FX Weekly Strategy: October 14th - 18th

ECB meeting to deliver expected rate cut

EUR/USD risks still on the downside

UK data to support weaker GBP tone

JPY to remain soft in the absence of news

Strategy for the week ahead

ECB meeting to deliver expected rate cut

EUR/USD risks still on the downside

UK data to support weaker GBP tone

JPY to remain soft in the absence of news

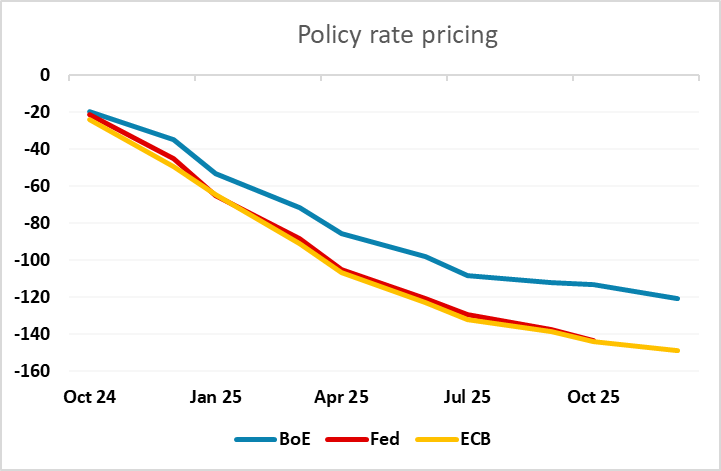

The main event this week is the ECB meeting on Thursday, but there is no longer much uncertainty around the decision, with a 25bp rate cut now 95% priced in following dovish comments from Lagarde and weak inflation data. The ECB are usually reluctant to provide much in the way of forward guidance, but in the absence of significant data, the market is likely to maintain its expectation of a further 25bp cut in December as well.

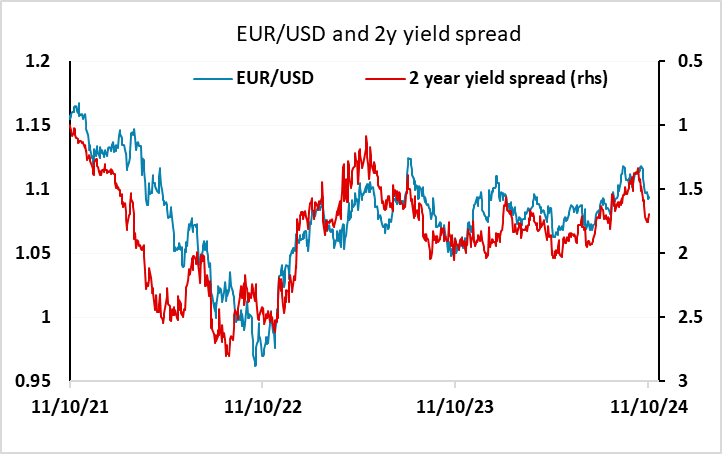

For EUR/USD, the risks still looks to be on the downside as the combination of an easier ECB stance and stronger US data that has led to the market pricing less aggressive Fed easing means that yield spreads have moved in the USD’s favour in the last couple of weeks, and now suggest scope sub-1.09. While the ECB meeting looks unlikely to provide a significant surprise, an ECB rate cut would support this more dovish relative ECB view and we would still see risks to the EUR/USD downside.

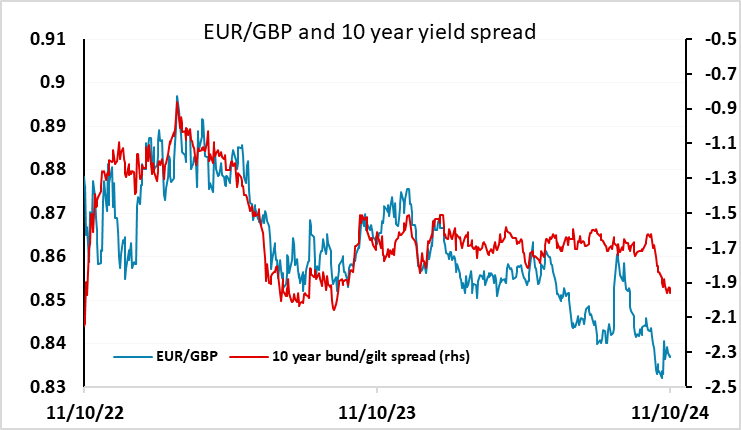

There is the usual set of mid month UK data in the shape of labour market and CPI data. We expect weaker numbers for CPI, employment and earning, supporting the more aggressively dovish stance that governor Bailey suggested the MPC are ready to adopt going forward. While UK front end yields have fallen in response to Bailey’s comments, there is still plenty of scope for further declines in UK rate expectations to bring the market’s anticipated path for the BoE more in line with the Fed and ECB. As it stands, GBP already looks expensive against the EUR both relative to long term history and to recent yield spread moves, so we see risks as being clearly to the GBP downside, with the 0.8300 level in EUR/GBP looking likely to represent a long term base.

