FX Weekly Strategy: March 11th-15th

USD to manage modest recovery unless CPI proves weaker than expected

USD/JPY downside still preferred

NOK/SEK may start to see upside progress on this week’s Scandi CPI data

EUR/GBP well supported at 0.85 unless UK data surprises strongly on the upside

Strategy for the week ahead

USD to manage modest recovery unless CPI proves weaker than expected

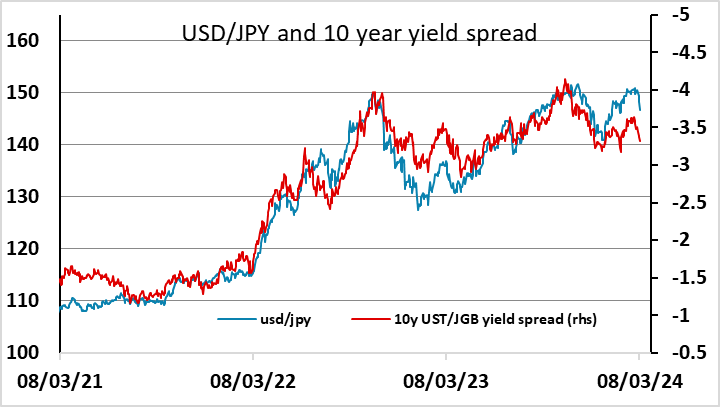

USD/JPY downside still preferred

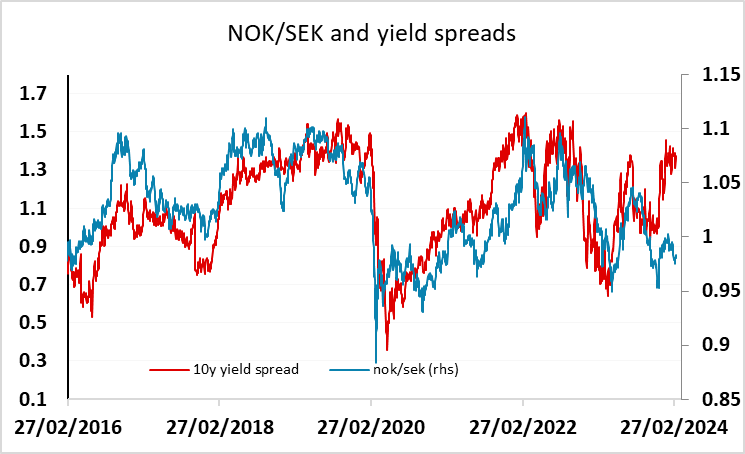

NOK/SEK may start to see upside progress on this week’s Scandi CPI data

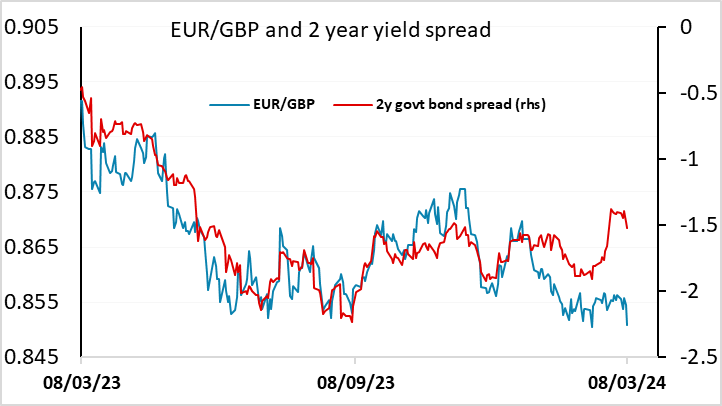

EUR/GBP well supported at 0.85 unless UK data surprises strongly on the upside

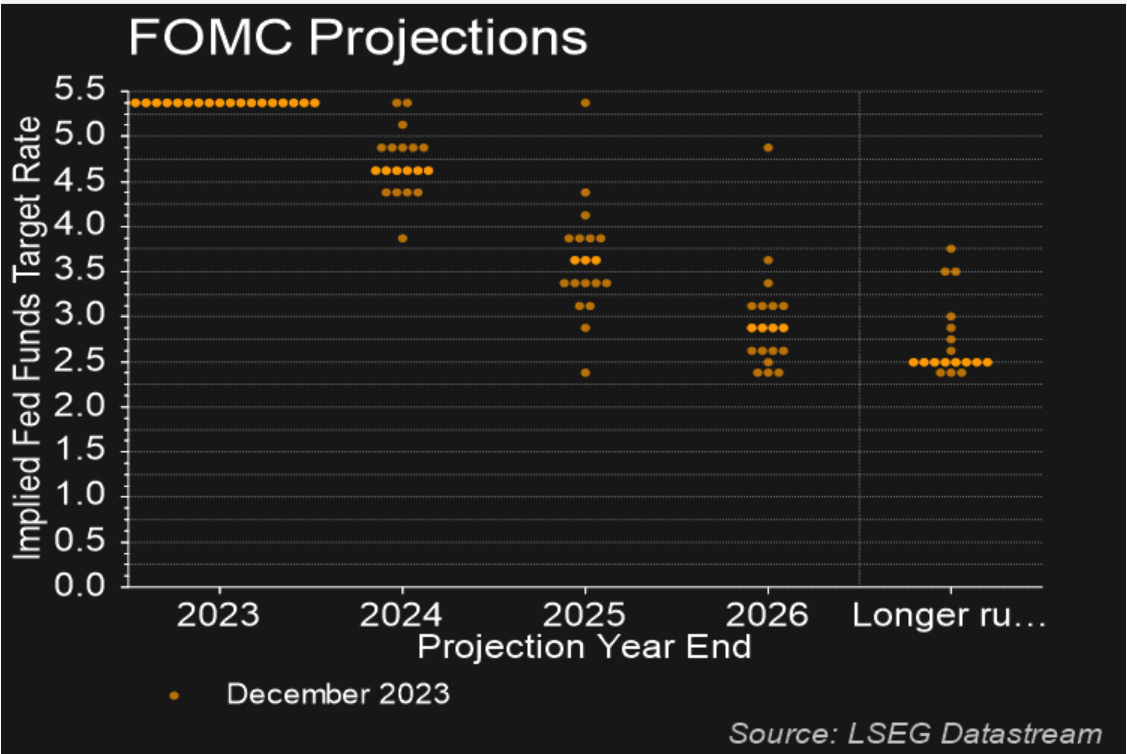

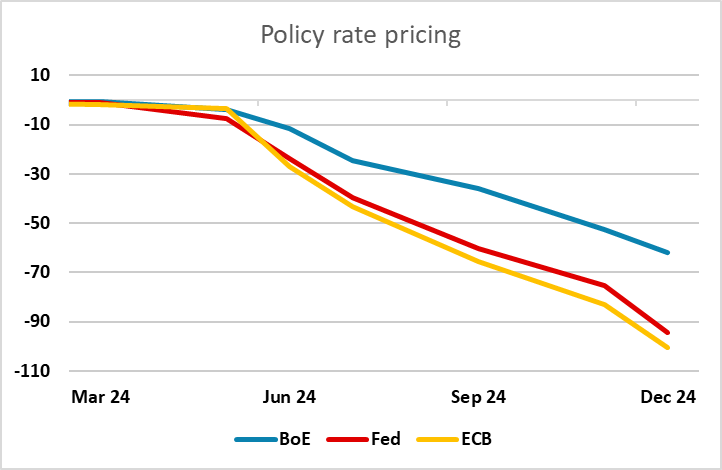

US CPI will be the main focus this week. Last week saw a significant move lower in US yields after the Powell half-yearly testimony to Congress. The market responded to his comments by pushing yields lower, but we did not see his comments as being particularly dovish. While he accepted that rate cuts in 2024 were likely, he made it clear that the inflation fight was not yet won, and didn’t suggest a more dovish view than the Fed indicated in its latest statement. However, after this comments, and after the February employment report, which was seen as on the soft side due to downward revisions in December and January payrolls and weaker than expected average hourly earnings, the market moved to discount 100bps of rate cuts this year. The median Fed projection in the dots from the December meeting suggested three rate cuts or 75bps, and since the December meeting the data has clearly been on the strong side – notably the 0.4% rise in January core CPI. So we see very limited scope for further declines in US yields, and if CPI comes in above the market consensus (and our forecast) of 0.4% headline, 0.3% core there is scope for a sharp correction higher in US yields and the USD, while a downside miss is less likely to increase market expectations of easing.

