FX Daily Strategy: Asia, May 13th

US CPI the main focus, but implications less clear

Weaker data might be seen as USD positive

GBP may slip lower on softer labour market data

JPY weakness reaching extremes

US CPI the main focus, but implications less clear

Weaker data might be seen as USD positive

GBP may slip lower on softer labour market data

JPY weakness reaching extremes

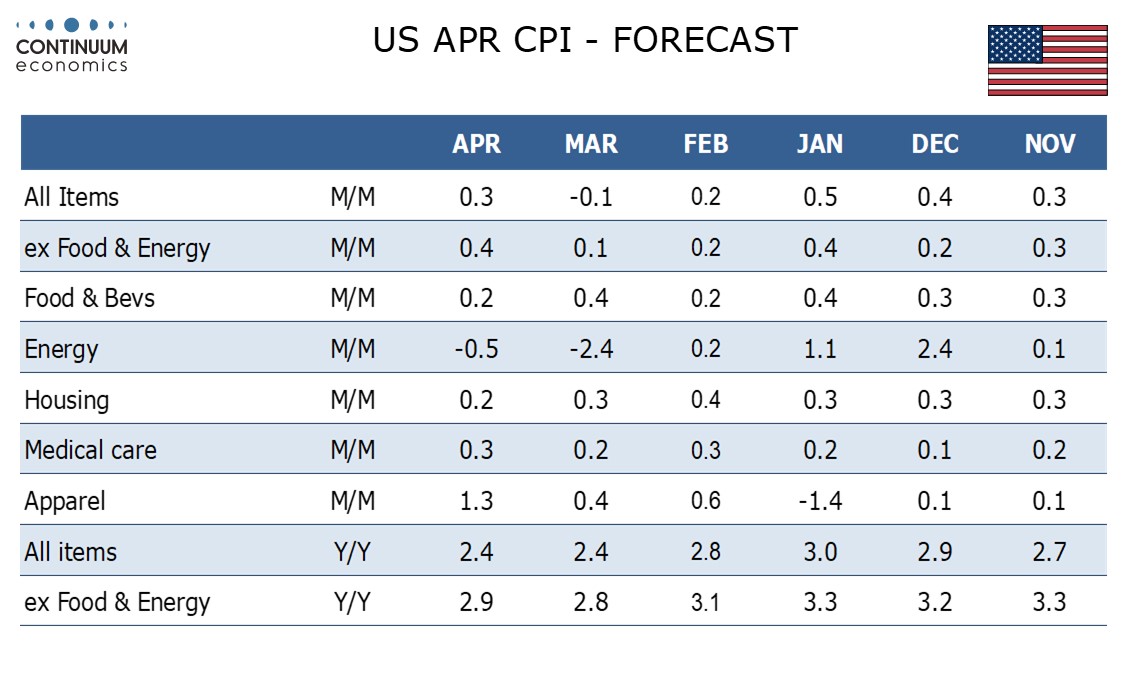

Tuesday sees the main data of the week in the shape of US CPI. We expect April CPI to increase by 0.3% overall and by 0.4% ex food and energy, the core rate reflecting a rebound from a below trend March as well as some impact from tariffs, though the extent of the tariff impact is highly uncertain. We see the core rate at 0.38% before rounding. Our forecast is slightly above the market consensus of 0.3% for the core, but it’s unclear what the market reaction would be to a stronger number. The last few years have tended to see higher inflation numbers leading to a stronger USD due to expectations of tighter Fed policy. But the last few months have seen the USD less sensitive to Fed policy expectations if inflation is rising due to tariffs, both because of the negative growth implications of higher prices and because confidence in the USD has been hit by the uncertainty surrounding the impact of tariffs. The picture is all the more uncertain with the latest reduction in US/China tariffs, but even with this, there is likely to be a significantly positive impact of tariffs on prices in the next few months.