There is Japanese national CPI on Friday, but this rarely has much impact as there are rarely surprises with the Tokyo CPI data already released. The JPY has been under pressure for the last month, in part because recent comments from Ueda and Ishiba have suggested there is no immediate desire to tighten, in part because the markets have taken on a risk positive tone since the Fed cut rates 50bp. It’s hard to see any of this week’s events changing the JPY tone, with no major data and the ECB rate cut well anticipated. But the JPY is certainly approaching levels that are likely to attract long term buyers. Yield spreads still suggest USD/JPY is stretched at current levels, and while Ueda has been talking more dovishly, the BoJ have allowed 10 year JGB yields to rise to their highest since early August. But while we see potential for substantial JPY gains in the next couple of years, it is likely to need a trigger of more negative risk sentiment for any major gains, and the bias this week is likely to remain to the JPY’s downside as carry trading predominates in relatively quiet markets.

Data and events for the week ahead

USA

In the US, on Monday Fed’s Waller is due to speak. Tuesday sees October’s Empire State manufacturing survey and Fed’s Daly will speak. Wednesday sees September import prices.

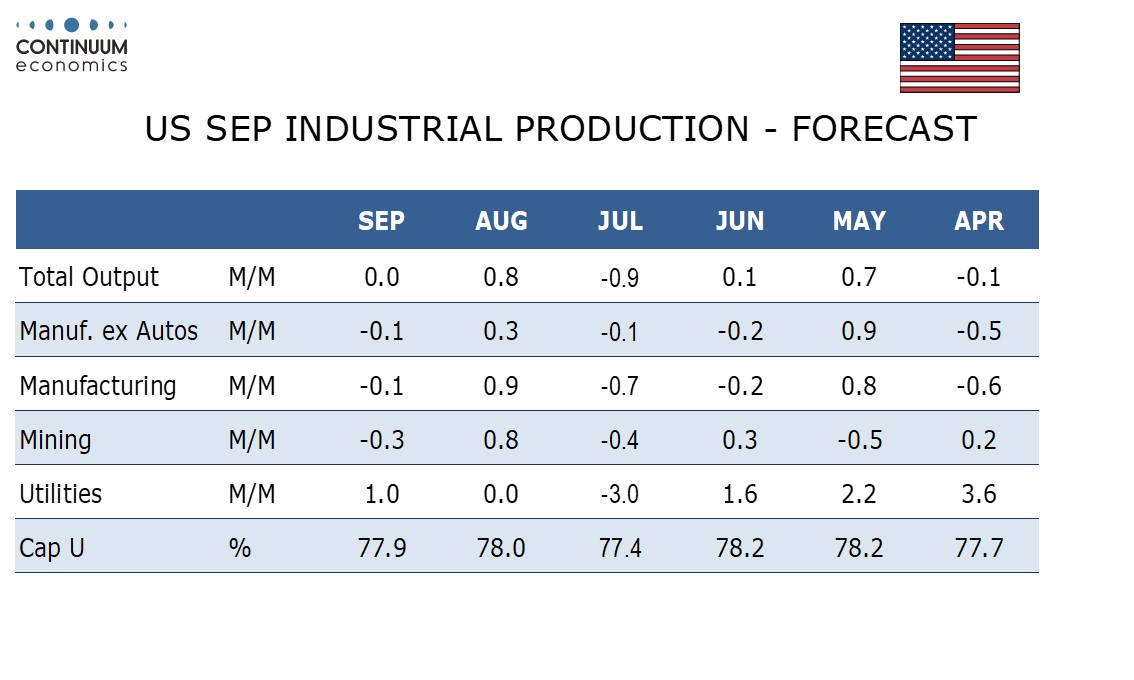

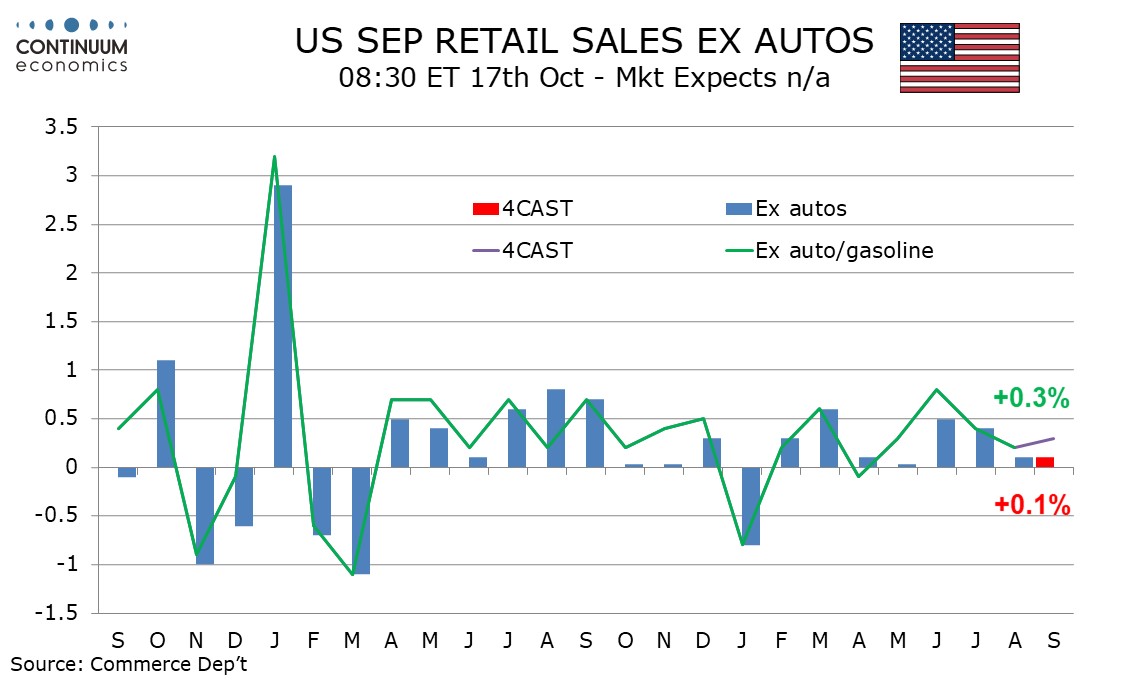

The week’s most significant release may be September retail sales on Thursday. We expect moderate gains of 0.2% overall, 0.1% ex autos and 0.3% ex autos and gasoline, which will complete a solid quarter. Due with the retail sales report are October’s Philly Fed manufacturing survey and weekly initial claims, which may be influenced by Hurricane Milton. September industrial production follows, which we expect to be unchanged with a 0.1% decline in manufacturing. After that we will see October’s NAHB homebuilders’ survey, and August business inventories, where recent data suggests a rise of 0.3%.

