FX Daily Strategy: APAC, January 31st

FOMC the main focus – some risks towards higher US yields

Eurozone yields also biased higher so limited downside for EUR/USD

USD/JPY already looks extended relative to yield spreads

AUD well supported even if CPI is on the weak side

FOMC the main focus – some risks towards higher US yields

Eurozone yields also biased higher so limited downside for EUR/USD

USD/JPY already looks extended relative to yield spreads

AUD well supported even if CPI is on the weak side

The FOMC meeting will be the main focus for Wednesday. Rates look set to remain at 5.25-5.50%. After having raised expectations for 2024 easing in December the FOMC is likely to adopt a cautious tone at this meeting, changing little in the statement other than to note recent resilience in the economy. Progress in reducing inflation will be noted but the Fed is not ready to declare victory. We expect the statement to maintain a reference to potential further tightening.

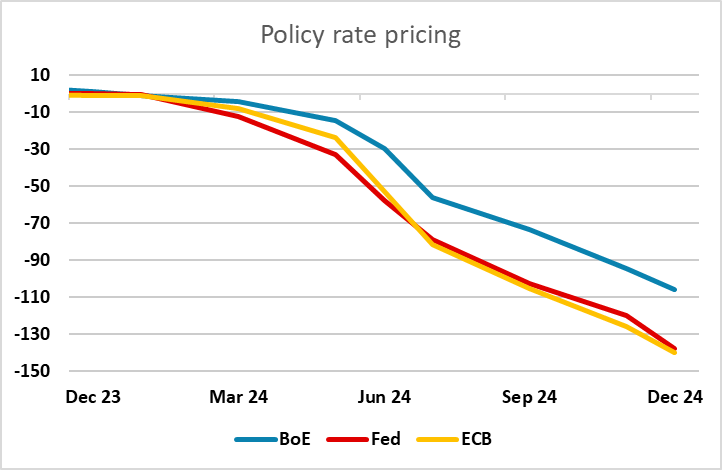

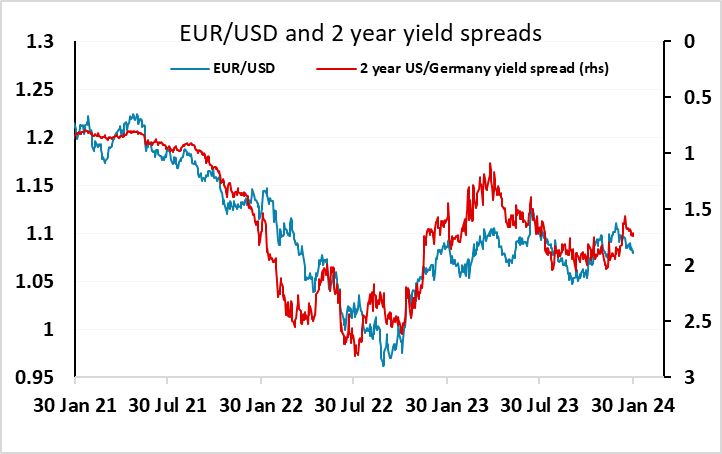

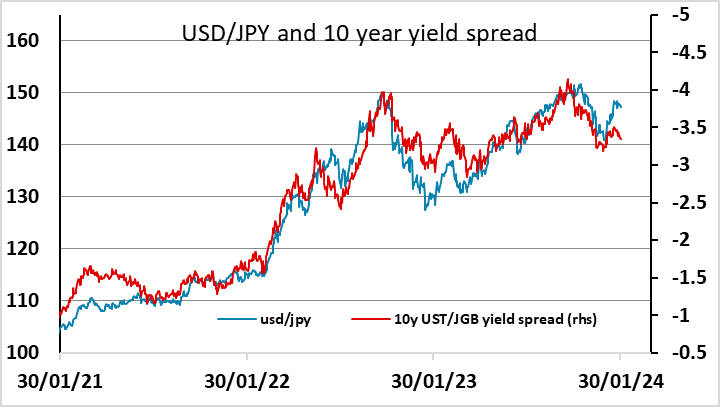

This being the case, the risks should be on the upside for the USD. The market is currently pricing in 137bps of tightening this year, with the March meeting priced as a 50-50 chance of a 25bp cut. The risk is that he market prices this out, pushing up front end yields in particular, but likely pushing yields higher along the curve. For the USD, higher yields would be supportive against all currencies, but there is more case for gains against the EUR and CHF than most other currencies. EUR/USD has broadly been following front end yield spreads, while USD/JPY has tended to follow 10 year spreads, and is already trading some way higher than the correlation seen in the last few years implies.

