USD, JPY, EUR flows: JPY gains as risk weakens

Weaker equities and lower yields on tariff concerns supporting JPY gains

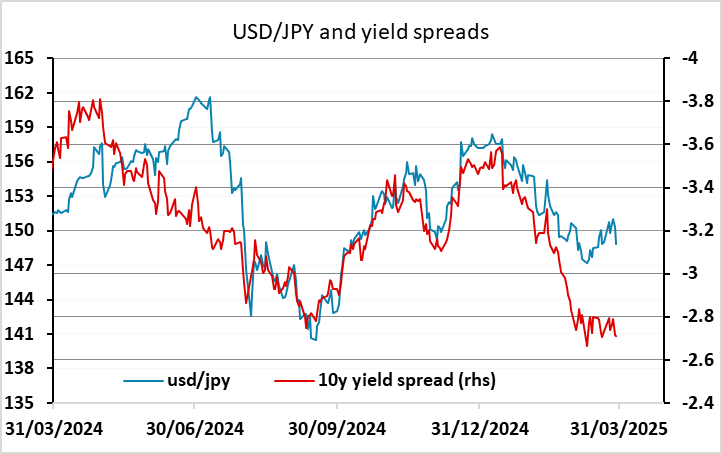

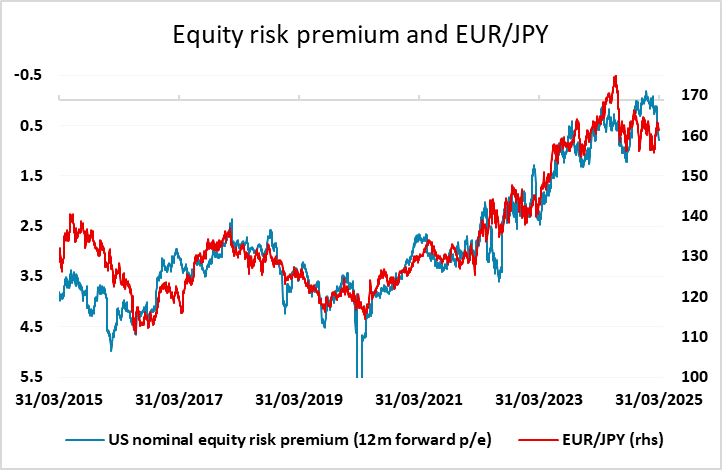

A risk negative tone to markets overnight with concerns about reciprocal tariff announcements later this week, with Trump maintaining his pro-tariff stance over the weekend. FX-wise this has translated mainly into JPY strength, with USD/JPY extending the decline that started on Friday. Yields are lower everywhere, and the 10 year US/Japan spread hasn’t moved much, but USD/JPY was already some ay above the level suggested by the spread, so still has plenty of downside scope if risk sentiment stays weak. EUR/JPY continues to be guided by movements in equity risk premia, and the overnight rise in risk premia suggests scope for some further decline to 160.

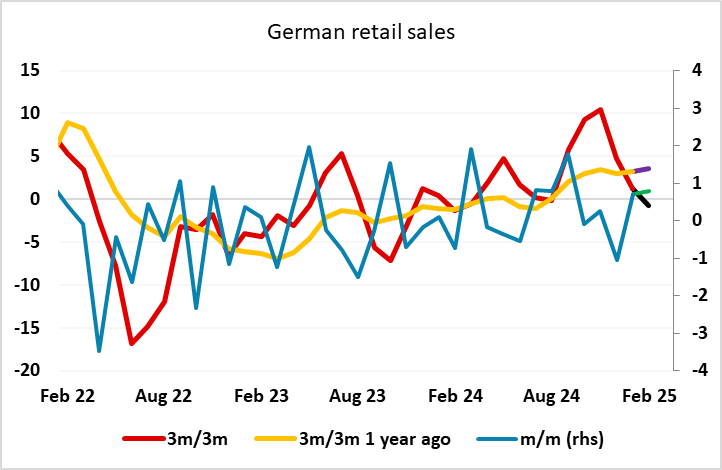

This morning’s German retail sales data was slightly above expectations, but the numbers are volatile and today’s data don’t really change the impression of a mild recovery in the trend, although the last 3 months have been close to flat due to a dip in December. There will be more focus on the German state CPI data due (mostly) for release at 09:00 BST. The French and Spanish preliminary CPI data was on the soft side, and the comments from the ECB’s Piero Cipollone on Friday suggested a dovish stance, as do Lagarde’s comments on tariffs this morning. Then market is already close to fully pricing in a 25bp ECB cut in April, but there may still be scope to increase expectations of cuts over the year, with only 2 ½ more cuts priced in.