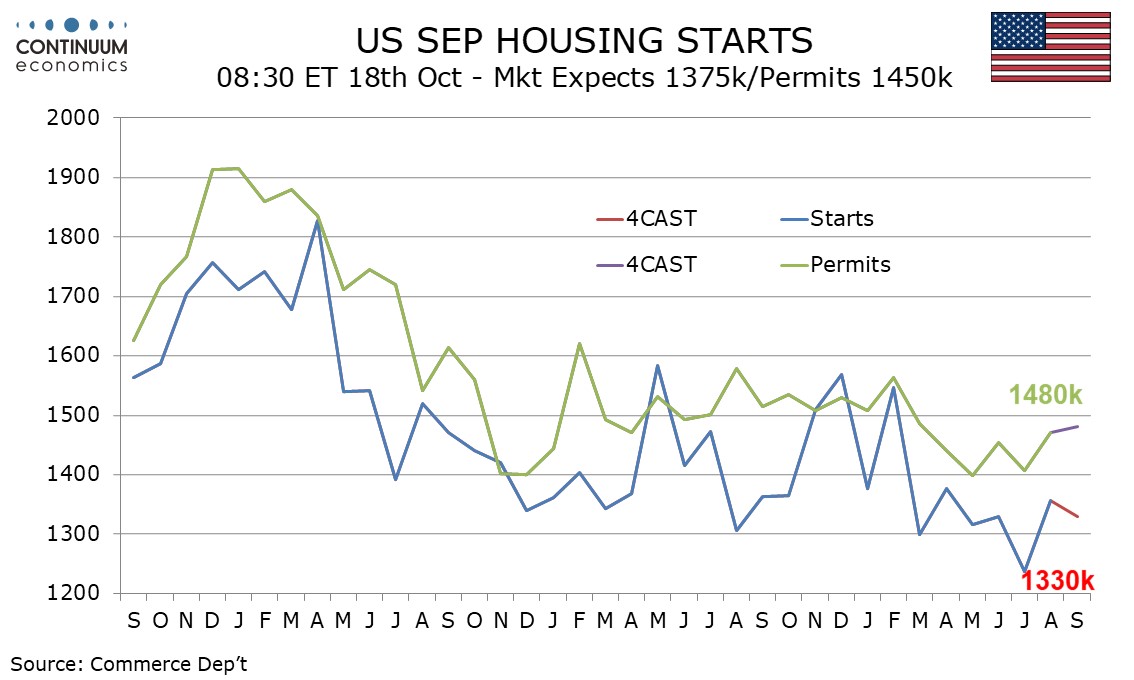

On Friday we expect September housing starts to fall by 1.9% to 1330k but a 0.7% rise in permits to 1480k will hint at an improving underlying trend. Fed’s Kashkari will speak on Friday.

Canada

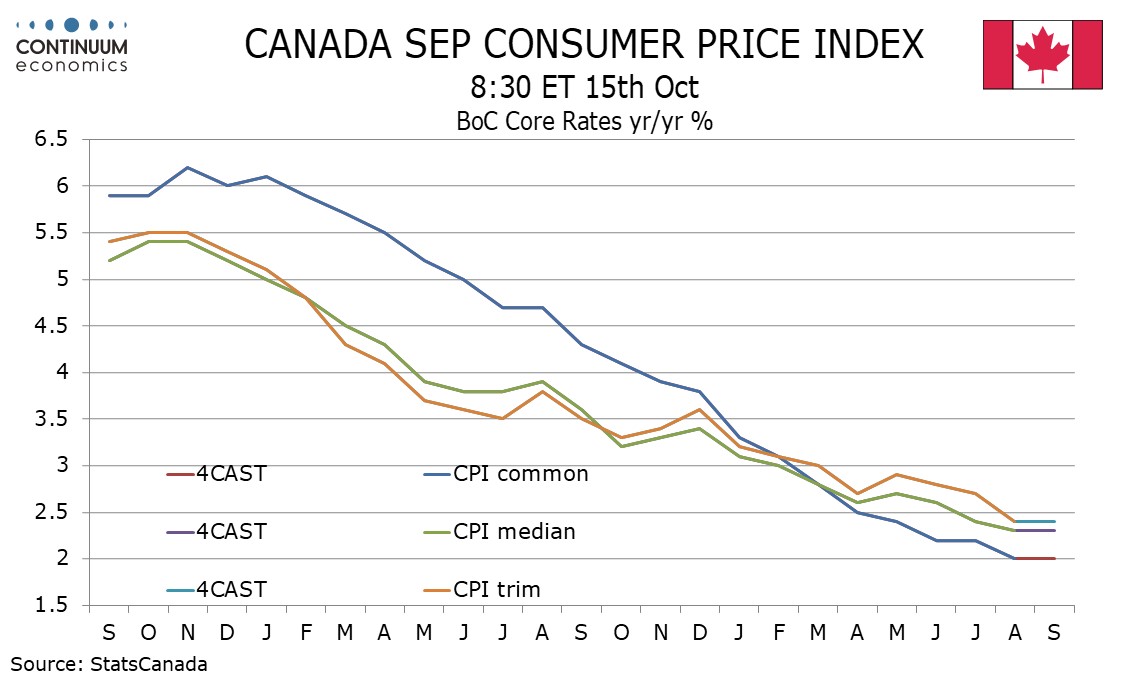

Canada’s key release is September CPI on Tuesday, which we expect to slip to 1.9% yr/yr from 2.0% overall though we expect the Bank of Canada’s core rates to be unchanged, pausing after slippage in most recent months. Tuesday also sees August wholesale sales, where preliminary data saw a 1.1% decline, and September existing home sales. Wednesday sees September housing starts and August manufacturing shipments, where preliminary data saw a 1.5% decline.

