FX Daily Strategy: Europe, January 28th

RBA Trimmed Mean CPI Surprised to the Upside

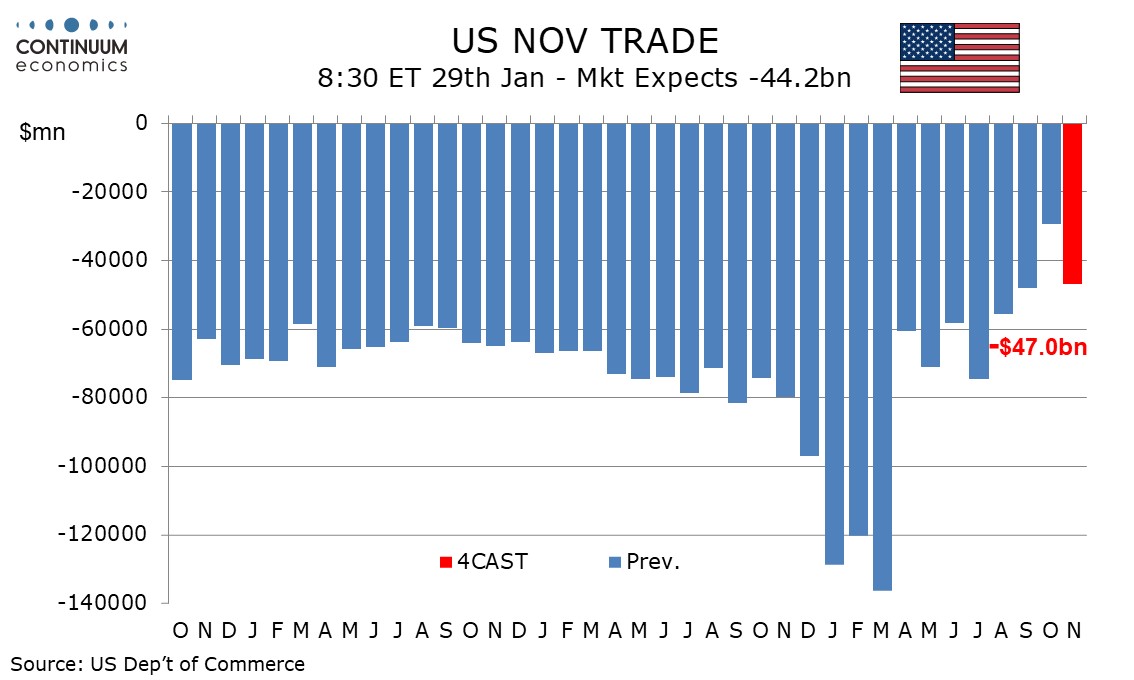

U.S. Narrower October deficit looks unsustainable for November

Tier Two Kiwi data Unlikely Push the Bird Higher

Trump Will Likely Do Anything for Mid Terms

The Q4 CPI has surprised to the upside for Australia. More importantly, the RBA preferred trim mean CPI is showing even more hawkish surprise than headline CPI. The strong inflationary pressure will further exacerbate market participants' anticipation of an upcoming hike. On balance, we do not see an imminent hike from the RBA without a change in forward guidance first.

On the chart, the pair is extending sharp rally from the low of last week with break above the .6942, 2024 year high, reaching fresh high at .7015. Consolidation here see prices unwinding overbought intraday studies but bullish momentum keep pressure on the upside and further gains cannot be ruled out. Higher will see room to the .7050/.7100 congestion. However, stretched daily and weekly studies caution corrective pullback with support now raised to .6942 2024 year high and extending to the .6900 Friday's high and gap area. Would take break here to open up room for deeper corrective pullback to support at the .6850/.6800 congestion.

We expect a November trade deficit of $47.0bn, up from October’s $29.35bn which was the lowest since June 2009 and which looks unsustainably low, but still slightly narrower than September’s $48.14bn, which was itself the narrowest since March 2020. The sharp narrowing in October’s deficit came largely from a second straight sharp rise in exports of nonmonetary gold, and a sharp fall in imports of pharmaceutical preparations which more than fully reversed a strong rise in September. While it is far from certain that data will return to underlying trend as soon as November, such a move would see a sharp fall in goods exports reversing most of the September and October gains, and goods imports somewhere between the levels of September and October.

We expect goods exports to fall by 6.0% after gains of 5.6% in September and 3.8% in October while goods imports rise by 2.5% after a 4.3% fall in October that followed a 1.0% increase in September. Price gains will contribute around 0.5% to the November gains in each series. We expect service exports to rise by 0.5% after a 0.7% October gain while service imports rise by 0.1% after bouncing by 1.4% in October, leaving overall exports down by 3.7% and overall imports up by 1.9%. It will be some time before the underlying trade picture becomes clear given continuing volatility in policy but it is likely that the deficit remains below underlying trend after surging in Q1 ahead of the tariffs. The average deficit in the first 10 months of 2025 is $78.3bn, not far from an average monthly deficit of $75.3bn in 2024.

We have a slate of tier two data for Kiwi on Wednesday but we doubt such i going to move the Kiwi. The Kiwi has been pushing forward on stronger commodity prices, weaker USD and higher than target range inflation. However, without a pivot form the RBNZ, the existing catalyst is unlikely to push Kiwi through 0.6 round figure. With most of the good news are out, it will just take a simple complication to persuade market participants to turn from bid to offer. What is clear is the RBNZ has been reinforcing their easing stance despite expected higher inflationary figure and that is not supportive for the Kiwi in a medium term.

On the chart, follow-through above the .5850 resistance has seen sharp rally to reach fresh year high at .5928 as retrace the July/November losses. Daily and weekly studies are tracking higher and suggest room further extend strong gains from the .5710 low of last week. Higher will see continuation to .5950 congestion then the .6000 figure. Meanwhile, support is raised to the .5900 level. Below this will delay bulls and see room for consolidation to strong support at the .5853/31 December highs.

It is clear that Trump is doing everything he can to seize attention for the mid terms. From Venezuela to Cuba and Iran, he is trying to accomplish mission that hasn't been completed in the past century by taking down these "hostile, communist" countries and gain support from hawks. On the other hand, he is putting maximum pressure on trade partners, like South Korea, to make sure they are delivering results of negotiation, to show off for his voters that he got stuff done. All of this point towards Trump trying to consolidate his position, especially after Minnesota's shooting that is shaking the political environment, even with Republicans.

When Trump is seeking accomplishment, it is likely he will make some bold/aggressive decision. Such decision could turn the market upside down. The closest area to watch for is intervention in Iran and Cuba. Cuba would be strategically easier as ships has already been placed near the area before to capture Maduro. Iran, on the other hand, would be a bigger target as Tehran has long been considered an unstable factor.