FX Daily Strategy: APAC, May 1st

US ISM the main focus on Mayday

USD risks on the downside if forward looking indicators point lower

JPY has the most potential for gains

Post-election CAD strength unlikely to persist

US ISM the main focus on Mayday

USD risks on the downside if forward looking indicators point lower

JPY has the most potential for gains

Post-election CAD strength unlikely to persist

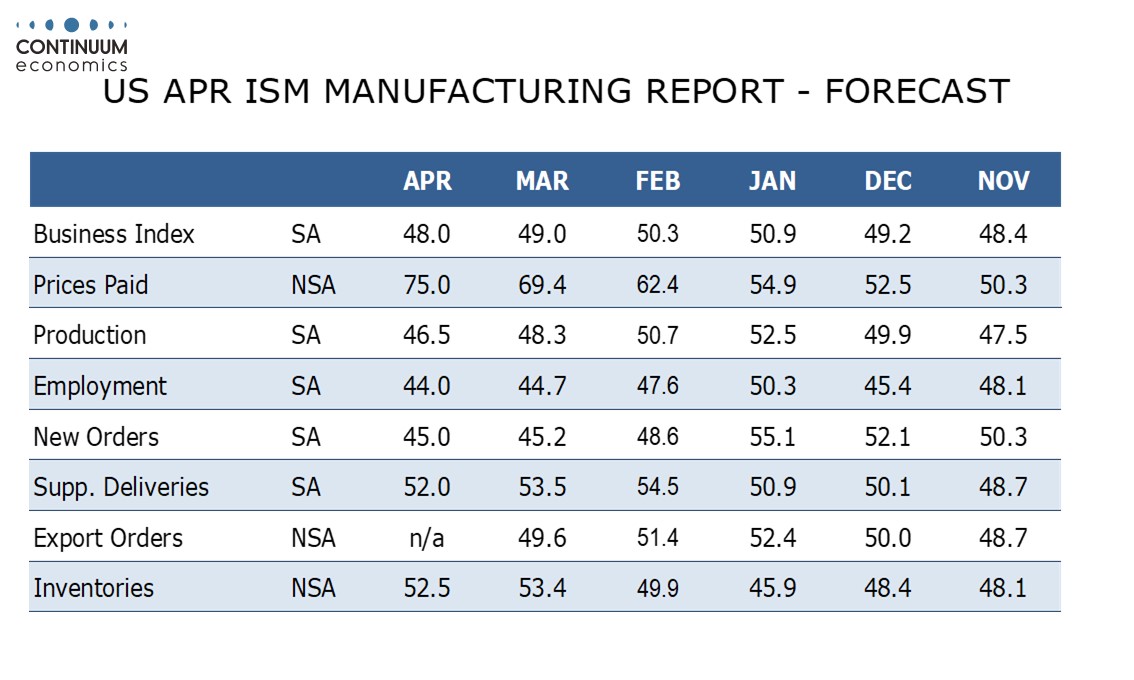

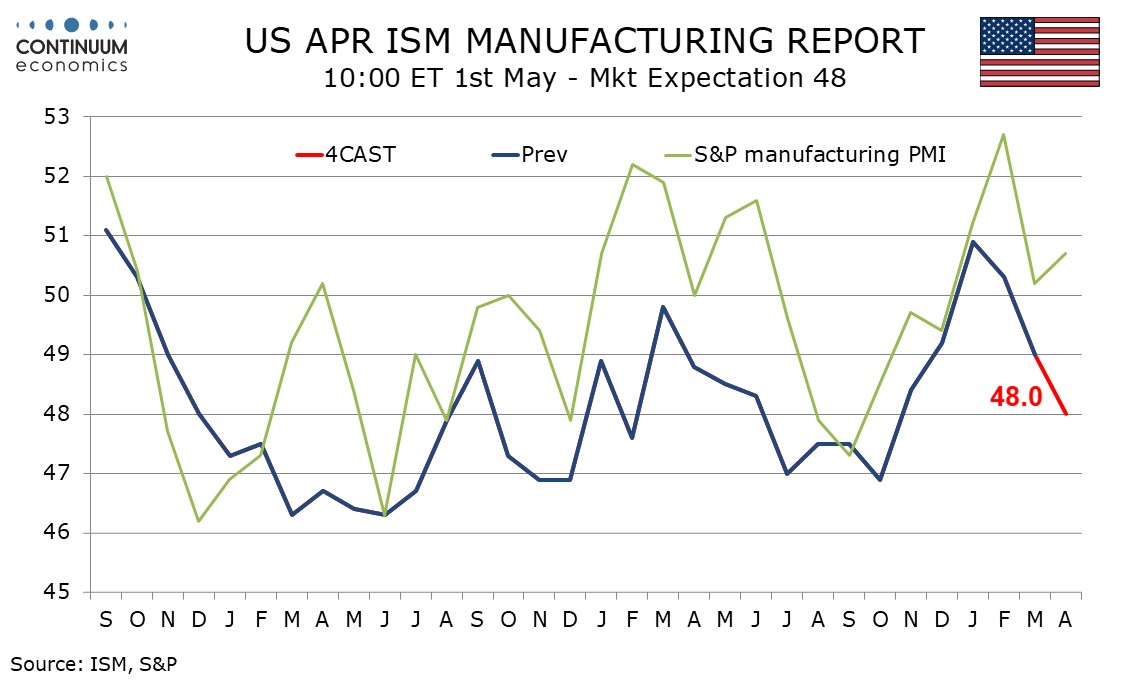

Much of Europe is on holiday on Thursday for Mayday, so the focus will be even more on the US than usual. The ISM manufacturing survey is the main data. We expect an April ISM manufacturing index of 48.0, which would be the weakest since October. While the S and P manufacturing index saw an unexpected rise in April, most regional manufacturing surveys have been weak, the Philly Fed particularly so. We expect declines in all five of the components that make up the composite, though only modest slippage in the two components that fell the most in March, new orders and employment. That new orders in March at 45.2 were their weakest since May 2023 is a negative signal.

