USD, JPY, EUR flows: USD falls on weak ADP employment data

USD softer across the board but JPY favoured going forward

US ADP employment data has shown a decline of 32k in September, well below market consensus, with the August number also revised to a 3k decline from an initial report of a 54k gain. The September decline is the largest since the pandemic, with three of the last four months now showing declines. Ordinarily, the ADP data would be taken with a large pinch of salt, as its correlation with the official reemployment data has been patchy over the years. But with the official data now not being released on Friday due to the government shutdown, it takes on greater significance, particularly since the recent correlation with the official data has improved.

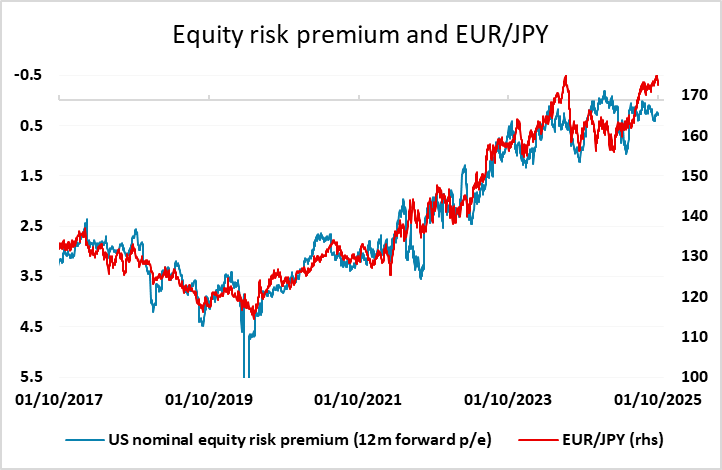

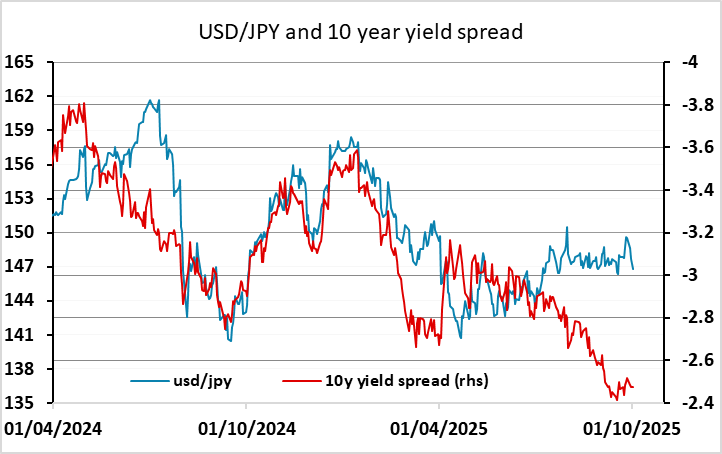

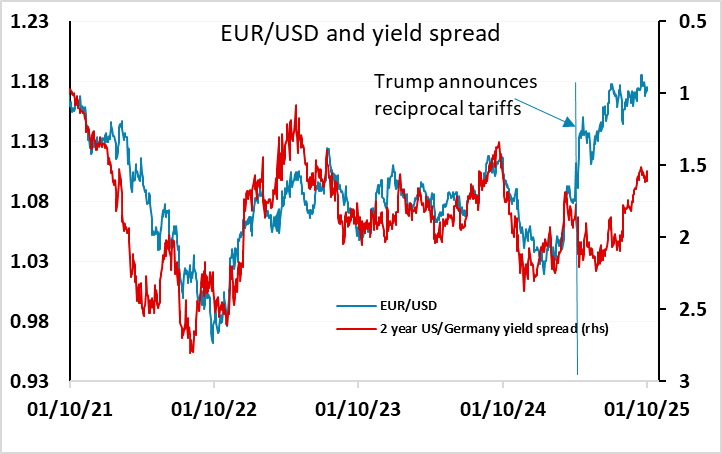

The USD has fallen across the board in reaction to the data, with US yields down around 5bps across the curve. The yield decline has prevented a negative equity market reaction, but ought to mean that the JPY is the best performer going forward, as the yield decline implies a further rise in the equity risk premium, which was already suggesting scope for JPY gains on the crosses. Upside for EUR/USD looks more limited with the EUR having outperformed yield spreads earlier this year, but the USD is likely to edge lower even against the riskier currencies as long as equity markets hold up.