U.S. Unit Labor Costs and Initial Claims suggest inflationary risk from labor market strength

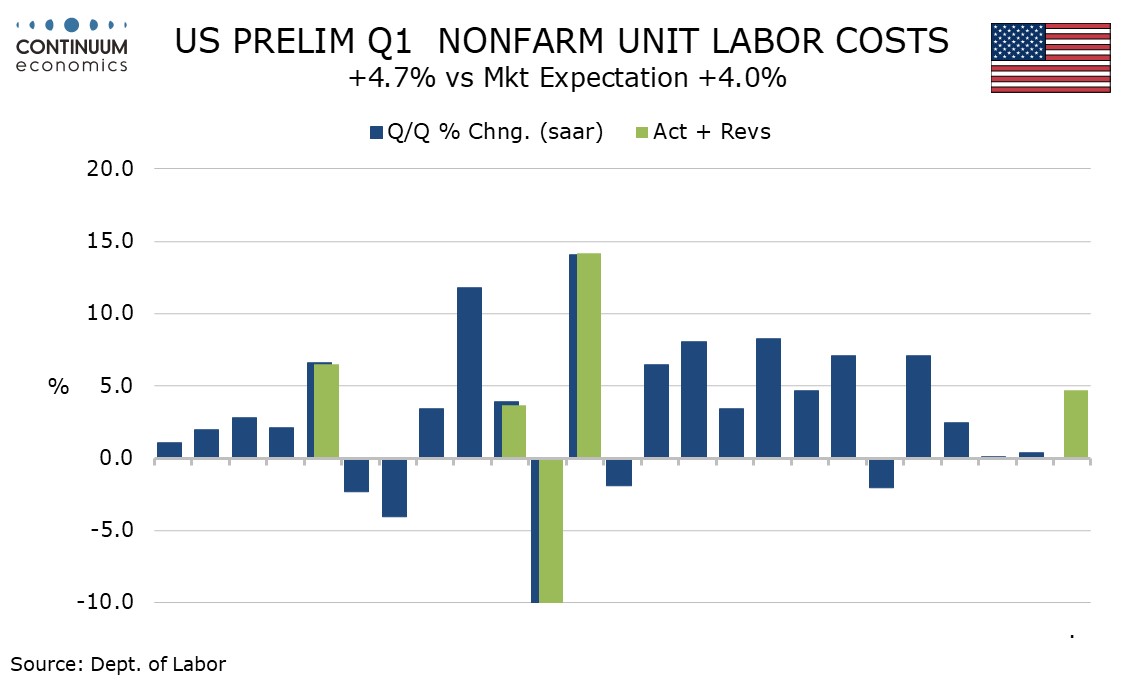

Initial claims at 208k are unchanged at a very low level while continued claims at 1774k are also unchanged, the preceding data revised from 207k and 1781k respectively. The labor market remains tight while unit labor costs saw a significant bounce to 4.7% annualized in Q1.

There is some evidence in surveys such as the ISM and S and P PMIs that economic growth is losing some momentum at the start of Q2, while GDP lost some momentum in Q1, though the initial claims data shows no sign of any loss of momentum in the labor market.

