FX Daily Strategy: N America, February 22nd

PMIs support risk positive tone

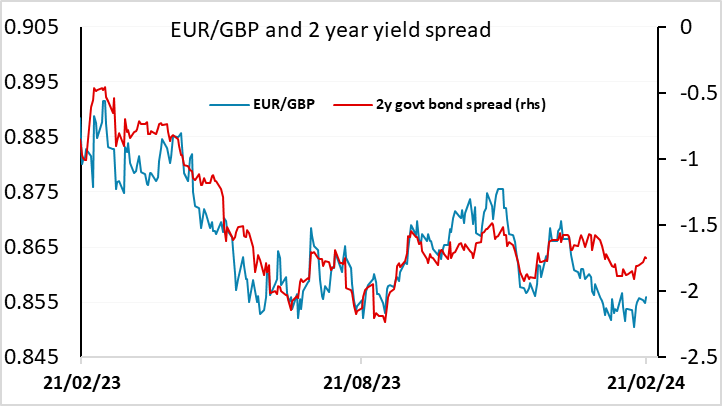

Spread between the UK and Eurozone looks unliekly to persist

EUR/JPY remains supported while global yields rise

PMIs support risk positive tone

Spread between the UK and Eurozone looks unliekly to persist

EUR/JPY remains supported while global yields rise

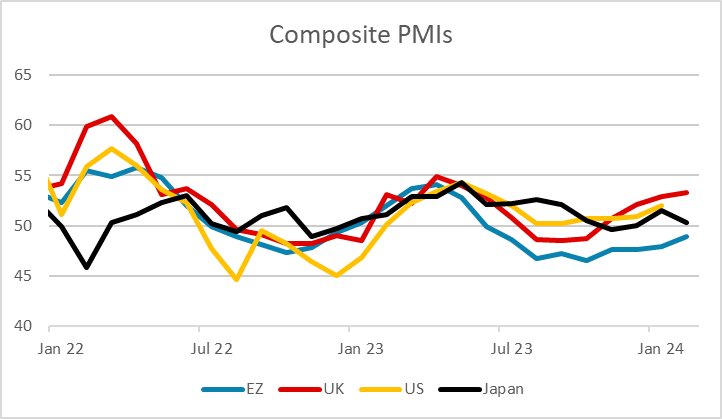

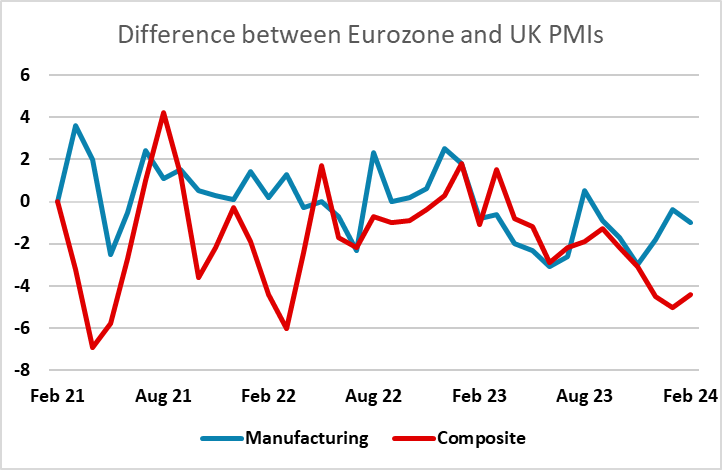

UK and Eurozone composite PMIs both higher in February, with the Eurozone rising more but the UK at a higher level. There is some doubt that the UK numbers give a good guide to growth, especially given the strength of the PMIs in Q4 when GDP fell 0.3%. But the Eurozone numbers tend to be a more consistent indicator. The gap between the two is high by historic standards, but doesn’t usually stay high for long, and it is hard to find a good reason for the current divergence. We would expect some convergence in coming months which should support EUR/GBP gains.

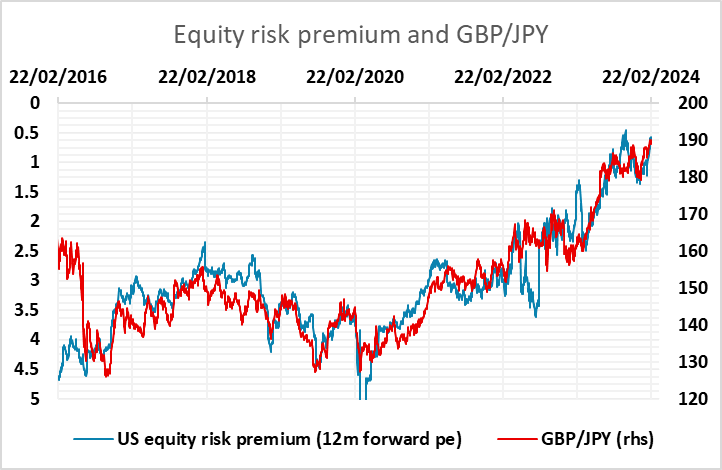

We would therefore be wary of treating the UK number too seriously. However, the rise in both numbers is supportive for the current risk positive market tone, and suggests the recent gains in EUR/JPY and GBP/JPY will hold for now, even though we see the current levels as heavily overvalued from a longer term perspective.

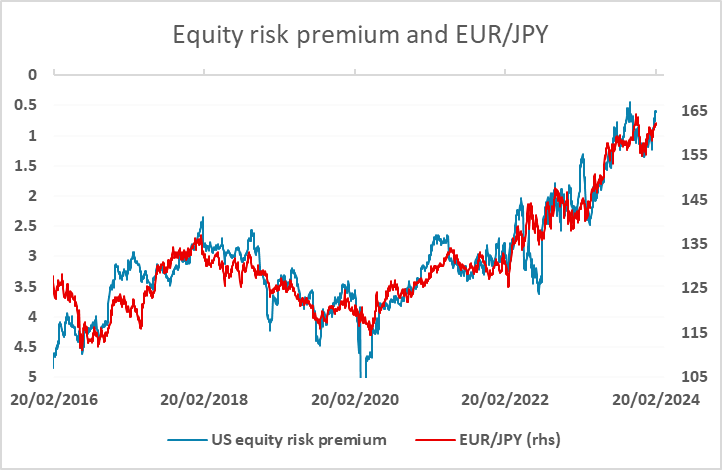

There is little else on the calendar that is likely to move markets, but Wednesday was another day that saw the JPY fall back on the crosses, with EUR/JPY hitting another post-November high, and AUD/JPY, GBP/JPY and CAD/JPY all hitting multi-year highs overnight. Strong global equity market performance looks to have been behind this as much as anything, combined with the low vol conditions that have generally favoured the high yielders. The uptrend in EUR/JPY continues to be supported by declining risk premia, and this trend is most likely to be halted by yields turning lower in the US and globally rather than equities falling back. In either case, weaker PMIs look to be needed to halt the EUR/JPY uptrend.

In the US there is likely to be more interest in the jobless claims numbers than the PMIs, with the US market still tending to be more focused on the ISM survey. Thursday’s weekly initial claims data will cover the survey week for February’s non-farm payroll, and after the strong January employment report, the market will be on watch for evidence of any slowdown. At this stage, a rising bias in US yields looks likely to persist in the absence of weaker data, which should be USD supportive albeit primarily against the lower yields.