FX Daily Strategy: Europe, February 11th

Quietish Tuesday calendar – focus on Powell

USD risks slightly on the downside but little action seen ahead of CPI

NOK can build on Monday’s gains

CAD still vulnerable after tariff announcement

Quietish Tuesday calendar – focus on Powell

USD risks slightly on the downside but little action seen ahead of CPI

NOK can build on Monday’s gains

CAD still vulnerable after tariff announcement

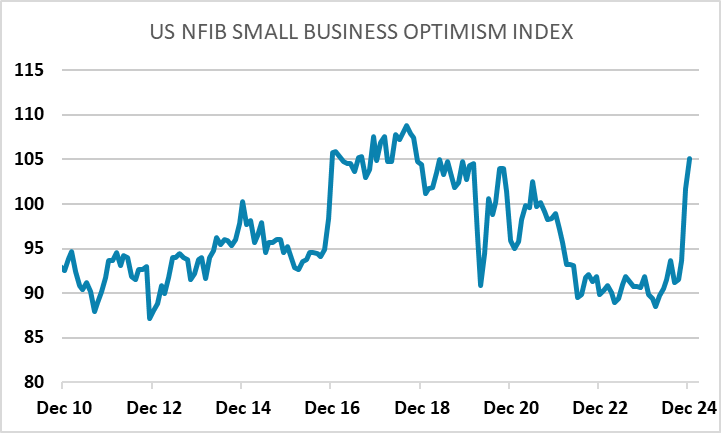

Tuesday sees another quiet calendar, with no data of real note out of the US or Europe. The US NFIB survey is of minor interest, as the surge since the election mirrors a similar surge after the last Trump victory, and seems unlikely to provide any real information about the economy. However, there is testimony from Fed chair Powell, and this is likely to be the main market focus. But we doubt there will be any real adjustment to the comments he made after the January Fed meeting. While the Fed statement appeared to make a mild hawkish adjustment, Powell played this down, and suggested the door was open to easing if there was more progress on inflation or evidence of weakening in the labour market. Powell’s comments, and the recent employment data suggest a decline in inflation is the more likely trigger. The lack of anything clear cut on fiscal policy from Trump also means the Fed can’t make any new assumptions on that front. His comments are therefore likely to increase the focus on Wednesday’s CPI data, but we wouldn’t expect much immediate market reaction. If anything, the market concern is that the Fed turn more hawkish, so to that extent the risks from a fairly neutral sounding Powell are towards a weaker USD.

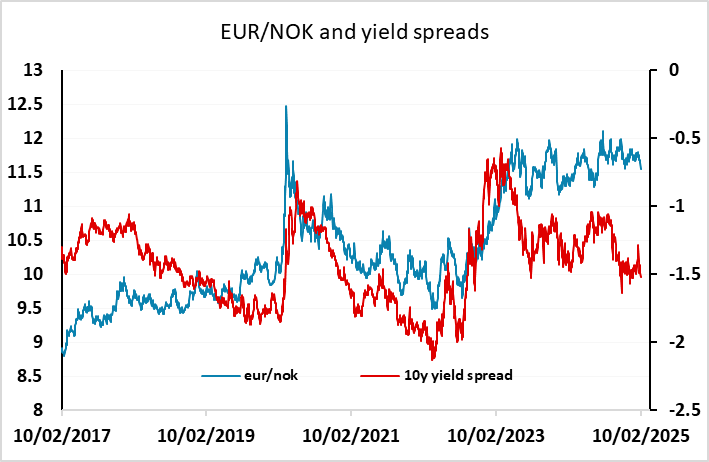

In Europe there is little of note. Norwegian Q1 GDP is released and should show a modest rise in Mainland GDP. Following Monday’s release of slightly stronger than expected January CPI, the NOK made some small gains against the EUR, but continues to look extremely cheap against both the EUR and SEK. The current rise in European gas prices can only be favourable, so we continue to see upside risks for the NOK from the still very low levels relative to history and relative to the very attractive yield spreads.

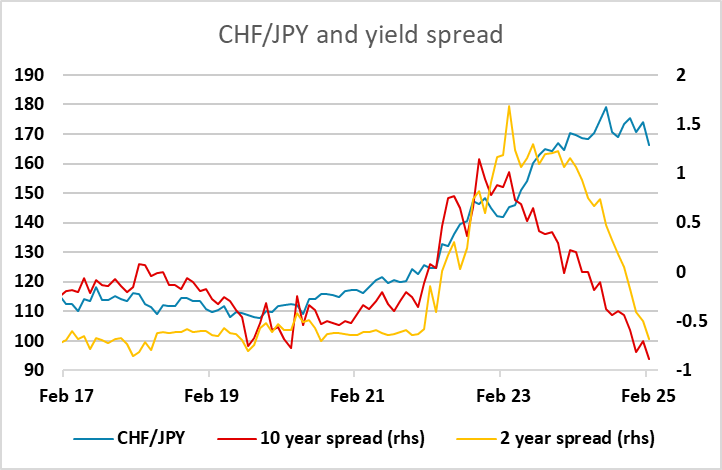

The JPY continues to be the most solid performer, and yield spreads still suggests a dip to 150 in USD/JPY is possible in the short run. However, the correlation with yield spreads seen over the last 6 months suggests that could be the limit for JPY gains for now, although longer term correlations indicate scope for much larger JPY gains. Major gains against the riskier currencies only tend to come when we see some weakening in risk sentiment, and at the moment equities continue to perform relatively well. JPY bulls looking to benefit from the improvement in yield spreads in the JPY’s favour and the big decline in value in recent years might want to focus on CHF/JPY, where the scale of JPY weakness is most obvious.

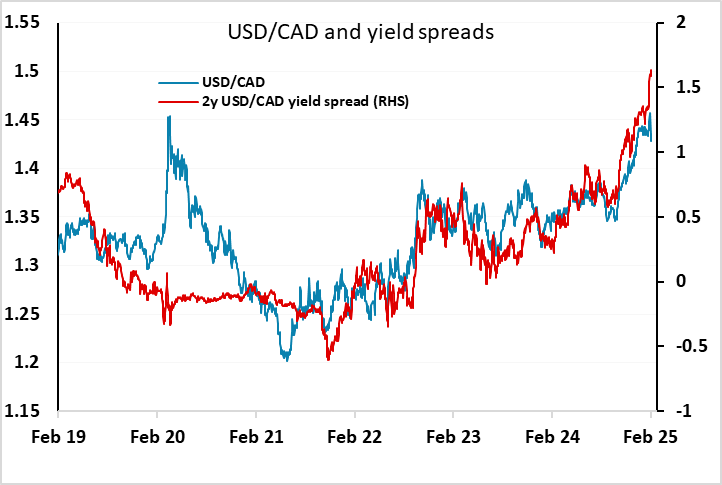

The major FX market was generally not much affected by the Trump announcement of tariffs on steel and aluminium at the weekend, perhaps showing some scepticism that these measures will be implemented. But we see less reason to assume Trump backs away from this announcement, and this should be seen as negative for the CAD, which is the biggest exporter of steel to the US. USD/CAD in any case still looks low relative to the recent yield spread correlation, and the threat of other tariffs also hasn’t completely disappeared.