FX Daily Strategy: N America, September 27th

JPY rallies as Ishiba wins LDP election

EUR soft on weak French and Spanish CPI

US PCE prices should be in line with consensus…

…but strong US data may start to favour the USD

JPY rallies as Ishiba wins LDP election

EUR soft on weak French and Spanish CPI

US PCE prices should be in line with consensus…

…but strong US data may start to favour the USD

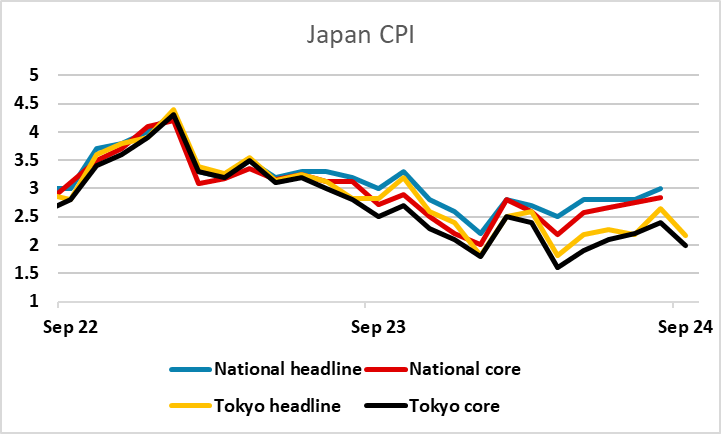

The JPY started weak on the back of the Tokyo September CPI data. The market consensus was for a drop in core CPI to 2.0% from 2.4%, breaking the recent uptrend. At the post-BoJ press conference governor Ueda focused on the October CPI data as important for policy rather than the September data, so the likely drop this month may not be too significant. The Tokyo area September Headline CPI came in at estimate of 2.2% y/y down from 2.6% in August. Ex fresh food also tread lower from 2.4% to 2% y/y while ex fresh food and energy remain at 1.6%. It seems to suggest the strength in CPI may not be as sustainable as the BoJ sees.

