U.S. May Durable Goods Orders and Weekly Initial Claims stronger, Q1 GDP and May Trade Balance weaker

The latest data is mixed, with a downward revision to Q1 GDP to -0.5% from -0.2% led by consumer spending, and a higher advance goods trade deficit for May of $96.6bn from $87.0bn is negative for Q2. However initial claims at 236k from 246k are lower than expected while May durable goods orders surged by 16.4%, mostly on aircraft, but ex transport with a 0.5% rise is also stronger than expected.

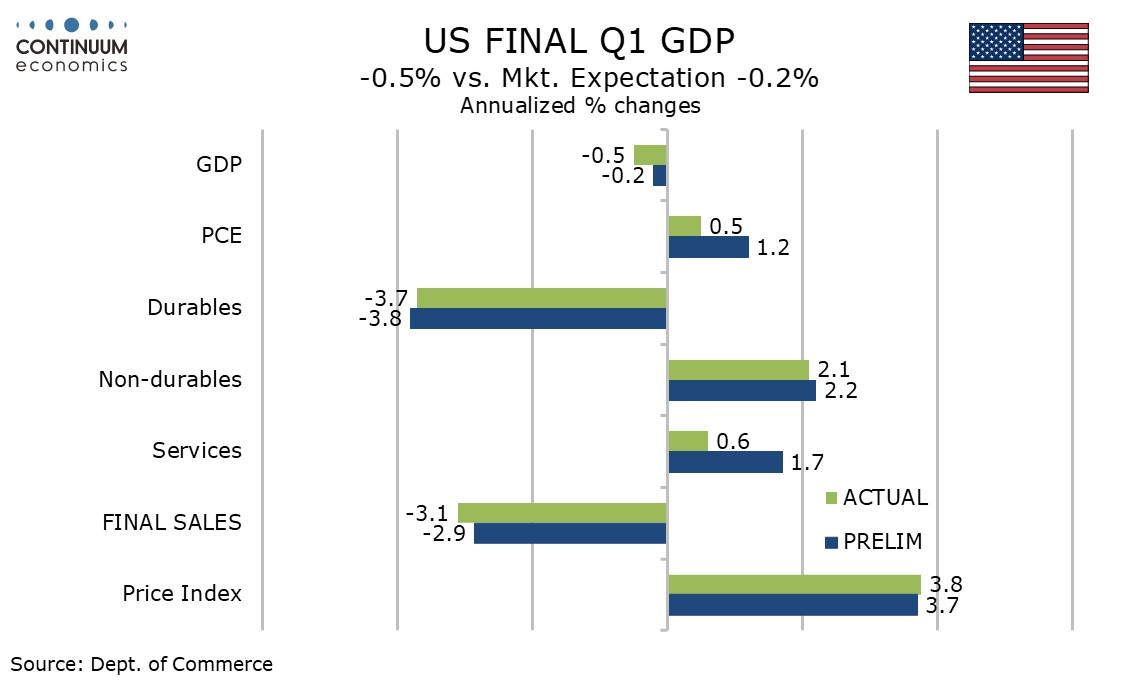

The GDP revision was led by consumer spending, now up only 0.5% annualized rather than 1.2%, with the revision fully due to services, now seen at 0.6% rather than 1.7%, with goods unrevised at 0.1%. Disposable personal income was also revised down, to a still healthy 2.5% from 2.9%, but Gross Domestic Income was revised up to a 0.2% rise from -0.2%, now outperforming GDP.

