FX Daily Strategy: N America, May 31st

Japanese CPI has minimal impact

US PCE data needs to be weaker to extend USD decline

EUR CPI data support the EUR

EUR/CHF decline hard to oppose but CHF/JPY looks too high

Japanese CPI has minimal impact

US PCE data needs to be weaker to extend USD decline

EUR CPI data support the EUR

EUR/CHF decline hard to oppose but CHF/JPY looks too high

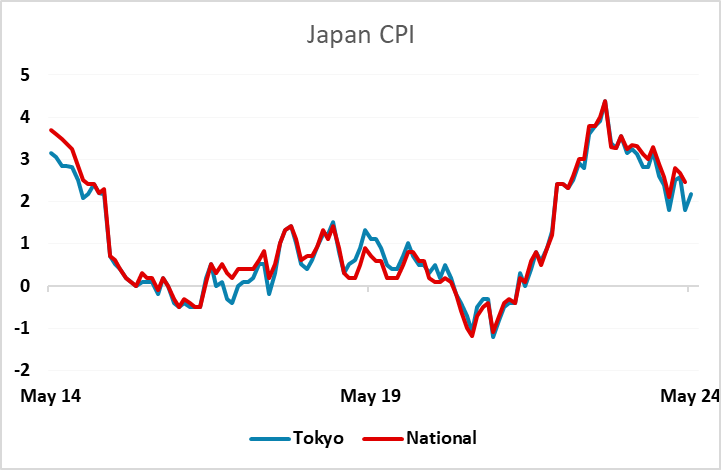

Friday sees a lot of price data from around the world, starting with Japanese Tokyo CPI data. This showed a sharp drop in April relating to a change in the calculation of education prices, but this was not fully reflected in the national numbers. Headline y/y CPI rebounded above 2% to 2.2% from 1.8%, as did ex-fresh food and energy. Ex fresh food y/y CPI stays below 2% at 1.9% but also rebounded from 1.6% in April. We are forecasting National CPI to also rebound to 2% y/y, which will maintain expectations of BoJ tightening (by 10bps) in July.

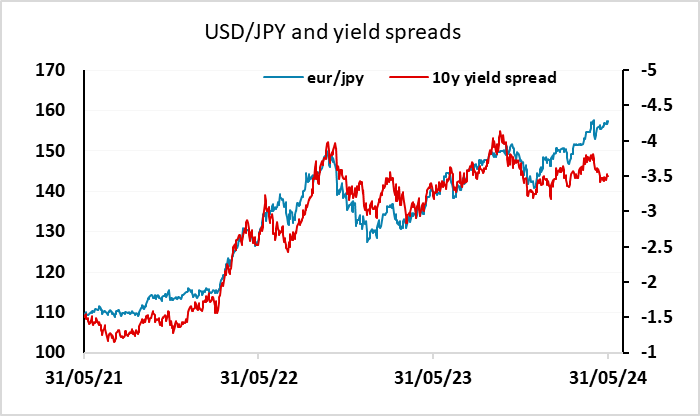

The JPY has a better day on Thursday, but USD/JPY still only moved modestly lower despite the general drop in yields in the US and Europe. We suspect that the Wednesday/Thursday highs are going to be hard to break given the spread narrowing we have seen in favour of the JPY and the threat of BoJ intervention in the 158 area, but that doesn’t mean that USD/JPY will gain significant downside momentum without some news. The US data on Thursday was only modestly on the weak side, with the larger than expected April trade deficit perhaps the most significant release, as it suggests weak Q1 GDP growth could extend into Q2. There is of course also a direct negative implication for the USD of a larger trade deficit, but this is generally not seen as a significant factor in the short run.