Our forecast is in line with market consensus, so the reaction is unlikely to be too sharp on that view, but we still see some potential for US yields to edge a little higher, as 0.4%, 0.3% isn’t a great start to the year for core CPI. This should mean that EUR/USD hold below 1.10 and USD/JPY above 146, at least initially. In fact, there wasn’t a great deal of movement in USD-EUR yield spreads in the last week, with EUR yields also falling after the ECB meeting, but the EUR and the other risky currencies benefited to some extent against the USD from the positive risk impact of lower yields. However, there was more benefit for the JPY, with Japanese yields actually rising as market speculation of a spring rate hike – possibly even this month – picked up following reports of higher wage settlement sin the spring pay round. We still see more upside potential for the JPY, with current yield spreads indicating scope for a move to the low 140s, but a break of the 200 day moving average near 146 may require some clear positive news, either from US CPI or from Japan.

This week also sees February CPI data from both Norway and Sweden, with Norway on Monday and Sweden on Thursday. We look for Norwegian numbers marginally above consensus, and unchanged from January at 5.3% for the core rate, but still a tad below the Norges Bank projections, while the Swedish core rate should drop back below 3%. Our forecasts are not far from market projections, but the relatively high rate of inflation in Norway should emphasise the likelihood that Norges Bank holds relatively tighter policy. In any case, the NOK continues to look too weak both against the EUR and against the SEK, with NOK/SEK well below the level suggested by the normal yield spread correlation. We continue to see scope for a NOK/SEK move back to parity and beyond.

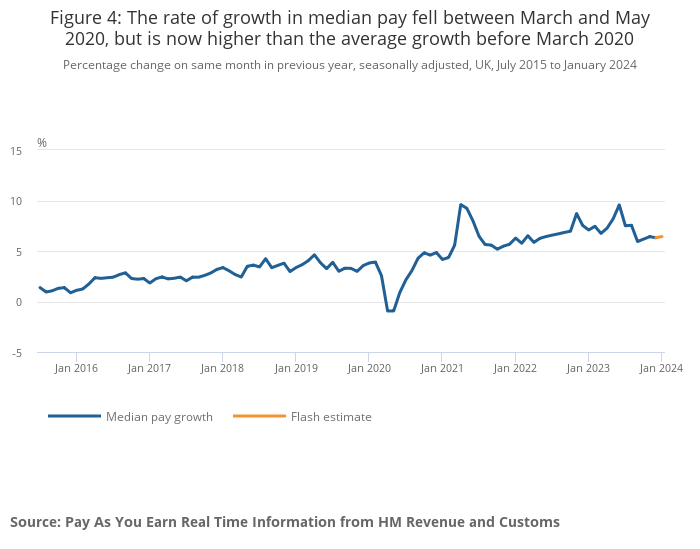

GBP made some gains against the EUR in the last week as the EUR fell back following the ECB meeting, which the market saw as being on the dovish side. However, there was little justification for GBP strength in yield moves, with UK yields moving lower with the USD and EUR yields. It remains the case that the market is pricing in a much shallower decline in GBP rates than USD and EUR rates, in spite of the high starting point and weak UK growth expectations, mainly because of the hawkish BoE rhetoric which is founded primarily on concerns about the tight labour market. This week’s labour market data will therefore once again be closely watched. The HMRC data on pay has become the most significant number in the labour market dataset, and this has already shown a significant decline from the highs. But there will need to be some decline from the 6% annual rate of pay growth seen in January if the market is to start to discount a steeper rate cut path from the BoE. Nevertheless, it’s hard to see the BoE remaining as hawkish as the market is currently pricing relative to the ECB, and EUR/GBP, even on the basis of a hawkish BoE, is trading somewhat below the level suggested by yield spreads. So we would expect 0.85 to prove strong support for EUR/GBP, provided there are no major upside surprises in the labour market data on Tuesday or the GDP data on Wednesday.

