FX Daily Strategy: Europe, February 28th

NZD sunk after RBNZ signals no hike

Swedish data unlikely to have much impact, but NOK/SEK looks too low

EUR/USD stuck in a range ahead of the inflation data on Thursday and Friday

NZD may have some downside on RBNZ

Swedish data unlikely to have much impact, but NOK/SEK looks too low

EUR/USD stuck in a range ahead of the inflation data on Thursday and Friday

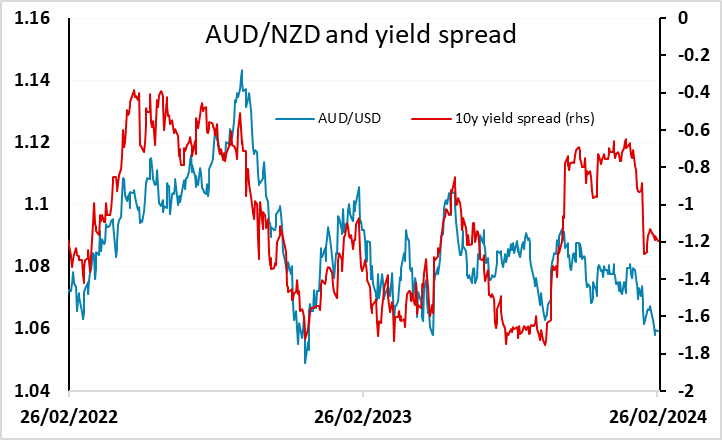

Wednesday kicks off with the RBNZ monetary policy decision. The vast majority of forecasters expect no change in rates. ANZ was the only one of the 28 forecasters originally surveyed by Reuters to look for a 25bp hike, but TD has also now indicated a hike is likely, and the market is pricing in a more significant risk at around a 25% chance. We don’t expect a move, and given the pricing this suggests there are some downside risks for the NZD, which may halt the recent decline in AUD/NZD and secure some progress above 1.06, which yield spreads suggest are justified.

As per our forecast, the RBNZ has kept rate unchanged but revised 2024 inflation forecast higher and OCR forecast lower. The hawkish speculation (2 rate hikes) from TD and ANZ are disappointed for the RBNZ recognized higher inflation in 2024 but does not see it to be significant in affecting bring inflation back to target in 2025. RBNZ now see OCR at 5.59% in June 2024 with prior at 5.67%, at 5.47% in March 2025 with prior at 5.56%. It seems to suggest hawkish speculators are wrong for the coming OCR path from RBNZ as they are signalling no more rate hikes. They also see annual CPI to be higher throughout 2024 and at 2.6% by March 2025 from prior 2.4%. The key forward guidance has been changed to "The Committee remains confident that the current level of the OCR is restricting demand....The OCR needs to remain at a restrictive level for a sustained period of time to ensure this (ensure headline inflation returns to 1-3 percent)occurs." The forward guidance from RBNZ suggested that they are comfortable the current OCR will bring headline inflation back to target range, which kills hawkish speculation. Yet, they also reinforce the need for OCR to remain at current level for a longer period of time, signalling rate cuts will not arrive as soon as their American counterpart.

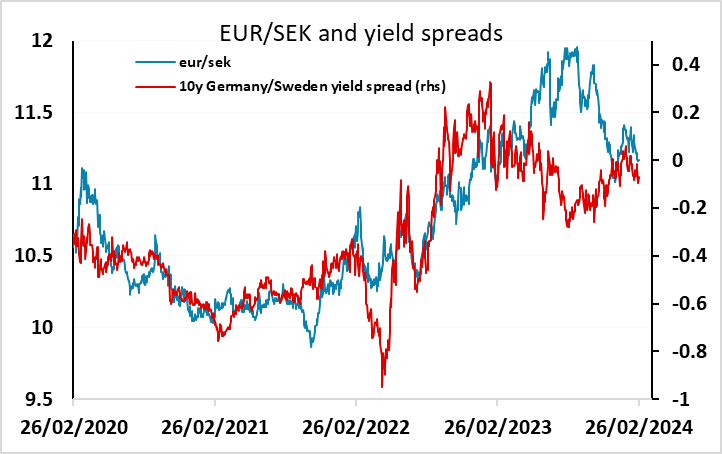

In Europe, there is a lot of Swedish data due, including confidence data for consumers and businesses and the economic tendency survey, as well as PPI. The Economic Tendency Indicator jumped 5.8 points to 90.5 in January, the largest increase since April 2021. All sectors contributed to this improved sentiment, with the consumer indicator rising furthest. Firms’ inflation expectations one year ahead dropped to 1.7 per cent in January and have fallen for five consecutive quarters since peaking in October 2022. Another improvement this time around could be expected to give the SEK a boost, especially if accompanied by weaker inflation expectations and/or soft PPI.