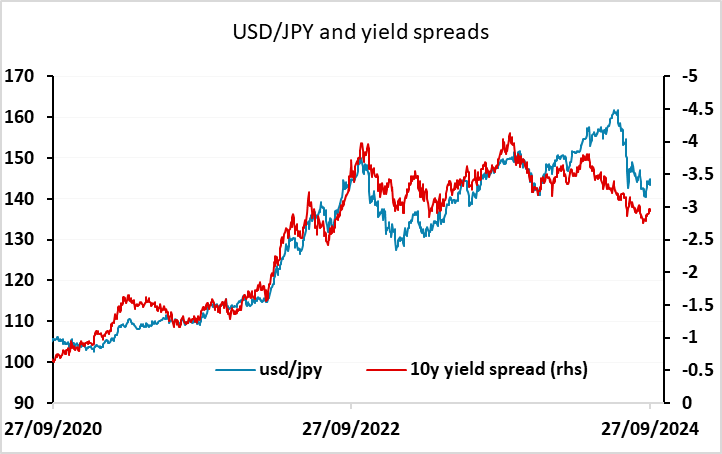

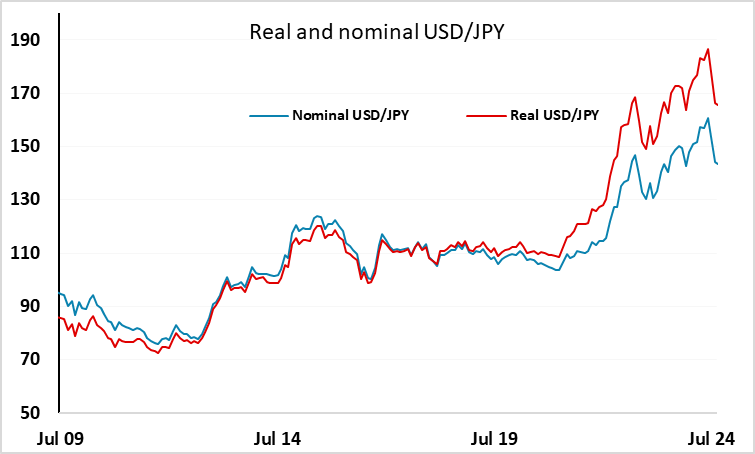

However, Europe kicked off with sharp JPY gains which appeared to be related to the LDP leadership election victory for Ishiba. USD/JPY fell from above 146 to below 144 in a couple of minutes. Markets were worried about the potential victory of hardline nationalist Sanae Takaichi, a vocal opponent of further interest rate hikes, but the win for Ishiba should allow the BoJ to follow its planned tightening cycle if data allows. The JPY was on its tenth consecutive day of decline against GBP and CHF, and the carry trade that had sent USD/JPY to 160 was clearly back in play. As was the case back in July, the JPY decline was progressing far beyond the levels suggested by the normal metrics, so the JPY was ripe for a recovery.

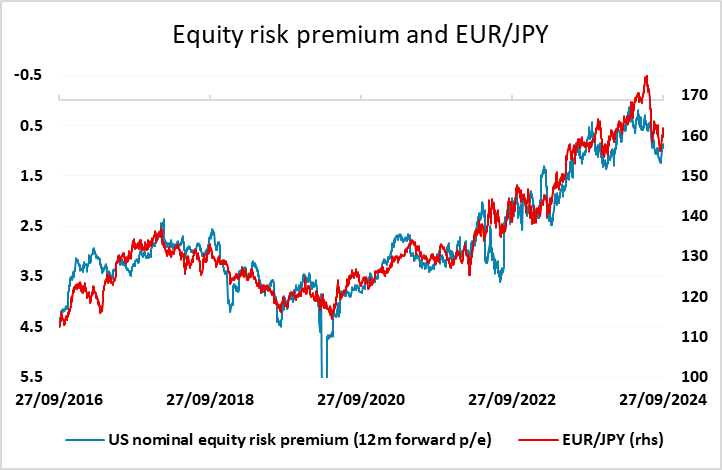

How persistent this move is will depend on how markets in general proceed from here. The BoJ has the option of raising rates as early as October, but is likely to be reluctant to do so after the latest inflation data showed a dip to 2.0% in core Tokyo CPI. They are looking for more evidence of higher wages feeding through to services prices before they are confident enough to enact further tightening. The movements in yield spreads and risk premia which are generally the drivers of USD/JPY are therefore likely to be determined by moves in US yields and equities. US 10 year yields have edged up since the Fed rate cut, but spreads are still at a level that suggests scope for USD/JPY to move back to 140. Equity strength has also been persistent since the Fed move, sending equity risk premia lower, but the EUR/JPY correlation with risk premia still suggests scope for a move sub-160. But if we see US yields rise further form here, and equities hold current levels, the case for further JPY gains will weaken.

