German Data Review: Inflation Back at Target?

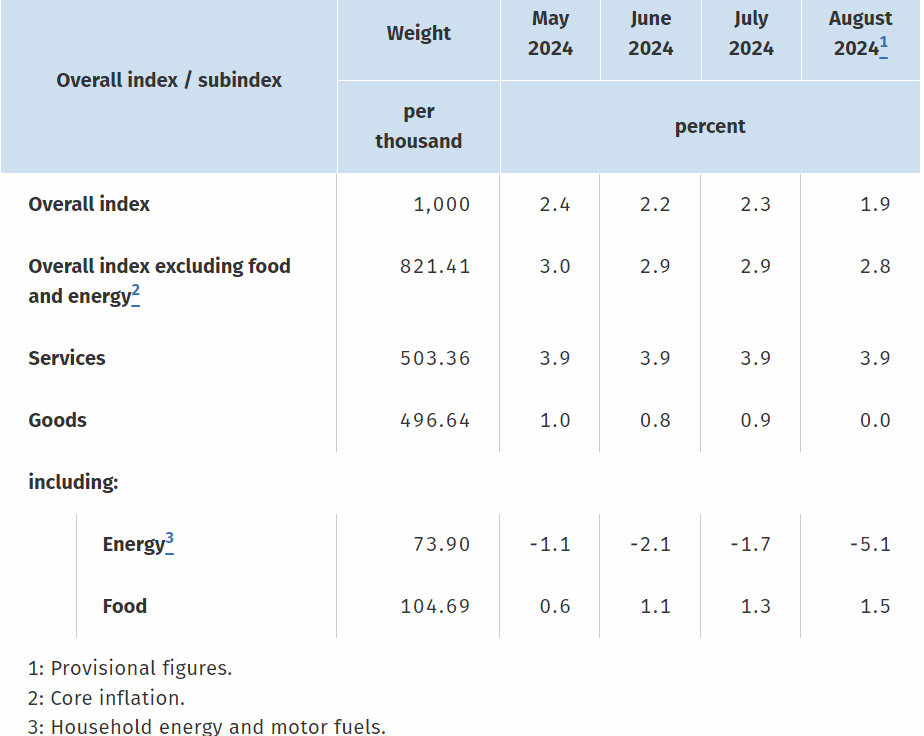

Germany’s disinflation process has not been smooth due to swings in base effects and this was again clearly the case in the August data. After July saw the headline HICP rate rise an unexpected 0.1 ppt to 2.6%, unwinding a third of fall seen in June, it plummeted this month to a 41-month low of 2.0%, ie consistent with the ECB target and well below expectations. Indeed, the CPI counterpart actually fell a notch below 2%, albeit with the core rate on this basis down just 0.1 ppt. Details show stable services and with more negative energy and slightly higher food inflation causing the higher headline outcome.

This German data mirrors weaker than expected Spanish figures today and hints that the EZ HICP flash due tomorrow could also hit the 2% target, a full year earlier than ECB projections suggest. Perhaps the last mile for inflation is not the hardest, after all, for middle distance runners the last mile is often the quickest!

Figure 1: Inflation at Target?

Source: German Federal Stats Office,

Regardless, looking ahead, the disinflation trend is seen continuing in the next 2-3 months, mainly due to slower core goods and energy prices. Even so, while headline inflation is now at 2% it may perk back towards 2.5% by end-year due to energy base effects. The ECB will have to take note although the hawks on the Council will point to still apparently resilient services inflation, but where the doves may counter by pointing to recent much softer wage inflation news.