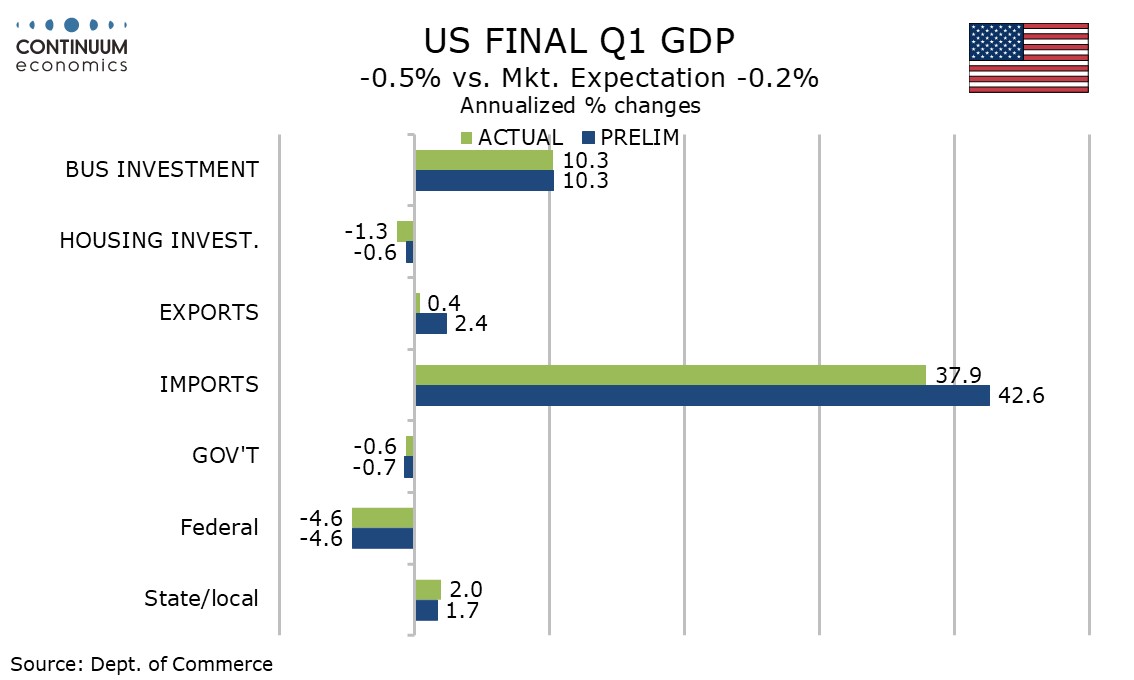

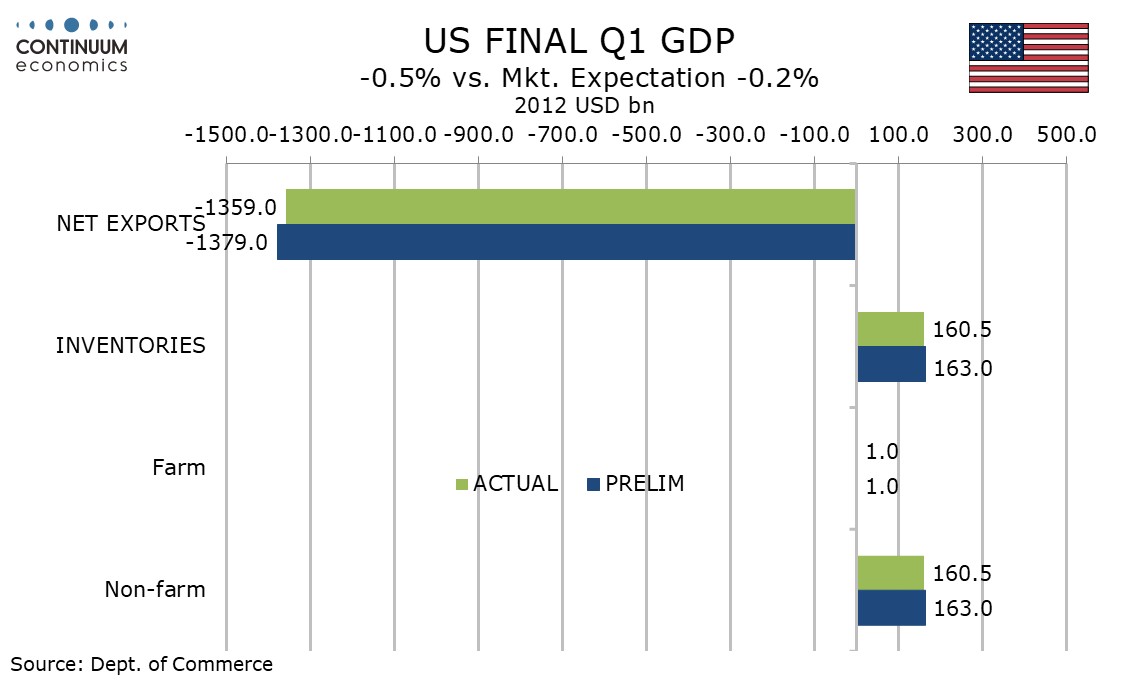

Elsewhere housing as revised down to -1.3% from -0.6%, government revised up to -0.6% from -0.7%, inventories revised marginally lower from a strong Q1 build up but net exports revised higher from a sharp deterioration. Exports were revised to 0.4% from 2.4% but imports revised to 37.9% from 42.6%

Price indices were revised marginally higher, core PCE to 3.5% from 3.4%. overall; PCE to 3.7% from 3.6% and the GDP price index to 3.8% from 3.7%.

