Published: 2024-04-23T14:16:39.000Z

U.S. March New Home Sales - Gain may not be sustained in Q2

Senior Economist , North America

-

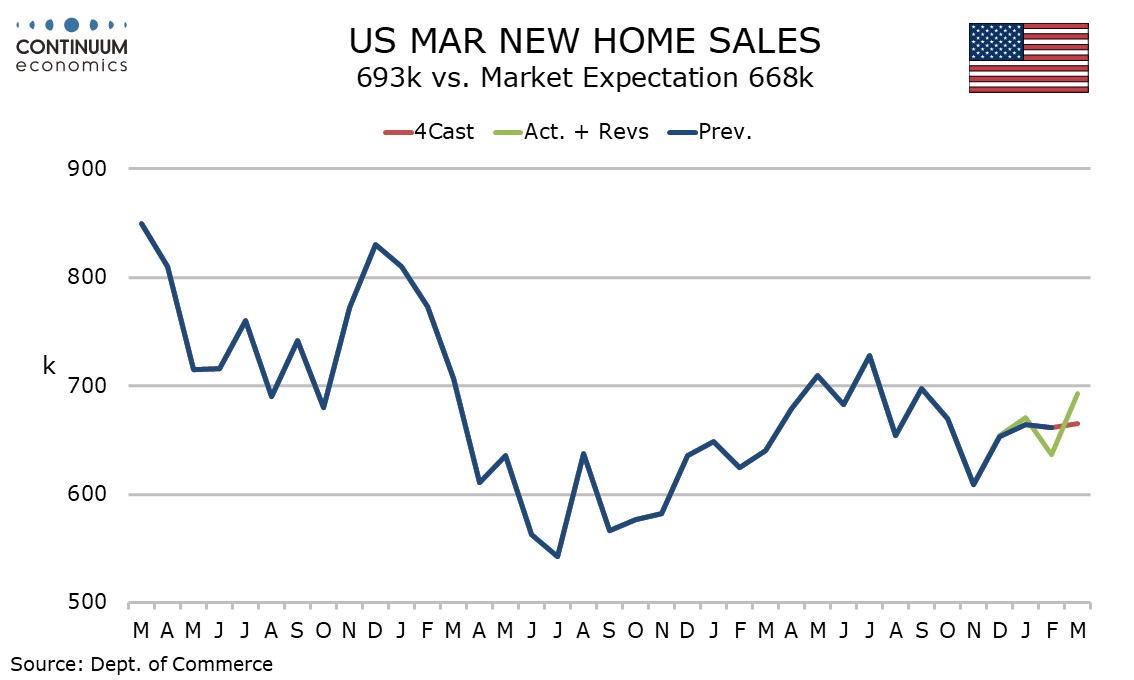

March new home sales at 693k are stronger than expected, up 8.8% from a downwardly revised February to their highest level since September, though still moving in quite a narrow range with Q2 sales vulnerable to higher mortgage rates.

April’s NAHB homebuilders’ index stalled after four straight gains and could start to slip if mortgage rates pick up in response to fading expectations for Fed easing.

April’s stronger than expected 8.8% increase should be seen alongside a 5.1% decline in February which was originally reported as a decline of only 0.3%, meaning a modest net upside surprise.

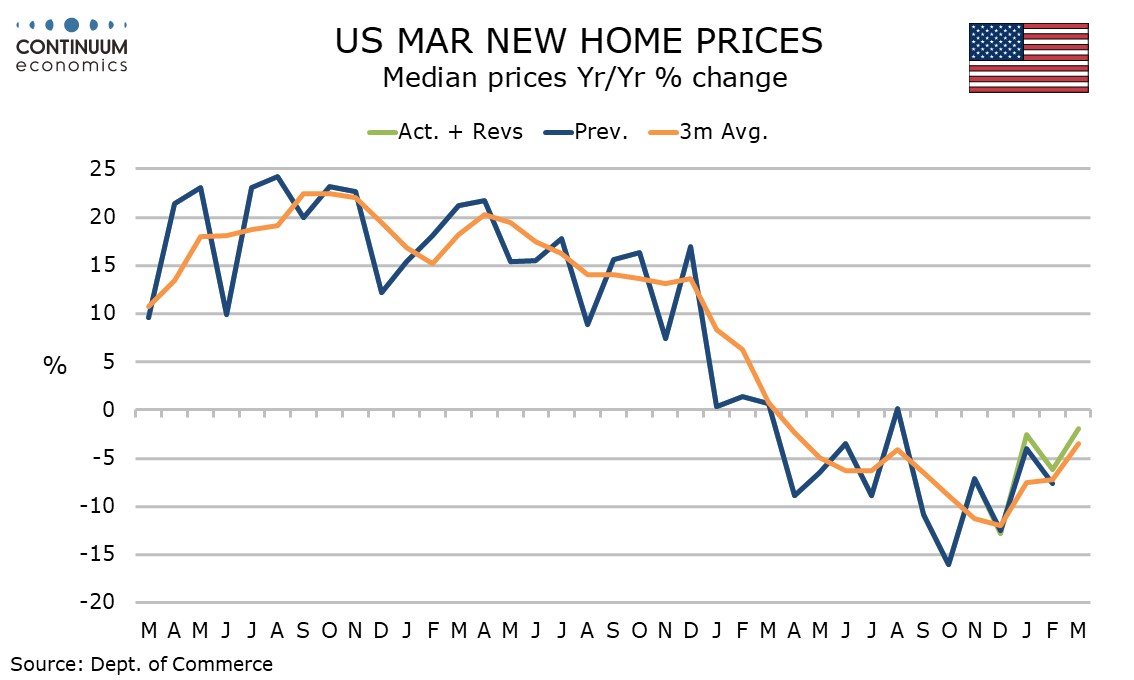

Price data was strong in March, the median up by 6.0% on the month and the average up by 7.4%. This should be seen alongside February declines of 3.6% and 6.7% respectively. Yr/yr data is down by 1.9% for the median and up by 1.0% for the average, both near flat but stronger than recent trend.