FX Daily Strategy: Europe, February 12th

US CPI the focus but our forecasts are in line with consensus

Risks slightly biased to higher CPI, higher US yields and a higher USD

Higher inflation data mainly USD positive against the riskier currencies

JPY still looks biased higher in most scenarios

US CPI the focus but our forecasts are in line with consensus

Risks slightly biased to higher CPI, higher US yields and a higher USD

Higher inflation data mainly USD positive against the riskier currencies

JPY still looks biased higher in most scenarios

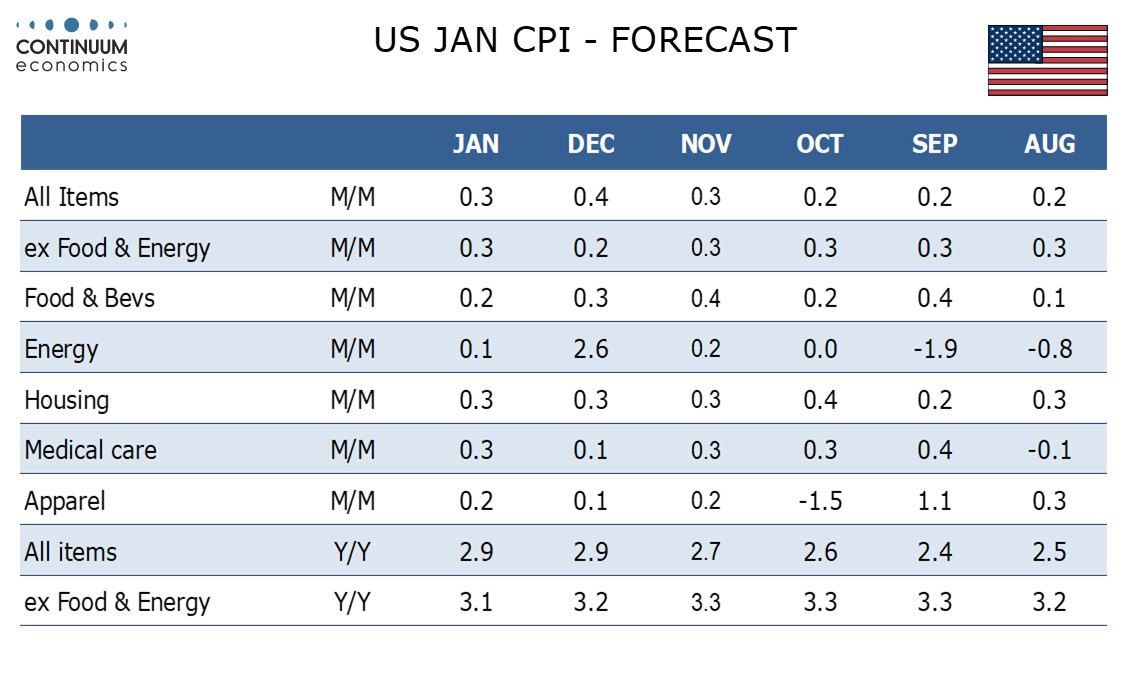

The US CPI data will be the primary market focus on Wednesday. We expect January’s CPI to increase by 0.3% both overall and ex food and energy, with the overall figure close to 0.3% even before rounding, but the core rate rising by 0.33%, which would be the strongest monthly gain since the three months of Q1 2024 each showed monthly core rates of 0.4% (each a little below 0.4% before rounding). Our forecasts are in line with the consensus, and imply the core y/y rate dropping slightly to 3.1% with the headline staying stable at 2.9%. But 0.3% months are not enough to bring inflation down to target, so we wouldn’t see this data as suggestive of an early Fed ease. If anything, given our forecast of 0.33% for the core, the risk is toward 0.4% rather than 0.2%, so the risk should also be on the upside for the USD and USD yields.

Of course, higher US yields are not always USD positive against everything, and the USD reaction in each pair will typically depend on other factors. Higher US yields which are based on stronger real data or stronger earnings will tend to be supportive for both the USD and the riskier currencies, and negative for the JPY and CHF. But higher yields due to higher inflation are less likely to benefit the riskier currencies, as a less dovish Fed policy without the compensation of stronger real data will likely be negative for equities and tend to weaken riskier currencies. Even though it would typically require quite a sharp decline in equities on the back of the rise in yields to benefit the JPY against the USD, a rise in US yields due to higher inflation would likely be more USD positive against the risky currencies than the JPY.