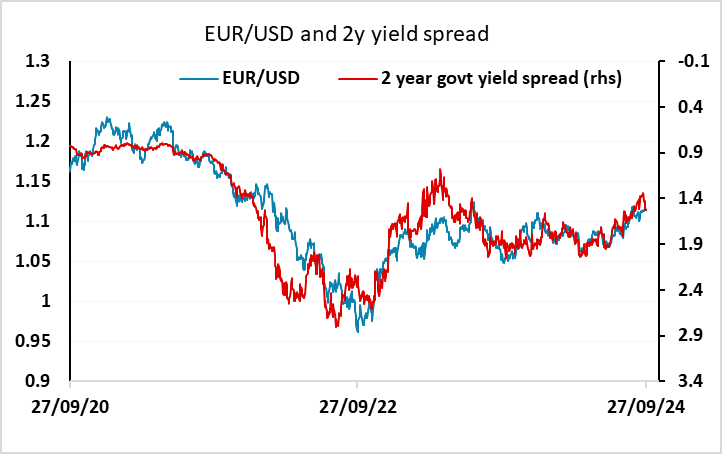

Following the Japanese data, we had preliminary French and Spanish inflation numbers for September. These were much weaker than expected in September at 1.5% and 1.7% respectively on an HICP basis, and strengthen the case for an ECB rate cut in October. This is now priced as a 92% chance from around a 72% chance yesterday. The decline in 2 year yields has been relatively modest, but has now been sufficient to mean there is no longer a yield spread argument for EUR/USD gains. But from here there is now not much more downside in front end EUR yields, so stability close to 1.11 looks like the most likely outcome until or unless we get US data that changes market perceptions of the path of Fed policy. Longer term, we still see some upside scope for EUR/USD since as time goes on front end US yields will fall more than EUR yields if the market is right about the rate cut profiles on both sides of the Atlantic, but it looks like being a slow process.

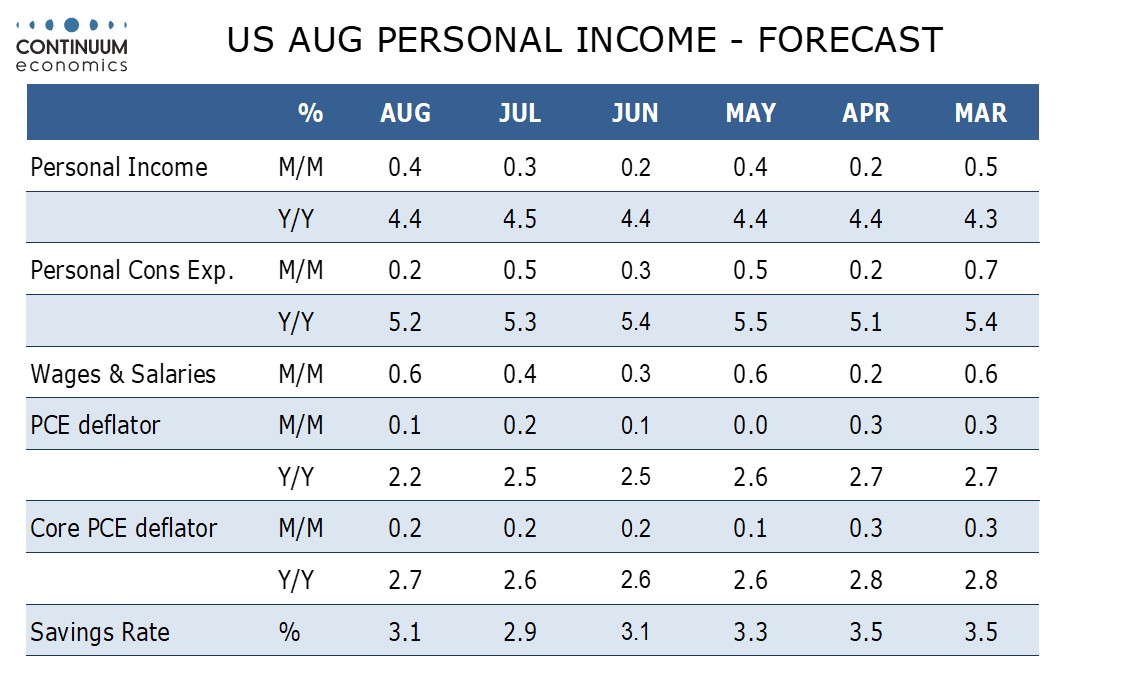

In the US, there is the core PCE price index for August – the Fed’s targeted measure and consequently important, although CPI does tend to provide a strong lead so there is unlikely to be a major surprise. We expect August core PCE prices to rise by 0.2%, a little softer than the 0.3% core CPI which rose by 0.28% before rounding. We also expect personal income with a 0.4% rise to unusually outpace a 0.2% increase in personal spending. Our forecast is in line with consensus, so shouldn’t have a significant impact.