U.S. December PPI - A subdued month with core rates below recent trend

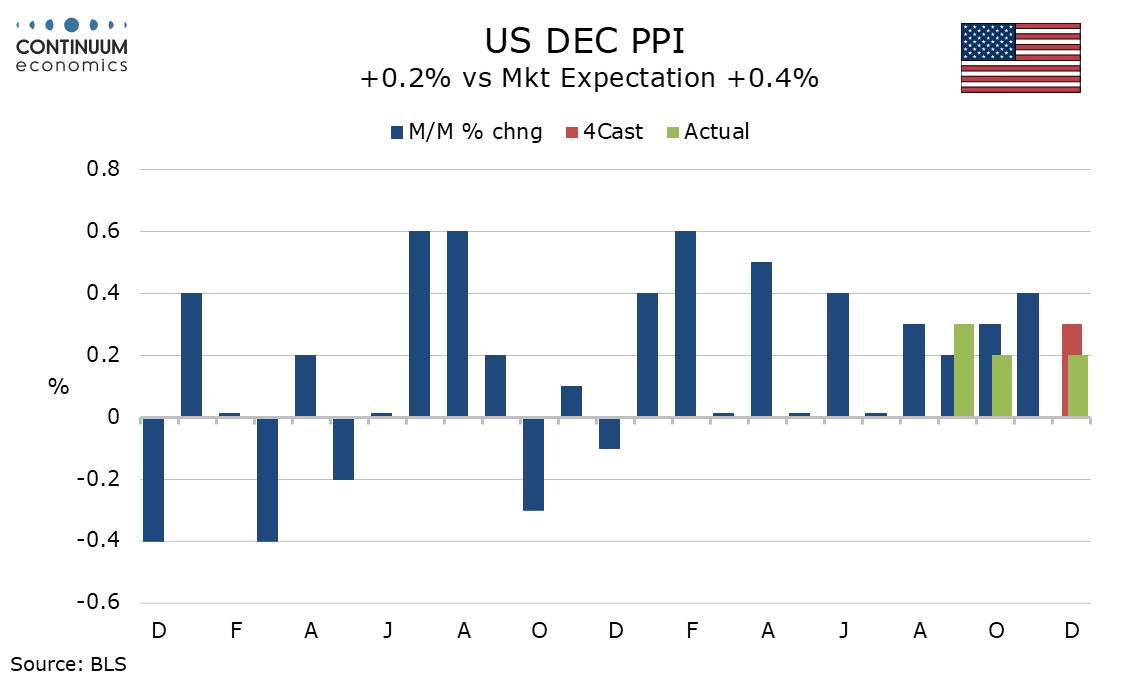

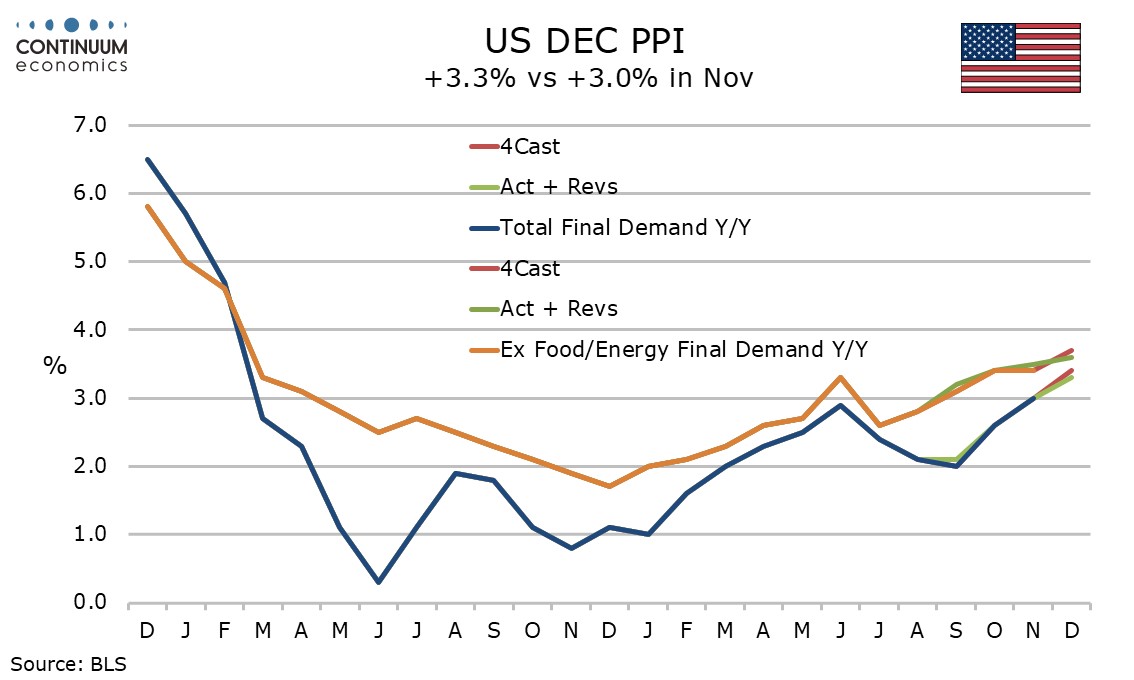

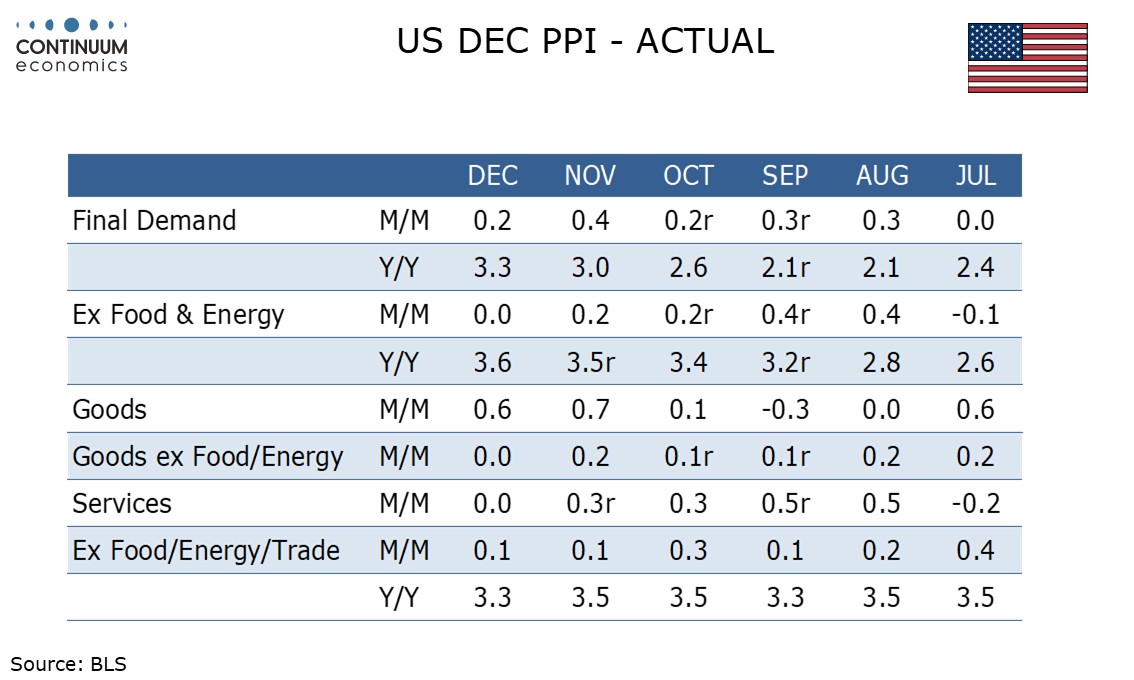

Despite getting a lift from energy, December’s PPI increase of 0.2% is softer than expected, with the core rates softer than recent trend at 0.1% ex food, energy and trade and unchanged ex food and energy. While this is an encouraging report, yr/yr rates remain higher than the Fed would like.