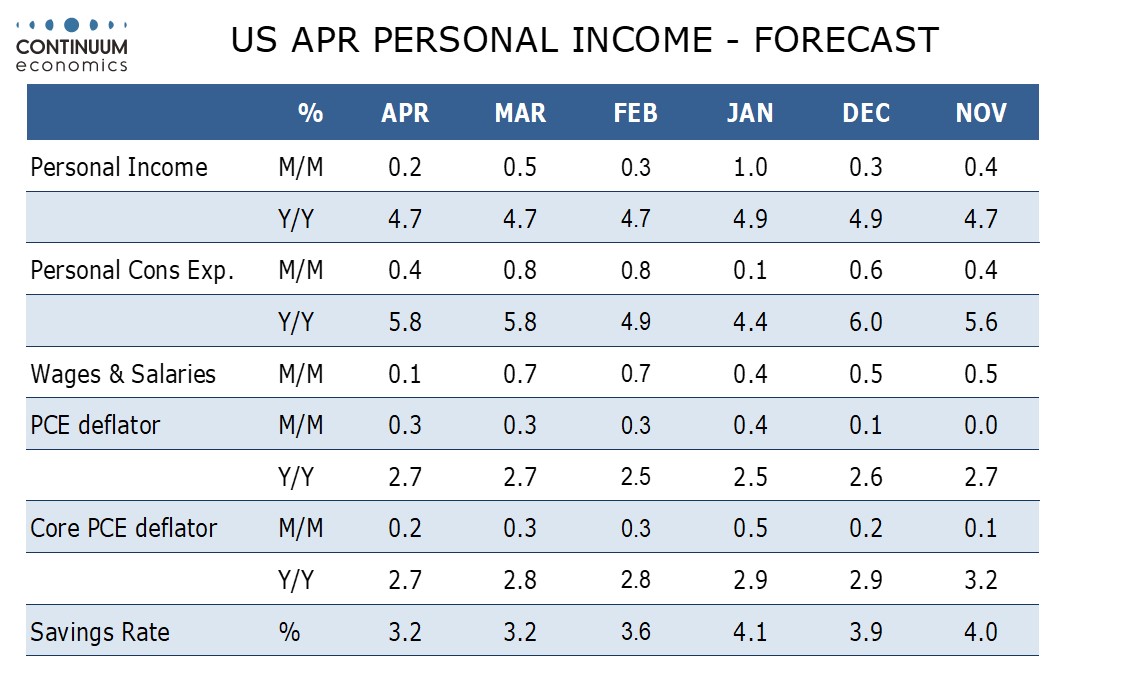

The PCE data on Friday will need to be on the weak side of expectations if USD weakness is to extend. April’s core PCE price index looks set to come in close to 0.25% before rounding, though we expect the index to be rounded down to 0.2%, while overall PCE prices are rounded up to 0.3%. Our forecast for core is on the low side of market consensus, so could be enough to extend the USD decline, but it’s a close call and we wouldn’t expect a large impact.

The Eurozone CPI data came in slightly above expectations after mixed country data at 2.6% y/y, with core a little stronger still at 2.9%, and this did push short end EUR yields a little higher. It is very unliekly to prevent an ECB rate cut next week, but has slightly reduced market expectations of subsequent cuts and the EUR is a littl estornger as a result. However, we continue to see current EUR yields as pricing in too little ECB easing this year, which suggests limited EUR upside.

