FX Daily Strategy: N America, Oct 16

The Australian Employment Report Worsens

JPY Continue to be Affected by Political Tilt

GBP little changed after GDP comes in as expected

The Australian employment data was released in the Asia session. The Australian labor market has chopped to the downside in recent months. However, the overall labor market remains healthy and should continue to see healthy unemployment and participation rate while headline employment changes fluctuate. The Australian September unemployment rate has worsened to 4.5% from 4.2%, helped by an uptick in participation rate to 67% from 66.8%. Market participants seem to have tilted towards an imminent cut but they could be caught wrong footed as RBA has previewed a higher Q3 CPI, ruling out a November cut. Yet, the latest move in the Aussie seems to be not only correlated with RBA rate anticipation, but also the changes in global risk sentiment. Comments regarding the U.S.-China trade front are going to have a huge impact towards the Aussie.

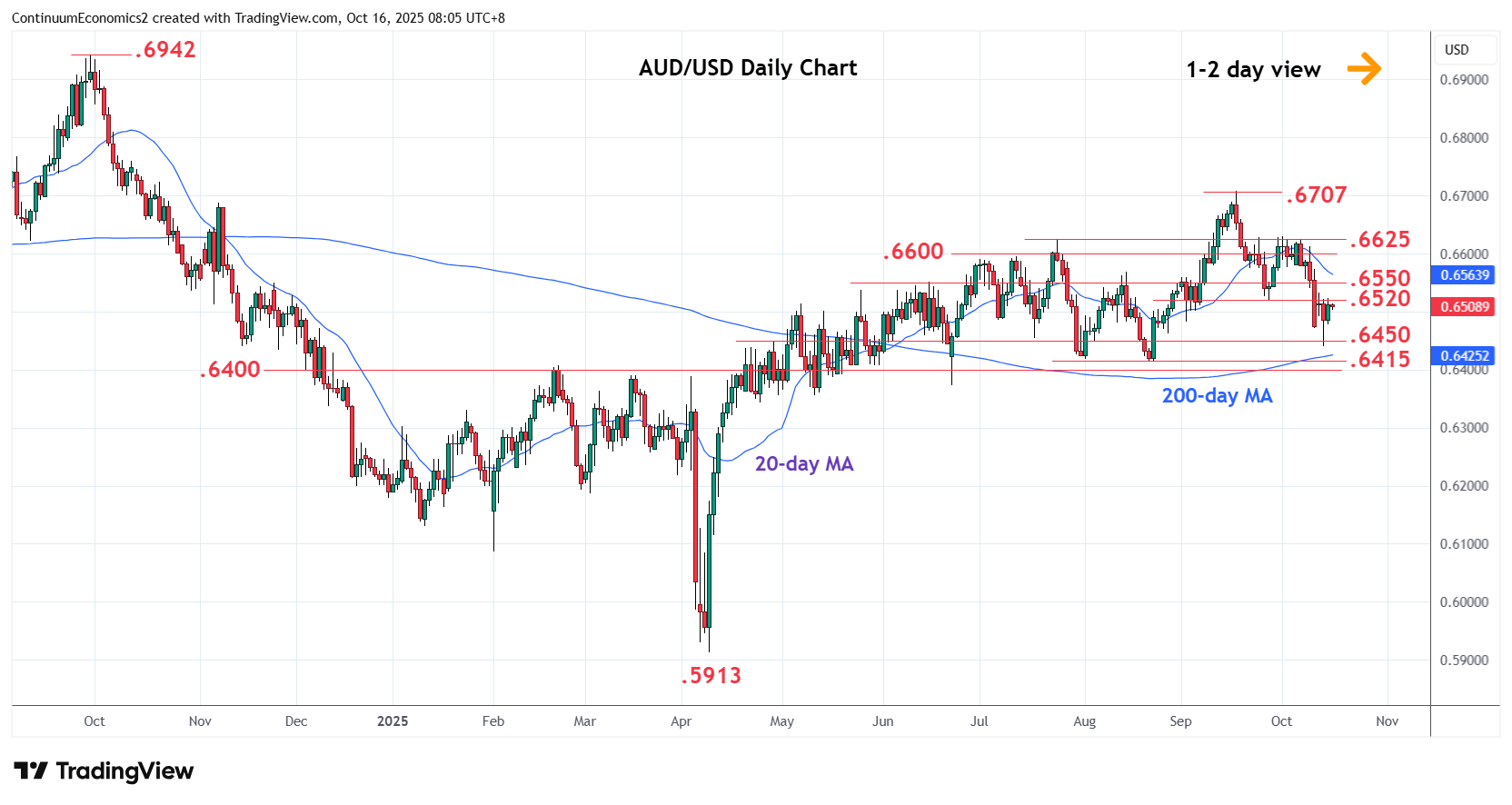

On the chart, the break of the .6470 low of last week has seen losses reach .6440. A bounce from here saw prices unwinding oversold intraday studies but consolidation here is expected to give way to fresh selling pressure later. Below the .6440 low will see room for deeper pullback to retrace the April/September rally and see extension to strong support at the .6415/00, August low and 38.2% Fibonacci level. Meanwhile, resistance is lowered to .6500/20 area. Above here will open up room for stronger bounce to .6550 congestion.

Political uncertainty regarding the Japan governance persists, Komeito seems to have broken their coalition with LDP. More importantly, the opposition seems to be in discussion of narrowing policy difference. If successfully, they may join hands and become the majority and push their own candidate for PM. LDP may lose their leadership after decades of control. While it is still a distant possibility, the speculation is enough to turn sentiment on monetary policy.