Energy rose by 3.5% on a sharp 9.7% rise on gasoline, exaggerated by seasonal adjustments. Food with a 0.1% decline largely sustained November’s 2.9% surge, with eggs up 0.5% after a 55.6% November surge that was attributed to the consequences of bird flu.

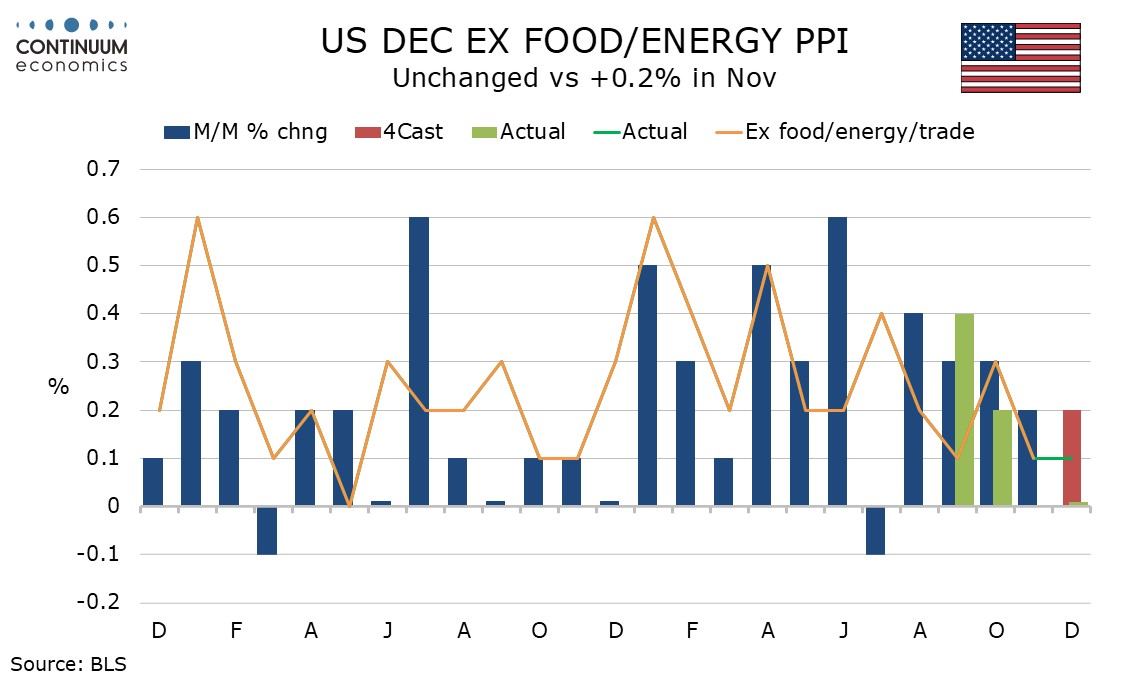

The ex food, energy and trade PPI saw its second straight 0.1% increase and third in four months, a hint that there trend is losing momentum, and yr/yr growth in the series slipped to 3.3% from 3.5%.

Yr/yr growth in ex food and energy PPI was however stable at 3.5% despite an unchanged outcome on the month, while overall PPI rose to 3.3% yr/yr from 3.0%.

Goods less food and energy was unchanged, the softest month since March, as were services, this the softest since July. Transport and warehousing was strong with a 2.2% rise but trade fell by 0.1% and other services fell by 0.2%.

Intermediate PPI data was also generally subdued ex energy. Processed goods were up 0.3% led by energy but unchanged less food and energy, while unprocessed goods rose by 3.2% on energy with a 1.8% decline ex food and energy. Intermediate services rose by 0.4%, but this follows a 0.3% November decline.