Published: 2024-12-03T14:47:16.000Z

Preview: Due December 12 - U.S. November PPI - Core rates slightly below trend after slightly above trend October

9

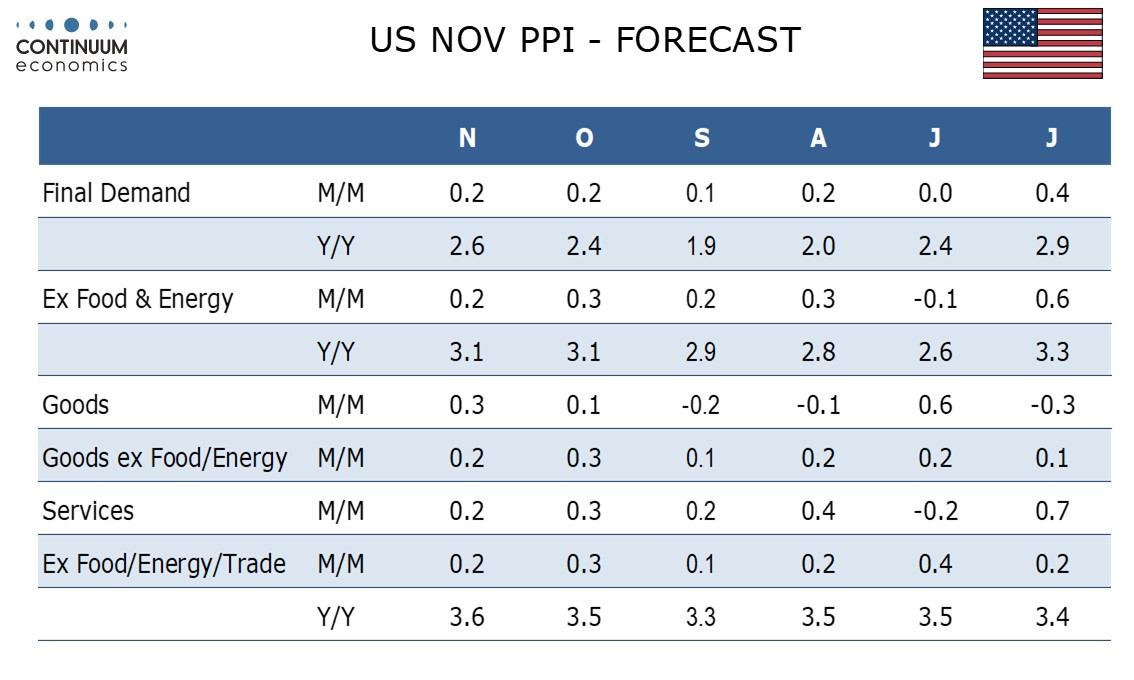

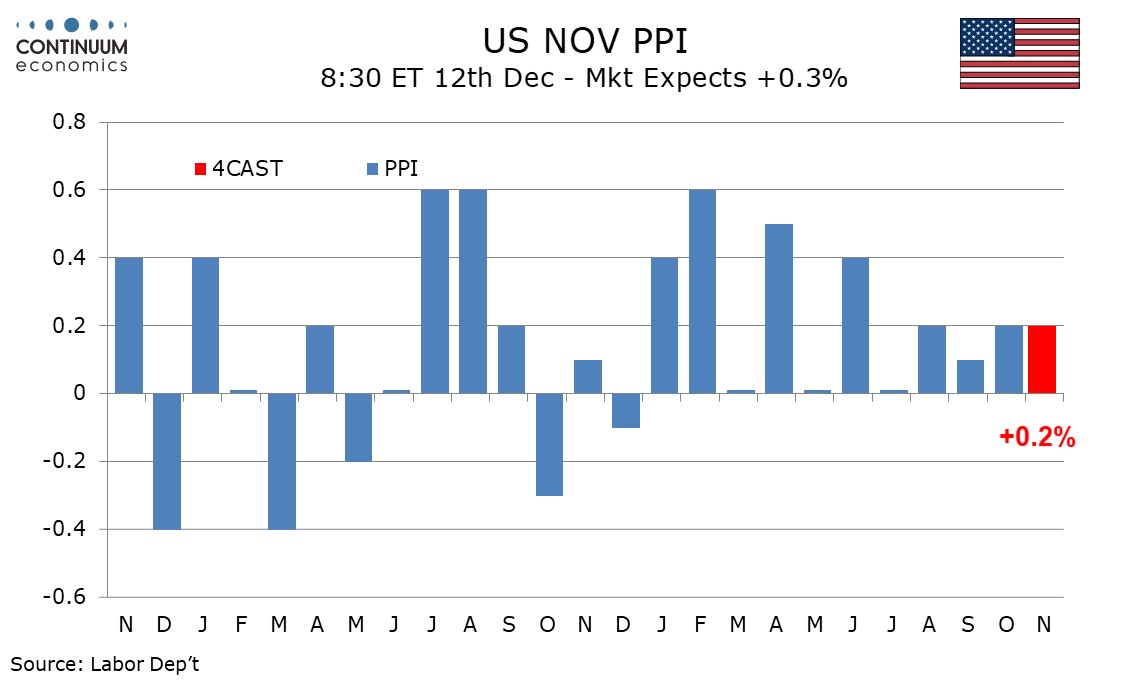

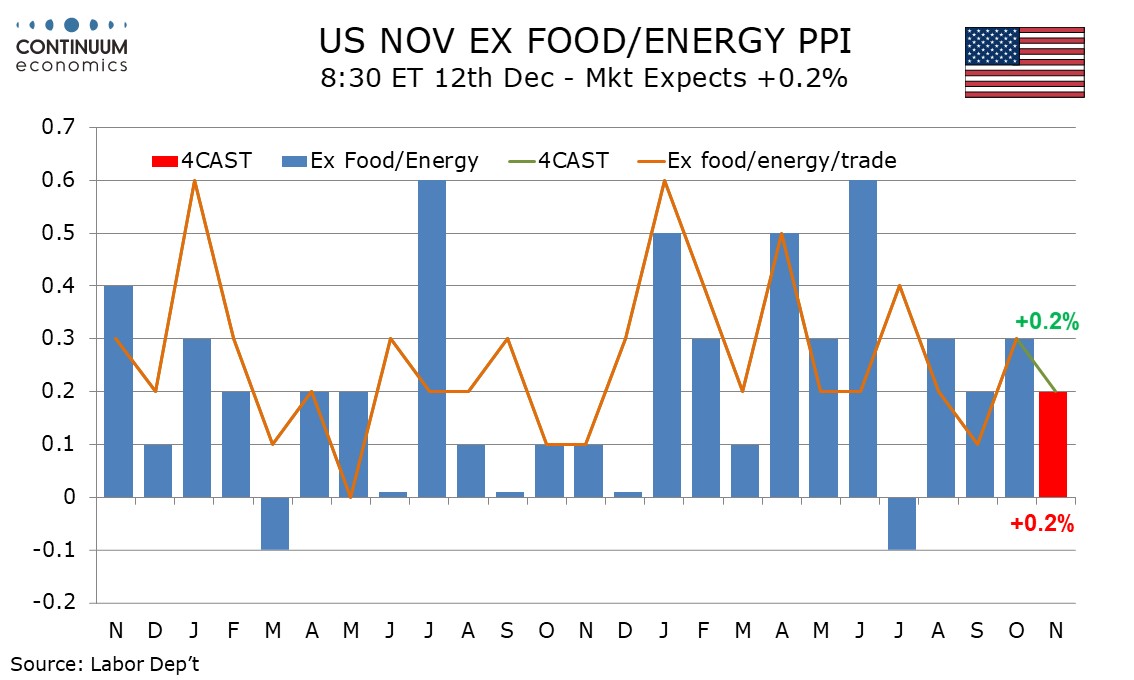

We expect moderate gains of 0.2% in November PPI, overall and in each of the core rates, ex food and energy and ex food, energy and trade. 0.2% gains in the core rates would be on the low side of trend, which remains a little too high to be consistent with inflation returning to the 2.0% target.

We expect modest gains in both food and energy, picking up from slippage in October, but not by enough to lift the overall PPI above the two core rates.

Trend in the core rates appears to be around 0.25% per month, and after gains of 0.3% in October both ex food and energy and ex food, energy and trade, we expect gains of 0.2% in November.

Yr/yr growth would then rise to 2.6% overall from 2.4%, but remain at 3.1% ex food and energy. Ex food, energy and trade the yr/yr pace would rise to 3.6% from 3.5%. While this is ahead of the yr/yr ex food and energy pace recent monthly data has shown the two core rates becoming more consistent.