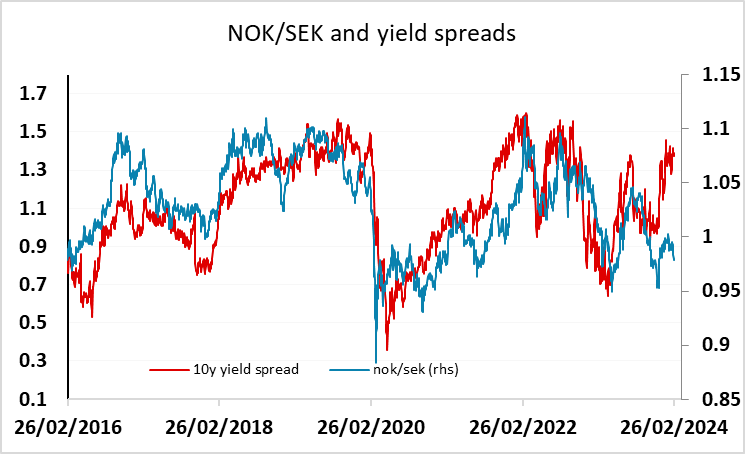

EUR/SEK has been fairly steady in recent days, having returned to levels that are consistent with the yield spread correlation, and we doubt there will be a large move. However, we still see the SEK as vulnerable to losses against the NOK, given the move in yield spreads in the NOK’s favour in recent weeks, and weaker numbers could see NOK/SEK back above 0.98, although it is likely to require a EUR/NOK move if NOK/SEK is to come back to challenge parity.

The European Commission survey for the Eurozone is also due, but rarely provides any new impetus. The bunsienss and consumer survey has improved modestly in the last couple of months, but the business climate index continues to just bump along the bottom. We doubt we will see any significant move, but the risks are probably slightly to the downside given the weaker French consumer confidence number released on Tuesday. Even so, the market is unlikely to see the data as sufficiently important to threaten the edges of the 1.08-1.09 range in EUR/USD.

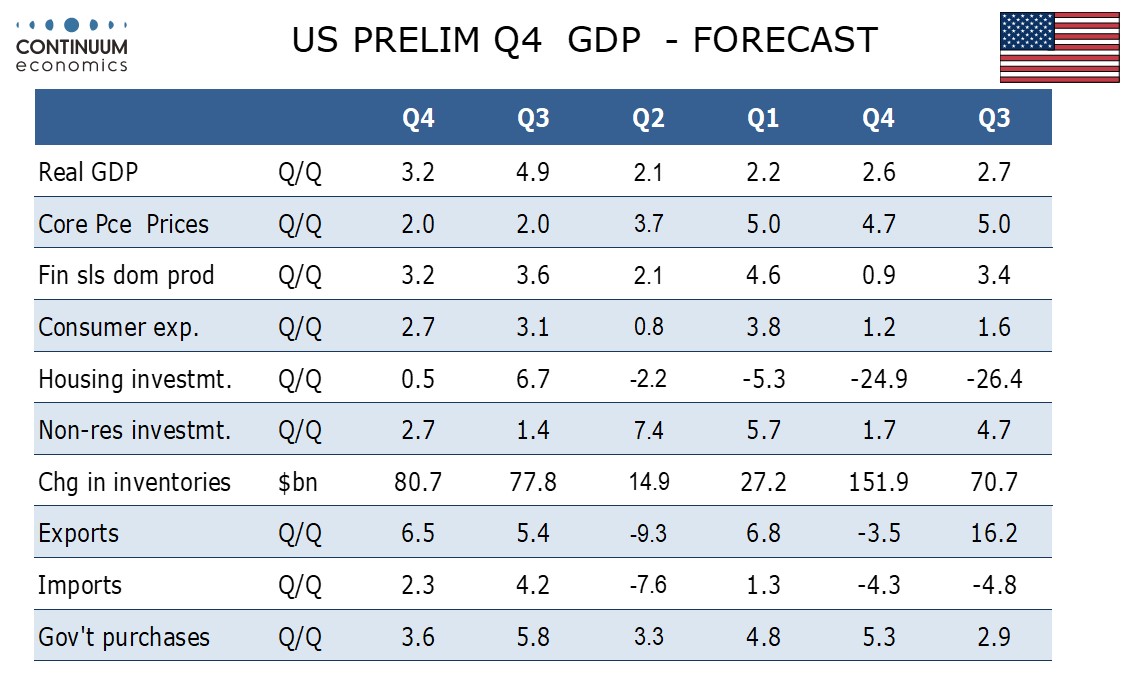

US revised GDP data is similarly unlikely to have a big impact, with the market more interested in the PCE price data for January due on Thursday. The inflation numbers from Europe on Thursday and Friday are also likely to preclude any real reaction to the European data, so expect to stay stuck in ranges.