FX Daily Strategy: N America, January 15th

US and UK CPI the main focus

USD biased lower given the strong post-election performance and minimal Fed easing now priced in

GBP also has downside risks as inflation data support a more dovish BoE view

US and UK CPI the main focus

USD biased lower given the strong post-election performance and minimal Fed easing now priced in

GBP also has downside risks as inflation data support a more dovish BoE view

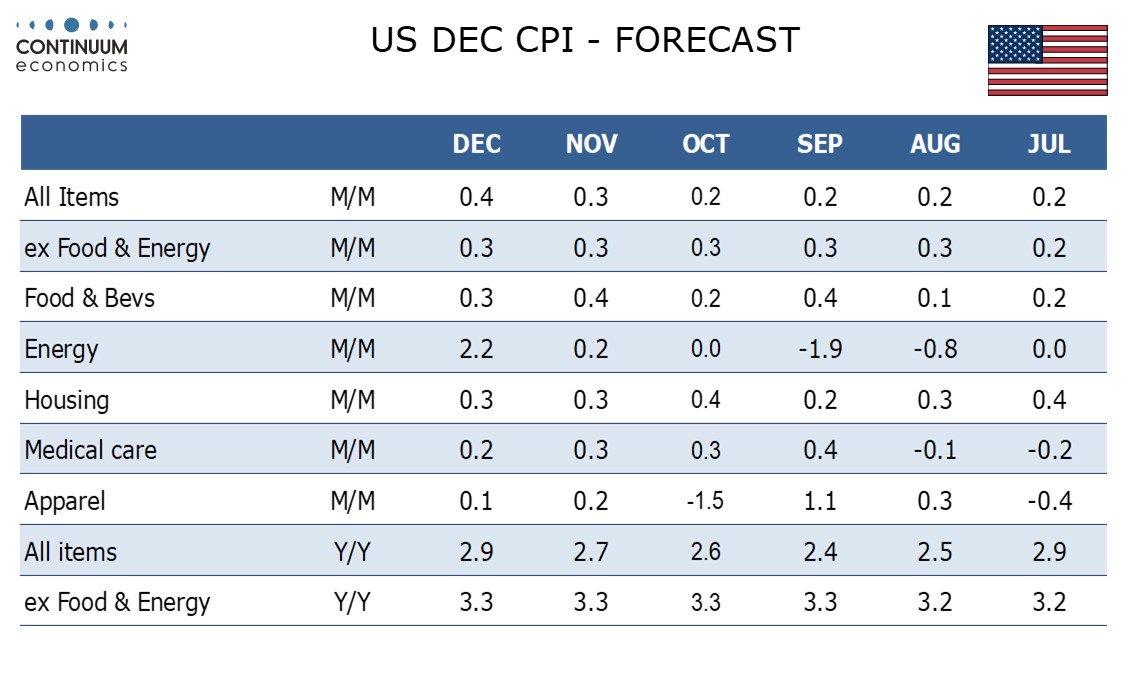

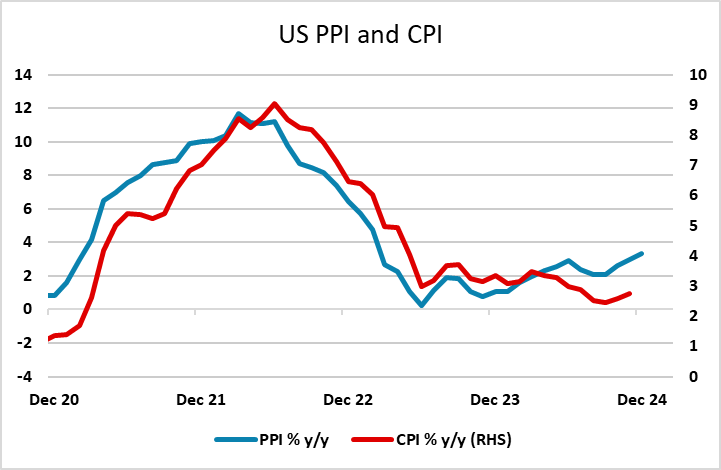

US and UK CPI will be the main focuses on Wednesday. We expect December’s CPI to increase by a nine-month high of 0.4% overall with a fifth straight 0.3% increase ex food and energy. We expect the ex-food and energy index to increase by 0.26% before rounding, which would make it the softest of the five straight 0.3% gains in the core rate. However, this is still above the market consensus of a 0.2% rise, although the consensus is also looking for a 0.4% rise in the headline. While the PPI data was weaker than expected on Tuesday, PPI is not a reliable guide to CPI on a month/month basis. The rising y/y rates on PPI if anything suggest some upside risks to CPI.

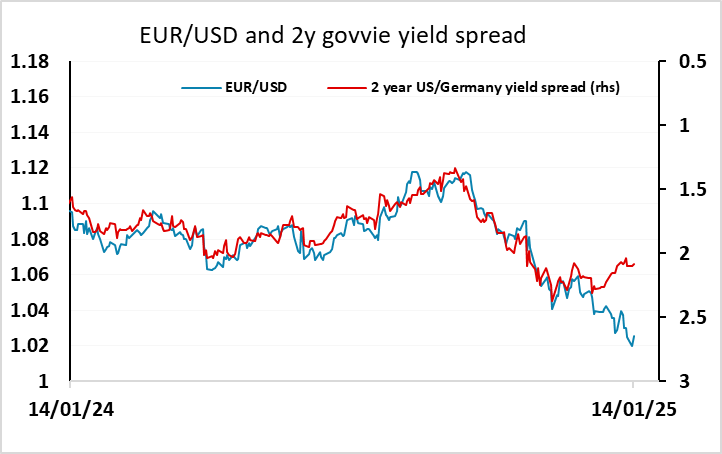

As expected CPI data might be mildly USD negative, as the market continues to price in a hawkish view of the Fed that requires data to be on the strong side of consensus to justify it. However, our forecast is marginally above consensus so should see the USD at least hold its own. Even so, we see the USD strength since the election as being somewhat overdone, and with yield spreads pointing towards a lower USD despite the rise in short dated US yields, it looks difficult for the USD to extend recent gains unless the data is clearly strong and drives US yields higher. Even then, we saw after the employment report that while this may support the USD against riskier currencies, the equity market looks unable to absorb any further rises in yields so that the equity impact of strong data could turn out to be positive for the JPY.