Data and events for the week ahead

USA

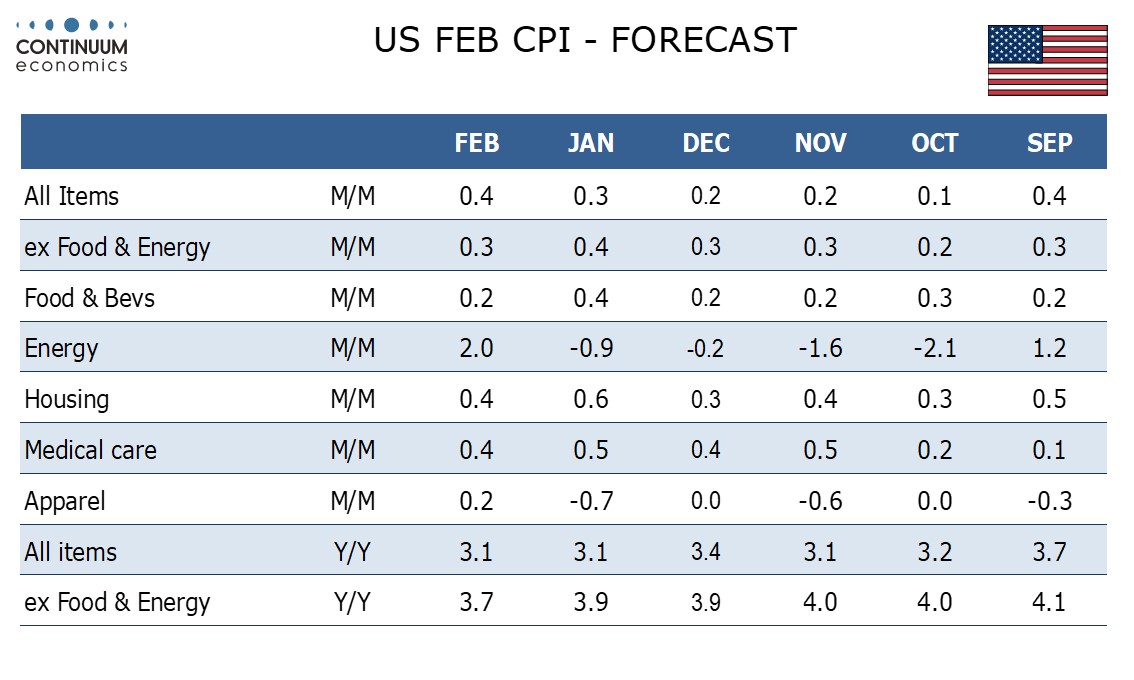

After a quiet Monday the week’s key U.S. release comes on Tuesday. We expect a 0.4% increase in February’s CPI, which would be the strongest rise since September, but we expect the ex food and energy rate to slow to a 0.3% pace after January’s worrying 0.4% outcome. Minor releases due on Tuesday are February’s NFIB small business optimism survey and February’s budget.