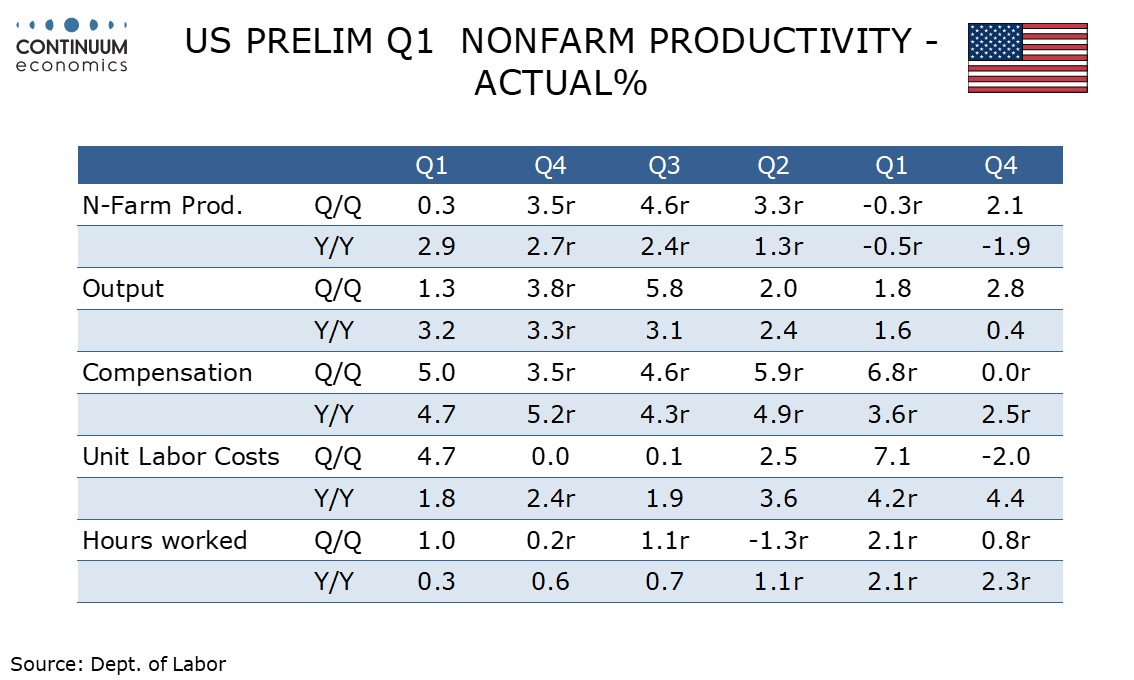

Non-farm productivity rose by a modest 0.3% in Q1 with a 1.3% rise in non-farm business output (already seen in the GDP detail) marginally exceeding a 1.0% rise in aggregate hours worked. The latter was consistent with non-farm payroll details, softening of the workweek weighing against strong job growth.