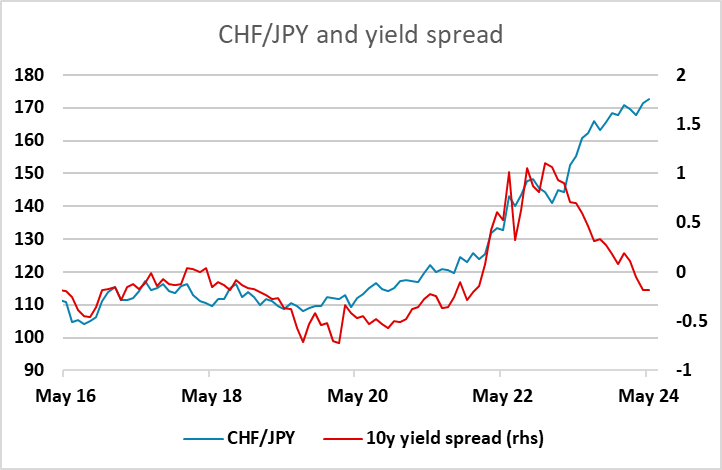

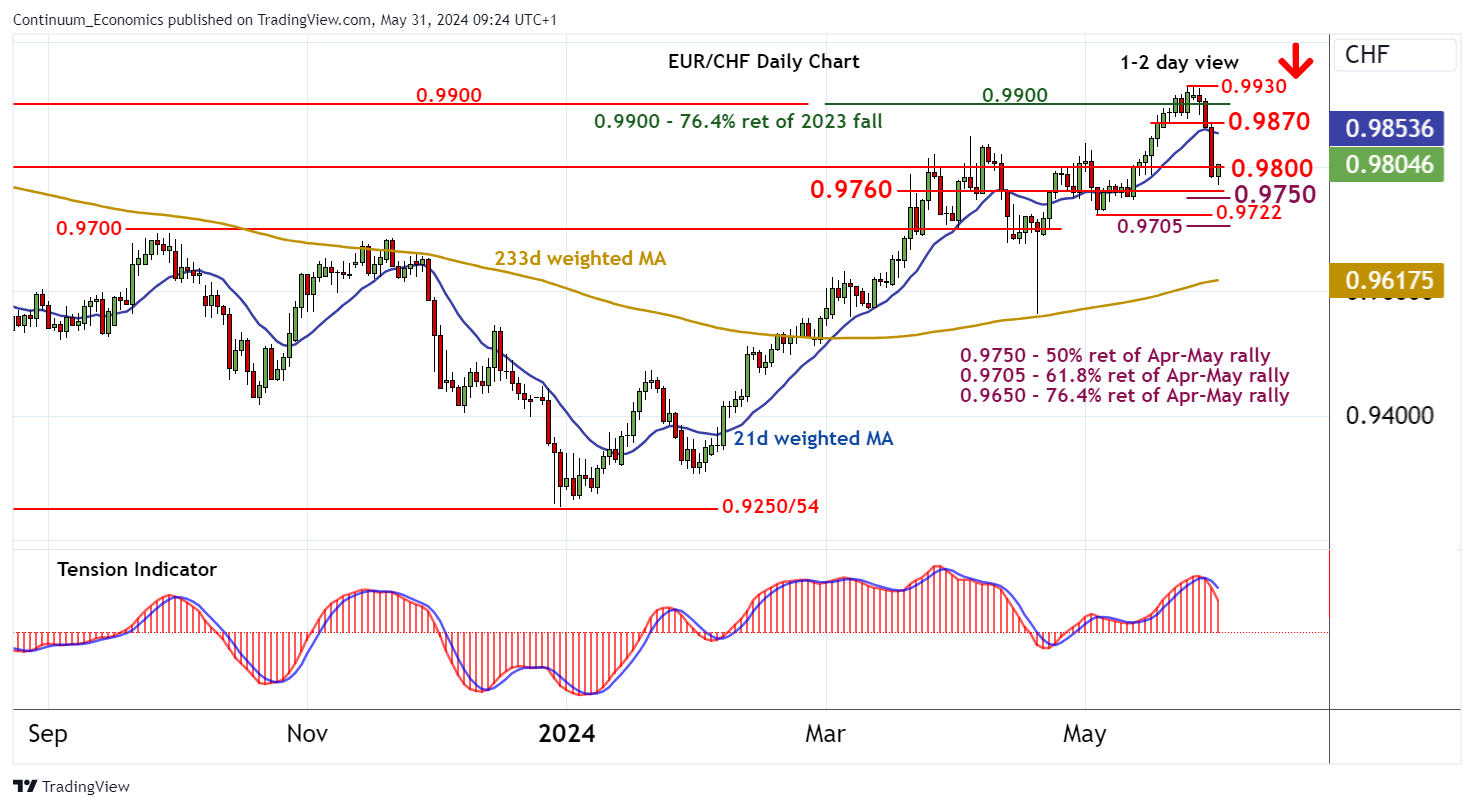

While the JPY performed a little better on Thursday, the best performer was the CHF, with EUR/CHF dipping below 0.98 after better than expected Swiss Q1 GDP data. The retreat from parity in EUR/CHF may mark the short term end of the rally seen this year, with the coming months more likely to see rate cuts from the ECB than the SNB. Nevertheless, the CHF looks a more attractive funding currency than the JPY given the huge valuation move in the last few years, and with CHF/JPY hitting its highest since the BoJ intervention at end April/beginning of May, it looks ripe for a reversal lower.