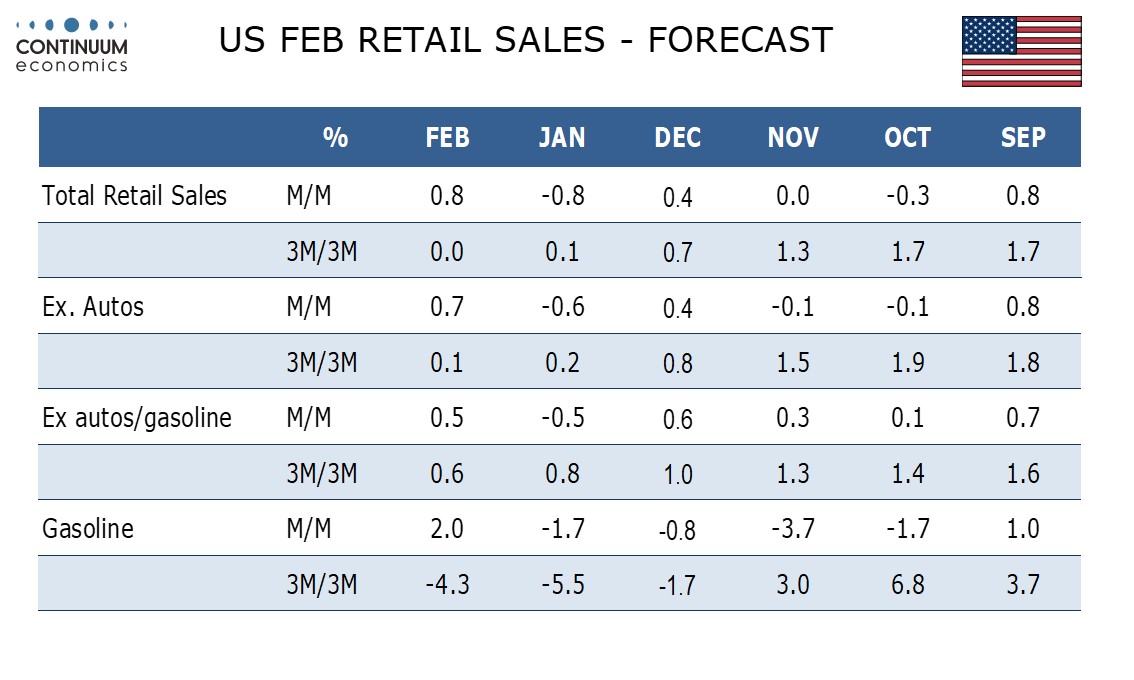

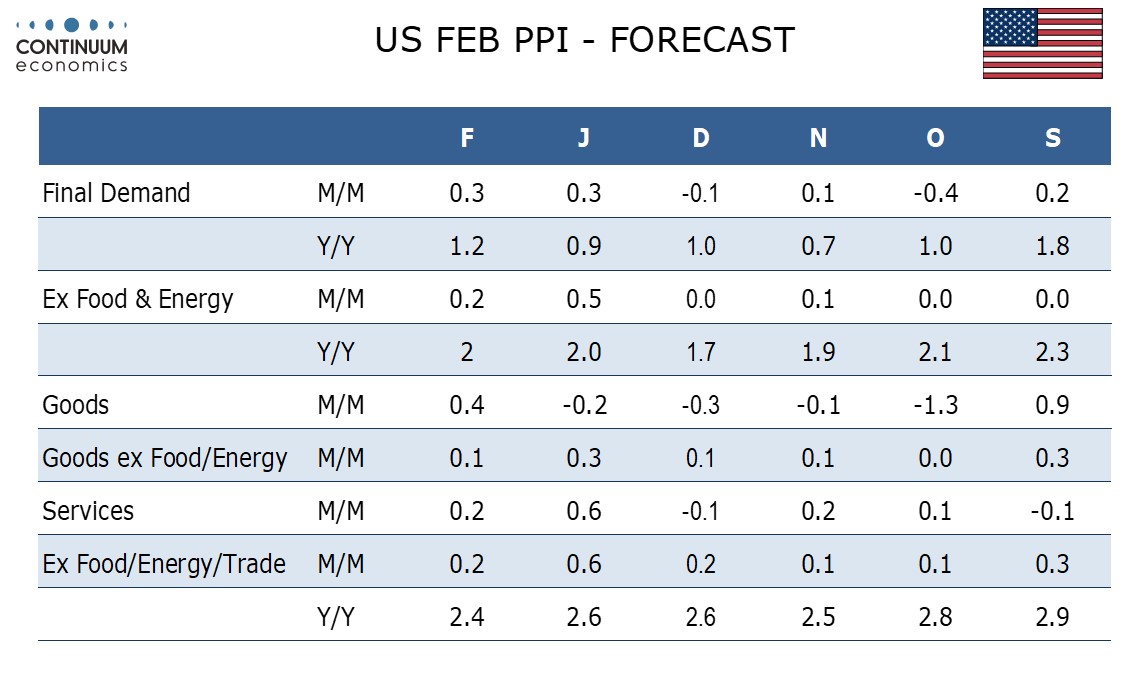

After a quiet Wednesday more significant data is due on Thursday. We expect February retail sales to rise by 0.8%, reversing a weather-influenced 0.8% decline in January, with a 0.7% ruse ex autos to follow a 0.6% January decline while sales ex autos and gasoline rose by 0.5% after falling by 0.5% in January. We expect a 0.3% rise in February’s PPI, with a modest 0.2% increase ex food and energy. Weekly initial claims data is due with the above releases and January business inventories follow, where existing data implies an unchanged outcome.

Friday sees March Empire State manufacturing data and February import and export prices. February industrial production follows, another series where January data was depressed by bad weather. Preliminary March Michigan CSI data also due. February data suggested a recent bounce has started to fade. The week will see little Fed talk with the March 20 rates decision getting closer.

Canada

Canada releases January manufacturing shipments on Thursday and January wholesale sales on Friday. Preliminary estimates are for a rise of 0.4% and a fall of 0.6% respectively. February housing starts are also due on Friday.

UK

As for ever more important labour market data, still presented amid continuing concerns over the accuracy of figures, arrive next Tuesday. The revised numbers may show a softer than thought jobless rate and higher inactivity, but there will me as much weight on HMRC numbers regarding job dynamics which has suggested clearer slowing in private sector employment. However, the average earnings figures will be the most closely watched and where we see no material change in either regular pay growth (3 mth mov avg) at just above 6% and the headline rate remaining just under 6%. Regardless, with even the BoE (belatedly) casting doubt on the validity of these numbers, more attention may be paid to the PAYE pay data where a clear(er) slowing has already been seen. Tuesday also sees the Treasury Committee review the Budget with Chancellor Hunt due to testify on Wednesday.