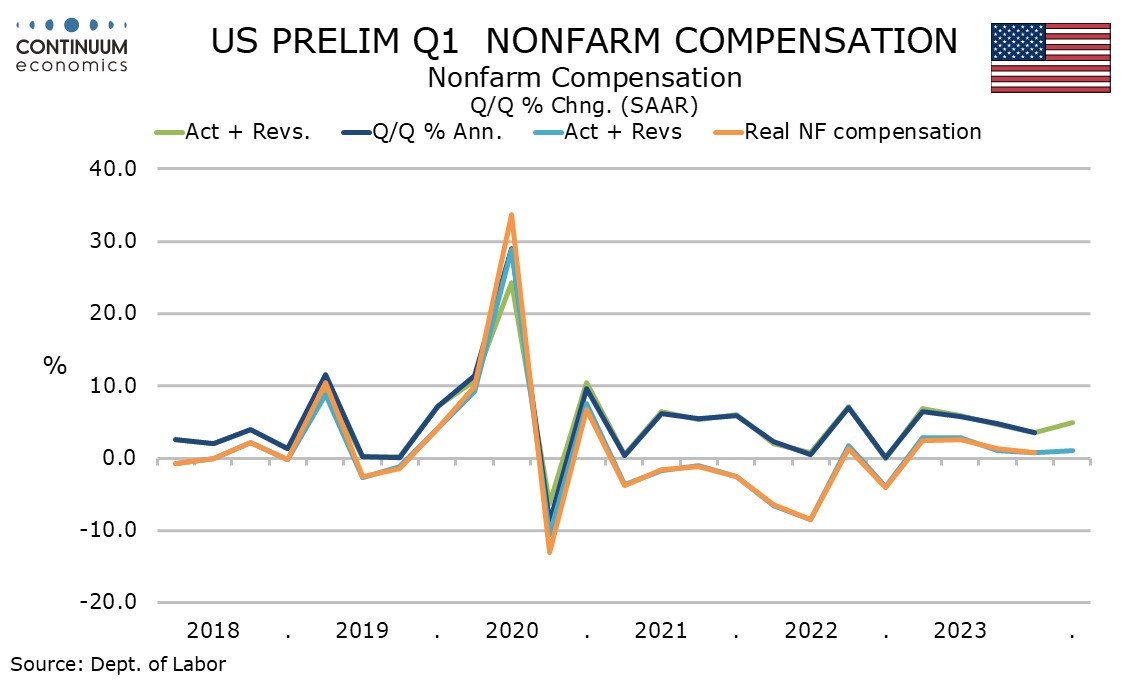

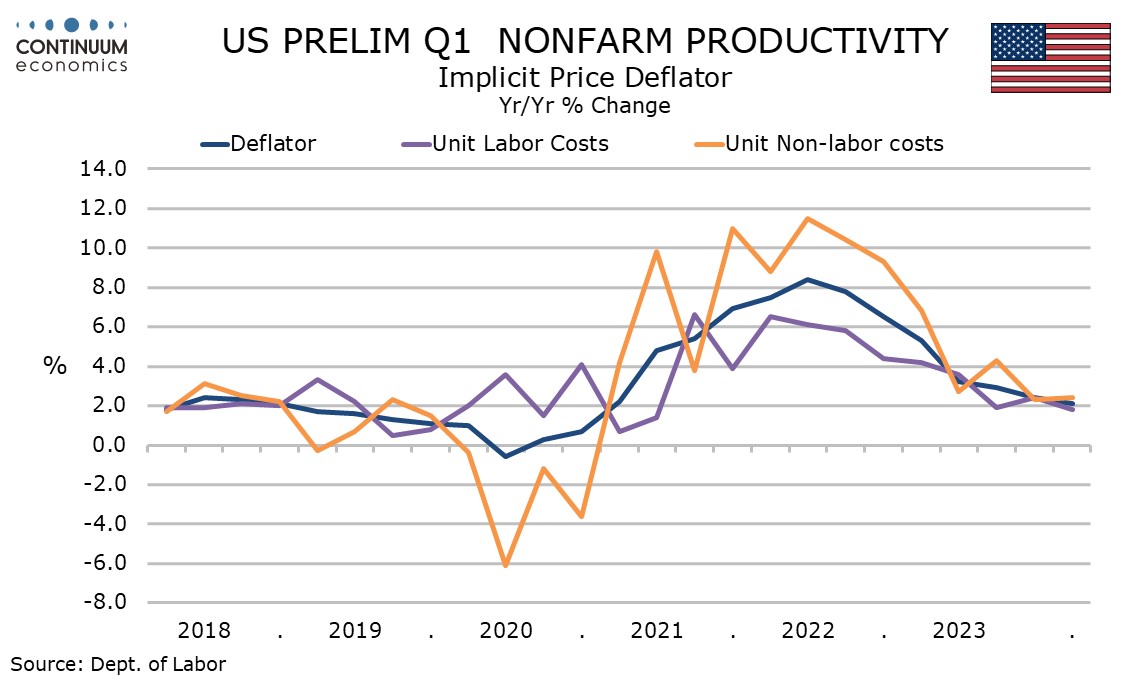

A 5.0% rise in non-farm compensation and a 0.3% rose in productivity left unit labor costs at a 4-quarter high of 4.7%. Non-labor costs rose by a modest 0.5% leaving the overall deflator up by 2.8%.

Strong year ago data means that yr/yr growth in the inflationary indicators continues to moderate, unit labor costs to 1.8% from 2.4% and the deflator to 2.1% from 2.4%, and these look consistent with the Fed’s 2.0% target.

However keeping these figures in line with a 2.0% pace will require stronger productivity and/or slower compensation growth. The former will require either an acceleration in growth (unlikely) or a slowing in the labor market (plausible but there are few signs of that at present). A slowing labor market is also likely to be required for slowing compensation growth.