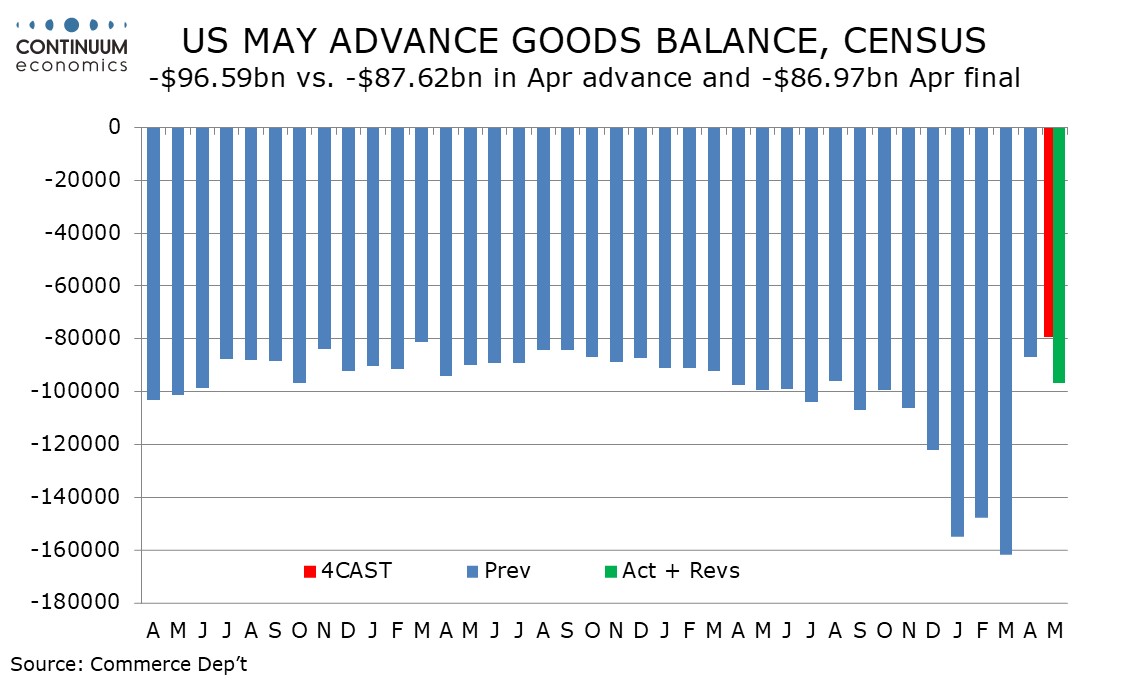

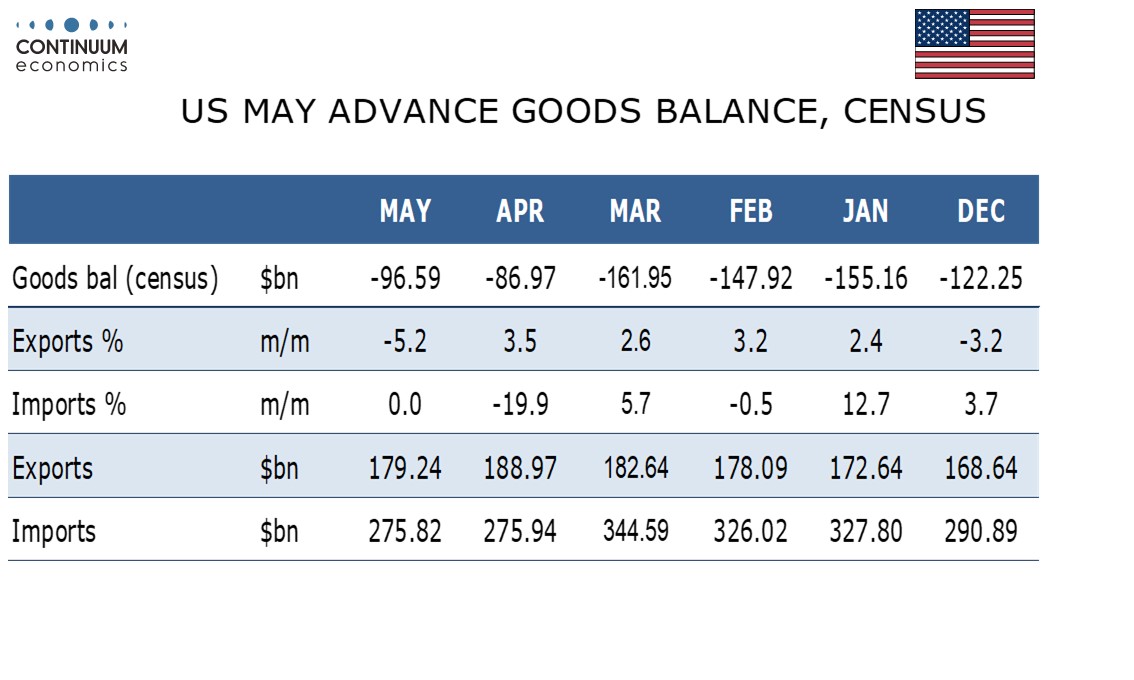

The advance trade deficit of $96.6bn in May is still well below the Q1 average of $155.0bn when imports surged ahead of anticipated tariffs but back to near where trend was before the election, suggesting that only April’s $87.0bn deficit will come in significantly below the pre-election trend.

May exports fell by 5.2% after a 3.5% April increase while May imports were unchanged after a 19.9% April decline. Imports are up 2.8% yr/yr while exports are up 6.2% yr/yr.

The larger than expected trade deficit will reduce estimates for Q2 GDP though a significant positive from net exports is still all but certain. Advance May inventory data is not very supportive either, with a 0.3% rise in retail offset by a 0.3% fall in wholesale. Advance durable goods inventories rose by 0.2%.