UK

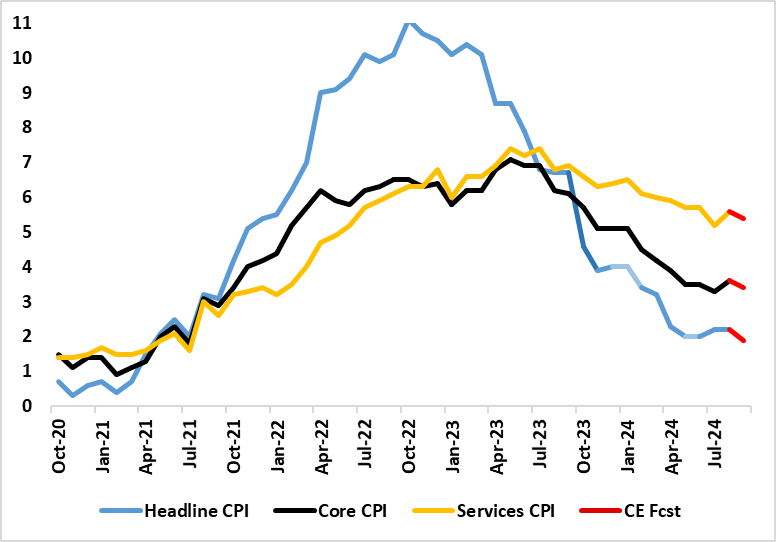

More major data awaits with the September CPI (Wed). Helped by a fall in fuel prices, amplified by base effects, alongside some belated softening in services costs, UK inflation may drop to 1.9% in the September CPI (from 2.2%), thus falling below target for the first time since April 2021. Admittedly, the drop in services may be limited to a notch lower from September’s 5.6%, with the core falling similarly from 3.6%. The day before sees key labor market data which may show a fresh rise in the jobless rate and higher inactivity, but there will be as much weight on HMRC numbers regarding job dynamics which have suggested clearer slowing in private sector employment, if not an actual contraction. However, the average earnings figures will be the most closely watched. We see a further slowing in both regular pay growth (3 mth mov avg) down to 4.8% and the headline rate down to around 3.7 % on base effects.

Broad Inflation Drop Ahead?

Source: ONS, Continuum Economics

Regardless, with even the BoE (belatedly) casting doubt on the validity of these numbers, more attention may be paid to the PAYE pay data where a clear(er) slowing may be on the cards. Notably, this PAYE data also chimes with weaker activity backdrop highlighted by the ONS which showed a marked fall in vacancies alongside increased signs of employment contracting and not just in terms of self-employment. Indeed, the jobs data conflict with the headline pick-up in recent GDP growth, albeit more in line with the soggy domestic demand picture those national account data nevertheless highlighted. Finally, retail sales data (also Fri) may be flat partly due to poor weather which was unsettled, wet and dull through September.

Eurozone

It now seems very likely that the ECB next Thursday will cut rates at a successive Council meeting for the first time in this easing cycle dating back to June. To date, the ECB has allowed the impression that it would ease only every other meeting, ie once a quarter, partly to give it access to what it sees as key labor cost numbers. But yet another downside inflation surprise, alongside business survey data highlighting both fresh stagnation risks and much reduced cost pressures, have changed the ECB mindset. Thus we see a 25 bp cut and perhaps a change in rhetoric. Indeed, President Lagarde may use the press conference to repeat that policy will still have to remain restrictive but possibly amending or even omitting the ‘for some time’ qualification used of late. It will be interesting to see if the looming new Bank Lending Survey (Tue) reinforces a downside risks scenario, in suggesting weak credit demand and/or curtailed supply. The German ZEW survey (Tue) may do likewise!

Rest of Western Europe

There are key events in Sweden. Final CPI data (Tue) should confirm the recent innovative flash numbers. Labor market figures (Fri) may show a fresh rise in the jobless rate. Norway sees a speech from Norges Bank Governor Ida Wolden Bache which may hint at even earlier start to easing in the wake of the softer-than-expected core CPI numbers for last month

Japan

National CPI on Friday remains critical. The August CPI has come in higher at 3%, which favours the hawkish stance of BoJ, yet it remains to be seen whether such inflation is sustained. Trade Balance on Thursday will also be important as it reveals the state of domestic demand.

Australia

We will have the employment data on Thursday where we expect the Australian labor market to remain solid. Else it is rather empty.

NZ

Mostly tier two data. RBNZ’s Governor will be speaking on Monday but with little expectation.