FX Daily Strategy: APAC, August 29th

JPY upside risks if Japan CPI fails to decline

European CPI unlikely to have much impact

US trade data could undermine the USD

CAD vulnerable to decline in GDP

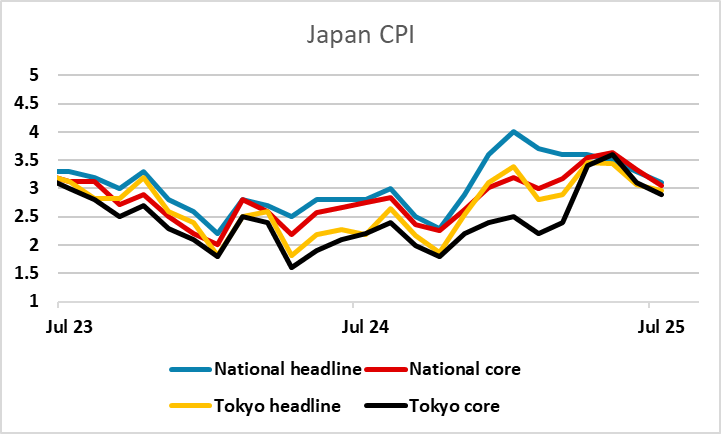

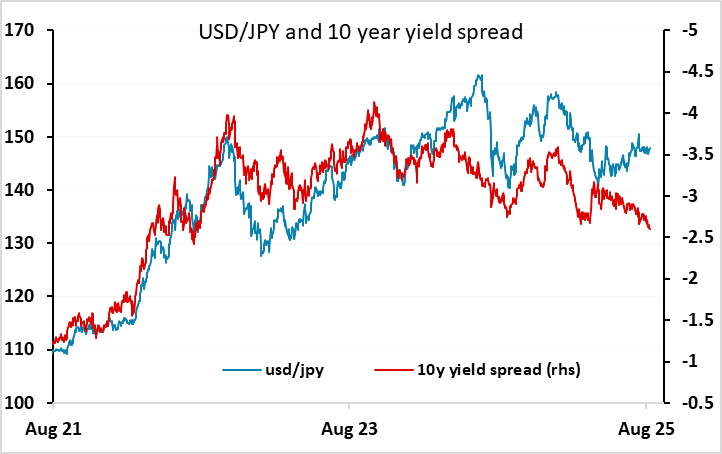

JPY upside risks if Japan CPI fails to decline

European CPI unlikely to have much impact

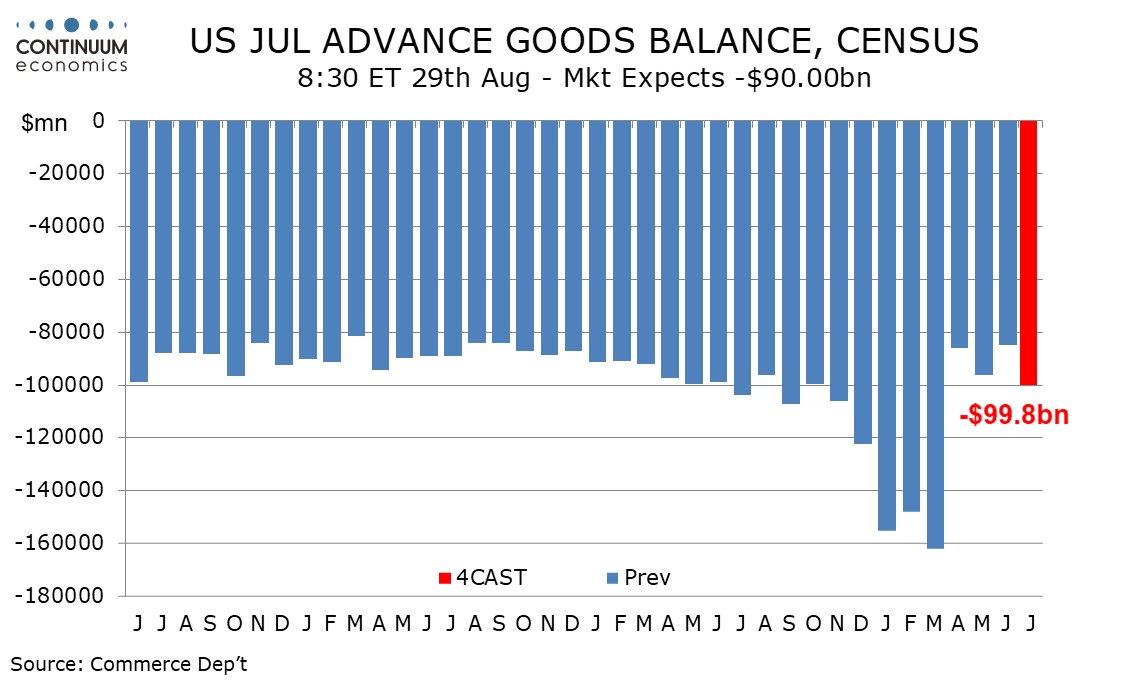

US trade data could undermine the USD

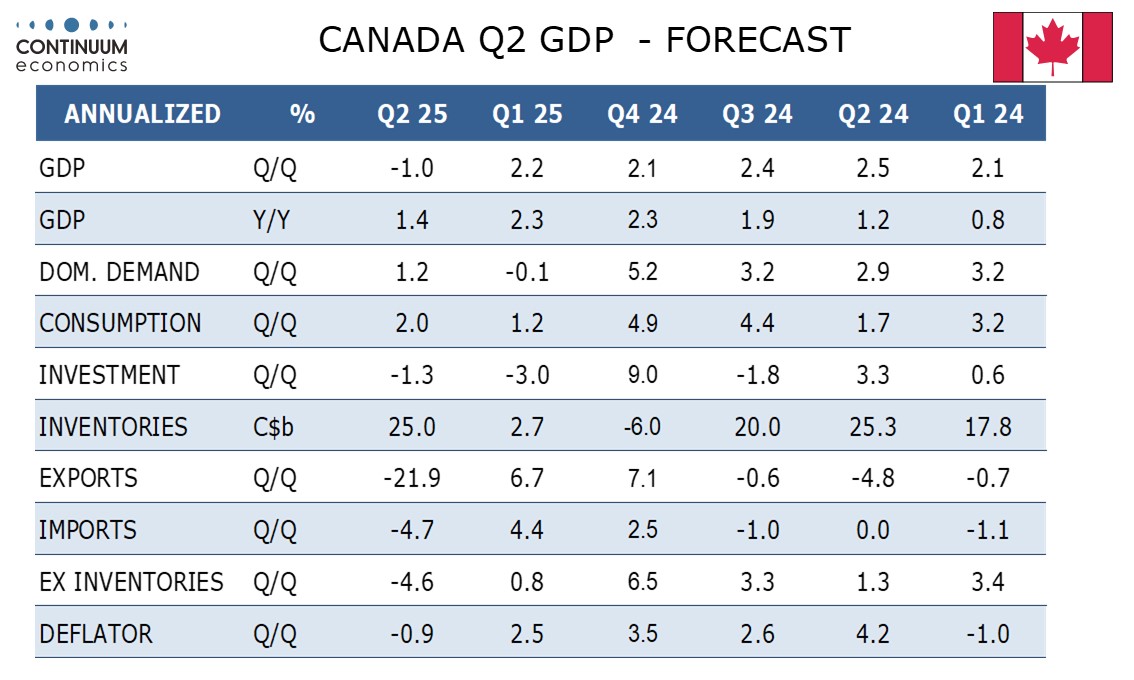

CAD vulnerable to decline in GDP

After a week largely devoid of significant data, Friday sees some potentially market-moving data in the form of Tokyo CPI from Japan and preliminary CPI from France, Germany and Spain, trade and personal income and consumption data from the US and GDP data from Canada.

First up is Tokyo CPI, which is effectively preliminary CPI for Japan. The consensus sees a decline in core CPI to 2.5% from 2.9%, which might reduce market expectations of early BoJ tightening, although the market is still only pricing in a very modest tightening of 17bps this year, so there may be more sensitivity to higher than expected inflation. USD/JPY continues to looks dramatically undervalued relative to yield spreads, and is likely being held up by demand related to the continued low level of risk premia. However, sooner or later there is likely to be an adjustment lower in USD/JPY to take account of the narrowing yield spreads in recent months, so most of the risks are on the downside.

In Europe there is likely less sensitivity to the inflation data, as the latest set of ECB minutes (technically the account of the monetary policy meeting) sounded very neutral, and it will take a lot to move the ECB from this stance given the continuing uncertainties around the impact of tariffs on the US and world economy and Fed policy under the Trump administration. But the HICP risks may be slightly to the upside this month due to energy base effects. EUR/USD seems unlikely to react, and remains stuck in a 1.16-1.7 range for now.

The trade numbers may be the main focus in the US data, as there will once again have a significant impact on the projections for Q3 GDP. We expect an advance July goods trade deficit of $99.8bn, up from $84.9bn in June but still closer to the Q2 average of $89.0bn than the Q1 average of $155.0bn when imports surged ahead of tariffs. Our forecast nevertheless indicates a much higher deficit than the $90bn consensus, and we would consequently see USD downside risks on the data.

We expect Q2 Canadian GDP to fall by 1.0% annualized after five straight gains marginally above 2.0%. This would be slightly stronger than a Bank of Canada forecast of -1.5% but weaker than what monthly GDP data is likely to imply for the quarter, with June seen rising by 0.1%. The market consensus is for a decline of 0.6% annualised, so there are some downside risks for the CAD on these numbers.