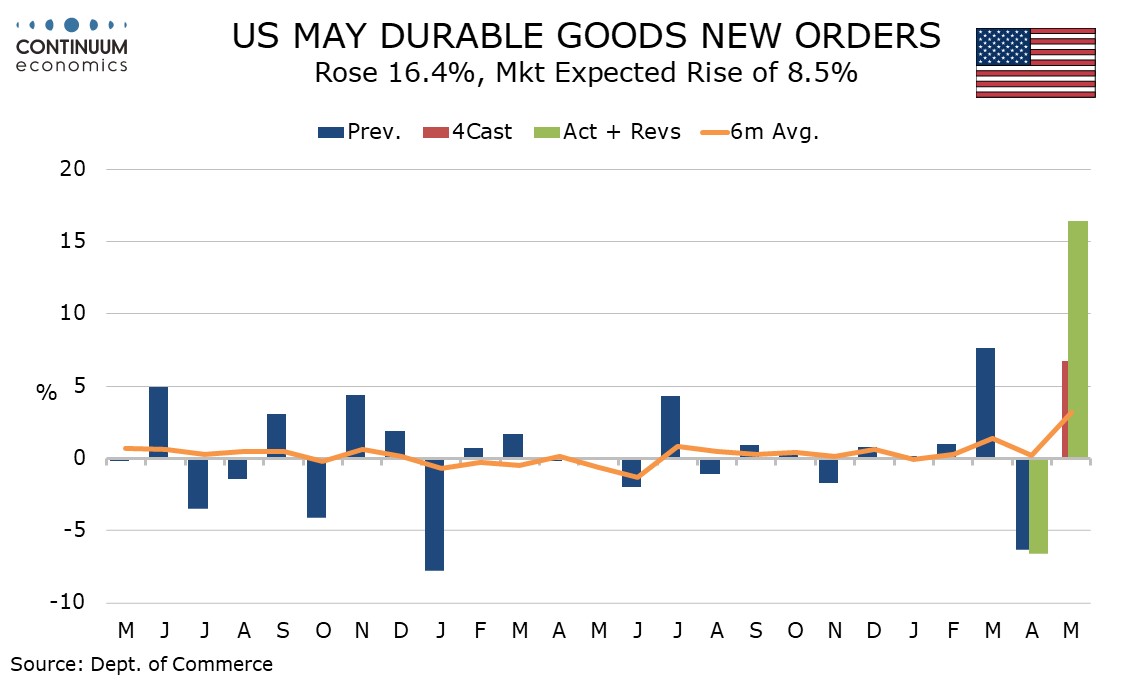

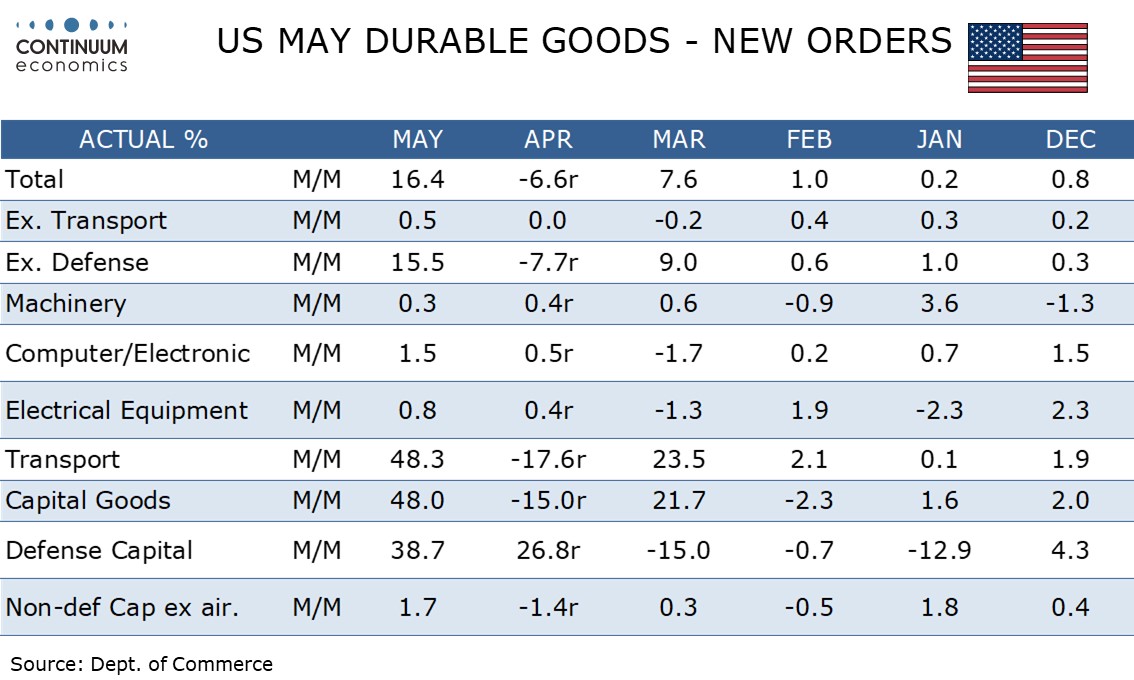

Advance durable goods orders surged by 16.4% in May though the 0.5% rise ex transport was the strongest since September 2024, after a flat April and a 0.2% decline in March. Non-defense capital orders ex aircraft, a key indicator for business investment, rise by 1.7% after a 1.5% March decline, which could be a hint that uncertainty over tariffs is past its peak.

Transport orders surged by 48.3%, rising to a very strong level after a 17.7% April decline reversed a 23.5% March increase. 88% of the transport surge came from civil aircraft but autos and defense (which has a large overlap with transport) saw gains too. Orders ex defense rose by 15.5%.

