GBP flows: GBP little changed after CPI

UK February CPI slightly softer than expected, but still strong services inflation makes it unliekly BoE hawks will turn dovish

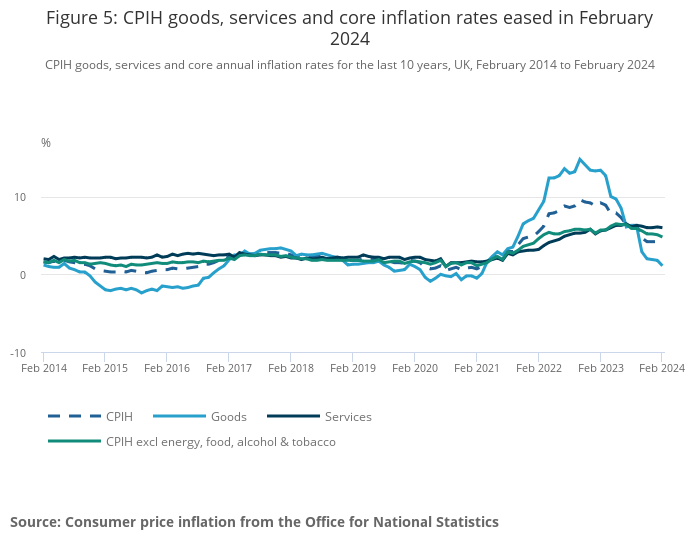

GBP is little changed after the UK CPI data. We saw an initial GBP spike lower with the CPI numbers slightly on the weak side of expectations, but this was short-lived and the pound has returned to pre-data levels. CPI was 0.1% below consensus both for headline and core, but the decline is not seen as sufficient to change the minds of the BoE hawks. The BoE anticipated CPI dropping sub-2% in the summer but expect it to rise again, so the focus is more on the core rates, and I particular services inflation which is seen as a better indicator of domestically generated price pressure. Services inflation did fall modestly on a y/y basis to 6.0% from 6.1%, but still rose 0.6% m/m and at these levels is clearly still a concern, so the BoE hawks are unlikely to see this data as a reason to turn dovish. EUR/GBP holding close to 0.8540 and likely to remain there ahead of tomorrow’s BoE MPC meeting.