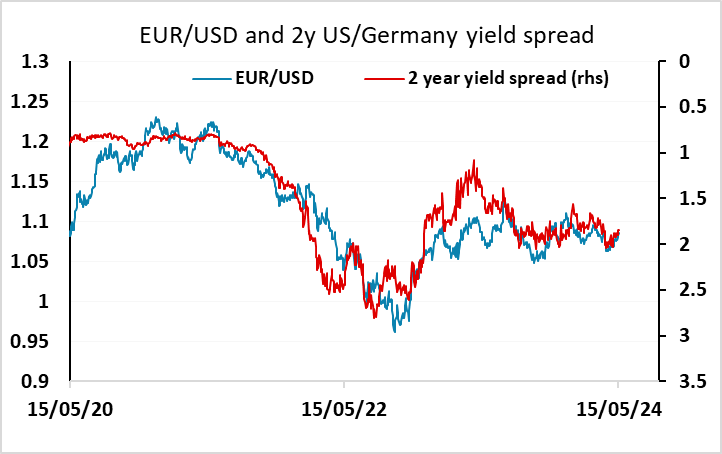

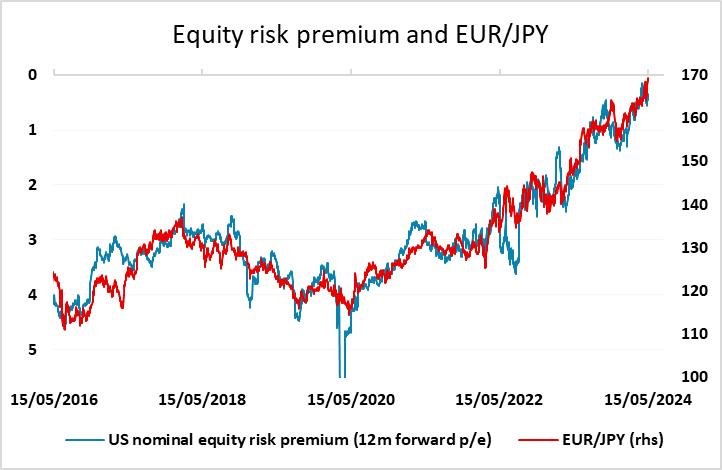

The USD also fell back slightly against the riskier currencies after the data, but with European yields broadly matching the decline seen in US yields, the case for significant USD losses against the riskier currencies is weaker. While there is generally some support for European currencies and the commodity currencies from the equity market gains that result from lower US yields, yield spreads don’t suggest there is a lot of USD downside against the riskier currencies at this stage. The support for EUR/JPY that tends to come from low equity risk premia has also waned a little as equity risk premia have risen slightly as US yields have fallen. This suggests that while there may be some scope for EUR/USD to push up towards 1.09, there is scope for EUR/JPY to decline into the mid-160s as USD/JPY falls towards 150.

For Thursday there is relatively little on the calendar in the US and Europe, but the day starts with Japanese Q1 GDP and the Australian April employment report. Japanese GDP is expected to have fallen in Q1 due to the weakness of real income and consumption growth as prices rose and wage growth stagnated, but this is likely to be treated as historical by the BoJ with the focus more on current wage agreements. There is rarely any direct impact from Japanese growth numbers on the JPY.

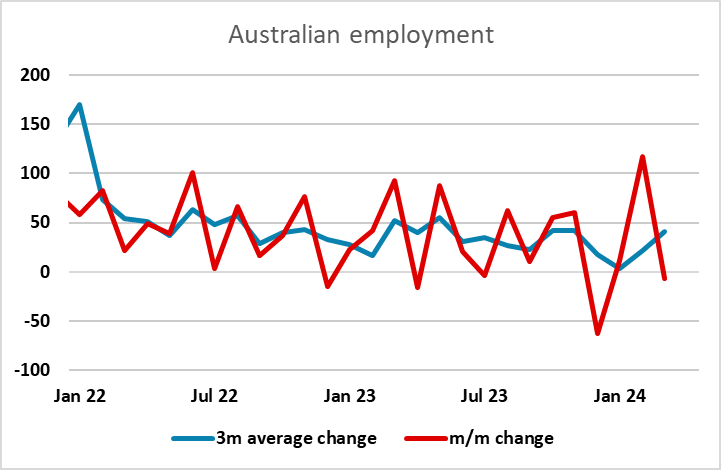

The Australian employment picture has been choppy on a month to month basis, but the trend has been reasonably stable although the unemployment rate has risen slightly in recent months. Given the volatility in the data, with the last two months seeing a rise of 118k followed by a decline of 7k, it’s unlikely to market will react too dramatically unless the numbers are wildly away from the market consensus of a 22k gain in employment. AUD has traded firmer in the last few days helped by a little more optimism on the Chinese economy, but yield spreads still need some movement in the AUD’s favour to support a rise to 0.67 and beyond.