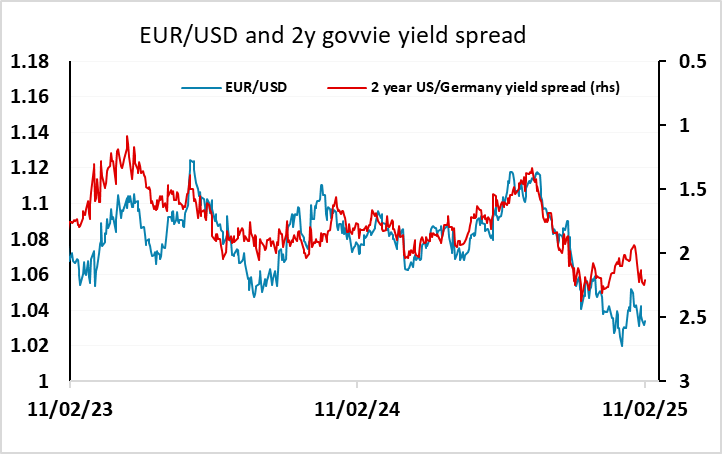

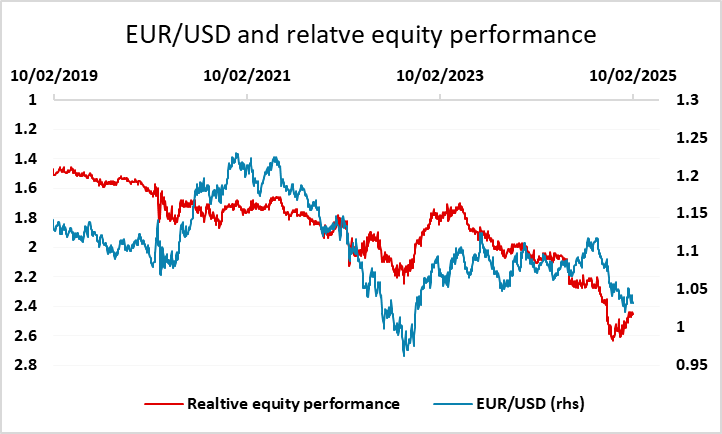

Other than the US CPI data there isn’t a great deal on the calendar. Tuesday saw some gains for the riskier currencies against the JPY, correcting some of the JPY strength seen over the last week. The EUR also benefited from a rise in front end European yields which exceeded the rise in US yields. Even so, the trend in recent weeks has been for the US/Germany yield spread to be widening at the front end. This tends to weaken the EUR, but the EUR has received some support this year from the outperformance of European equities, having suffered from the US outperformance at the end of 2024. For now, these two forces are broadly balanced, but we see the risks as being towards the EUR upside longer term, even though any sharp decline in US equities can initially be expected to benefit the USD.

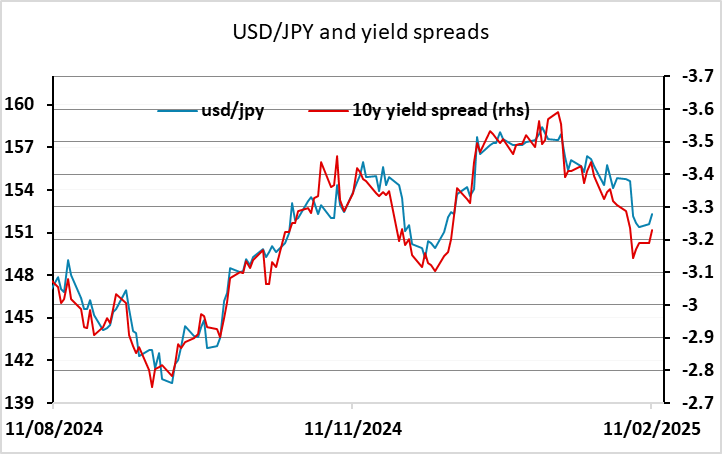

For the JPY, the rise in US yields on Tuesday brought USD/JPY nearly back in line with the yield spread correlation that has held for the last 6 months. Nevertheless, the JPY still looks biased higher in most scenarios. If US front end yields rise due to higher than expected inflation, the JPY may benefit from equity weakness which undermines longer term yields and triggers JPY inflows on the crosses. If US front end yields fall due to lower inflation, yield spreads are still likely to help the JPY.