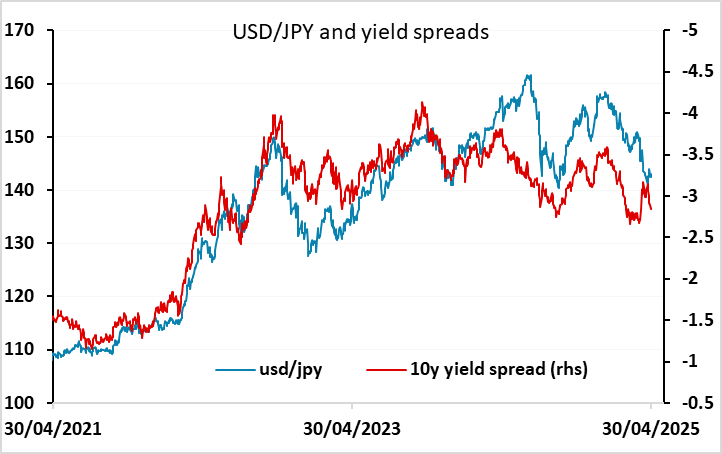

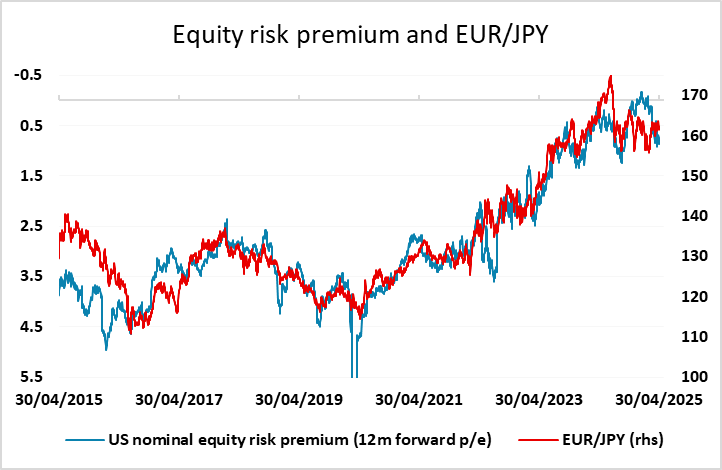

For the USD, the survey data may be more important than the contemporaneous official data, as the surveys contain more forward looking information. Orders will therefore be a major focus for the ISM as well as the main index. Another decline might dampen the recent firmer USD tone. The stronger USD on Wednesday in any case doesn’t sit well with the weaker equity market performance following the Q1 GDP data, particularly against the JPY. While the pressure on the US bond market seems to have eased for the moment, this also means that yield spreads are once again starting to point towards a lower USD/JPY, while EUR/JPY should also start to be dragged lower as equity risk premia rise.

Before the US data we have the BoJ monetary policy meeting, although this seems unlikely to produce any change in policy or any strong indication of future policy given the current uncertainties over the impact of US tariffs and the lack of any trade deal. Even so, we would expect Ueda to confirm the broad intention of further tightening as long as the Japanese economy continues to grow and wage growth and inflation continue to move higher. This should on balance be mildly JPY positive, although we are still likely to need to see further significant equity weakness if the JPY is to make significant gains.

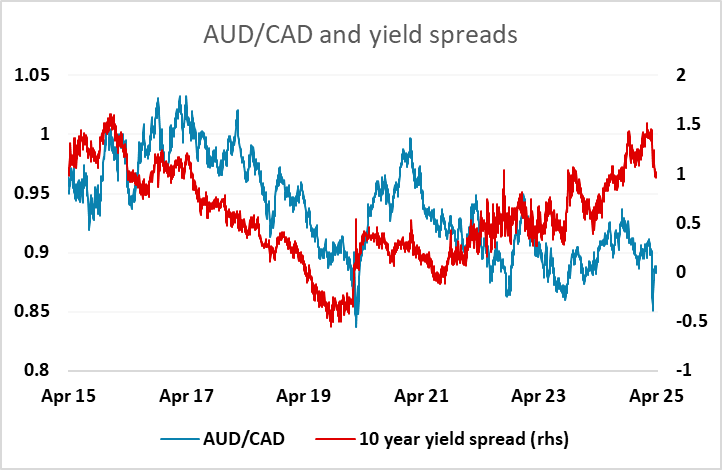

The CAD has performed well since the Canadian election, gaining ground not only against the USD but also on most crosses. But with the Canadian GDP data on Wednesday coming in somewhat weaker than expected, and further weakness likely to com due to tariff effects, we see little upside from here. CAD/JPY still looks the most vulnerable cross, but if risk appetite holds up AUD/CAD should also perform well.