Wednesday sees monthly GDP figures. GDP shrank by 0.1% m/m in December data, a result that reflected the plunge in retail sales and abnormal weather that meant a Q4 drop in GDP and consumer spending. We see stagnation in these January figures, this actually extending through the whole of the current quarter so that a flat q/q Q1 GDP reading is also envisaged (ie a notch below BoE thinking) and with downside risks (Figure 1). Admittedly some upside risks are apparently posed by some survey data but where the clear recovery already reported for January retail sales is likely to be offset by industrial action hitting health once more and by sharp fall in manufacturing (based around vehicles) and may be the impact of the record warm at the end of the month hitting utilities. Otherwise, RICS survey data may offer more positive signs for the housing market while the BoE-compiled household inflation expectations may suggest they remain anchored.

Eurozone

Data are not much of a focus this week, although speeches from ECB Chief Economist Lane (Wed) may help shape market thinking. EZ industrial production may data may show fresh weakness (Wed) despite improved energy output.

Rest of Western Europe

There are key events in Sweden, with the focus on the CPI figures (Thu) which have been volatile of late. We see the key CPIF measures slowing to back under 3% after the jump to 3.3% last time around, this projection chiming with Riksbank thinking. In Norway, CPI data (Mon) should see stable CPI-ATE reading, at 5.3%, this being a notch below Norges Bank projections.

Japan

We will have the Q4 2023 GDP for Japan early in the week. The preliminary numbers are weak and tilted Japan into a technical recession and with the current development, it is hard to see any revision to the upside. It maybe less impactful than usual as all eyes will be on wage negotiation results. PPI On Monday would be tier 2 data. Outside of the economics calendar, we are expecting major wage negotiation results on Wednesday and could spark reaction from the fx market.

Australia

Quiet week for the Aussie. Only consumer confidence and business conditions and confidence on Monday.

NZ

Business PMI on Thursday.