EUR flows: EUR lower after German state CPIs

German state CPI look to be broadly in line with consensus, but market treating them as soft and EUR a little weaker. Weakness unlikely to persist

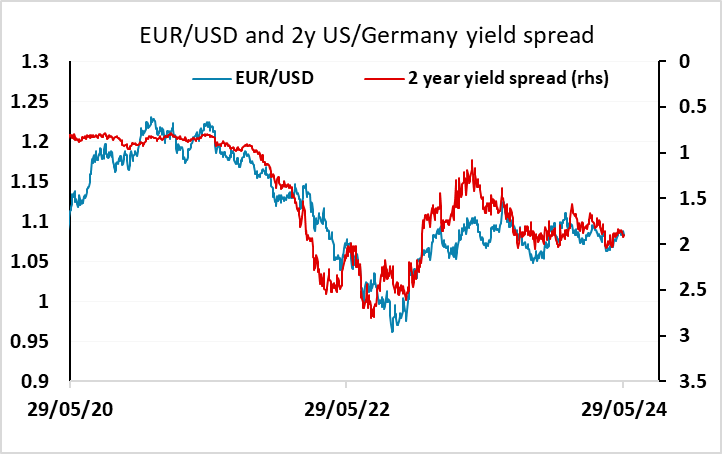

German state CPI data look to be broadly in line with expectations. The market consensus is for a rise in the y/y rate for the national CPI to 2.4% in May (2.7% HICP basis) from 2.2% in April (2.4% HICP basis). The average rise in the y/y rate for the state CPIs is around 0.2%, with North Rhine Westphalia and Bavaria, two of the largest states, both rising 0.2% to 2.5% and 2.7% respectively (from 2.3% and 2.5%). However, front end yields are a little lower, and EUR/USD has dropped around 20 pips, suggesting the market sees the data as being on the soft side of expectations. Slightly weaker than expected household loan data in the money and credit data, which showed a 0.2% m/m rise, may also have contributed, but we don’t see the decline in yields or the EUR as really being justified by the data. However, the market is only pricing in a little more than two rate cuts this year, and this looks to be overly conservative in our view, especially given the recent dovish comments from ECB council members Lane and Villeroy, so there is some downside scope for yields in the bigger picture. Even so, the stronger German confidence numbers earlier suggest better growth prospects are materialising, and this should be EUR supportive even if rate cut expectations rise. We therefore would still see support above 1.08 for EUR/USD.