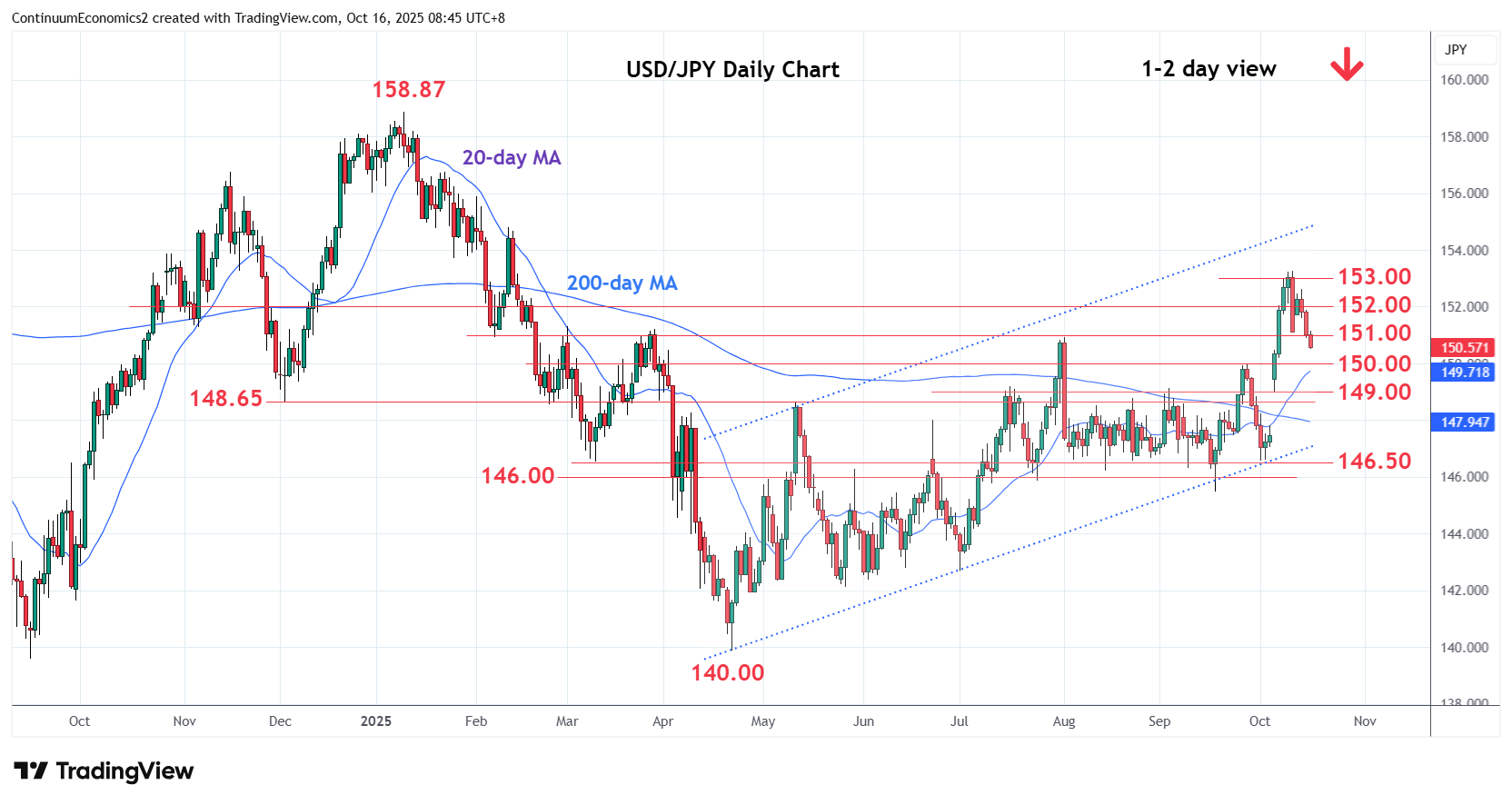

On the chart, the pair is leaning lower in consolidation and below the 152.00 level see room for retest of the 151.10, Friday's low. Overbought daily studies suggest scope for break here to open up room to the 151.00 congestion then 150.92, August high. Break here will see room for deeper pullback to strong support at 150.00 level and september high. Meanwhile, resistance is lowered to the 152.00/152.50 congestion area now expected to cap and sustain pullback from the 153.27 high. Clearance, but not expected, will further extend April gains.

