NOK, SEK, CAD, JPY flows: Potential for corrections

FX moves driven by the tariff driven risk sell off can correct in less volatile markets

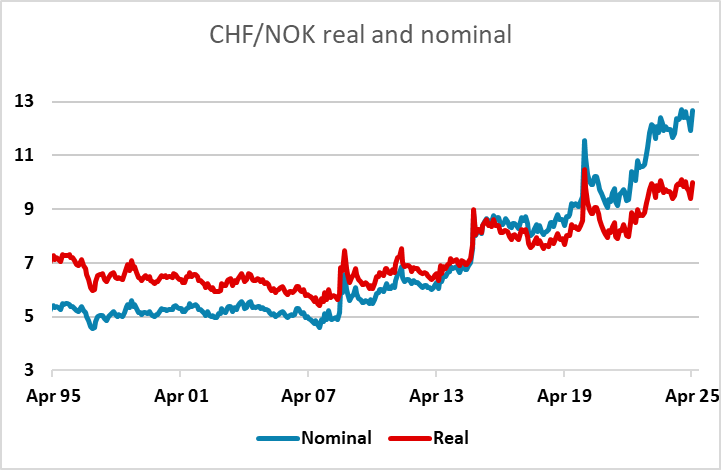

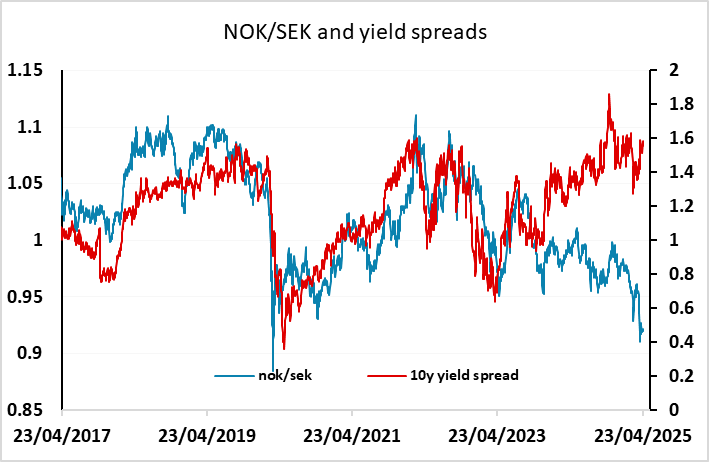

Thursday looks set to be relatively quiet, with just the German IFO survey and US durable goods orders and jobless claims on the data front, and little evidence of any real movement in the tariff wars, with trade deals still looking some way off. Equities continue to settle in the centre of the recent wide range, with the S&P 500 trading 4800-5800. These calmer markets may allow some of the excesses generated in the initial tariff sell off to be corrected. The most glaring to us is the weakness of the NOK, particularly against the SEK and CHF. CHF/NOK made an all time high on April 11, and NOK/SEK hit its lowest since the all time low seen during the pandemic. The moves look to be risk and liquidity driven, and at these levels the NOK represents value against both the CHF and SEK, with NOK/SEK looking the least vulnerable to a renewed risk downturn.

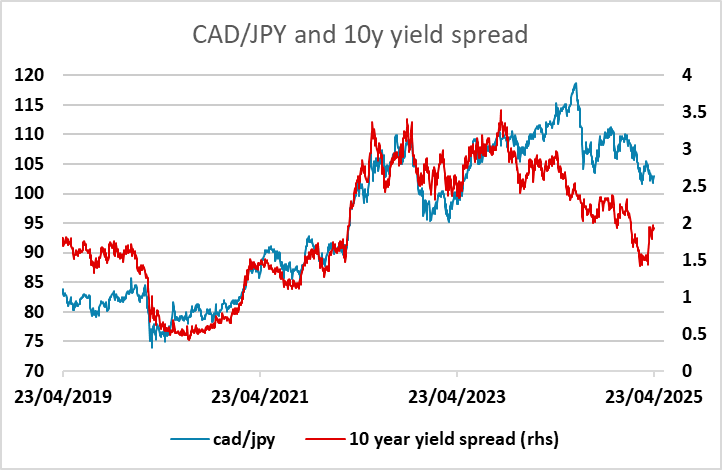

Otherwise, the CAD has continued to perform well, in spite of renewed threats of higher tariffs from Trump overnight. While USD/JPY has now moved to a level that is broadly consistent with nominal yields spread correlations, CAD/JPY is outperforming spreads, and has held up well despite its normal risk sensitivity. But it’s hard to see a case for a stronger CAD against the JPY almost whatever the outcome of the trade wars.