USD flows: Another partial climbdown from Trump, uncertainty persists

Stocks have surged on the latest Trump announcement, a 90-day pause on tariffs with the reciprocal rate lowered to an across the board 10%, coupled with a fresh escalation with China, moving to 125% from 104%. It appears China’s retaliation has given Trump an excuse to partially back down elsewhere without looking weak. USD/JPY is sharply higher, but overall the net USD advance is moderate.

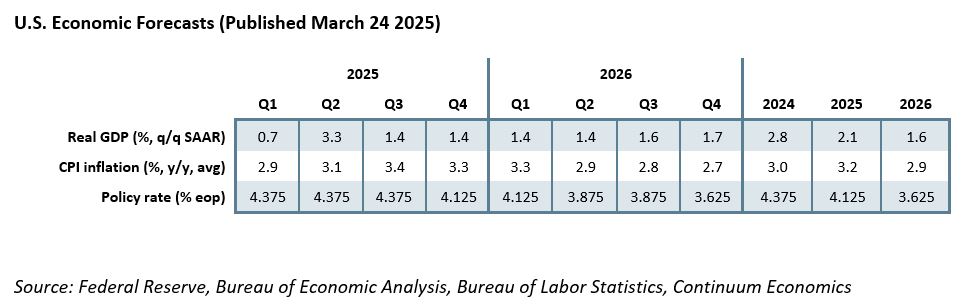

The latest news is clearly welcome to the markets, most of all because it suggests Trump is sensitive to what the markets are telling him, something markets had expected after his election win but had started to seriously doubt. Still a 10% baseline plus 125% on China is still a heavy dosage of tariffs, which will have some impact in lifting US inflation and slowing US GDP growth. The partial backdown today is reminiscent of what was done with Canada and Mexico. We may now see gradual announcement of deals with individual countries and if so the end of the 90-day pause may not be a date that will need to clarify much more, though the uncertainty, itself economically damaging, persists. As for our economic forecasts, our forecasts made in late March look less in need of a rethink now than they had from the April 2 announcement through this morning.