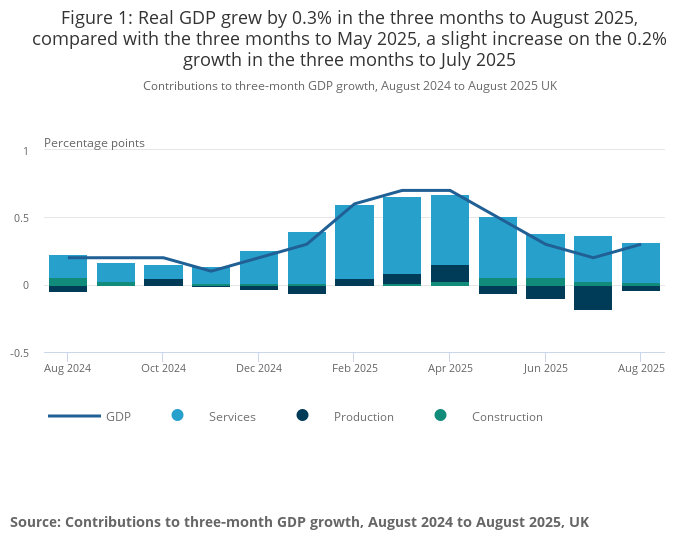

EUR/GBP is very slightly firmer after this morning’s August GDP data came in in line with consensus at 0.1% m/m. The 3m/3m trend remains fairly solid at 0.3%, and a flat number in September would see Q3 growth at 0.2% q/q. This is still stronger than the Eurozone performance, and is unlikely to convince the BoE that there is any urgent need for rate cuts, with inflation still well above target. EUR/GBP has edged a little higher, but is struggling to move far away from the 0.87 level. The year’s high above 0.8760 remains out of reach for now.