CHF flows: SNB dovish but EUR/CHF dips initially

SNB cuts rates as expected an indicates further easing likely with inflation forecatss cut. Initial EUR/CHF dip looks like a "sell on the news" reaction rather than a genuinely CHF positive take on the decision.

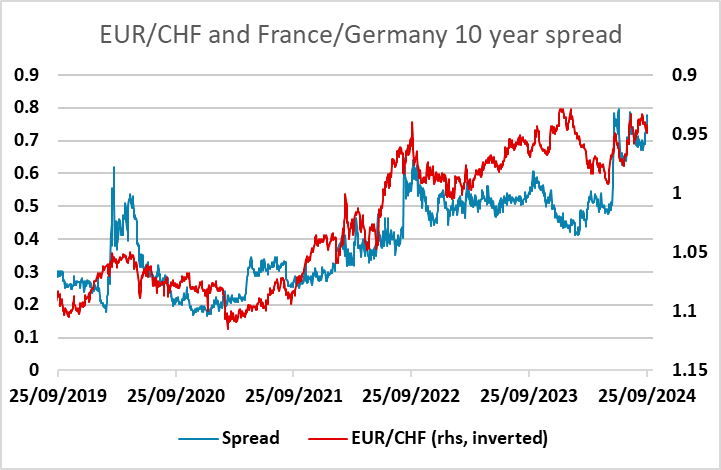

The SNB has cut rates the expected 25bps to 1.0%, and maintained a dovish stance, cutting their forecasts for 2025 and 2026 inflation to 0.6% and 0.7% respectively (from 1.1% and 1.0%). They also said further cuts in rates may become necessary in the coming quarters to ensure price stability over the medium term. Given the dovish tone of the statement and the forecasts, the decline in EUR/CHF on the announcement looks like a “sell on the news” reaction rather than an indication that the market sees the statement as hawkish or in any way CHF supportive. It might be argued that the indication that rate cuts might be necessary in the coming quarters suggests no more than one cut a quarter, but less than that is priced into the market anyway. However, there is very little medium term correlation between movements in the CHF and interest rate spreads, so SNB policy is of limited relevance. EUR/CHF will tend to gain on a more risk positive take on European developments rather than movements in yield spreads. As long as the globally risk positive tone we have seen since the Fed rate cut is sustained, we would favour EUR/CHF gains, but there is a risk of a dip if market sentiment deteriorates or European data shows weakness.