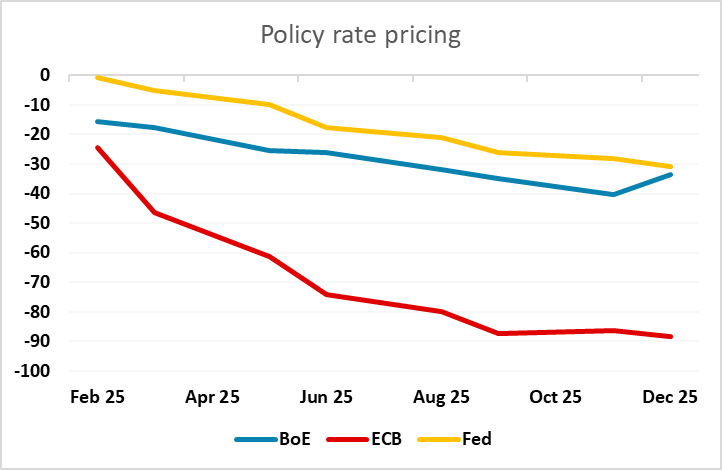

UK CPI has come in below expectations, with the headline rate at 2.5% and the core at 3.2%, against market consensus of 2.6% and 3.4% respectively. CPIH inflation, which includes owner occupied housing costs (OOH), held steady at 3.5% due to OOH rising 8.0% y/y. GBP has weakened modestly on the data, which increases the chance that the BoE will cut rates at the February 6 MPC meeting. This is currently priced as around a 60% chance, but with inflation declining, and more clearly than the y/y rates suggest with underlying trends looking much more moderate in the last 6 months or so, we would rate the chances of a UK rate cut as higher than this.

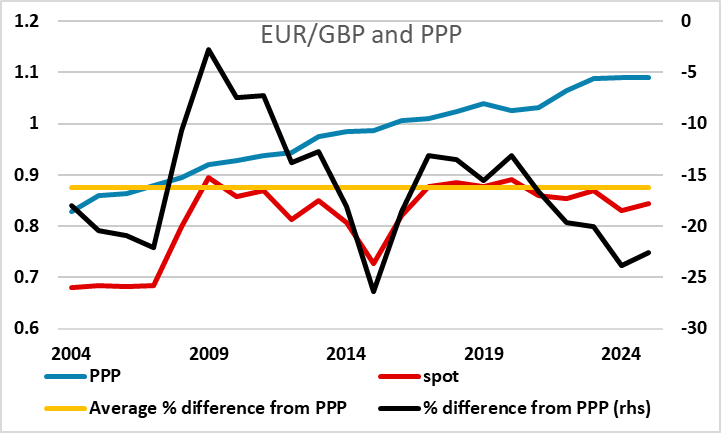

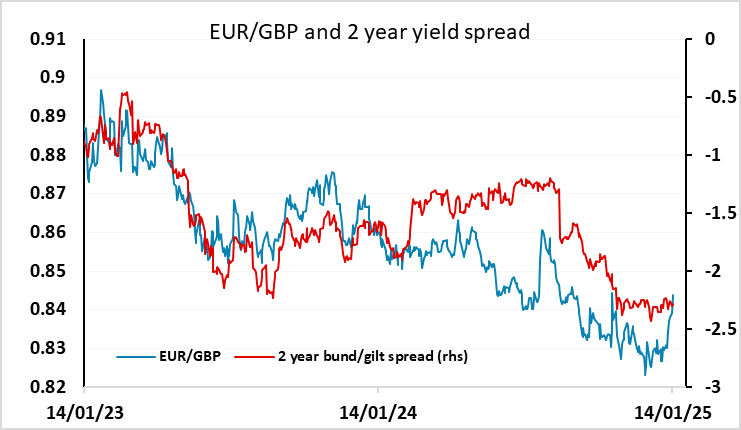

EUR/GBP has risen in recent sessions even though UK yields have been rising. The rise in UK yields looks like an indication of a loss of confidence in the UK and concern about the UK fiscal situation rather than a real expression of the market’s expectation of monetary policy, as the UK data has been generally soft and the BoE comments on balance dovish. This sort of loss of confidence would normally affect the long end of the curve much more than the short end, and we would expect to see some curve steepening with the front end of the curve falling to reflect expectations of more BoE easing. So while GBP may not suffer further losses due to confidence effects, there is likely to be some yield decline to drive some further GBP losses.

While there has been much comment on the decline in GBP/USD to its lowest for a year, in reality GBP is at strong levels on a trade-weighted basis after a strong performance for most of 2024, with the weakness against the USD mainly a result of USD strength rather than GBP weakness. So some decline in GBP should not be something that the BoE is concerned about, and won’t prevent rate cuts. We look for EUR/GBP to head towards 0.85 by the time of the February 6 MPC meeting.