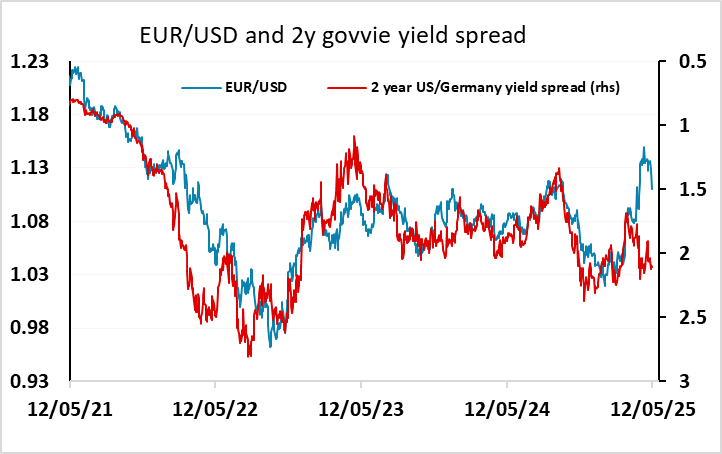

In practice, this probably all means that the CPI data is less important than it was in the past, with more of a focus on the growth numbers going forward. On balance, the fact that EUR/USD remains a lot higher than suggested by the yield spread correlation of the last few years suggests to us that weaker CPI may be better for the USD, as it will support the view that the tariff concerns are overblown. Of course, the main impact of tariffs on CPI are unlikely to be seen until the May and June data, so this month’s numbers only seem likely to have an impact if they are on the strong side, and in that case they will likely be negative for the USD.

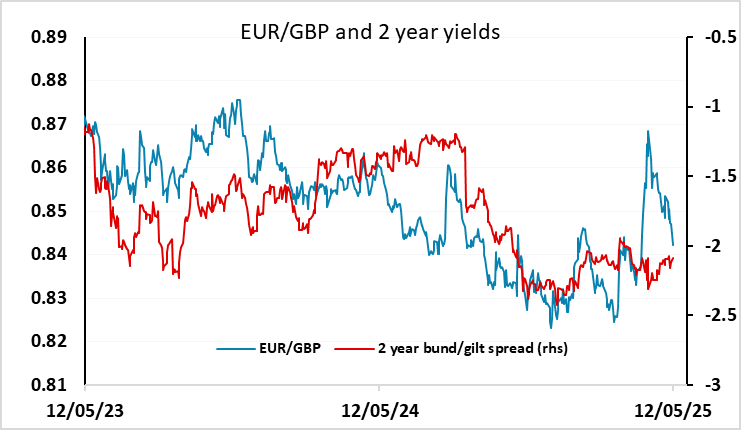

Before the US data we have UK labour market data, which remains an important focus of the Bank of England MPC, even though they see the data as somewhat unreliable. The data is expected to show signs of weakness with a significant decline in the y/y rate of earnings growth and a rise in the unemployment rate, although as usual the more up to date HMRC data ought to attract as much if not more attention than the official ONS data. While last week’s BoE MPC decision saw a three way split, we continue to expect the doves to come out on top and there is some scope for UK rate expectations to fall even if the data is in line with consensus. EUR/GBP has already fallen substantially in the last week and is now broadly back in line with the typical yield spread relationship, so we would see some risk of weaker earnings data leading to a EUR/GBP recovery.

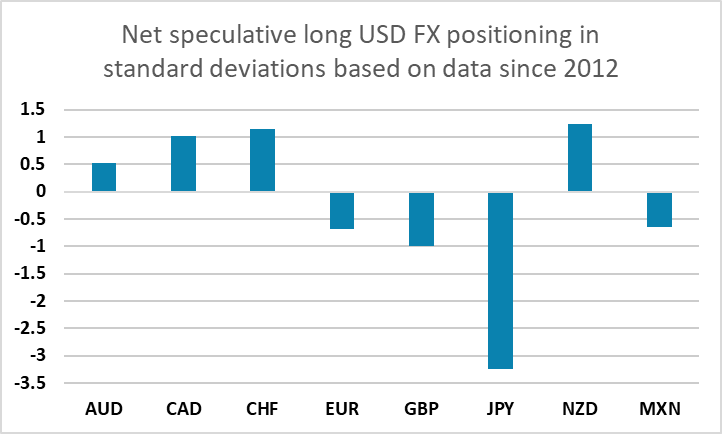

The main FX move in the last week has been the weakening of the JPY, which has not only fallen to its lowest since April 2 against the USD but has also made new highs for the year against the EUR. This relates almost entirely to the strength of the equity market, with EUR/JPY and other JPY crosses still tending to benefit from any decline in the implied US equity risk premium. But with the S&P 500 now having retraced more than 75% of the decline from the highs, and trading above the level seen when reciprocal tariffs were announced, there doesn’t loom to be much more upside for equities near term, and the risks may be shifting to the JPY’s upside, even though the CFTC data still showed a very large long JPY position as of a week ago.