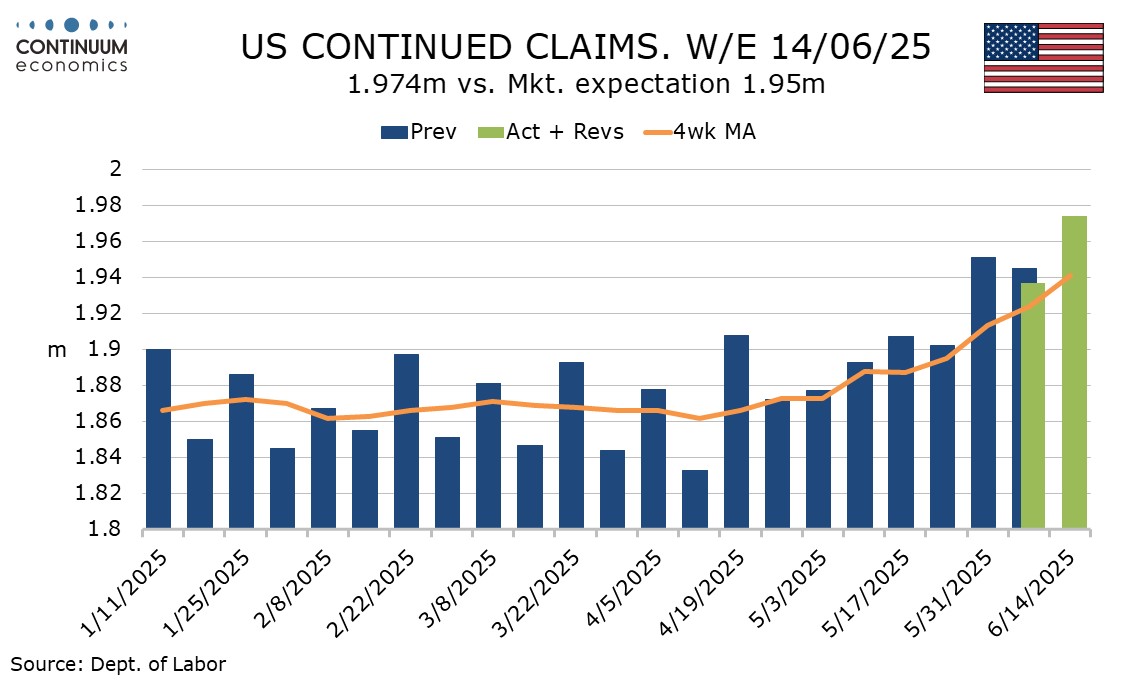

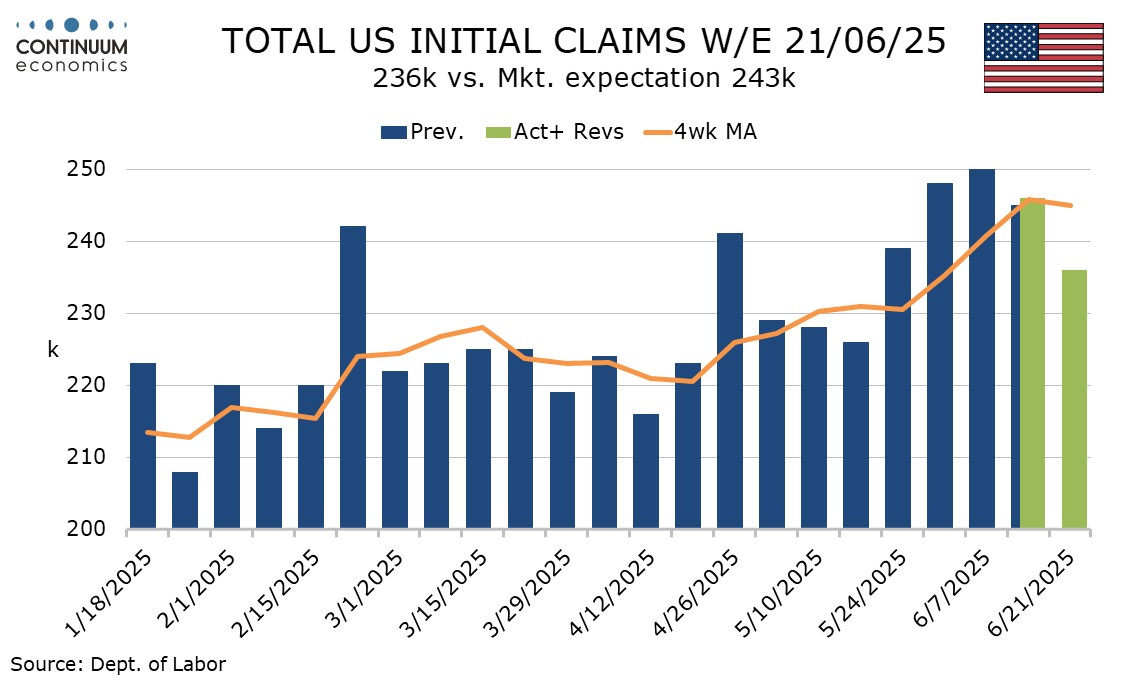

Initial claims with a 10k fall to 236k are at a 5-week low and a second straight decline from 250k two weeks ago. This may be another sign of uncertainty from tariffs starting to fade though conclusions should be tentative at this point. Continued claims, covering the week before initial claims, continue a recent acceleration, to 1.974m from 1,937m, reaching their highest since November 2021.