However, before the FOMC we have preliminary CPI data from France and Germany. Following the stronger than expected Q4 GDP data from the Eurozone on Tuesday, and the stronger than expected preliminary Spanish CPI data for January, there is also scope for Eurozone yields to rise, as even after this data the market is pricing around a 90% chance of an ECB rate cut in April. Stronger than expected CPI data could lead to some reduction in that probability, so that EUR front end yields could rise in line with any move in US yields. Even so, the stronger growth picture in the US suggests that the risk is towards further widening of spreads in the USD’s favour, given that currently similar easing in priced in the US and Eurozone in the next year.

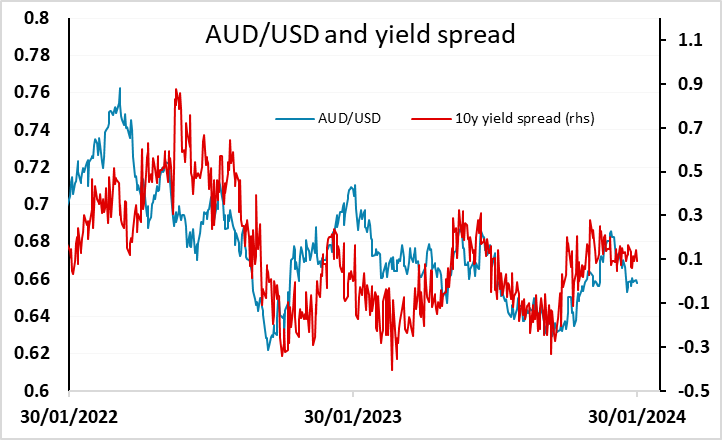

Before the European data and the FOMC there is Australian December and Q4 CPI data. As elsewhere, there is no real risk of tightening priced for the RBA, but a much more modest easing path of just 40bps seen for this year. The consensus sees CPI coming down to 4.3% y/y and rising 0.8% q/q. This is still strong enough to discourage any thoughts of early easing, but the risks are likely to be towards more rather than less easing being priced in. However, AUD/USD has slightly underperformed relative to yield spreads in recent weeks, so should be well supported on any dip.

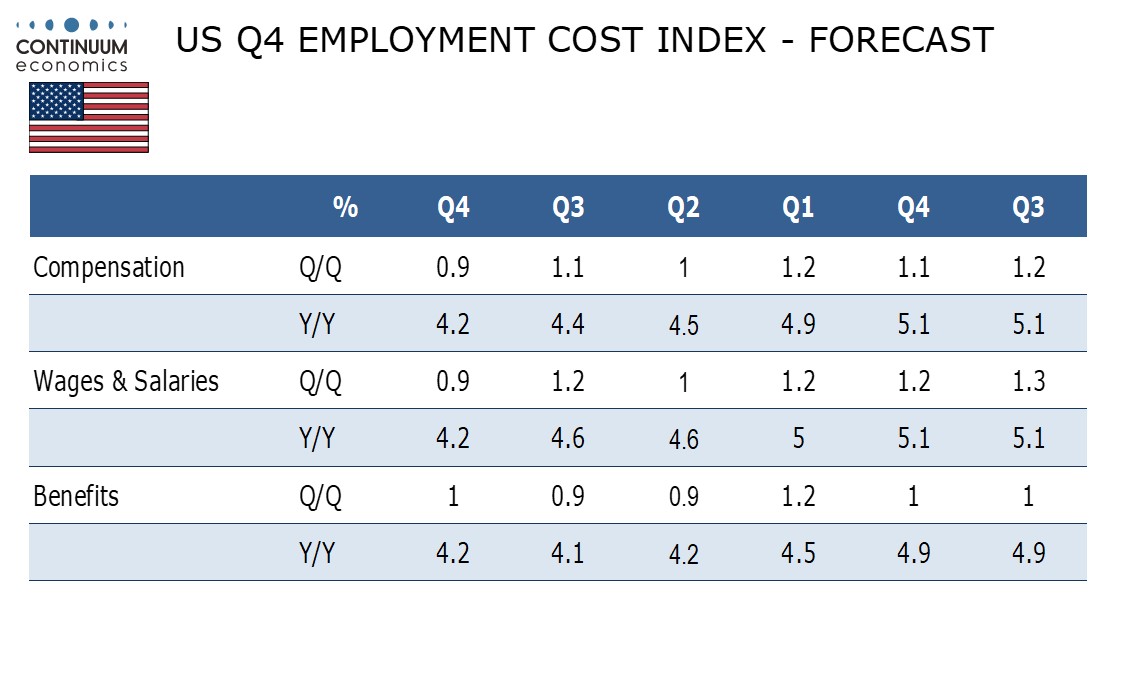

Before the FOMC there is ADP data and probably more important the employment cost index for Q4. Another solid but modest rise is expected for ADP, but the market is unlikely to be very sensitive to these numbers, given the haphazard correlation with the official employment data. The employment cost index may, however, be of greater interest to the Fed, as this is some sort of guide to the second round effects of inflation coming through via the labour market. The 1% q/q consensus rise would not be seen as particularly dangerous for inflation.